- Home

- »

- Plastics, Polymers & Resins

- »

-

Retail Ready Packaging Market Size, Industry Report, 2030GVR Report cover

![Retail Ready Packaging Market Size, Share & Trends Report]()

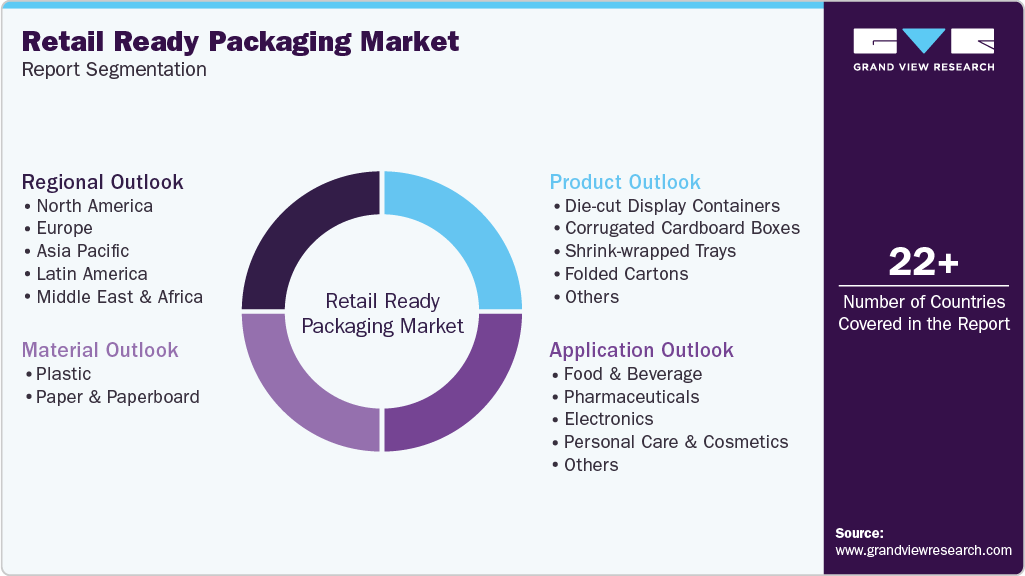

Retail Ready Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Die-cut display containers, Corrugated cardboard boxes), By Material (Plastic, Paper & Paperboard), By Application (Pharmaceuticals, Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-148-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Retail Ready Packaging Market Summary

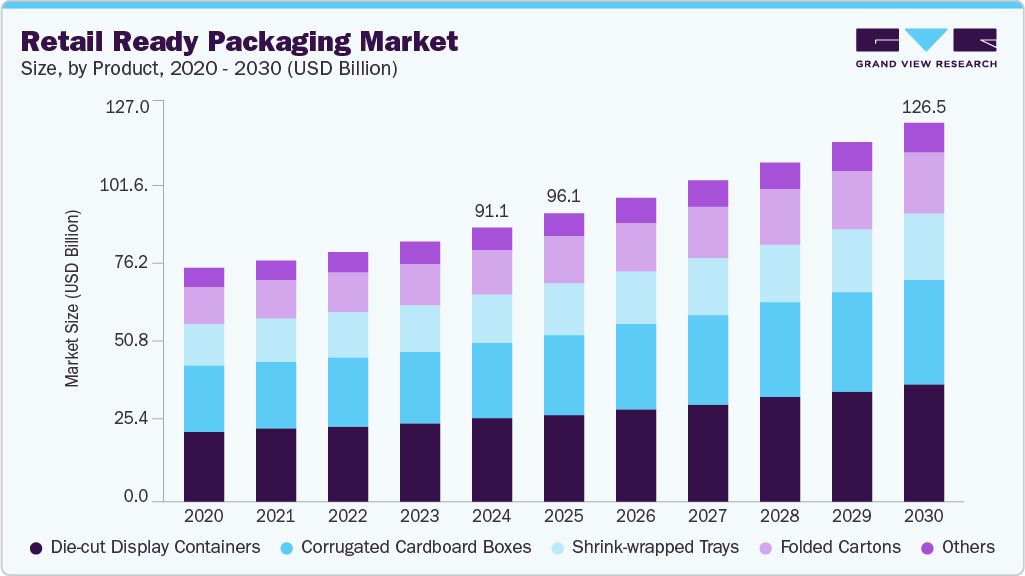

The global retail ready packaging market size was valued at USD 91.11 billion in 2024 and is projected to reach USD 126.5 billion by 2030, growing at a CAGR of 5.6% from 2025 to 2030. Retail-ready packaging is often used with products sold in bulk, like household goods, beauty products, and food.

Key Market Trends & Insights

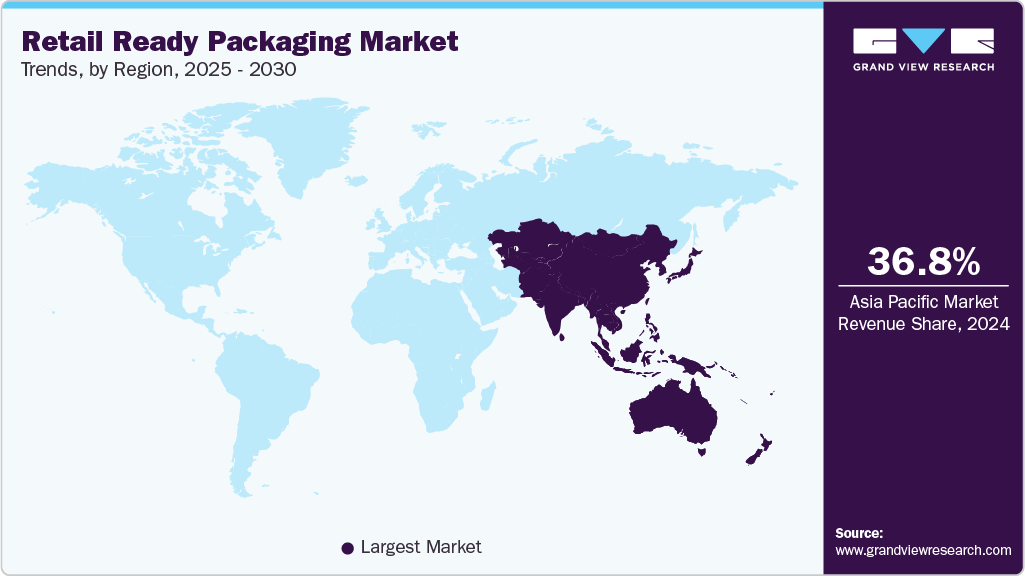

- Asia Pacific retail ready packaging market dominated with the largest revenue share of 36.8% in 2024.

- China's retail-ready packaging market accounted for the largest share in the regional market in 2024.

- By product, the die-cut display containers segment dominated the market with the largest revenue share of 30.0% in 2024.

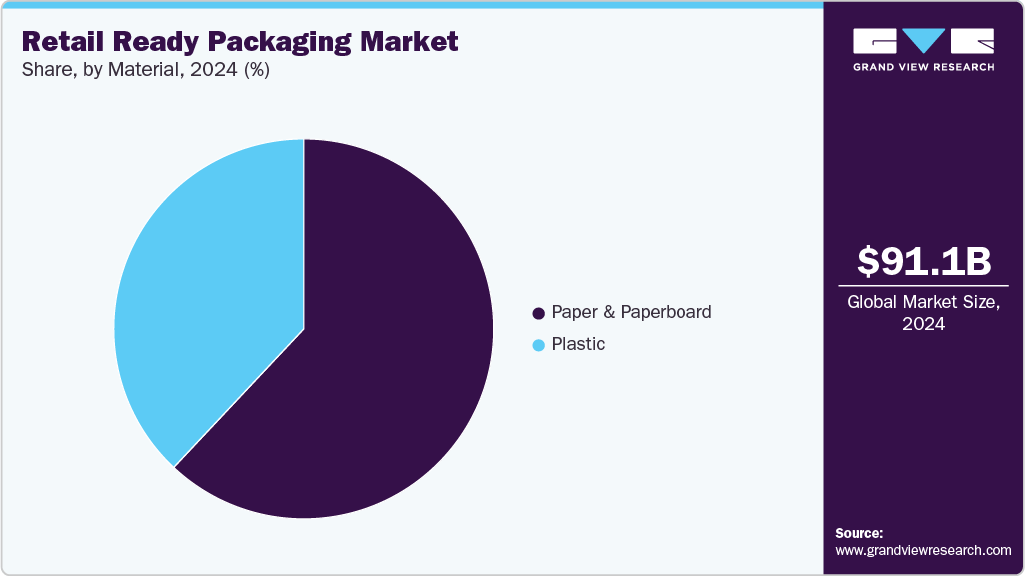

- By material, the paper & paperboard segment held the largest revenue share in 2024.

- By application, the food & beverage segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Revenue: USD 91.11 Billion

- 2030 Projected Market Size: USD 126.5 Billion

- CAGR (2025-2030): 5.6%

- Asia-Pacific: Largest market in 2024

The growing competition in consumer goods, food & beverage, electronics, and personal care & cosmetics is driving the end-use players operating in these industries to develop retail-ready packaging, enabling customers and merchandise engagement and reducing the requirement for individual product packaging, thereby supporting its market demand.

High operational costs are a major concern for retail stores, particularly those associated with labor for tasks such as product display, stock management, and disposal of leftover packaging. These costs can be reduced by taking products directly from the truck to the shelf. Retail-ready packaging supports this approach, helping to lower operational expenses and making it a preferred choice among retailers.

Rapid growth in the e-commerce industry and rising demand from the food and beverage sector are propelling the retail-ready packaging industry forward. Online retailers and grocery chains seek packaging solutions that improve product visibility, reduce handling time, and enhance the unboxing experience. Food and beverage companies are increasingly adopting these formats to ensure faster shelf replenishment and better product presentation. Retail-ready packaging supports supply chain efficiency and helps brands stand out in crowded marketplaces, making it an essential component of modern retail and logistics strategies.

Innovations in packaging design and materials are significantly driving the growth of the retail-ready packaging market. Advanced designs improve product protection, ease of handling, and shelf appeal, meeting evolving retailer and consumer demands. Moreover, the growing preference for eco-friendly, recyclable, and biodegradable packaging materials is shaping market trends, as sustainability becomes a priority for brands and consumers. These environmentally responsible solutions reduce waste and carbon footprint, aligning with global regulations and consumer expectations, thereby accelerating the adoption of retail-ready packaging across various industries. In April 2025, Stora Enso launched a next-generation folding boxboard, Performa Nova. It is a high-yield, high-performance folding boxboard for food packaging designed for renewable, recyclable, and efficient use in dry, frozen, chilled foods, chocolate, and confectionery.

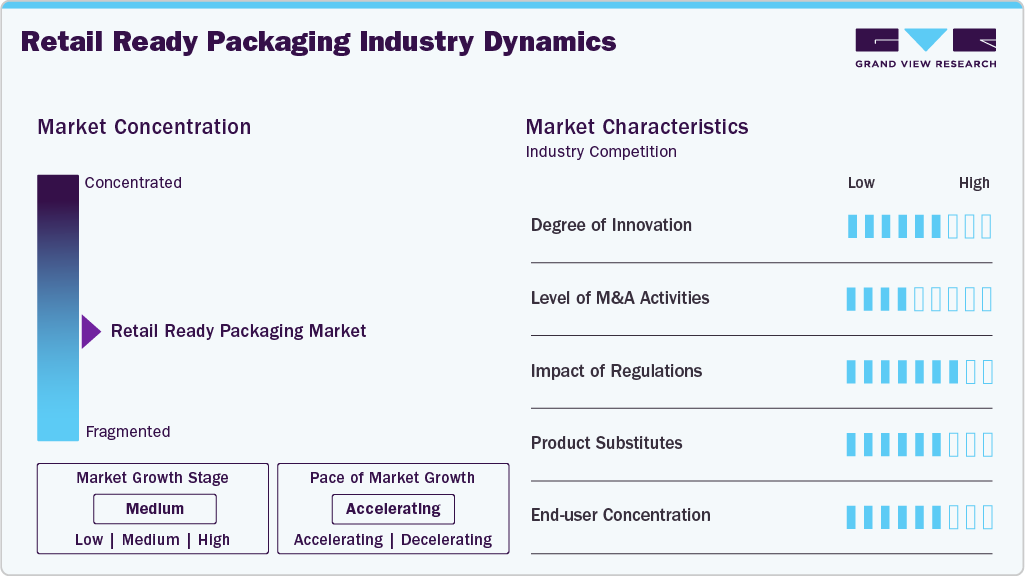

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. Ongoing efforts by key industry participants have resulted in fragmented market scenarios by driving innovation, sustainability, and collaboration. Companies like DS Smith and Smurfit Kappa are introducing eco-friendly solutions such as mono-material wraps and recyclable paperboard trays, reducing plastic waste and enhancing branding opportunities. Retailers like Tesco and Ocado are pioneering refillable and reusable packaging models, aiming to minimize single-use plastics and enhance consumer engagement. In May 2024, Graphic Packaging International partnered with UK retailer Morrisons to introduce a first-of-its-kind, photographic print pressed board tray for its private label steak range.

The global retail-ready packaging industry is characterized by a high degree of innovation, driving significant advancements in sustainability, functionality, and consumer engagement. Cutting-edge materials and eco-friendly designs reduce waste while enhancing product protection. Innovative packaging improves shelf appeal and simplifies handling for retailers, boosting operational efficiency. In addition, integrating digital technologies like QR codes and smart labeling creates interactive experiences, increasing brand loyalty.

In June 2023, DS Smith introduced DD Wrap, a sustainable and innovative shelf-ready packaging solution designed to support the circular economy. This eco-friendly packaging focuses on reducing resource use and minimizing waste.

Product Insights

The die-cut display containers segment dominated the market with the largest revenue share of 30.0% in 2024, fueled by their custom-fit design, which enhances product visibility and reduces packaging waste. Stamped from corrugated sheets in a cookie-cutter style, these containers offer exceptional versatility in size, shape, and branding potential. Their efficient storage, minimal tape usage, and ease of shelf placement make them highly cost-effective. Retailers value their ability to serve as protective packaging and as attractive in-store displays, driving widespread adoption across food, beverage, personal care, and household product segments.

The folded cartons segment is anticipated to grow at a significant CAGR of 6.2% over the forecast period, attributed to their sustainability, versatility, and cost-effectiveness. Their lightweight yet sturdy design reduces shipping costs while providing excellent product protection. High-quality printing capabilities enable vibrant branding and product information, enhancing shelf appeal and consumer engagement. Increasing demand from the food and beverage, personal care, and pharmaceutical industries is fueling growth.

The shrink-wrapped tray consists of a cardboard tray wrapped in a shrink film. This type of retail ready packaging is economical compared to full-case packing. In addition, it offers more product visibility, allowing retailers to display the inventory. Snack products like granola bars, sunflower seeds, crackers, single-serve mini-cookies, and beverages are packed in rigid containers such as jars and bottles. These products are further provided with secondary protection by enclosing the primary packaging in the shrink-wrapped trays. The function of trays is to protect the vulnerable areas of the primary packaging and the shrink film helps hold the product in place during distribution.

Corrugated cardboard boxes are used in retail-ready packaging to enclose bulk products. They often enclose edible oil jerry cans or detergent powder pouches. They are usually regular slotted types (RSC). The corrugated cardboard boxes have excellent strength and a good-to-weight ratio. The corrugated boxes can be customized to fit particular-sized products and come in varying sizes. The double-layer walls with B and E flutes protect items against handling, shipping, and environmental impacts. Product protection also plays a critical role in retail-ready packaging. Damaged external packaging can influence the buyer's purchasing decision. Hence, the strength and durability of the corrugated boxes can contribute to their demand in the retail-ready packaging market.

Material Insights

The paper & paperboard segment held the largest revenue share in 2024, propelled by their versatility, cost-effectiveness, and sustainability. These materials offer excellent printability, lightweight structure, and easy customization, making them suitable for diverse retail environments. The ease of recycling paperboard materials, minimal handling needs, and sustainable sourcing methods have made it an ideal choice for retail-ready packaging solutions. Growing consumer preference for eco-friendly options and retailer demand for efficient shelf-ready formats further boost this segment.

Strong adoption across food, beverage, and personal care sectors continues to drive market dominance. In October 2024, Visy launched a new A$175 million corrugated cardboard box facility in Hemmant, Queensland, Australia. Capable of producing up to one million boxes daily, the plant is expected to supply packaging primarily to food and beverage companies.

The plastic segment is expected to be the fastest-growing retail-ready packaging industry from 2025 to 2030, owing to its superior durability, moisture resistance, and ability to protect products during transportation and handling. These qualities make it especially suitable for items requiring enhanced environmental protection. Its lightweight nature also reduces shipping costs and supports shelf-ready presentation. Despite recycling challenges, advancements in biodegradable and recyclable plastics are improving their environmental profile, encouraging wider adoption across sectors like food, personal care, and household goods. Demand for practical, resilient packaging solutions continues to drive growth in this segment.

Application Insights

The food & beverage segment accounted for the largest market share in 2024 due to its constant need for efficient, protective, and visually appealing packaging solutions. Retail-ready packaging supports fast shelf replenishment and enhances product visibility, making it ideal for high-turnover items like snacks, beverages, edible oils, and bakery goods. This approach enhances logistical efficiency for retailers and strengthens manufacturers' brand identity.

The pharmaceuticals segment is projected to grow at the fastest CAGR over the forecast period, propelled by rising global sales and increasing over-the-counter drug demand. Retail-ready packaging allows pharmacists to quickly locate and organize medications, improving operational efficiency in retail environments. Pharmaceutical companies are turning to this packaging in a highly competitive industry to enhance brand visibility and differentiate their products.

Regional Insights

The North America retail-ready packaging market is expected to witness a significant CAGR of 5.9% from 2025 to 2030, driven by a growth in the young population, increasing disposable income, and strong purchasing power. The presence of major retailers such as Walmart, Target, and Home Depot, actively expanding their store networks, is boosting demand for efficient retail-ready packaging solutions. In addition, established packaging manufacturers such as International Paper and Smurfit Kappa support this growth by offering innovative products.

U.S. Retail Ready Packaging Market Trends

The U.S. retail-ready packaging market held the largest share in 2024, owing to customization for brand differentiation and the surge in e-commerce. Brands increasingly adopt tailored packaging solutions to enhance shelf appeal and create a strong visual identity, helping them stand out in a competitive retail environment. Furthermore, online shopping has intensified the need for packaging that ensures product protection, facilitates easy handling, and delivers an engaging unboxing experience.

Europe Retail Ready Packaging Market Trends

Europe retail-ready packaging market is anticipated to experience significant expansion during the forecast period, fueled by sustainability initiatives and the integration of smart packaging technologies. Growing environmental regulations and consumer preference for eco-friendly materials push manufacturers to adopt recyclable, biodegradable packaging solutions. In June 2024, Smurfit Kappa acquired Artemis Limited, a bag-in-box packaging facility in Shumen, Bulgaria, to strengthen its presence in Eastern Europe. The acquisition aims to expand its customer base and boost innovation and product offerings in the bag-in-box segment.

Asia Pacific Retail Ready Packaging Market Trends

Asia Pacific retail ready packaging market dominated with the largest revenue share of 36.8% in 2024, attributed to rapid urbanization and technological advancements. Growing urban populations fuel demand for efficient retail formats and convenient packaging solutions, especially in fast-paced metropolitan areas. Technological innovations such as automation, smart labeling, and digital printing enhance supply chain efficiency and product differentiation. Retailers and manufacturers leverage these advancements to meet consumer expectations for convenience, sustainability, and visual appeal. This synergy between urban growth and innovation creates new opportunities, positioning the region as a major hub for retail ready packaging expansion. For instance, in July 2024, Mondi introduced FlexiBag Reinforced, a new addition to its sustainable packaging line. This innovative range features recyclable, mono-PE-based plastic bags designed with enhanced mechanical properties.

China Retail Ready Packaging Market Trends

China's retail-ready packaging market accounted for the largest share in the regional market in 2024, driven by customization and branding efforts, coupled with the rapid rise of online shopping. Companies increasingly leverage customized packaging to strengthen brand identity and appeal to consumer preferences in a competitive marketplace. The booming e-commerce sector demands packaging that ensures product safety during transit, enhances the unboxing experience, and simplifies last-mile delivery.

Key Retail Ready Packaging Company Insights

Some of the key companies in the retail ready packaging industry include International Paper; Mondi; Smurfit Westrock; Green Bay Packaging Inc.; DS Smith; and Weedon Group Ltd.

-

Smurfit WestRock provides sustainable packaging solutions, including corrugated boxes, consumer packaging, Bag-in-Box systems, point-of-sale displays, and automation services. They serve diverse food, beverage, e-commerce, and consumer goods sectors.

-

Green Bay Packaging Inc. is a vertically integrated manufacturer specializing in sustainable custom packaging solutions. Its offerings include corrugated boxes, folding cartons, coated label products, and retail-ready packaging.

Key Retail Ready Packaging Companies:

The following are the leading companies in the retail ready packaging market. These companies collectively hold the largest market share and dictate industry trends.

- International Paper

- Mondi

- Smurfit Westrock

- Green Bay Packaging Inc.

- DS Smith

- Weedon Group Ltd

- Vanguard Packaging, LLC

- Graphic Packaging International, LLC

- The Cardboard Box Company

- BoxesIndia

- STI - Gustav Stabernack GmbH

- Bennett

- WestRock Company

- Abbe

Recent Developments

-

In August 2024, Smurfit Westrock created shelf-ready beer boxes for Woodforde’s, designed to stand out on crowded supermarket shelves, resist water damage, and attract repeated purchases.

Retail Ready Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 96.12 billion

Revenue forecast in 2030

USD 126.5 billion

Growth rate

CAGR of 5.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

International Paper; Mondi; Smurfit Westrock; Green Bay Packaging Inc.; DS Smith; Weedon Group Ltd; Vanguard Packaging, LLC; Graphic Packaging International, LLC; The Cardboard Box Company; BoxesIndia; STI - Gustav Stabernack GmbH; Bennett; WestRock Company; Abbe

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Retail Ready Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global retail ready packaging market report based on product, material, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Die-cut display containers

-

Corrugated cardboard boxes

-

Shrink-wrapped trays

-

Folded cartons

-

Others

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Plastic

-

Paper & Paperboard

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Beverage

-

Pharmaceuticals

-

Electronics

-

Personal Care & Cosmetics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.