- Home

- »

- Medical Devices

- »

-

RFID (Radio-frequency Identification) Smart Cabinets MarketGVR Report cover

![RFID (Radio-frequency Identification) Smart Cabinets Market Size, Share & Trends Report]()

RFID (Radio-frequency Identification) Smart Cabinets Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (RFID Antenna, RFID Reader, RFID Tag, & Others), By Region, And Segment Forecast

- Report ID: 978-1-68038-019-4

- Number of Report Pages: 208

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

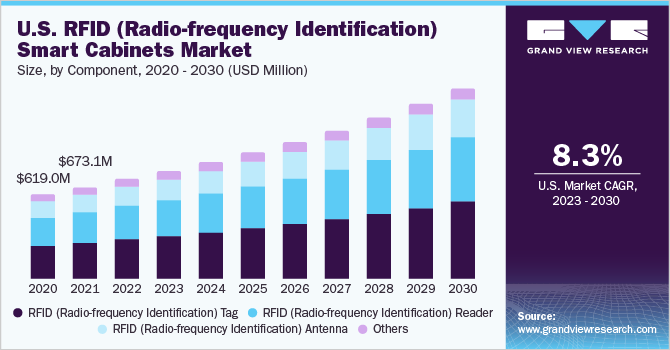

The global RFID (Radio-frequency Identification) smart cabinets market size was valued at USD 1,614.1 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 9.1% from 2023 to 2030. The market has been growing steadily due to the increasing adoption of RFID technology in healthcare, a growing need to improve inventory management and reduce operational costs, and rising demand for effective healthcare supply chain management.

Furthermore, increasing government initiatives are promoting the adoption of RFID technology in various industries to improve supply chain visibility, enhance security, and reduce counterfeiting. These factors are also driving the demand for RFID technology in various industries. The advantages associated with RFID smart cabinets include data accuracy, real-time tracking, and less inventory waste & equipment losses. These factors decrease the operational costs of hospitals and pharmaceutical companies, and therefore, hospitals have started to adopt RFID smart cabinets for tracking of various items across the globe.

The introduction of mobile RFID smart cabinets has also impacted the market positively. These cabinets are designed to be mobile and can be moved around the facility as needed, allowing for easy access to inventory and efficient management of medical supplies. Companies such as Terso Solutions have introduced mobile RFID smart cabinets that feature an integrated touchscreen, making it easy for healthcare professionals to access inventory information and track usage. In addition, the RFID smart cabinet market has also seen the development of RFID smart cabinets with temperature control capabilities.

These cabinets are designed to store temperature-sensitive medical supplies, such as vaccines and medications, at the appropriate temperature to maintain their efficacy. Companies such as Grifols, S.A. have introduced RFID smart cabinets with temperature control capabilities that enable better inventory management and improved patient safety. The healthcare industry is one of the major end-users of RFID smart cabinets. The increasing demand for healthcare solutions, including medical device tracking, patient tracking, and inventory management, is driving the growth of the market. For instance, in September 2020, IntelliGuard announced the launch of a next-generation Vendor Managed Inventory solution. It is a cloud-based platform that offers IoT capabilities for real-time tracing and tracking of medication inventory dispensing and replenishment.

The pandemic has had a substantial impact on the market for Radio-frequency Identification smart cabinets, particularly in the healthcare industry. Demand has increased as hospitals utilize this technology to reduce virus spread, identify and control infection, and manage inventory. Wireless communication tools used to identify and track assets and equipment have seen widespread use.

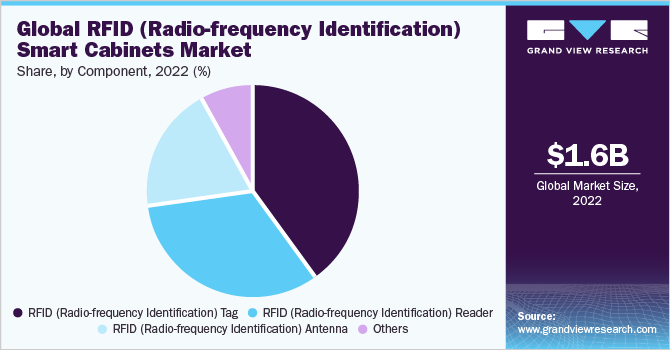

Component Insights

RFID (Radio-frequency Identification) Tags captured the highest market share of 39.7% in 2022. These are small electronic device that consists of a microchip and an antenna. It is designed to store and transmit information wirelessly using radio waves. RFID tags are a versatile and widely used technology that enables businesses to track and manage their inventory and assets more efficiently and effectively. Moreover, it can also be used for several other applications such as access control, payment systems, and vehicle tracking. This makes them versatile and useful technology in a range of industries.

RFID Antenna is projected to witness considerable growth in the coming years. These are used to transmit and receive radio signals between the RFID reader and the tag. Advances in RFID antenna technology have led to smaller, more efficient, and cost-effective antennas, making RFID technology more accessible.

Radio-frequency Identification Reader is used to gather information from an RFID tag, which helps to track objects. To transfer data from the tag to a reader radio waves are used. These readers could be integrated with technologies such as GPS and sensors, which makes them even more useful in applications such as logistics, transportation, and supply chain management. Moreover, advancements in data analytics and cloud computing have also enabled RFID readers to provide real-time insights and analytics that can be used to optimize processes and improve decision-making.

Regional Insights

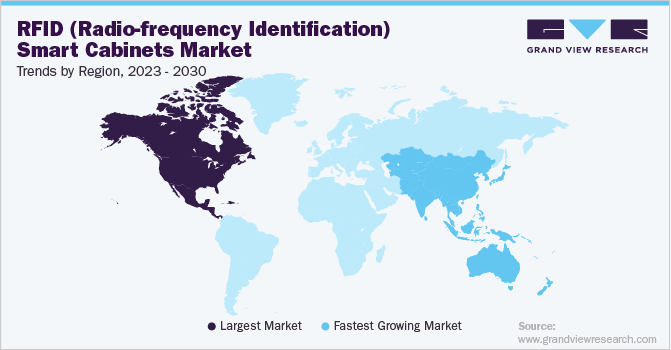

North America captured the highest market share of USD 811.5 million in 2022. The region has a strong healthcare industry, and RFID smart cabinets have become a popular solution for tracking medical supplies and equipment in hospitals and clinics. The growing penetration rate of radio-frequency identification technologies due to the availability of a well-developed healthcare infrastructure is one of the major factors responsible for the market growth in North America.

Asia Pacific is anticipated to witness the fastest growth rate in the forecast period from 2023 to 2030 due to the increasing awareness about radio-frequency identification systems and rise in medical tourism. The Asia Pacific region has a large and growing healthcare industry which would boost the demand for RFID smart cabinets in the region. Moreover, the market is driven by the constant need to improve operational efficiency, reduce costs, and comply with regulations.

The adoption of radio-frequency identification technology in Europe has been driven by a number of factors, including the need to improve operational efficiency, reduce costs, and comply with regulations. Moreover, the region has a highly developed IT infrastructure, making it easier to implement and manage RFID systems. Countries such as Germany and the UK dominated the European market in 2022 owing to the presence of large government-funded hospital programs.

Key Companies & Market Share Insights

The radio-frequency identification smart cabinets market is fragmented owing to the presence of several companies offering several solutions and technologies. Market players are undertaking strategic initiatives, such as product launches, partnerships, and acquisitions, to strengthen their presence. For instance, in January 2023, Avery Dennison announced to launch of a new manufacturing unit in Mexico, which aims to expand the company’s production capacity in the country. Some of the prominent players in the RFID (radio-frequency identification) smart cabinets market include:

-

Grifols, S.A.

-

Invengo Technology Pte. Ltd.

-

LogiTag

-

Alien Technology, LLC

-

GAO Group Inc.

-

Impinj, Inc.

-

Palex Medical

-

American RFID Solutions, LLC

-

CAEN RFID S.r.l.

-

IDENTI Medical

RFID (Radio-frequency Identification) Smart Cabinets Market Report Scope

Report Attribute

Details

The market size value in 2023

USD 1,754.5 million

The revenue forecast in 2030

USD 3,231.9 million

Growth rate

CAGR of 9.1% from 2023 to 2030

The base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, region

Country scope

U.S.; Canada; Germany; U.K.; Spain; France; Italy; Sweden; Norway; Denmark; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia and Kuwait

Key companies profiled

Grifols; S.A.; Invengo Technology Pte. Ltd.; LogiTag; Alien Technology, LLC; GAO Group Inc.; Impinj, Inc.; Palex Medical; American RFID Solutions, LLC; CAEN RFID S.r.l.; IDENTI Medical

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global RFID (Radio-frequency Identification) Smart Cabinets Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the RFID (Radio-frequency Identification) smart cabinets market based on component and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

RFID (Radio-frequency Identification) Antenna

-

RFID (Radio-frequency Identification) Reader

-

RFID (Radio-frequency Identification) Tag

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global RFID (Radio-frequency Identification) smart cabinets market size was estimated at USD 1,614.1 million in 2022 and is expected to reach USD 1,754.5 million in 2023.

b. The global RFID smart cabinets market is expected to grow at a compound annual growth rate of 9.1% from 2023 to 2030 to reach USD 3,231.9 million by 2030.

b. North America dominated the RFID (Radio-frequency Identification) smart cabinets market with a share of 50.3% in 2022. The growing penetration rate of RFID technologies due to the availability of well-developed healthcare infrastructure is one of the major factors responsible for the market growth in North America.

b. Some of the key players operating in the RFID smart cabinets market include Grifols, S.A., Invengo Technology Pte. Ltd., LogiTag, Alien Technology, LLC, GAO Group Inc., Impinj, Inc., Palex Medical, American RFID Solutions, LLC, CAEN RFID S.r.l., and IDENTI Medical

b. Rising adoption of RFID enabled cabinets due to their widening applications in healthcare and pharmaceuticals domain are likely to drive the market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.