- Home

- »

- Pharmaceuticals

- »

-

Rheumatoid Arthritis Therapeutics Market, Industry Report, 2018-2025GVR Report cover

![Rheumatoid Arthritis Therapeutics Market Size Report]()

Rheumatoid Arthritis Therapeutics Market Size Analysis Report By Molecule Type (Biopharmaceuticals (Biologics, Biosimilars), Pharmaceuticals), By Sales Channel (Prescription, OTC), And Segment Forecasts, 2018 - 2025

- Report ID: GVR-2-68038-313-3

- Number of Pages: 85

- Format: Electronic (PDF)

- Historical Range: 2014 - 2016

- Industry: Healthcare

Industry Outlook

The global rheumatoid arthritis therapeutics market size was valued at USD 20.3 billion in 2016. The market is anticipated to expand at a CAGR of 4.6% over the forecast period. Increasing prevalence of arthritis, growing acceptance of biopharmaceuticals, and the presence of well-defined regulatory guidelines in developed economies are among the key trends expected to trigger market growth.

Increasing launches of novel biologics and rising penetration of generic drugs are estimated to provide a significant boost to the market. For instance, introduction of Olumiant by Eli Lilly and Company in 2017 is likely to fuel revenue growth in Japan. Similarly, Upadacitinib, a novel JAK1-selective inhibitor by AbbVie, is awaiting approval by 2019. Recently approved biologics such as Xeljanz and Kevzara are poised to have strong market penetration due to the presence of favorable reimbursement scenario.

Growing patient awareness regarding rheumatic disorders and influx of new biopharmaceuticals in the global arena are projected to rev up adoption of rheumatoid arthritis (RA) therapeutics. In 2013, approximately 52.2 million adults suffered from arthritis in the U.S. alone. Most patients who have been treated with Disease-Modifying Antirheumatic Drugs (DMARDs) remain unsatisfied due to poor therapeutic benefits. For this patient group, a combination of biologics and DMARDs is likely to deliver higher therapeutic benefits. Thus, the rheumatoid arthritis market is witnessing a shift toward combination therapies that provide enhanced results to patients. Rise in penetration of combination of DMARDs and biologics will boost market revenue in the coming years.

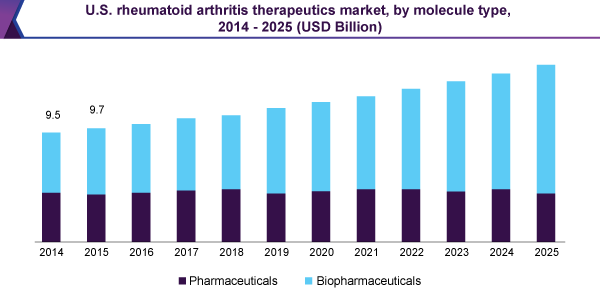

Molecule Type Insights

On the basis of molecule type used for treatment, the global rheumatoid arthritis drugs market has been segmented into biopharmaceuticals and pharmaceuticals. The biopharmaceutical segment dominated the market in 2016, accounting for just over 57.0% of the total market. The segment is likely to make inroads in the share of its counterpart, thereby retaining dominance through 2025. Pharmaceuticals are primarily used as the first line treatment for this disorder. However, their demand is low as compared to biopharmaceuticals due to the latter’s higher therapeutic output and disease remittance action. Biopharmaceuticals have been further divided into biologics and biosimilars. Biologic drugs are preferred to biosimilars by physicians for the treatment of RA and are anticipated to dominate the market throughout the forecast horizon.

Biologic drugs are estimated to represent the leading share in terms of revenue in developed economies throughout the forecast period. However, in developing countries such as Brazil, Mexico, and South Africa, these drugs face stiff competition from biosimilars and pharmaceutical generics owing to high prices of biologics.

On the other hand, demand for biosimilars is projected to witness an exponential rise in the coming years. Higher availability, positive results, and low price are supplementing the growth of the segment. Their demand is strong in emerging economies; nevertheless, they are also gradually gaining traction in developed countries due to launch of newer effective products. Biosimilars of Rituximab, Adalimumab, and Infliximab have already received regulatory approval in some countries. In January 2018, Glenmark pharmaceuticals launched biosimilar for Humira in the Indian market. Introduction of new biosimilars in the near future is poised to create a significant shift in prescription patterns.

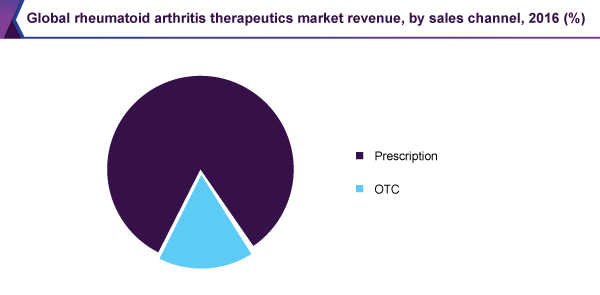

Sales Channel Insights

In recent times, there has been a tremendous upswing in patients preferring prescription drugs to OTC drugs. The factor responsible for the shift is rise in awareness regarding new disease reversal treatment options. The prescription segment is likely to dominate the rheumatoid arthritis drugs market throughout the forecast period owing to increasing rheumatologist consultations. Prolonged overuse of RA medication may lead to drug resistance, owing to which patients suffering from this disease are anticipated to consult rheumatologists and follow advised therapy. Additionally, the number of OTC products available for treatment is meagre.

OTC products comprise various active ingredients such as acetaminophen and diclofenac. Share of these OTC drugs is expected to decrease over the forecast period due to approval of newer therapeutics with fewer adverse effects and increasing awareness regarding disease remittance prescription therapies for arthritis. Moreover, regular consumption of OTC therapies for pain management may lead to serious side effects such as liver damage and habit formation.

Regional Insights

North America accounted for more than 55.0% of the rheumatoid arthritis therapeutics market in 2016. Heightened awareness of disease remittance therapies among patients, rising prevalence of RA, and high public and private healthcare spending are stimulating the growth of the region. Moreover, easy access to quality healthcare, favorable reimbursement policies, strong clinical pipeline, and approval of novel drugs are projected to promote revenue growth in North America.

The U.S. is at the forefront of growth in the region and is also an important revenue contributor in the global arena. An estimated 860 individuals out of every 100,000 in the country suffer from rheumatoid arthritis. Price-sensitive regions such as Latin America and MEA have higher acceptance of generic drugs as compared to innovator biologics due to lower price. Increasing demand for new treatment options for disease reversal is poised to augment the regional markets during the forecast period.

Asia Pacific is likely to post the highest CAGR between 2017 and 2025. Growing adoption of urban lifestyle is leading to expanding base of patients in the region. This, coupled with increasing healthcare spending, is expected to propel the market in APAC. Favorable regulatory policies for biosimilars are estimated to boost demand for therapies over the forecast period.

Rheumatoid Arthritis Therapeutics Market Share Insights

Manufacturers offering biopharmaceuticals dominate the global RA therapeutics market. Few players also provide both branded drugs and generics due to price-sensitive population in developing regions. Companies are focusing on building novel chemical entities and innovative molecules to consolidate their foothold. Some of the prominent market participants areAbbVie; Boehringer Ingelheim GmbH; Novartis AG; Regeneron Pharmaceuticals, Inc.; Pfizer, Inc.; Bristol-Myers Squibb Company; F. Hoffmann-La Roche Ltd.; UCB S.A.; Johnson & Johnson Services, Inc.; and Amgen, Inc.

Development of novel biologics and strong clinical pipeline is anticipated to increase competition in the market. The generic pharmaceuticals segment is poised to witness new entrants due to low entry barriers in the RA drugs market.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2016

Forecast period

2017 - 2025

Market representation

Revenue in USD Million and CAGR from 2017 to 2025

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, U.K., Germany, China, Japan, Brazil, Mexico, South Africa

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis on industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the global rheumatoid arthritis therapeutics market report on the basis of molecule type, sales channel, and region:

-

Molecule Type Outlook (Revenue, USD Million, 2014 - 2025)

-

Pharmaceuticals

-

NSAIDs

-

Analgesics

-

DMARDs

-

Glucocorticoids

-

-

Biopharmaceuticals

-

Biologics

-

TNF-α antagonists

-

T-cell inhibitors

-

CD20 antigen

-

JAK inhibitors

-

anti-IL6 biologics

-

-

Biosimilars

-

CD20 antigen

-

TNF-α antagonists

-

-

-

-

Sales Channel Outlook (Revenue, USD Million, 2014 - 2025)

-

Prescription

-

Over-the-Counter (OTC)

-

-

Regional Outlook (Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."