- Home

- »

- Homecare & Decor

- »

-

Ride Hailing Services Market Size, Industry Report, 2033GVR Report cover

![Ride Hailing Services Market Size, Share & Trends Report]()

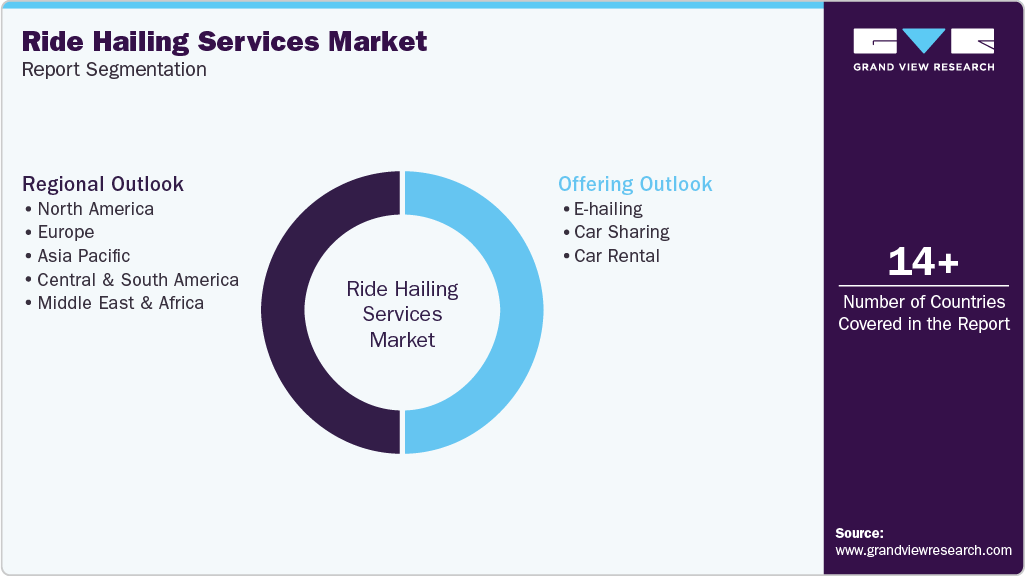

Ride Hailing Services Market (2026 - 2033) Size, Share & Trends Analysis Report By Offering (E-hailing, Car Sharing, Car Rental), By Region (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-3-68038-175-7

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ride Hailing Services Market Summary

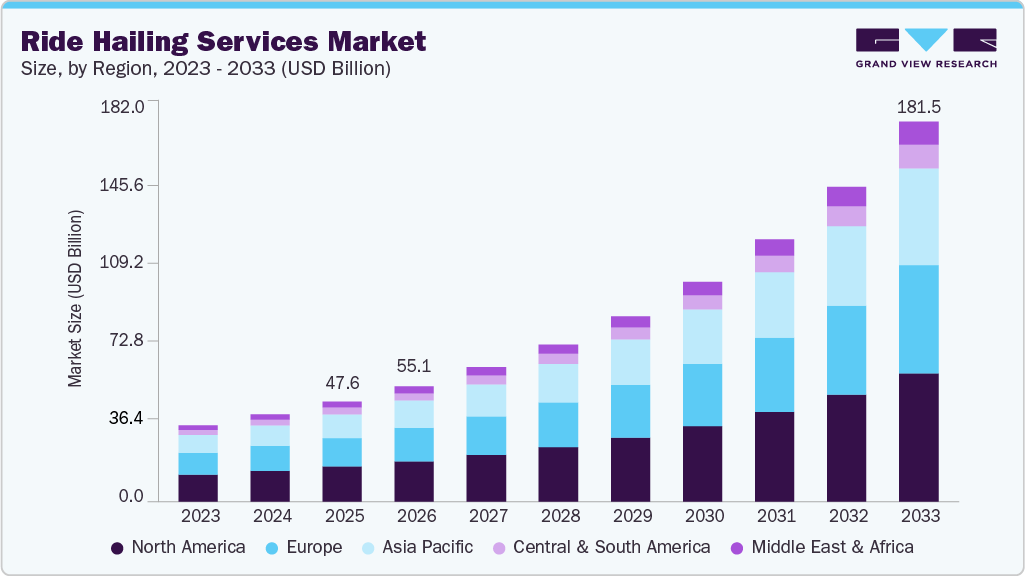

The global ride hailing services market size was estimated at USD 47.61 billion in 2025 and is projected to reach USD 181.54 billion by 2033, growing at a CAGR of 18.6% from 2026 to 2033. The popularity of the market for ride sharing has increased over the past several years as companies work toward improving transportation by making it more efficient, convenient, economical, and comfortable.

Key Market Trends & Insights

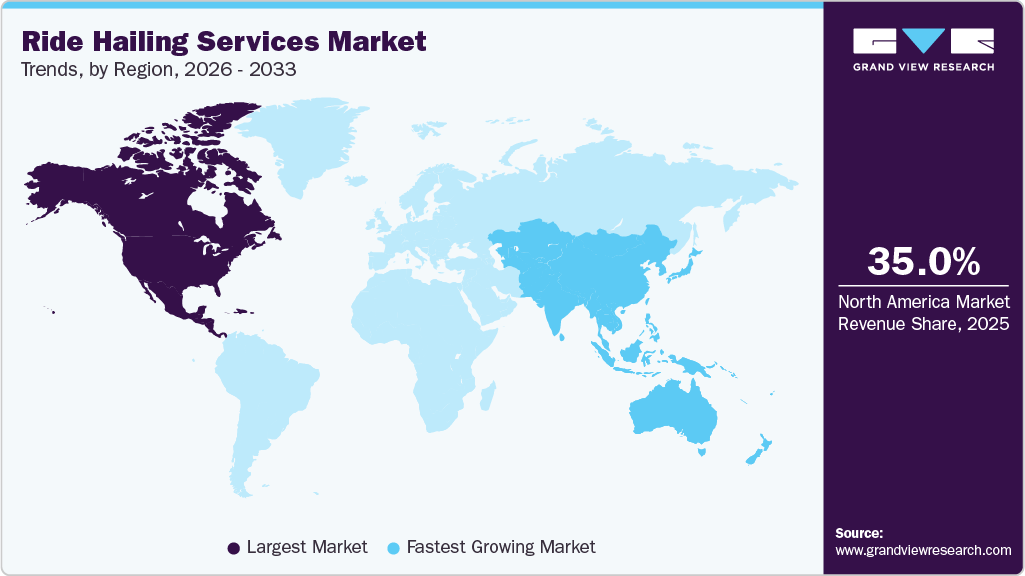

- North America dominated the ride-hailing services market with a share of 35.0% in 2025.

- The ride-hailing services market in the U.S. is expected to record a significant CAGR over the forecast period.

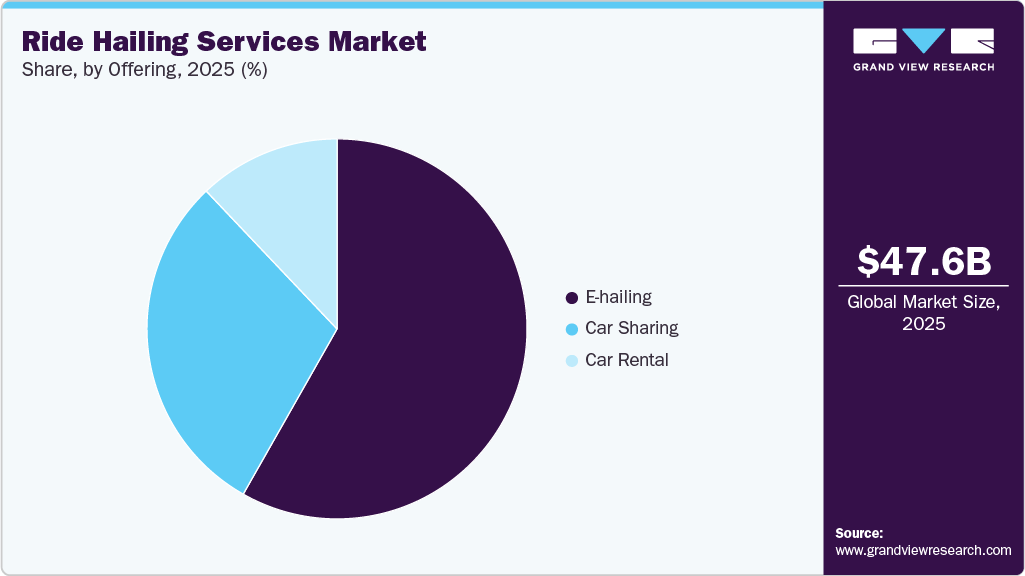

- Based on offering, the E-hailing market segment dominated the ride hailing services market with a share of 57.9% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 47.61 Billion

- 2033 Projected Market Size: USD 181.54 Billion

- CAGR (2026-2033): 18.6%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The prospect of self-driving cars, which are expected to significantly lower the cost of ride-hailing services, has contributed to the growing popularity of mobility-as-a-service (MaaS). Furthermore, banks and lenders have lowered their interest rates to make it simpler and less expensive to finance the purchase of an automobile. Employing fleets of automated vehicles helps businesses to innovate their services by enhancing the comfort and safety of passengers.

The rising population has led to problems such as increased traffic congestion, a lack of suitable public transport options, and longer wait times for public transportation services. As a result, ride hailing services are attracting more travelers as they provide faster and on-demand services. Increased fuel prices, increased vehicle maintenance costs, and the adoption of strict emission norms make ride hailing less expensive than owning a vehicle. These factors are expected to drive market growth over the forecast period.

The user-friendly booking options and convenience offered by these services are other key factors contributing to their growing demand. Digitally enabled car-sharing and ride hailing efficiently manage transport demands as well as provide convenient and environmentally friendly rides. This is handled through a single smartphone application, which is anticipated to generate a lucrative opportunity for the market during the forecast period.

As the ride hailing services require a huge workforce of trained drivers, the industry is receiving support from the governments of developing countries, including China and India. An increasing number of companies introducing innovation in services for the maximum comfort of commuters is also expected to boost the market.

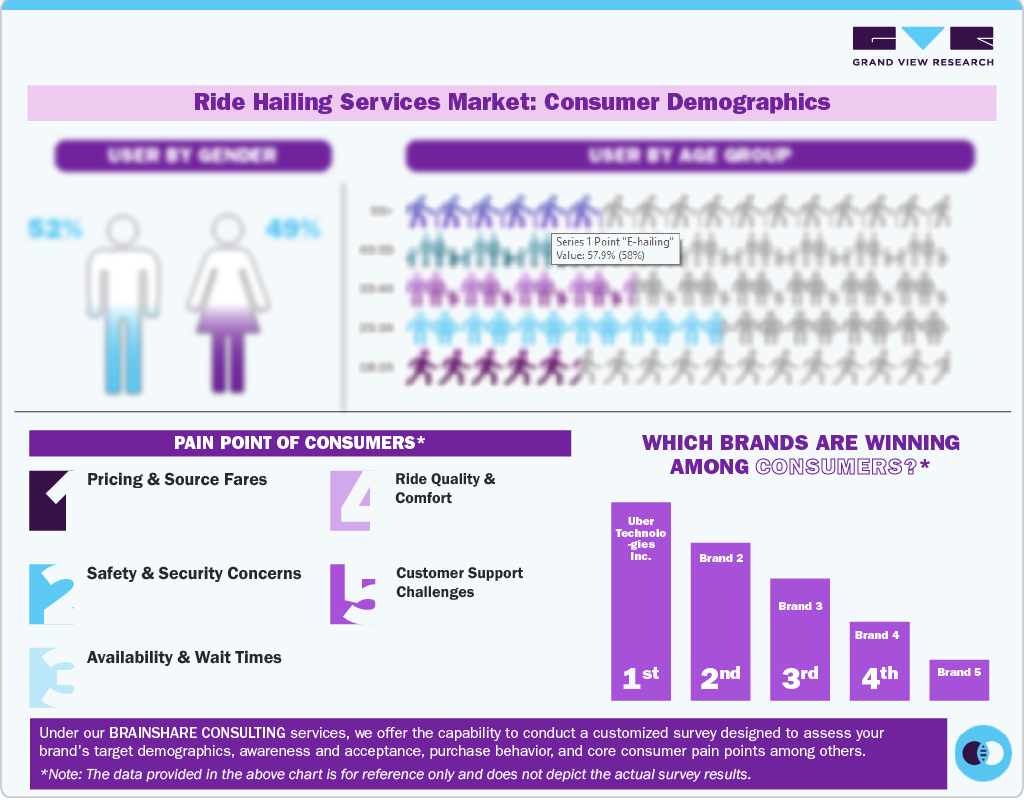

Consumer Insights

Younger consumers often prefer ride-hailing services because they are convenient, fast, and easy to use through mobile apps. In contrast, older people often prefer traditional taxis or their own cars. Each age group has its own reasons for using these services, as well as different habits and budgets, which affect market growth. By understanding these differences, ride-hailing companies can develop targeted marketing strategies, refine their services, and enhance app features to better meet the needs of each group.

Consumer Demographics

Gender plays a significant role in how people utilize ride-hailing services. Men tend to use these services more often for work, leisure, and technology-related trips, and they are usually the first to try new app features and digital payments. Women are more likely to prioritize safety, reliability, and comfort when booking rides, paying close attention to driver behavior and service quality. As more people become familiar with digital tools and mobile platforms, the gender gap is narrowing, but some differences in preferences still exist. By understanding these patterns, ride hailing companies can design targeted marketing campaigns, enhance app features, and offer services that better meet the needs of both men and women.

The growth of the global urban population significantly supports the expansion of the ride-hailing market. Urbanization drives higher demand for convenient, app-based mobility solutions, increases access to organized transportation networks, and encourages the adoption of digital payments. As cities expand, consumers enjoy greater access to ride-hailing platforms, higher disposable incomes, and a preference for fast, cashless, and flexible travel options.

Offering Insights

The E-hailing market segment dominated the ride hailing services market with a share of 57.9% in 2025. The rapid adoption of digital devices, such as smartphones and smart wearables, along with the increasing use of the internet, has contributed to the growth of E-hailing services. The rising popularity of the transportation model and growing use of app-based travel, driven by the increasing affordability of smartphones and internet services, are key factors driving the growth of this segment.

The car rental market segment is projected to record a CAGR of 19.5% over the forecast period. The growth of this segment is attributed to the convenience and ease of use of this service, which can be booked via phone as well as various taxi apps. In addition, a large number of car operators and the widespread availability of the taxi cum car services across the world are contributing to the global ride-hailing and taxi market.

Regional Insights

North America dominated the ride hailing services market with a share of 35.0% in 2025. Significant use of smartphones and the internet in the region has made ride-hailing apps widely accessible. Major companies like Uber and Lyft, a large urban population, and strong demand for convenient transportation have helped these services lead the market. Easy payment options, a shift toward cashless travel, and an increase in people using ride-hailing services for daily commutes, airport trips, and business travel have also strengthened the position of North America.

U.S. Ride Hailing Services Market Trends

The U.S. ride hailing services held the largest share in 2025 in the North America region. In the U.S., ride hailing service providers generate a majority of their gross income from trip bookings in large metropolitan areas, including trips to and from airports. Uber, a leader in ride-hailing services, accounts for approximately 14 million individual trips per day in the U.S. These factors contribute to the market share and are also expected to favor market growth in the country over the coming years.

Europe Ride Hailing Services Market Trends

Europe ride hailing services market is expected to grow over the forecast period. The growth of this region is linked to high urbanization rates in key cities such as London, Paris, and Berlin, with dense populations and limited public transport options. Mature digital infrastructure, widespread smartphone penetration (89%), and supportive regulations further contribute to market growth.

Asia Pacific Ride Hailing Services Market Trends

Asia Pacific is expected to witness the fastest CAGR of 19.6% from 2026 to 2033. The rising population of cities such as Delhi, Bangalore, Mumbai, Beijing, Shanghai, and Tokyo is driving the need for these services. Moreover, market players in these regions are receiving immense support from the regional or provincial governments of countries such as India, China, Japan, and Sri Lanka. Developing economies, increasing need for job opportunities, and efforts toward creating a business-friendly environment are contributing to the demand for these services in the region.

Central & South America Ride Hailing Services Market Trends

The Central & South America ride hailing services market is projected to grow over the forecast period. Rapid urbanization, high traffic congestion, and strong smartphone penetration shape the market in key countries like Brazil. Brazil leads the region, holding the highest market share.

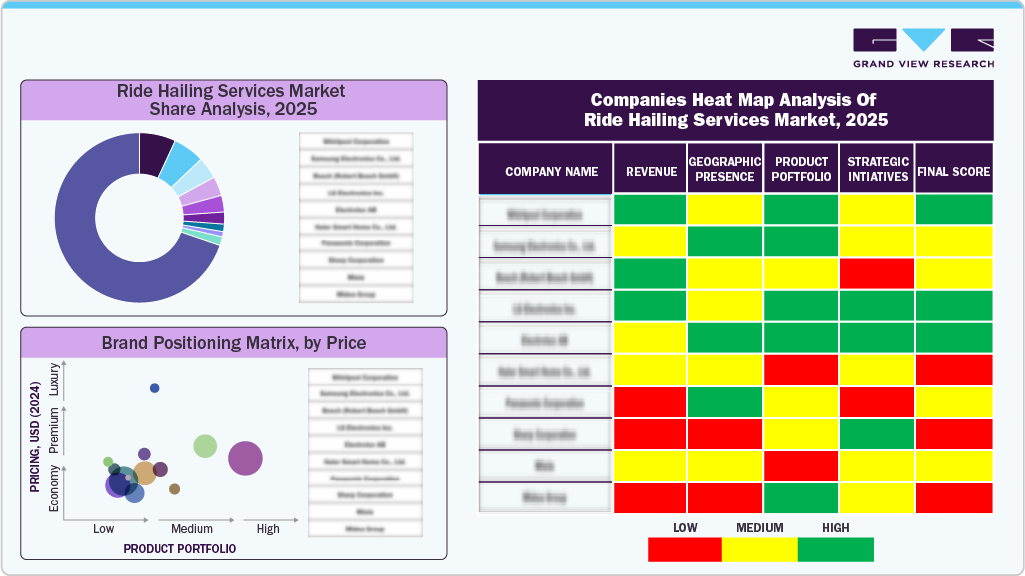

Key Ride Hailing Services Company Insights

Some of the key players operating in the ride hailing services market include Uber Technologies Inc.; Lyft, Inc.; Via Transportation, Inc.; Wheely; Ola Electric Mobility Pvt Ltd; and Rapido Transportation.

- Uber Technologies Inc. is a global technology platform dedicated to moving people, goods, and services efficiently. Uber connects riders, drivers, and delivery partners through its mobile app, enabling on-demand transportation, food delivery, freight logistics, and other services.

Key Ride Hailing Services Companies:

The following are the leading companies in the ride hailing services market. These companies collectively hold the largest market share and dictate industry trends.

- Uber Technologies Inc.

- Lyft, Inc

- Via Transportation, Inc.

- Wheely

- Gett

- Addison Lee Limited.

- BlaBlaCar

- Ola Electric Mobility Pvt Ltd

- Rapido Transportation

Recent Developments

-

In December 2025, Uber and Lyft partnered with Chinese tech giant Baidu to launch driverless taxi trials in London in 2026. This will be the first instance where U.S. and Chinese autonomous vehicle players compete directly in a European capital.

-

In November 2025, Uber announced its plan to partner with Starship Technologies to launch autonomous robot deliveries in the UK, starting in Leeds and Sheffield areas in December. The company plans to expand the service across Europe next year and the U.S. in 2027, as part of its broader push to automate delivery operations.

-

In October 2025, Rapido entered the online travel space by partnering with Goibibo, redBus, and ConfirmTkt, enabling users to book flights, hotels, buses, and trains directly through its app. This launch positions Rapido as India’s first homegrown one‑stop mobility‑led travel platform.

Ride Hailing Services Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 55.07 billion

Revenue forecast in 2033

USD 181.54 billion

Growth rate

CAGR of 18.6% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Offering, region

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Uber Technologies Inc.; Lyft, Inc.; Via Transportation, Inc.; Wheely; Gett; Addison Lee Limited; BlaBlaCar; Ola Electric Mobility Pvt Ltd; Rapido Transportation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ride Hailing Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global ride hailing services market report based on offering, and region:

-

Offering Outlook (Revenue, USD Billion, 2021 - 2033)

-

E-hailing

-

Car Sharing

-

Car Rental

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ride hailing services market was estimated at USD 47.61 billion in 2025 and is expected to reach USD 55.07 billion in 2026.

b. The ride hailing services is expected to grow at a compound annual growth rate of 18.6% from 2026 to 2033 to reach USD 181.54 billion by 2033.

b. North America dominated the ride-hailing services market with a share of around 34.95% in 2025. This is owing to the rising demand for car services in the metropolitan areas, including trips to and from airports across the region.

b. Some of the key players operating in the ride hailing services market include Uber, Lyft, Via, Juno, Xoox, Wheely, My Taxi, ViaVan, Gett, and Addison Lee.

b. Key factors that are driving the ride hailing services market growth include the rising population coupled with traffic congestion and increased fuel prices have led to the adoption of cab sharing and car rental services among the ride hailing services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.