- Home

- »

- Medical Devices

- »

-

Rigid Endoscopes Market Size, Share, Industry Report, 2033GVR Report cover

![Rigid Endoscopes Market Size, Share & Trends Report]()

Rigid Endoscopes Market (2025 - 2033) Size, Share & Trends Analysis Report By Product, By Angle of View, By Product Dimension, By Product Length, By Surgical Center Size, By Surgical Center Location, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-045-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Rigid Endoscopes Market Summary

The global rigid endoscopes market size was estimated at USD 7.31 billion in 2024 and is projected to reach USD 11.11 billion by 2033, growing at a CAGR of 4.74% from 2025 to 2033. The increasing prevalence of cancer and cancer-related mortality globally is one of the factors expected to drive the market.

Key Market Trends & Insights

- The North America rigid endoscopes market dominated the global market in 2024 and accounted for the largest revenue share of 40.69%.

- The U.S. dominated the rigid endoscopes market in North America region in 2024.

- By product, rigid laparoscopes segment dominated the market with the largest revenue share of 28.61% in 2024.

- In terms of the angle of view segment, the 30°segment held the largest revenue share in 2024.

- In terms of end use segment, the hospitals segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.31 Billion

- 2033 Projected Market Size: USD 11.11 Billion

- CAGR (2025-2033): 4.74%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

For instance, according to the Cancer Progress Report 2023 released by the American Cancer Society, in 2023, around 1,958,310 new cancer cases were diagnosed in the U.S., and 609,820 individuals succumbed to it. Projections indicate that by 2040, the number of new cancer cases could reach 2.3 million. As the prevalence of cancer rises globally, there is a growing need for effective diagnostic and treatment procedures. Endoscopes play a crucial role in offering minimally invasive options to accurately diagnose, stage, and treat various forms of cancer.

The increasing prevalence of cancer and cancer-related mortality globally is one of the factors expected to drive the market. For instance, according to the Cancer Progress Report 2023 released by the American Cancer Society, in 2023, around 1,958,310 new cancer cases were diagnosed in the U.S., and 609,820 individuals succumbed to it. Projections indicate that by 2040, the number of new cancer cases could reach 2.3 million. As the prevalence of cancer rises globally, there is a growing need for effective diagnostic and treatment procedures. Endoscopes play a crucial role in offering minimally invasive options to accurately diagnose, stage, and treat various forms of cancer.

Furthermore, endoscopic procedures, such as Endoscopic Ultrasonography (EUS) and Endoscopic Retrograde Cholangiopancreatography (ERCP), are valuable in detecting & assessing cancer in the gastrointestinal tract, lung, and other areas. These procedures allow for precise visualization of internal tissues, biopsy collection, and even removing precancerous growths or early-stage tumors without open surgery. This improves patient outcomes and significantly reduces recovery times & the risk of complications associated with invasive surgical procedures.

Minimally invasive or keyhole surgeries, utilizing small incisions for the diagnosis and treatment of various conditions, are gaining widespread acceptance globally. Surgeons are increasingly favoring robotic & endoscopic surgeries over conventional open surgeries due to the numerous benefits they offer.

Benefits of Minimally Invasive Surgeries

-

Reduced Postoperative Complications: Minimally invasive surgeries significantly lower the risk of postoperative complications compared to traditional open surgeries. The smaller incisions reduce the chances of infection and other surgical complications.

-

Shorter Hospital Stay and Recovery Time: Patients undergoing minimally invasive surgeries typically experience shorter hospital stays and faster recovery times. This enhances patient comfort and reduces the burden on healthcare facilities.

-

Decreased Blood Loss: These surgeries result in less blood loss during procedures, which is crucial for patient safety and recovery.

-

Economic Viability: Minimally invasive surgeries are often more cost-effective than open surgeries. The shorter hospital stays and quicker recoveries reduce overall healthcare costs, making these procedures economically viable alternatives.

The rigid endoscopes market has witnessed a significant surge in FDA approvals and the launch of new products. This is due to the advancements in medical technology and an increasing demand for minimally invasive procedures. Moreover, innovations in imaging technology are facilitating the trend of new product launches, enhancing the precision & effectiveness of diagnostic and therapeutic procedures. The launch of new products is expanding the range of options available to healthcare providers, improving patient outcomes, and promoting competitive dynamics in the market. Hence, manufacturers are intensifying their R&D efforts to stay ahead in this rapidly evolving landscape.

Table 1 List of FDA-approved rigid endoscopes and visualization system or device

Year of Approval

Company

Product Name

Description

January 2024

EndoSound

EndoSound’s Vision system

Integrates ultrasound imaging with endoscopy to enhance diagnostic capabilities.

December 2023

IQ Endoscopes

Q Vision G-100 (First-Generation Gastroscope)

Designed for gastrointestinal endoscopy, for visualization and treatment of the GI tract.

These advancements highlight a significant shift in the market, with a growing number of FDA approvals and product launches improving patient safety and driving market growth. The growing number of healthcare centers, such as hospitals, oncology specialty clinics, and cancer centers, is increasing the need for rigid endoscopes, which is expected to drive market growth. The number of endoscopies being performed in hospitals is growing with the increase in hospital facilities. The number of hospitals is increasing in most countries, including the U.S., the UK, Italy, Spain, China, India, Brazil, South Africa, and the UAE. According to American Hospital Association, there are 6,120 hospitals in the U.S. in 2024. Similarly, in 2021, there were 1,300 hospitals in Canada. The European Union has around 15,000 hospitals. Moreover, the UK has 1148 hospitals as of August 2023.

In addition, recent technological advancements in endoscopy devices, such as visualization components and imaging enhancement, which enabled the detection of gastrointestinal lesions without requiring dye injection, have increased demand for these devices in hospitals, diagnostic centers, and clinics, thereby driving market growth. For instance, in September 2022, Olympus Corporation introduced VISERA ELITE III, a surgical visualization platform catering to the needs of surgeons and healthcare practitioners across various endoscopic disciplines. This platform offers multiple imaging modalities and enables minimally invasive procedures, such as laparoscopic cholecystectomy & laparoscopic colectomy. VISERA ELITE III is available in MEA, Europe, Oceania, Asia, and Japan.

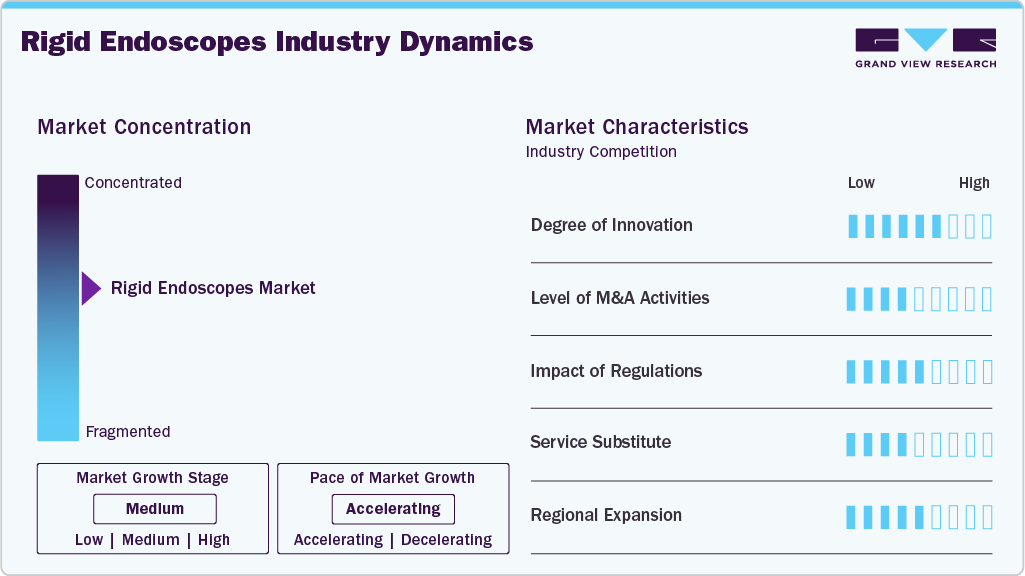

Market Concentration & Characteristics

The degree of innovation in the rigid endoscopes industry is medium, characterized by incremental advancements in optical clarity, illumination, and design ergonomics. Developments such as high-definition and 4K visualization, enhanced fluorescence imaging, and integration with digital image processing systems are steadily improving diagnostic and surgical precision. Collaborative efforts between optical engineers and software specialists enable better visualization and real-time image enhancement. However, widespread adoption is somewhat limited by high equipment costs, sterilization challenges, and the need for seamless integration within existing surgical workflows.

Mergers and acquisitions in the rigid endoscopes industry are moderate, primarily targeting companies with niche expertise in optical engineering, imaging enhancement, and minimally invasive instrumentation. These strategic moves aim to strengthen product portfolios, accelerate innovation, and expand global market presence. In addition to direct acquisitions, larger manufacturers increasingly pursue licensing deals and collaborative development agreements with smaller technology firms, enabling them to validate emerging technologies before full-scale integration and ensuring a steady, strategically managed growth path.

Regulatory frameworks significantly influence the rigid endoscopes market. Strict standards govern sterilization protocols, optical performance, biocompatibility, and mechanical durability to ensure patient safety and device reliability. Compliance with these regional and international regulations, such as FDA, CE, and ISO certifications, adds complexity, cost, and time to product development cycles. Companies with robust regulatory expertise and established global quality management systems hold a competitive advantage, as they can streamline product approvals, accelerate market entry, and maintain consistent compliance across diverse healthcare markets.

Product expansion in the rigid endoscopes market is moderate, driven mainly by incremental product line diversification and integration with advanced visualization technologies. Manufacturers are introducing models with varied diameters, lengths, and viewing angles to suit different surgical specialties, while enhancing compatibility with 3D and 4K imaging platforms. Many are also offering bundled solutions that combine endoscopes with complementary instruments and digital imaging systems to deliver greater clinical value. Recent innovations in robotic and digital visualization, such as compact and flexible camera systems, are further broadening the application scope and improving surgical precision.

Regional expansion in the rigid endoscopes industry is driven by increasing adoption of minimally invasive surgical procedures across emerging economies in Asia-Pacific, Latin America, and the Middle East. Leading manufacturers are focusing on establishing localized production facilities, strategic distribution networks, and surgeon training programs to strengthen their regional presence. In addition, government investments in healthcare infrastructure and the rising availability of advanced surgical technologies in developing regions are accelerating market penetration. These efforts collectively enhance accessibility, promote skill development, and support broader clinical acceptance of rigid endoscopic systems worldwide.

Product Insights

By product, rigid laparoscopes segment dominated the market with the largest revenue share of 28.61% in 2024. Rigid laparoscopes are the foundational instruments in standard laparoscopic surgery and represent one of the most dominant segments in the minimally invasive surgical device market. These highly durable scopes deliver superior image quality, enabling surgeons to perform procedures with smaller incisions, less bleeding, and quicker recovery. Their reliability and cost-efficiency have made them a staple across general, gynecologic, urologic, colorectal, and bariatric surgeries. The segment has seen sustained growth driven by increased minimally invasive procedures, rising hospital investments in laparoscopic infrastructure, and the global movement toward same-day surgical care. Advancements in optics (4K/HD), LED illumination, and lightweight scope designs have enhanced user experience and surgical precision.

The otoscopes segment is anticipated to grow at the fastest CAGR over the forecast period. Strategic initiatives by the key players drives the growth of the market. For instance, in November 2023, the recent partnership between E.A.R. Customized Hearing and BeBird, a Swiss technolog, highlights advancements in otoscopic technology. Together, they introduced three new cordless digital otoscope kits designed for ear examinations and wax removal. These devices feature high-resolution cameras that deliver clear, real-time imaging, enabling remote viewing and telemedicine applications. The portability and affordability of these video otoscopes represent a significant innovation for hearing health professionals, including audiologists, ENT specialists, and hearing aid dispensers. This development reflects the ongoing shift within the rigid endoscope market toward more compact, digital, and connected diagnostic tools that enhance clinical efficiency and patient accessibility.

Angle of View Insights

By angle of view, the 30°segment dominated the market with the largest revenue share of 38.88% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The 30° rigid scope is the most widely used angle of view in diagnostic and operative rigid endoscopy. It balances forward and lateral visualization, enabling surgeons to see around structures without physically repositioning the scope as frequently. This flexibility makes 30° scopes the standard choice in laparoscopic surgery, urology, gynecology, and general endoscopy. Devices such as the Olympus 5 mm 30° Rigid Laparoscope are used in hospitals and ambulatory centers. They are instrumental in gynecologic procedures (e.g., ovarian cystectomy, endometriosis treatment) and general surgery (e.g., cholecystectomy, hernia repair), where both central and peripheral structures need simultaneous monitoring.

The 45°segment is anticipated to grow at the significant CAGR over the forecast period. The 45° rigid endoscope is gaining traction in advanced laparoscopic, colorectal, and bariatric surgeries. This angle provides an extended oblique view, enabling surgeons to look “around corners” in deep or complex anatomical sites such as the pelvis, retroperitoneum, or upper mediastinum. This enhanced visualization is critical during dissections near sensitive structures or tight operative fields. Examples include the Olympus 5 mm 45° Laparoscope, which is designed with improved light distribution and reduced glare. In robotic and thoracoscopic setups, these scopes enable dynamic orientation without requiring frequent repositioning of the patient or instrument. They are often used with articulating camera systems or scope holders in longer procedures.

Product Dimension Insights

By product dimension, the 4-5.9 mm segment dominated the market with the largest revenue share of 29.78% in 2024. Rigid scopes with diameters between 4 mm and 5.9 mm scopes are standard in general surgery, gynecology, urology, and thoracic procedures. The 5 mm rigid laparoscope is widely used due to its optimal balance of durability, image quality, and compatibility with standard trocar systems. Examples include the Olympus 5 mm 30° and 45° rigid endoscopes and Stryker's autoclavable 5 mm HD scope. Their broad utility spans laparoscopic cholecystectomy, appendectomy, nephrectomy, hysterectomy, and endometriosis ablation. These scopes are highly compatible with current-generation 4K and fluorescence-guided systems, enhancing procedural accuracy and intraoperative decision-making.

The 2-3.9 mm segment is anticipated to grow at the fastest CAGR over the forecast period. Growth in this segment is fueled by the shift to outpatient and minimally invasive diagnostics. In gynecology, there is a rising demand for small-diameter scopes compatible with portable towers, making them ideal for mobile or remote clinics. The affordability of these scopes, along with strong procedure compatibility and moderate reusability, ensures consistent demand. Unit volume growth is robust in emerging markets where cost-sensitive clinics prefer smaller screens for adult and pediatric diagnostic applications.

Product Length Insights

By product length, the standard/long length scopes (30-35 cm) segment dominated the market with the largest revenue share of 36.24% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. Standard-length scopes (30-35 cm) are the most widely used and clinically versatile instruments in rigid endoscopy. They cover nearly all major laparoscopic procedures, including general, bariatric, colorectal, gynecologic, and thoracic surgeries. Their length provides adequate reach into abdominal and pelvic cavities while maintaining optimal ergonomics and visualization. Examples include the Olympus 33 cm 5 mm 30° laparoscope, KARL STORZ 30 cm bariatric telescopes, and Stryker 35 cm HD rigid scopes used in multi-specialty MIS. These scopes are generally autoclavable, made from high-durability materials, and often bundled into MIS procedure kits. They are standard in training institutions and are the baseline instruments in almost every laparoscopic tower system.

The extra-long scopes (> 35 cm) segment is anticipated to grow at the significant CAGR over the forecast period. Extra-long rigid scopes (>35 cm) are used in deep-cavity surgeries, bariatric and thoracic surgeries, robotic-assisted surgeries, and spinal endoscopies. Due to their extended reach, these scopes require enhanced handling and sterility solutions. They often employ sterile draping or sheathing systems to maintain asepsis while preventing cross-contamination across longer shaft lengths. Notable examples include robotically compatible 38-45 cm scopes, bariatric laparoscopes, and spinal endoscopes used in minimally invasive discectomies. Companies such as Intuitive Surgical, KARL STORZ, and Stryker offer scopes tailored for longer procedures, often integrating camera heads, fluorescence guidance, and articulated sheathing systems.

Surgical Center Size Insights

By surgical center size, the large (300+ beds) segment dominated the market with the largest revenue share of 41.01% in 2024. Multispecialty hospitals, academic medical centers, and tertiary care institutions comprise the large surgical centers. With departments for surgery, training, oncology, and high-acuity care, these facilities require a spectrum of rigid scopes across all specialties-general, colorectal, gynecology, urology, thoracic, ENT, bariatric, and more. These hospitals require scopes of all diameters and lengths, including robotic-compatible extra-long scopes, angled optics for complex dissections, and chip-on-tip systems for integrated imaging. Vendors such as Olympus, KARL STORZ, and Stryker maintain long-term equipment partnerships with these institutions, often bundling scopes with visualization towers and service contracts.

The medium (100-299 beds) segment is anticipated to grow at the fastest CAGR over the forecast period. Medium-sized surgical centers include regional hospitals, urban community hospitals, and private surgical institutes. Although these centers offer surgeries across specialties, they operate within mid-range budgets and limited OR capacity. Their scope of procurement is guided by versatility, standardization, and OR efficiency. They generally require 4-5.9 mm autoclavable scopes in standard lengths (30-35 cm), with angled optics (30°, 45°) being the preferred choice across most MIS procedures. Scope selection is often tied to manufacturer support-many centers enter vendor agreements that bundle endoscopes with light sources, monitors, and processors under long-term maintenance contracts.

Surgical Center Location Insights

By surgical center location, the metropolitan segment dominated the market with the largest revenue share of 48.12% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. Metropolitan surgical centers in large urban cities constitute the largest and most technologically advanced segment of the rigid endoscopes market. These centers include public and private tertiary care hospitals, academic medical centers, and multi-specialty private institutions. Due to high patient volumes, procedure diversity, and funding access, they drive the demand for rigid endoscopes. Metropolitan centers have the infrastructure to support a full range of rigid scopes varying in angle, diameter, and length across specialties such as general surgery, gynecology, urology, thoracic, and bariatrics. These hospitals are early adopters of 4K/3D visualization, robotic-integrated rigid scopes, and chip-on-tip imaging systems. Countries with large urban hospital networks-such as the U.S., Germany, and the UK, dominate this segment’s growth.

The suburban segment is anticipated to grow at the significant CAGR over the forecast period. Suburban surgical centers are located in smaller urban clusters or the periphery of major cities. They consist mainly of mid-sized community hospitals, specialty clinics, and ambulatory surgical centers (ASCs) that provide essential surgical care at a lower cost structure than metro facilities. Rigid endoscopes in suburban centers cover routine laparoscopic, gynecologic, and urology procedures. These centers prefer standard-diameter (4-5.9 mm), autoclavable scopes with 30°/45° viewing angles and moderate shaft lengths. Furthermore, the rising patient preference for localized, convenient care is a key market driver for the segment growth. As populations in suburban regions grow-particularly among middle-aged and elderly groups requiring routine surgeries-demand increases for facilities that offer high-quality procedures without traveling to congested city hospitals.

End Use Insights

By end use, the hospitals segment dominated the market with a revenue share of 42.71% in 2024. Hospitals dominate the rigid endoscope end use segment, accounting for the largest revenue share. This setting includes public, private, multi-specialty, and tertiary care hospitals, which handle a broad spectrum of surgeries across general, gynecologic, urologic, bariatric, orthopedic, and thoracic specialties. Rigid endoscopes are essential for emergency and elective procedures, and their presence is standard in most OR suites. Hospitals typically maintain large fleets of autoclavable rigid endoscopes in multiple diameters and lengths, allowing for efficient turnover, multi-procedure compatibility, and adherence to sterilization protocols. Major OEMs such as Olympus, KARL STORZ, Stryker, and Richard Wolf often supply hospital chains under capital bundles or service contracts, which include replacement cycles, scope tracking systems, and integrated video towers.

The outpatient facilities segment is expected to grow at the fastest rate during the forecast period. The outpatient segment comprises ambulatory surgical centers (ASCs) and specialty surgical centers, is growing rapidly as global healthcare systems shift toward cost-effective, short-stay interventions. These centers focus on high-volume, low-acuity MIS procedures such as laparoscopic cholecystectomy, hernia repair, diagnostic hysteroscopy, and urology interventions. Outpatient facilities play a vital role in the rigid endoscope market by providing convenient & efficient diagnostic and therapeutic procedures. The increasing popularity of endoscopes in outpatient settings is attributed to their numerous advantages. One significant advantage of endoscopes in outpatient facilities is their cost-effectiveness. Such factors boost the segment growth.

Regional Insights

North America dominated the rigid endoscopes market with a revenue share of 40.69% in 2024. Established regional R&D competencies, a high utilization rate of minimally invasive surgeries, and an efficient healthcare infrastructure all contribute to this dominance. In addition, the growing awareness of laparoscopic procedures among patients and healthcare providers is leading to the establishment of market leadership. In April 2023, Xenocor, a Utah-based medical device company, raised USD 10 million to launch its Saberscope, a single-use, HD, fog-free, articulating laparoscope cleared by the FDA.

U.S. Rigid Endoscopes Market Trends

The U.S. dominated the rigid endoscopes market in North America region in 2024. The growing preference for minimally invasive procedures across various medical specialties in the U.S., including gastroenterology, urology, and gynecology, is driving the demand for rigid endoscopes. Furthermore, the rising prevalence of cancer, the growing geriatric population, which is susceptible to chronic illnesses requiring endoscopic procedures, and the increasing importance of timely disease diagnosis & early interventions are driving the demand for endoscopes. According to the American Cancer Society, approximately 26,890 new cases of stomach cancer and around 10,880 stomach cancer-related deaths are expected to be reported in 2024.

Europe Rigid Endoscopes Market Trends

The rigid endoscopes market in Europe is expected to grow significantly over the forecast period. Ongoing technological advancements in endoscopy and rise in demand for minimally invasive procedures are among the factors driving the Europe rigid endoscopes market. Favorable macro environment factors are driving key players to revise their market entry strategies through mergers & acquisitions and technological collaborations to expand their footprint.

The rigid endoscopes industry in the UK is expected to grow significantly during the forecast period. The growing awareness of and preference among physicians and patients for improving post-procedure outcomes and growing investment by public or private market players and hospitals are driving the demand for rigid endoscopes. For instance, in May 2025, the Queen's Medical Centre (QMC) is expected to receive a refurbished and expanded unit to boost clinical capacity. This development comes after a significant investment of 16.31 million from Nottingham University Hospitals (NUH) NHS Trust, the organization that operates the hospital in collaboration with NHS England.

The rigid endoscopes market in Germany is expected to witness growth over the forecast period. The adoption of rigid endoscopes in Germany is expected to be driven by the increasing prevalence of chronic diseases. For instance, according to an article published by NCBI in February 2024, 46% of the adult population reported at least one chronic health condition in Germany. Furthermore, the presence of a greater number of endoscopic device manufacturers in Germany, coupled with a surge in the development of rigid endoscopes, is fueling market growth in the region.

Asia Pacific Rigid Endoscopes Market Trends

The Asia Pacific rigid endoscopes industry is expected to register the fastest growth rate over the forecast period. The region's growth is fueled by rising surgical volumes, awareness of minimally invasive procedures, and increasing healthcare costs. Government initiatives and the rapid expansion of hospitals in China, South Korea, and India further accelerate demand. In April 2025, to improve minimally invasive surgical capabilities in the area, the Administrator General of Tamil Nadu donated an advanced laparoscopy system with a high-definition camera to Kanniyakumari Government Medical College and Hospital.

China rigid endoscopes market is anticipated to register considerable growth during the forecast period. Growth is driven by expanding hospital infrastructure, increasing medical tourism, and rising adoption of laparoscopic surgeries across tertiary and secondary care facilities. In December 2022, Researchers at the University of Science and Technology of China and City University of Hong Kong developed a data-driven system to automate laparoscope adjustment in robotic surgery.

The rigid endoscopes market in Japan is expected to witness rapid growth. An aging population is driving demand, strict procedural guidelines, and the use of the latest laparoscopic technology in medical facilities. In February 2022, a Japanese team developed the world’s first 8K rigid laparoscope, offering unprecedented resolution for laparoscopic procedures. This device makes tiny nerves and blood vessels clearly visible and enables safer, more precise surgeries.

Latin America Rigid Endoscopes Market Trends

The Latin America rigid endoscopes industry is anticipated to witness considerable growth over the forecast period. Growth is fueled by rising investments in healthcare infrastructure, increasing minimally invasive surgical procedures, and expanding awareness of laparoscopic benefits. In January 2025, MicroPort MedBot’s Toumai laparoscopic surgical robot received market approval from Brazil’s ANVISA, marking a milestone in robotic-assisted laparoscopic surgery in Latin America.

Brazil rigid endoscopes industry is anticipated to register considerable growth during the forecast period. Rising procedural volumes, government support for modernizing healthcare facilities, and adopting advanced imaging technologies drive market expansion. In October 2024, Purple Surgical officially launched in Brazil at the 72nd Congress of Coloproctology, introducing its rigid endoscopes and other advanced laparoscopic instruments, surgical staplers, and trocars to the local market.

Middle East & Africa Rigid Endoscopes Market Trends

The Middle East and Africa rigid endoscopes market is anticipated to witness considerable growth over the forecast period. Growing private hospital networks, awareness of minimally invasive surgery, and rising healthcare spending contribute to growth. In August 2022, Robotica published an article reviewing robotic technologies for laparoscopic surgery. The article covered handheld devices, positioning robots, surgeon-console systems, and training platforms and highlighted surgical precision and dexterity improvements.

Saudi Arabia rigid endoscopes industry is anticipated to register considerable growth during the forecast period. Government programs to enhance surgical results, expanding healthcare infrastructure, and a growing emphasis on minimally invasive procedures in public and private hospitals are some of the driving factors of this industry. In November 2024, Fujifilm Middle East expanded in Saudi Arabia through MoUs with healthcare providers, endoscopy training programs, and AI-driven screening centers aligned with Vision 2030.

Key Rigid Endoscopes Company Insights

Key participants in the rigid endoscopes industry are focusing on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and expanding their business footprints.

Key Rigid Endoscopes Companies:

The following are the leading companies in the rigid endoscopes market. These companies collectively hold the largest market share and dictate industry trends.

- Olympus Corporation

- Arthrex, Inc.

- Karl Storz GmbH & Co. KG

- Stryker Corporation

- Smith+Nephew

- Richard Wolf GmbH

- Medtronic Plc

- B. Braun Melsungen AG

- CONMED Corporation

Recent Developments

-

In March 2024, NTT Corporation (NTT) and Olympus Corporation announced a joint venture to conduct a demonstration experiment of a cloud endoscopy system. This innovative system facilitates image processing through cloud computing, marking a significant advancement in medical technology. The collaboration between NTT and Olympus to develop a cloud endoscopy system represents a groundbreaking development in medical imaging. By leveraging cloud technology, this system enables real-time image processing and analysis during endoscopic procedures. This innovation has the potential to enhance diagnostic accuracy, streamline workflow efficiency, and improve patient outcomes.

-

In September 2024, Stryker launched its 1788 Advanced Imaging Platform in India. This versatile surgical visualization system, developed for various medical specialties, offers surgeons advanced imaging features that contribute to better patient outcomes.

-

In August 2023, Huaxin Medical and Yisi Medical formed a strategic alliance to accelerate the development and global commercialization of innovative rigid endoscopes. The partnership combines Huaxin’s R&D and manufacturing strengths with Yisi’s brand, clinical expertise, and international marketing channels.

Rigid Endoscopes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.67 billion

Revenue forecast in 2033

USD 11.11 billion

Growth rate

CAGR of 4.74% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, angle of view, product dimension, product length, surgical center size, surgical center location, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Olympus Corporation; Arthrex, Inc.; Karl Storz GmbH & Co. KG; Stryker Corporation; Smith+Nephew; Richard Wolf GmbH; Medtronic Plc; B. Braun Melsungen AG; CONMED Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rigid Endoscopes Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global rigid endoscopes market report based on product, angle of view, product dimension, product length, surgical center size, surgical center location, end use, and region:

-

Product Outlook (Revenue USD Million, 2021 - 2033) (Procedure Volume, In Thousands, 2021 - 2033) (Unit Volume, In Thousand Units, 2021 - 2033)

-

Rigid Laparoscopes

-

Gynecology Endoscopes

-

Gastrointestinal Endoscopes

-

Colonoscope

-

Gastroscope (Upper GI Endoscope)

-

Duodenoscope

-

Enteroscope

-

Sigmoidoscope

-

-

Bronchoscopes

-

Ureteroscopes

-

Laryngoscopes

-

Otoscopes

-

Cystoscopes

-

Nasopharyngoscopes

-

Arthroscopes

-

Rhinoscopes

-

Neuroendoscopes

-

Hysteroscopes

-

-

Angle of View Outlook (Revenue USD Million, 2021 - 2033)

-

0°

-

30°

-

45°

-

Others (70°, 90°, 120°+)

-

-

Product Dimension Outlook (Revenue USD Million, 2021 - 2033)

-

<2 mm

-

2-3.9 mm

-

4-5.9 mm

-

≥6 mm

-

-

Product Length Outlook (Revenue USD Million, 2021 - 2033)

-

Short Length Scopes (< 20 cm)

-

Medium Length Scopes (20-30 cm) [Autoclavable]

-

Standard/Long Length Scopes (30-35 cm)

-

Extra-Long Scopes (> 35 cm) [Draped (Sterile Sheathed)]

-

-

Surgical Center Size Outlook (Revenue USD Million, 2021 - 2033)

-

Small (1-99 beds)

-

Medium (100-299 beds)

-

Large (300+ beds)

-

-

Surgical Center Location Outlook (Revenue USD Million, 2021 - 2033)

-

Metropolitan

-

Suburban

-

Rural

-

-

End Use Outlook (Revenue USD Million, 2021 - 2033)

-

Hospitals

-

Outpatient Facilities

-

Ambulatory Surgical Centers

-

Specialty Surgical Centers

-

-

Academic Hospitals

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033) (Procedure Volume, In Thousands, 2021 - 2033) (Unit Volume, In Thousand Units, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global rigid endoscopes market size was valued at USD 7.31 billion in 2024 and is expected to reach USD 7.67 billion by 2025.

b. The global rigid endoscopes market is projected to grow at a compound annual growth rate (CAGR) of 4.74% from 2025 to 2033 to reach USD 11.11 billion by 2033.

b. Based on product, laparoscopes dominated the market with a share of 28.61% in 2024. Laparoscopies are generally done for gastrointestinal and gynecological cases. L laparoscopies treat typically diseases such as endometriosis, hernias, gall bladder, ovarian cancer, and others.

b. Some of the key players operating in the market are Olympus Corporation; Arthrex, Inc.; Karl Storz GmbH & Co. KG; Stryker Corporation; Smith+Nephew; Richard Wolf GmbH; Medtronic Plc; B. Braun Melsungen AG; CONMED Corporation

b. The increasing prevalence of cancer and cancer-related mortality globally is one of the factors expected to drive the market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.