- Home

- »

- Automotive & Transportation

- »

-

Road Safety Market Size, Revenue, Industry Report, 2030GVR Report cover

![Road Safety Market Size, Share & Trends Report]()

Road Safety Market (2023 - 2030) Size, Share & Trends Analysis Report By Solution (Red Light & Speed Enforcement, Incident Detection & Response, ALPR/ANPR, Others), By Service, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-943-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Road Safety Market Summary

The global road safety market size was estimated at USD 3.07 billion in 2022 and is projected to reach USD 10.13 billion by 2030, growing at a CAGR of 17.5% from 2023 to 2030. The market is gaining momentum owing to a surge in the number of road accidents and fatalities.

Key Market Trends & Insights

- Europe held the major share of 27.04% of the target market in 2022.

- Asia Pacific is anticipated to grow as the fastest-developing regional market at a CAGR of 19.6%.

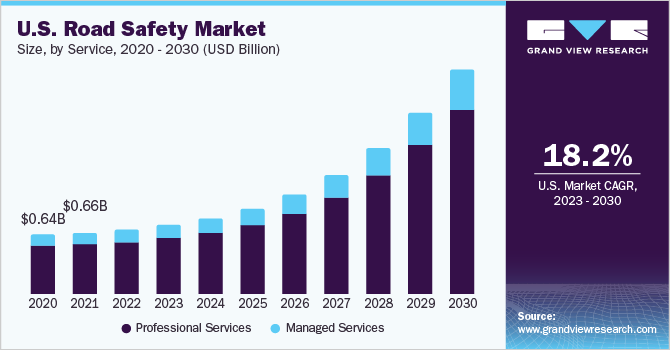

- Based on service, the professional service segment accounted for the largest market share of 80.30% in 2022.

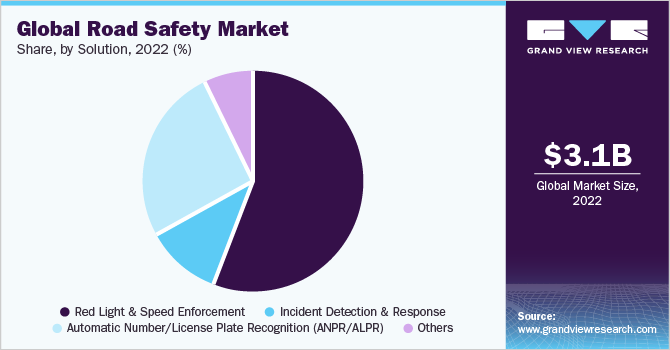

- In terms of solution, the red light & speed enforcement segment accounted for a market share of 56.19% in 2022.

- On the basis of solution, the Automatic Number/License Plate Recognition (ANPR/ALPR) segment is anticipated to grow at a CAGR of 17.1% during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 3.07 billion

- 2030 Projected Market Size: USD 10.13 billion

- CAGR (2023-2030): 17.5%

- Europe: Largest market in 2022

The increasing need for public security and improvement in road infrastructure bodes well for market growth. Additionally, several governments around the world are taking steps to decrease traffic accidents through numerous programs and initiatives. In an attempt to curb the growing number of road accidents and fatalities, governments worldwide are focusing on maintaining traffic discipline and ensuring commuters' safety.

Road safety products have witnessed several developments over the past few years. Earlier, to maintain traffic discipline, the operators installed red lights and speed monitoring services along roads and intersections. However, with increasing technological advancements, players focus on designing services combining red light and speed monitoring capabilities in a single unit. Furthermore, the growing preference for connected commercial vehicles is helping road safety solution providers implement solutions that can simultaneously collect vehicles and road infrastructure. Thus, investments in developing infrastructure that supports connected and autonomous vehicles provide new avenues for road safety solution providers. Companies can provide existing data to analyze road user behavior and traffic mobility and help in developing improved road infrastructure.

Globally, a rise in road fatalities has been a primary factor favoring road safety sales. As per the World Health Organization (WHO), road accidents lead to over 1.3 million deaths every year, with an average of 35 million people suffering non-fatal injuries resulting in disability or other health conditions. Therefore, highway safety has gained prominence, with governments worldwide promoting initiatives to lower these numbers. Further, growing awareness of public security has forced authorities to invest in road infrastructure. For instance, Singapore Government has launched the Smart Mobility 2030 strategic proposal, jointly developed by the Intelligent Transportation Society Singapore (ITSS) and the Land Transport Authority (LTA), Singapore. The initiative is aimed at deploying intelligent transport services to offer sustainable smart mobility solutions for commuters.

Favorable initiatives supporting the deployment of road safety measures, including rules and regulations and devices to track traffic, will go a long way in favoring growth over the forecast period. For instance, the U.S. federal government launched the Road to Zero initiative to eliminate traffic fatalities by 2050. The initiative was launched by the National Safety Council and encourages the use of safe and advanced services to put an end to traffic fatalities. In India, the Ministry of Road Transport and Highways has also been taking initiatives towards the improvement of road safety to reduce accidents on National Highways.

Service Insights

The professional service segment accounted for the largest market share of 80.30% in 2022. The professional services segment covers service integration, installation, training, consultancy, and support and maintenance. Implementation of the equipment requires a certain degree of calibration along with periodic maintenance and monitoring. Therefore, the demand for professional services has been dominating industry growth over the last few years and would continue to do so in the future.

The managed service segment is anticipated to grow at a CAGR of 15.9% during the forecast period. These services are managed as well as controlled by dedicated vendors' end-to-end, thereby making them a popular choice among end customers. The segment’s high growth is attributable to the growing preference for service outsourcing among customers. Additionally, outsourcing services' ease of business and convenience is a key factor favoring the demand for managed services worldwide.

Solution Insights

The red light & speed enforcement segment accounted for a market share of 56.19% in 2022. Additionally, these services were installed at road intersections or along roads to maintain traffic discipline. However, with advances in technology, companies began to focus on providing services that offer speed and red-light monitoring capability in a signal device. These advances in product design drove the market growth in 2020, a trend expected to continue over the next seven years. For instance, TraffiStar and Jenoptik provide combined speed monitoring and red light that uses high-resolution cameras to record traffic offenses up to four lanes. Similarly, Vitronik provides the Poliscan Red+Speed solution designed for intersection points to help monitor red lights and speed by vehicles.

The Automatic Number/License Plate Recognition (ANPR/ALPR) segment is anticipated to grow at a CAGR of 17.1% during the forecast period. Varied end-use applications such as road interactions, parking lots, private land, and schools, among others, are contributing factors to the large revenue share of the ANPR/ALPR segment. These solutions aid in locating a vehicle in case of theft, involvement in criminal activities, or traffic violations. The services are also known to provide 24 hour monitoring even in low light or bad weather conditions, further favoring their demand. Apart from ANPR/ALPR, the market has been segmented into speed enforcement, red light, incident detection, and response solutions.

Regional Insights

Europe held the major share of 27.04% of the target market in 2022. State-of-the-art road infrastructure coupled with high technology penetration has favored sales in Europe. The region will continue to contribute to the overall market demand with the prevalence of several players marking a strong regional presence along with a large end customer base. The road safety future is uncertain and not the same for all regions worldwide. Countries in Europe have a mature road safety approach, focusing on proactive techniques. Although the mortality rate due to road accidents is lower in Europe than the global average, it varies mainly among countries. Therefore, several countries are engaged in designing their road safety strategies to lower the risk of such fatalities. Initiatives and guidelines promoting road safety will upkeep the demand for road safety equipment in the EU.

Asia Pacific is anticipated to grow as the fastest-developing regional market at a CAGR of 19.6%. Growing investments in road infrastructure development and the increasing need to maintain traffic discipline is boosting regional growth. Additionally, countries such as China and India have large geographical areas and extensive roads and highways covering the region. More and more road construction & development in these countries are all together driving the market growth in the Asia Pacific region.

Key Companies & Market Share Insights

The key players operating in the road safety market are broadening their product offerings, and utilizing a variety of inorganic growth tactics, such as partnerships, regular mergers, and acquisitions. In August 2022, Conduent announced its partnership with Hayden AI (U.S.) to strengthen child safety with automated technology solutions designed with safety technology. The solution combines computer vision and artificial intelligence and uses mobile cameras mounted on the exteriors of the bus, which are activated when the vehicle’s light flash and “stop arm” extends. Prominent players dominating the global road safety market include:

-

American Traffic Solutions (Verra Mobility)

-

Conduent

-

Cubic Corporation

-

Dahua Technology

-

FLIR Services, Inc.

-

IDEMIA

-

Jenoptik

-

Kapsch TraficCom

-

Motorola Solutions

-

Redflex Holdings

-

Sensys Gatso Group AB

-

Siemens

-

Swarco

-

Teledyne FLIR

-

Vitronic

Road Safety Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.27 billion

Revenue forecast in 2030

USD 10.13 billion

Growth Rate

CAGR of 17.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Solution, service, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; U.A.E.; Saudi Arabia; South Africa

Key companies profiled

American Traffic Solutions (Verra Mobility); Conduent; Cubic Corporation; Dahua Technology; FLIR Services, Inc.; IDEMIA; Jenoptik; Kapsch TraficCom; Motorola Solutions; Redflex Holdings; Sensys Gatso Group AB; Siemens; Swarco; Teledyne FLIR; Vitronic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Road Safety Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global road safety market based on solution, service, and region.

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Red Light & Speed Enforcement

-

Incident Detection & Response

-

Automatic Number/License Plate Recognition (ANPR/ALPR)

-

Others

-

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Professional Services

-

Managed Services

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global road safety market size was estimated at USD 3.07 billion in 2022 and is expected to reach USD 3.27 billion in 2023.

b. The global road safety market is expected to grow at a compound annual growth rate of 17.5% from 2023 to 2030 to reach USD 10.13 billion by 2030.

b. Europe led the demand for road safety solutions in 2022 with a revenue share of 27.04% in the global market.

b. Some key players operating in the road safety market include American Traffic Solutions (Verra Mobility), Conduent, Cubic Corporation, Dahua Technology, FLIR Services, Inc., IDEMIA, Jenoptik, Kapsch TraficCom, Motorola Solutions, Redflex Holdings, Sensys Gatso Group AB, Siemens, Swarco, Teledyne FLIR, and Vitronic.

b. Key factors that are driving the road safety market growth include the imminent need to ensure safe road infrastructure to prevent accidents and investments made by the governments in road infrastructure development.

b. The managed road safety services segment is estimated to register a CAGR exceeding 17.5% from 2023 to 2030 in the global market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.