- Home

- »

- Medical Devices

- »

-

Robotic Biopsy Devices Market Size & Share Report, 2030GVR Report cover

![Robotic Biopsy Devices Market Size, Share & Trends Report]()

Robotic Biopsy Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (System), By Application (Lung Biopsy, Brain Biopsy, Prostate Biopsy), By End Use (Outpatient Facilities), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-012-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Robotic Biopsy Devices Market Trends

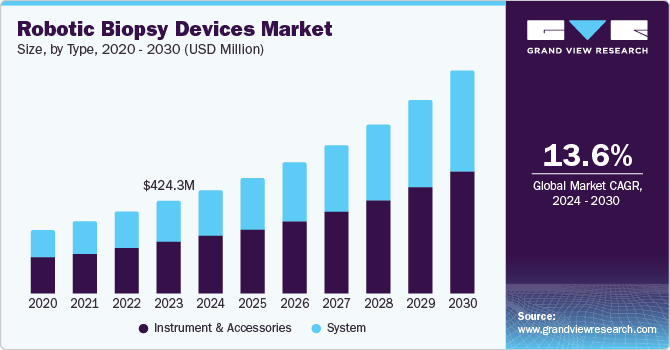

The global robotic biopsy devices market size was valued at USD 424.3 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 13.6% from 2024 to 2030. This growth is attributed to advancements in technology, such as improved precision and stability of robotic manipulators, enabling more accurate and minimally invasive procedures compared to traditional manual techniques. In addition, the rising prevalence of cancer and the growing emphasis on early detection are fueling demand for robotic biopsy systems. Furthermore, collaborations with research organizations and healthcare institutions are also providing growth prospects for market players, thereby driving the market growth.

The market is expected to grow because robotics and artificial intelligence augmented with the Internet of Things (IoT) are becoming more significant in the healthcare sector with proficiency related to high accuracy and independence in operating and managing for overall better and improved results. Moreover, an increase in the incidence of cancer-related to lung cancer and diseases leads to the growth in the adoption of biopsy devices in developed and developing economies; diverse applications of biopsy procedures facilitate the development of the biopsy devices market, rising government initiatives for early cancer detection backs the application of biopsy devices.

However, demand for minimally invasive procedures has increased to minimize patient discomfort and speed recovery. These medical instruments collect tissue samples from the body to diagnose several conditions, including cancer, infections, and inflammatory diseases. Collecting tissue samples, including the skin, lungs, liver, and kidneys, can be beneficial. Furthermore, there is also a lower risk of infection because of less invasion, which eventually results in the recovery of patients. Therefore, the adoption of robotic procedures for quality results and improved patient treatment is increased.

Biopsy devices are essential tools for identifying and monitoring multiple medical conditions. By enhancing the accuracy, safety, and convenience of biopsies, innovative and efficient biopsy devices are helping to secure patients' lives worldwide. Integrating advanced and innovative technologies associated with biopsies signifies an evolving trend in the global biopsy devices market, impacting the shift in diagnostic and treatment approaches.

Product Insights

The instrument & accessories dominated the market and accounted for the largest revenue share of 55.9% in 2023 driven by technological advancements, enabling the development of more accurate and efficient robotic biopsy devices. In addition, regarding the availability of a wide range of biopsy instruments and accessories in the market, such as the number of biopsies, the number of instruments such as needles and brushes required in processes also increases, resulting in accurate diagnostic tools. Furthermore, there is a positive growth for minimally invasive procedures in robotic biopsy devices due to less patient discomfort.

The system segment is projected to grow at a CAGR of 14.0% over the forecast period. They are advanced medical devices used for minimally invasive biopsies and surgical procedures. These systems provide the infrastructure for biopsies. In addition, systems offer accuracy and efficiency by improving overall diagnostic results. The augmentation of advanced technologies such as artificial intelligence and machine learning further extends the capabilities of these systems, enabling more accurate and timely results. This market offers a broad range of products to execute biopsies in various medical applications efficiently.

Application Insights

The lung biopsy led the market and accounted for the largest revenue share of 44.1% in 2023. Developing lung disorders are common nowadays because the large population addicted to smoking, changing environmental conditions, and rising air impurity levels are different causes that led to the market development of the lung robotic biopsy application section. These devices are designed to improve diagnostic proficiencies and enhance patient care outcomes. Whether for detecting cancerous cells in the lungs or examining dysfunction in the brain, robotic biopsy devices provide innovative solutions for conducting biopsies in various medical specialties.

Prostate biopsy is expected to grow at a CAGR of 14.4% over the forecast period. Prostate biopsy is a technique in which experts use a biopsy needle to accumulate tissue samples from a specific area of the prostate for the diagnosis of cancer, which is crucial for early detection and treatment. Currently, the incidence of prostate cancer in men is observed to grow year on year. Therefore, early diagnosis and better and faster treatment are necessary. Robotic prostate biopsy benefits from a high degree of automation, is not mandatory to rely on the skills and experience of specialists, and decreases the work intensity and operation time of experts.

End Use Insights

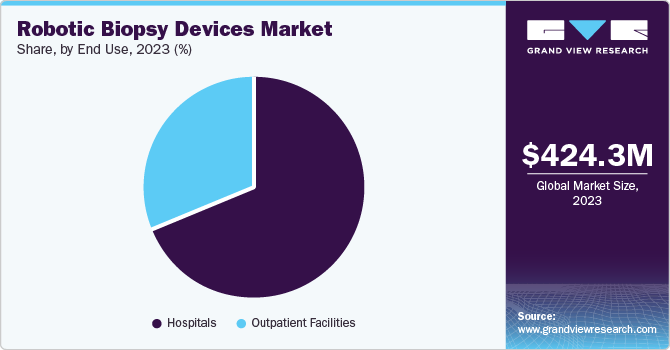

The hospitals dominated the market and accounted for the largest revenue share of 69.1% in 2023 owing to a growing aging population, increasing prevalence of chronic diseases, and betterment in healthcare infrastructure. The comprehensive healthcare facilities provided by the hospitals with specialized departments and advanced technologies have been driving the demand for biopsy procedures from the hospitals. In addition, the ease of access to various medical facilities for patients, such as emergency treatment, consultation, medication, etc., has resulted in the increasing demand for hospital biopsy procedures. Hospitals provide a wide range of complex medical procedures, which makes them central to the healthcare delivery systems. In addition, hospitals often cater to various acute and severe cases that require robotic equipment, leading to more significant reimbursement amounts.

Outpatient facilities are expected to grow at a CAGR of 14.2% over the forecast period. The growth factors include the rising number of robotic biopsy cases worldwide. These are modern healthcare facilities that are designed for practicing and performing various medical processes and are well-equipped to perform critical instances. Moreover, enhanced devices enable outpatient facilities to perform a wide range of procedures safely and effectively. At the same time, implementing an all-inclusive robotic biopsy system has significantly improved the results of Robotic Biopsy patients. Furthermore, faster patient recovery and shorter hospital stays are likely to accelerate the growth of outpatient facilities during the forecast period.

Regional Insights

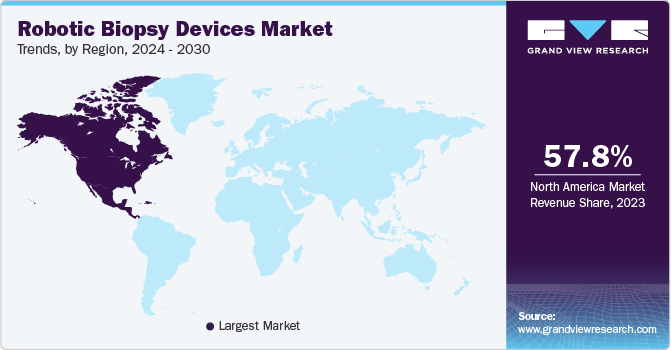

North America robotic biopsy devices market dominated the global market and accounted for the largest revenue share of 57.8% in 2023 attributed to the supporting reimbursement policies in the healthcare system. In addition, the presence of developed and equipped tech facilities, healthcare infrastructure, and easy accessibility to advanced healthcare services among the general population also contributed to the market growth in the region.

U.S. Robotic Biopsy Devices Market Trends

The robotic biopsy devices market in the U.S. dominated the North American market and accounted for the largest revenue share of 87.4% in 2023 driven by the increasing focus and initiatives the government took to raise awareness about cancer, which emerged as a significant fueling aspect for implementing robotic biopsy devices. Furthermore, governments are also identifying the importance of early detection and timely diagnosis for improving cancer results, thereby contributing to the growth of the country's market.

Europe Robotic Biopsy Devices Market Trends

Europe robotic biopsy devices market is expected to grow significantly over the forecast years owing to the rising number of elderly people, more active lifestyles, and technological innovations that have led to the growth in the overall market by people who seek quality treatment.

The robotic biopsy devices market in the UK is expected to grow substantially over the projected years. This growth is attributed to the increasing adoption of medical tools in healthcare, such as robotic biopsy devices, to the ever-rising prevalence of cancers among citizens, the need for better devices and services becomes more significant. Furthermore, several key companies are augmenting their technologies as per the medical requirements to provide technologically advanced systems and services through continuous research and development.

Asia Pacific Robotic Biopsy Devices Market Trends

The Asia Pacific robotic biopsy devices market is anticipated to grow at a CAGR of 17.6% over the forecast period. This growth is attributed to the increasing prevalence of cancer in the region, which has heightened the demand for accurate diagnostic tools. In addition, rapid advancements in robotic and imaging technologies enhance the precision and efficiency of biopsies, making them less invasive. Furthermore, rising healthcare expenditures and improved medical infrastructure support market expansion, particularly in countries such as China. Increased awareness of early disease detection further propels the adoption of robotic biopsy devices across various medical specialties.

The robotic biopsy devices market in China is projected to grow substantially owing to increased awareness of improved robotic biopsy devices, healthcare expenditures, good economic conditions, and a large population engaged with severe disorders such as lung cancers or other disorders, and technical innovations drive the market. Furthermore, the demand for robotic biopsy devices has positive growth because of the country's presence in the healthcare sector and rising cases of the elderly population with cases, which increases the demand for robotic biopsy surgery devices.

Key Robotic Biopsy Devices Company Insights

Some of the key companies in the robotic biopsy devices market include Medtronic, Renishaw plc, Zimmer Biomet, Biobot Surgical, Intuitive Surgical Operations, Inc., and XACT Robotics. These companies are focusing on continuous development and innovation to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives.

-

Integra LifeSciences Corporation is a medical technology company specializing in developing and commercializing innovative medical devices across various surgical disciplines. Integra focuses on enhancing patient outcomes through advanced surgical solutions, including tools that facilitate precise tissue sampling for accurate diagnostics. Their product portfolio encompasses applications in neuro-trauma, neurosurgery, and plastic and reconstructive surgery, positioning the company as a critical player in the evolving landscape of minimally invasive procedures and robotic-assisted technologies.

-

Smith+Nephew is a British medical technology company specializing in developing advanced surgical solutions, including robotic biopsy devices. The company focuses on enhancing surgical precision and patient outcomes through innovative technologies. Smith+Nephew integrates robotics with digital health solutions to facilitate minimally invasive procedures.

Key Robotic Biopsy Devices Companies:

The following are the leading companies in the robotic biopsy devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medical Device Business Services, Inc.

- Stryker

- Zimmer Biomet

- Smith+Nephew

- Medtronic

- Integra LifeSciences Corporation.

- Wright Medical Group N.V.

- Acumed LLC

- Bioretec GmbH

- Cardinal Health.

Recent Developments

-

In June 2024, RevelAi Health and Zimmer Biomet entered into a multi-year partnership focused on co-marketing generative artificial intelligence (AI) solutions aimed at enhancing value-based orthopedic care and promoting health equity. As part of this collaboration, Zimmer Biomet is expected to market RevelAi Health's patient care management platform, which includes a dashboard for care teams and other forthcoming products. This agreement highlights the commitment of both companies to leverage AI technology to improve patient engagement and streamline clinical workflows, ultimately addressing disparities in healthcare access and outcomes.

Robotic Biopsy Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 473.9 million

Revenue forecast in 2030

USD 1.02 billion

Growth rate

CAGR of 13.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Medtronic; Renishaw plc.; Zimmer Biomet; Biobot Surgical; Intuitive Surgical Operations, Inc.; XACT Robotics.; Siemens Healthineers AG; Eigen Health.; BD; Hologic, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Robotic Biopsy Devices Market Report Segmentation

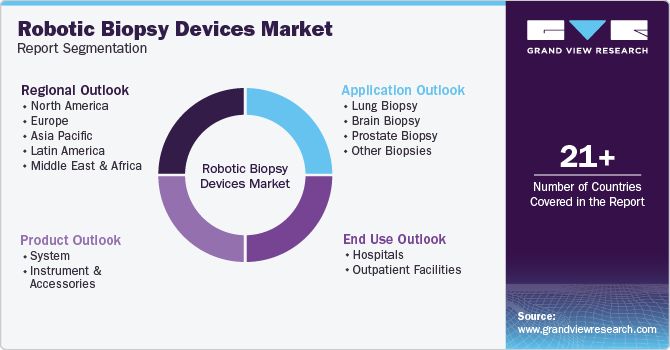

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global robotic biopsy devices market report based on product, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

System

-

Instrument & Accessories

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Lung Biopsy

-

Brain Biopsy

-

Prostate Biopsy

-

Other Biopsies

-

-

End use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.