- Home

- »

- HVAC & Construction

- »

-

Robotic Lawn Mowers Market Size, Industry Report, 2033GVR Report cover

![Robotic Lawn Mowers Market Size, Share & Trends Report]()

Robotic Lawn Mowers Market (2025 - 2033) Size, Share & Trends Analysis Report By Battery Capacity (Up to 20V, 20V to 30V), By Sales Channel (Retail Stores/Offline, Online), By End Use (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-624-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Robotic Lawn Mowers Market Summary

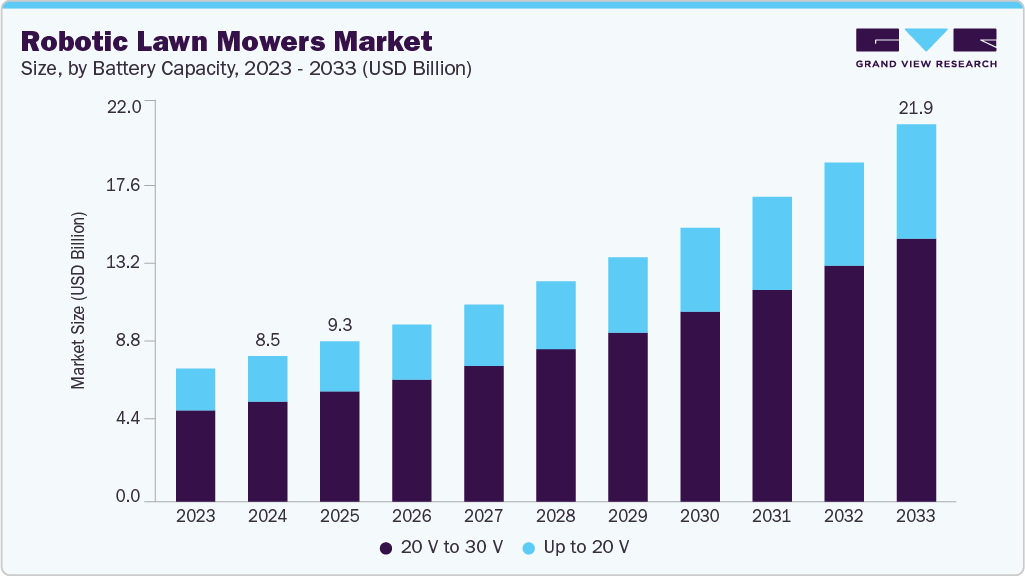

The global robotic lawn mowers market size was estimated at USD 8.47 billion in 2024, and is projected to reach USD 21.97 billion by 2033, growing at a CAGR of 11.3% from 2025 to 2033. The emergence of remote-controlled and GPS-equipped autonomous lawn mowers has made gardening easier by making these products easy to track, monitor, and operate.

Key Market Trends & Insights

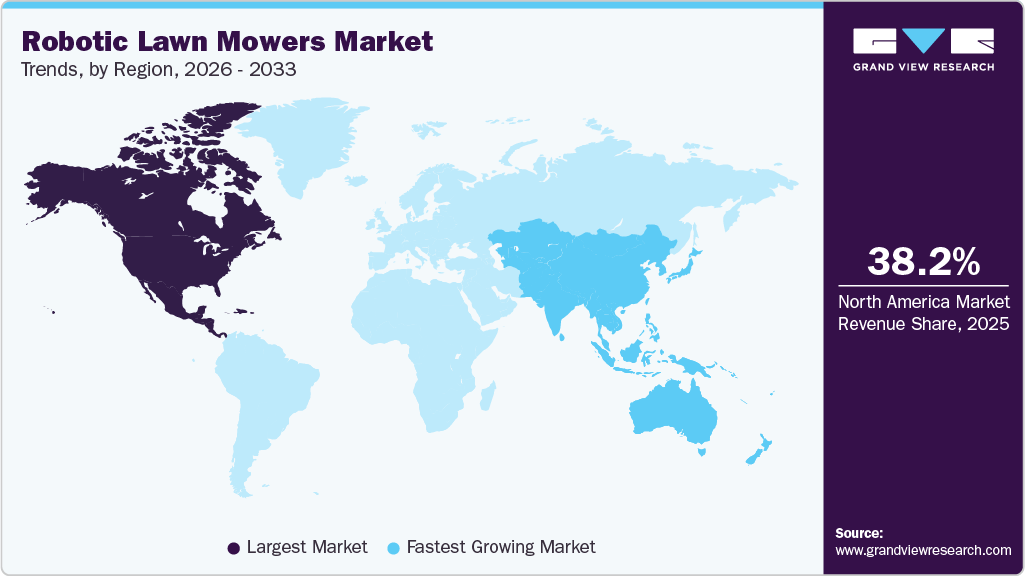

- North America robotic lawn mower market accounted for a 35.34% share of the overall market in 2024.

- The robotic lawn mower Industry in the U.S. held a dominant position in 2024.

- By battery capacity, the 20V to 30V segment accounted for the largest share of 68.66% in 2024.

- By sales channel, the retail stores/offline segment held the largest market share in 2024.

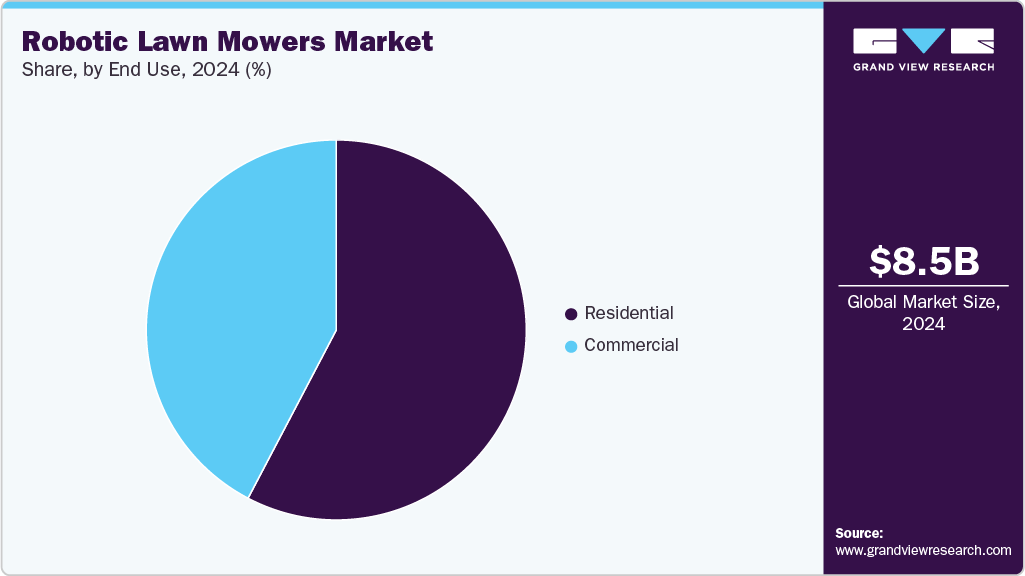

- By end use, the residential segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.47 Billion

- 2033 Projected Market Size: USD 21.97 Billion

- CAGR (2025-2033): 11.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest Market

Also, there has been a notable rise in consumer interest in gardening activities across the globe, creating an increased need for gardening tools such as robotic lawn mowers.Growing expenditure on activities such as backyard beautification, landscaping, garden parties, and backyard cookouts, among others, along with the need to save time spent on lawn maintenance activities, are expected to drive the demand for gardening tools. The market is also driven by factors such as the growing construction and tourism industries, coupled with the increasing disposable income of individuals across the globe. Moreover, growing consumer preference toward energy-efficient products and the growing popularity of autonomous products is also anticipated to impact the global demand for robotic lawn mowers positively.

Consumers in countries such as the U.S., Germany, and the UK are significantly investing time and money in improving their gardens, yards, and lawns. This consumer approach is apparently increasing demand for smart lawn care products that save time, money, and energy. Thus, high consumer spending on landscaping activities is anticipated to drive the growth of the market.

Robotic mowers are programmed to follow efficient and precise cutting patterns. Unlike traditional mowers that tend to create uneven patches, the consistent cutting patterns of robotic mowers promote healthier grass growth. This improved lawn health reduces the need for excessive chemical inputs such as fertilizers and pesticides, contributing to a more environmentally friendly lawn care approach.

The market encounters a significant challenge due to the significant initial cost associated with these machines. Robotic lawn mowers' advanced features and capabilities include remote control via smartphone apps, automatic scheduling, and integration with smart home ecosystems. These features enhance user convenience but require additional components and engineering effort, contributing to higher product costs. However, this elevated cost can deter potential consumers, particularly those prioritizing budget considerations. Consumers who are price-sensitive may opt for more affordable traditional mowers. As a result, such factors challenge the growth of the market.

Battery Capacity Insights

The 20V to 30V segment accounted for the largest share of 68.66% in 2024. Batteries in the 20V to 30V range predominantly feature in robotic lawn mowers used commercially. These relatively costlier products are often employed for mowing lawns that are 1.0 to 2.5 acres in size, often found in commercial areas such as sports/golf fields or the hospitality sector. The segment provides ample power to navigate various terrains, handle taller grass, and operate for extended periods between charges. Moreover, battery innovations have led to faster charging times and longer overall lifespans, addressing downtime and maintenance cost concerns. With app-based controls, GPS mapping, and automated scheduling, users can manage their lawn maintenance remotely effortlessly.

The Up to 20V segment is anticipated to grow at a considerable growth rate over the forecast period. This is attributed to the rising usage of automated lawn mowers in residential applications. Up to 20V robotic lawn mowers are expected to become increasingly popular due to their eco-friendly and efficient operation. Up to 20V robotic lawn mowers offer extended operation times, covering larger areas on a single charge.

Sales Channel Insights

The retail stores/offline segment held the largest market in 2024. The increasing demand for time-saving and convenient solutions has pushed traditional retail stores to embrace robotic lawn mowers. These devices cater to homeowners seeking effortless lawn maintenance, urge to a wide demographic ranging from busy professionals to elderly individuals who may find traditional mowing physically challenging. The sector's success is intrinsically tied to consumers' demands for convenience, variety, and value.

The online segment is expected to register a highest CAGR during the forecast period. The growing trend of convenience-seeking consumers has propelled the demand for online shopping. With a few clicks, the customers can compare a wide range of robotic lawn mower models, features, and prices from their homes. One of the primary drivers is the widespread adoption of digital technologies and the increasing accessibility of the internet, which has connected billions of people worldwide. This connectivity has enabled consumers to shop conveniently from the comfort of their homes or mobile devices, thereby fueling the demand for online shopping platforms.

End Use Insights

The residential segment dominated the market in 2024. The increasing demand for convenience and time-saving solutions has led homeowners to seek automated alternatives for lawn maintenance. Robotic lawn mowers offer the advantage of hands-free operation, allowing homeowners to delegate the time-consuming task of mowing to a machine while they focus on other activities.

The commercial sector is expected to register considerable growth over the forecast period. Rising government investment into improving existing infrastructure, parks, and lawns near historic monuments is anticipated to drive the demand for robotic lawn mowers in the commercial sector. Also, the segment is also expected to witness significant growth over the forecast period owing to the steady growth of the hospitality and tourism industries.

Regional Insights

North America dominated the market with a revenue share of 35.34% in 2024. Busy lifestyle patterns resulted in end users' approach towards automating lawn maintenance activities. Robotic lawn mowers offer the convenience of hands-free operation, allowing users to allocate their time to more important activities. Innovations in sensors, artificial intelligence, and GPS navigation systems enable robotic lawn mowers to navigate and maintain lawns of varying sizes and complexities efficiently.

U.S. Robotic Lawn Mowers Market Trends

The U.S. is one of the largest markets for robotic lawn mowers, underpinned by high consumer purchasing power, large residential lawns, and a growing inclination towards home automation. Increasing labor costs and a shift toward eco-friendly and low-maintenance landscaping solutions are key factors fueling adoption. Major manufacturers are investing in product innovation, including AI-driven navigation and integration with smart home systems, to enhance market competitiveness. The market also benefits from established retail networks and e-commerce platforms that support widespread product availability.

Asia Pacific Robotic Lawn Mowers Market Trends

Asia Pacific region is expected to register the highest CAGR over the forecast period. In the Asia Pacific, the rapid urbanization and increasing affluence across countries have led to a rise in demand for smart and convenient home solutions. Robotic lawn mowers align with this trend by offering an automated and hassle-free way to maintain outdoor spaces, saving homeowners time and effort. Countries such as Japan, South Korea, and China have been at the forefront of robotics and automation, fostering a favorable environment for developing and deploying cutting-edge technologies.

China robotic lawn mowers market presents significant growth potential, supported by its robust smart home ecosystem and expanding middle class. With government initiatives encouraging automation and smart city development, demand for autonomous landscaping equipment is expected to gain momentum, especially in high-income urban clusters. In addition, domestic manufacturers are entering the market, offering competitively priced robotic mowers tailored to local consumer preferences. However, regulatory standards and strong competition from manual and semi-automated equipment remain key considerations for market entrants.

Europe Robotic Lawn Mowers Market Trends

Europe robotic lawn mowers market accounts for a significant share due to early adoption and strong consumer demand for sustainable and automated gardening solutions. Countries such as UK, Germany, and France, are key contributors, backed by favorable climate conditions and widespread lawn culture. Additionally, environmental regulations supporting battery-powered equipment over fuel-based alternatives are accelerating the shift to robotic solutions. The region continues to see product advancements, including GPS navigation and weather-sensing technologies, which cater to increasingly sophisticated consumer expectations.

The UK robotic lawn mowers market is gaining traction, driven by rising consumer interest in smart garden solutions and time-saving appliances. The demand is especially strong in suburban households and among landscaping service providers looking to improve operational efficiency. Seasonal variations and relatively compact garden sizes have led to the popularity of compact and weather-resistant robotic models.

Germany robotic lawn mowers market stands as one of the most mature and technologically advanced markets in Europe. The country's strong culture of home and garden care, combined with a high degree of automation readiness, supports steady demand growth. German consumers prioritize performance, durability, and precision, leading to increased adoption of premium robotic mowers equipped with advanced navigation and safety features. Domestic brands, along with established global players, maintain a strong foothold through dense distribution networks and brand loyalty.

Key Robotic Lawn Mowers Company Insights

Some of the key companies in the robotic lawn mowers industry include Husqvarna Group, STIGA S.p.A., and HONDA MOTOR CO., LTD., among others. Market players are engaging in several growth strategies, including mergers & acquisitions, partnerships, collaborations, and geographical expansion, to stay afloat in the competitive market. The competitiveness is anticipated to intensify further as many companies focus on expanding their product portfolio by introducing advanced features or technologies in their existing product lines.

-

Husqvarna Group is a pioneer and global market leader in the robotic lawn mower segment, with a well-established portfolio. The company has consistently led innovation in autonomous mowing technologies, offering a wide range of models catering to both residential and professional landscaping markets. Husqvarna’s robotic mowers are equipped with advanced features such as GPS-assisted navigation, weather sensors, mobile app connectivity, and integration with smart home ecosystems.

-

Honda Motor Co., Ltd. has a selective yet high-quality presence in the robotic lawn mower market through its Miimo product line. Designed for precision and reliability, Miimo robotic mowers reflect Honda’s engineering excellence and focus on safety, quiet operation, and energy efficiency. The portfolio includes models with programmable cutting schedules, obstacle detection, and automatic charging capabilities, targeting primarily premium residential users in Europe and select global markets.

Key Robotic Lawn Mowers Companies:

The following are the leading companies in the robotic lawn mowers market. These companies collectively hold the largest market share and dictate industry trends.

- AL-KO

- Belrobotics

- Deere & Company

- HONDA MOTOR CO., LTD.

- Husqvarna Group

- Robert Bosch GmbH

- STIGA S.p.A.

- WIPER S.R.L.

- Worx

- Segway Navimow

Recent Developments

-

In February 2025, Husqvarna Group unveiled an expanded lineup of its boundary wire-free robotic lawn mowers for the 2025 season, adding 13 new models to the range. With this update, the company now offers a total of 24 models designed for both residential and commercial use, capable of maintaining lawns ranging from 600 square meters to more than 50,000 square meters.

-

In January 2025, MAMMOTION, a prominent player in robotic lawn care technology, has introduced enhancements to its robotic mowing solutions. The company’s UltraSense AI Vision system leverages advanced artificial intelligence to deliver high-precision, professional-level lawn maintenance with greater ease and efficiency.

Robotic Lawn Mowers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.33 billion

Revenue forecast in 2033

USD 21.97 billion

Growth rate

CAGR of 11.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Battery capacity, sales channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

AL-KO; Belrobotics; Deere & Company; HONDA MOTOR CO., LTD.; Husqvarna Group; Robert Bosch GmbH; STIGA S.p.A.; WIPER S.R.L.; Worx; Segway Navimow

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Robotic Lawn Mowers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest Industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global robotic lawn mowers market report based on battery capacity, sales channel, end use, and region.

-

Battery Capacity Outlook (Revenue, USD Million, 2021 - 2033)

-

Up to 20V

-

20V to 30V

-

-

Sales Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail Stores/Offline

-

Online

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global robotic lawn mowers market size was estimated at USD 8.47 billion in 2024 and is expected to reach USD 9.33 billion in 2025.

b. The global robotic lawn mowers market is expected to grow at a compound annual growth rate of 11.3% from 2025 to 2033 to reach USD 21.97 million by 2033.

b. North America dominated the robotic lawn mowers market in 2024 with a share of over 35.0%. Busy lifestyle patterns resulted in end users' approach towards automating lawn maintenance activities.

b. Some key players operating in the robotic lawn mowers market include Deere & Company, American Honda Motor Co., Inc., Robert Bosch GmbH, STIGA S.p.A., Robomow Friendly House, and Husqvarna Group.

b. Key factors that are driving the robotic lawn mowers market growth include increased expenditure on activities such as landscaping, backyard beautification, backyard cookouts, and garden parties, along with the need to save time spent on lawn maintenance activities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.