- Home

- »

- Electronic & Electrical

- »

-

Robotic Wheelchairs Market Size And Share Report, 2030GVR Report cover

![Robotic Wheelchairs Market Size, Share & Trends Report]()

Robotic Wheelchairs Market (2024 - 2030) Size, Share & Trends Analysis Report By Distribution Channel (Retail, E-commerce), By End-use (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-267-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Robotic Wheelchairs Market Size & Trends

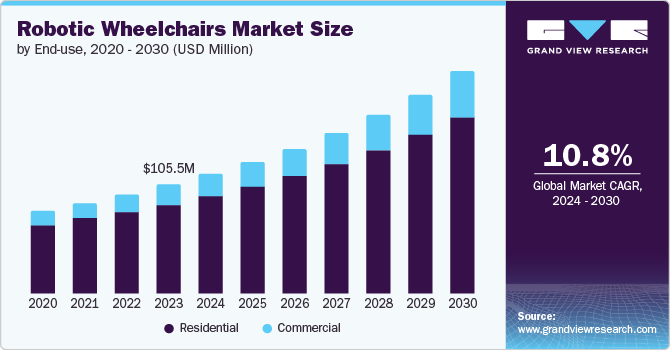

The global robotic wheelchairs market size was valued at USD 105.5 million in 2023 and is projected to grow at a CAGR of 10.8% from 2024 to 2030. Demographic trends such as the rise in the aging population and increasing rates of mobility impairments due to chronic conditions contribute to the rising demand for robotic wheelchairs. As more individuals seek solutions that offer mobility assistance and technological convenience, the market for robotic wheelchairs expands to meet these evolving needs.

Advancements in technology have significantly enhanced the capabilities of robotic wheelchairs, making them more accessible and functional for users with mobility impairments. These technological advancements include improved sensors, AI-driven navigation systems, and better battery life, enhancing the overall user experience and independence. For instance, in May 2024, researchers at IIIT Bangalore [AI1] created an IoT-enabled wheelchair device designed to aid in rehabilitating stroke patients by monitoring and assisting them in real-time, potentially improving their recovery outcomes. Hence, such research and developments in robotic wheelchair technology are expected to drive market growth further.

The growing emphasis on improving the quality of life for individuals with disabilities further drives the demand for robotic wheelchairs. The increasing demand for enhanced mobility assistance is driven by the frequency of disabilities, which can be attributed to congenital factors, age-related illnesses, or accident victims. According to WHO, over 1.3 million people in the world live with disabilities in 2023. Robotic wheelchairs offer greater maneuverability and autonomy than traditional manual wheelchairs, enabling users to navigate environments more easily and participate more fully in daily activities. This aspect is crucial in promoting inclusivity and accessibility in public spaces and private residences. Furthermore, healthcare providers and insurers recognize the long-term benefits of robotic wheelchairs in reducing healthcare costs associated with manual handling and improving overall patient outcomes. These chairs can prevent manual pushing and lifting injuries, thereby reducing caregiver burden and hospital readmissions.

End-use Insights

Residential segment dominated the market accounting for a market share of 81.8% in 2023. Advancements in technology have led to the development of more sophisticated and user-friendly robotic wheelchair models that cater specifically to home environments. These wheelchairs are equipped with features such as obstacle detection and avoidance, navigation assistance, and enhanced maneuverability, which are particularly beneficial for navigating a residential space's confines. The growing aging population has increased the demand for assistive technologies that improve mobility and independence at home.

The commercial segment is expected to witness the fastest CAGR of 12.6% over the forecast period. Advancements in technology have significantly enhanced the capabilities of robotic wheelchairs, making them more suitable for use in various commercial settings such as hospitals, airports, and shopping malls. These advancements include improved navigation systems, obstacle avoidance technology, and enhanced user interfaces, which make robotic wheelchairs easier to operate and safer to use in crowded environments. Moreover, the growing awareness and adoption of assistive technologies globally are driven by an aging population and the increasing prevalence of mobility impairments.

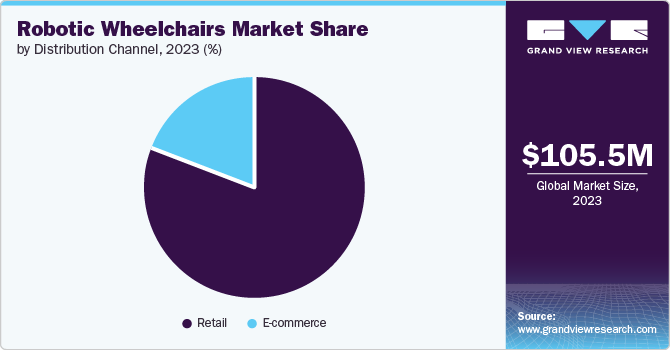

Distribution Channel Insights

Retail segment held the largest market revenue share in 2023. Retail outlets offer accessibility and convenience for potential buyers, allowing them to interact with different models of robotic wheelchairs physically. This hands-on experience is crucial for consumers who want to assess comfort, functionality, and suitability before purchasing. Moreover, retail channels often provide specialized staff who can offer personalized guidance and support, addressing the specific needs and preferences of wheelchair users. Additionally, retail environments facilitate immediate availability, enabling customers to acquire robotic wheelchairs promptly, which is vital, especially in cases where mobility needs are urgent.

The e-commerce segment is expected to grow at the fastest CAGR over the forecast period. E-commerce offers significant advantages, such as convenience, accessibility, and a wide range of product options, for consumers seeking robotic wheelchairs tailored to their needs. This platform allows users to compare features, read reviews, and make informed decisions from the comfort of their homes, which is especially beneficial for individuals with mobility challenges. Moreover, the global reach of e-commerce enables wheelchair manufacturers and distributors to expand their market presence beyond traditional geographical limitations, tapping into diverse consumer demographics worldwide. As technology advances, enhancing the customization and functionality of robotic wheelchairs, the e-commerce segment provides a dynamic platform for showcasing these innovations and meeting the evolving preferences of users seeking greater independence and mobility solutions.

Regional Insights

North America held the largest market revenue share of 32.2% in 2023. Technological advancements have significantly improved the functionality and accessibility of these devices, catering to the diverse needs of users with mobility impairments. Innovations such as enhanced navigation systems, obstacle detection, and intuitive controls have made robotic wheelchairs more user-friendly and capable of navigating various environments independently. Additionally, an aging population in North America has contributed to increased demand as older adults seek solutions that offer greater mobility and independence. Furthermore, there's growing recognition among healthcare providers and policymakers about the benefits of robotic wheelchairs in improving quality of life and reducing healthcare costs by enabling users to remain more active and self-sufficient.

U.S. Robotic Wheelchairs Market Trends

U.S. robotic wheelchairs market held the largest market revenue regionally. The growing emphasis on enhancing independence and mobility among individuals with disabilities has fueled the demand for robotic wheelchairs in the country. Moreover, demographic shifts toward an aging population in the U.S. have increased the need for mobility solutions that offer both comfort and reliability, driving the adoption of robotic wheelchairs as a preferred choice over traditional manual models. In addition, the U.S. has a robust healthcare system that actively supports assistive technologies. Hospitals, rehabilitation centers, and clinics are embracing and recommending robotic wheelchairs, thereby driving demand for these innovative products.

Europe Robotic Wheelchairs Market Trends

Europe robotic wheelchairs market is witnessing a significant growth in the robotic wheelchair market and is expected to maintain the pace over the forecast period.Robotic wheelchairs offer advanced features such as obstacle avoidance, navigation assistance, and ergonomic designs tailored to the needs of older users. Additionally, there is growing awareness and acceptance of innovative healthcare solutions in Europe, supported by government initiatives and healthcare reforms prioritizing accessibility and quality of life improvements for individuals with mobility impairments. Furthermore, advancements in robotics and AI technologies have made these wheelchairs more reliable and user-friendly, further driving their adoption across the region.

The UK robotic wheelchairs market is projected to witness a rapid growth. The demand for robotic wheelchairs in the UK is on the rise due to factors related to disabilities and healthcare infrastructure. These advanced wheelchairs offer enhanced mobility and independence to individuals with disabilities, enabling them to navigate both indoor and outdoor environments more efficiently. This capability is particularly beneficial in a country where accessibility standards continue to evolve, making it easier for wheelchair users to participate more fully in society. Additionally, the UK's healthcare infrastructure is increasingly focused on promoting personalized care and improving the quality of life for patients with mobility impairments. Robotic wheelchairs align with this objective by providing customizable features such as automated navigation and user-friendly controls catering to diverse patient needs.

The robotic wheelchairs market in Germany is witnessed as a lucrative in this industry. The demand for robotic wheelchairs in Germany is on the rise, primarily due to healthcare infrastructure advancements prioritizing accessibility and mobility solutions for patients. Germany's healthcare system is emphasizing innovative technologies that enhance patient care and independence. Robotic wheelchairs, equipped with features like advanced navigation systems and obstacle avoidance technology, cater to the needs of individuals with mobility impairments more effectively than traditional wheelchairs. These advancements improve users' quality of life and align with Germany's commitment to providing inclusive healthcare services. Moreover, as the population ages, there is a growing need for solutions that enable elderly individuals to maintain their autonomy and mobility, further driving the adoption of robotic wheelchair technologies across the region.

Asia Pacific Robotic Wheelchairs Market Trends

Asia Pacific is projected to witness the fastest CAGR over the forecast period. The rise in per capita income in emerging nations allows consumers to spend more on healthcare. Asia Pacific is experiencing a rise in the elderly population, increasing the demand for mobility solutions. The rapidly expanding healthcare industry drives the demand for the robotic wheelchair market. The rising instance of disabilities due to chronic diseases, accidents, and age-related issues further contributes to market growth.

India robotic wheelchairs market is experiencing rapid growth. The increase in road accidents and incidents causing disabilities has heightened the need for advanced mobility solutions, such as robotic wheelchairs that offer greater independence and mobility to users. Additionally, specific initiatives within India, such as government programs and NGOs focusing on disability rights and accessibility, have raised awareness and provided funding support for innovative assistive technologies like robotic wheelchairs. These initiatives aim to improve the quality of life for individuals with disabilities by promoting the adoption of advanced mobility aids that enhance mobility, thereby addressing the specific needs and challenges faced by disabled individuals in the country.

The robotic wheelchairs market in China is witnessing a significant growth. Rising healthcare expenditures and a growing awareness of the benefits of assistive technologies have encouraged healthcare providers and individuals to invest in robotic wheelchairs as a long-term solution to mobility challenges. China's rapid economic development has increased disposable incomes among urban residents, enabling more individuals to afford advanced healthcare solutions like robotic wheelchairs. Lastly, government support through policies promoting innovation and accessibility in healthcare has further stimulated the market, fostering a conducive environment for adopting advanced assistive technologies across the country.

Key Robotic Wheelchairs Company Insights

Some of the key companies in robotic wheelchair market include Sunrise Medical Ltd., Invacare Holdings Corp, DEKA Research and Development, Upnride Robotics.

-

Sunrise Medical Ltd. manufactures & markets home care and extended care products, they also deal with manufacturing wheelchairs, mobility scooters, stabilizing cushions, urinals, shower aids, commodes, and raised toilet seats.

-

Invacare Holdings Corp, is a medical equipment company which develops, manufactures, and markets medical devices for non-acute care, such as the home healthcare and long-term care markets.

Key Robotic Wheelchairs Companies:

The following are the leading companies in the robotic wheelchairs market. These companies collectively hold the largest market share and dictate industry trends.

- Sunrise Medical LLC

- Invacare Corporation

- Permobil Corporation

- Meyra GmbH

- Karman healthcare

- Ottobock SE & Company

- Matia Robotics

- Upnride Robotics

- DEKA Research & Development

- Whill Inc.

Recent Developments

-

In January 2024, Sunrise Medical announced the launch of its new product, the Switch, aimed at enhancing mobility for wheelchair users. The Switch is a versatile mobility aid that adapts to various environments, offering both manual and powered modes. It features advanced technology, such as intuitive controls and customizable seating options for individual user needs.

-

In September 2023, Permobil acquired PDG Mobility, a manufacturer of manual tilt wheelchairs. This strategic move aimed to broaden Permobil's product portfolio and strengthen its position in the mobility solutions market. PDG Mobility is known for designing and manufacturing high-quality manual tilt wheelchairs, crucial for users seeking greater comfort and mobility options.

Robotic Wheelchairs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 116.0 million

Revenue forecast in 2030

USD 214.4 million

Growth Rate

CAGR of 10.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Distribution channel, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, China, India, Brazil, South Africa

Key companies profiled

Sunrise Medical; Invacare Holdings Corpo.; Permobil Corporation; Karman Healthcare; Meyra GmbH; Ottobock SE & company; Matia Robotics; Upnride Robotics; DEKA Research and Development; Whill Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Robotic Wheelchairs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global robotic wheelchairs market report based on end-use, distribution channel, and region.

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-commerce

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

India

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

- South Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.