- Home

- »

- Medical Devices

- »

-

Rotator Cuff Repair Market Size, Share, Industry Report 2033GVR Report cover

![Rotator Cuff Repair Market Size, Share & Trends Report]()

Rotator Cuff Repair Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Shoulder Implants/Fixation Devices, Suture Anchors, Surgical Instruments & Kits), By Treatment Type, By Injury Severity, By Approach/Technique (Arthroscopic, Open Surgery), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-191-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Rotator Cuff Repair Market Summary

The global rotator cuff repair market size was estimated at USD 899.58 million in 2024 and is projected to reach USD 1,689.40 million by 2033, growing at a CAGR of 7.58% from 2025 to 2033. The primary factors driving the market growth are the growing incidence of degenerative shoulder disorders in the elderly population, improvements in arthroscopic repair methods, and the growing use of orthobiologics to enhance surgical results.

Key Market Trends & Insights

- North America dominated the global rotator cuff repair market with the largest revenue share of 47.38% in 2024.

- The U.S. dominated the North America rotator cuff repair industry in 2024.

- By product, the shoulder implants / fixation devices segment dominated the rotator cuff repair market with the largest revenue share of 42.78% in 2024.

- By treatment type, the surgical/curative treatment segment dominated the rotator cuff repair industry with the largest revenue share of 54.20% in 2024.

- By injury severity, the partial-thickness tear segment held the largest revenue share of 61.71% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 899.58 Million

- 2033 Projected Market Size: USD 1,689.40 Million

- CAGR (2025-2033): 7.58%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

The rotator cuff repair industry is growing as a result of ambulatory surgical centers' growing contribution to providing affordable procedures.In July 2023, in India, Smith+Nephew launched the REGENETEN Bioinductive Implant for rotator cuff repair, designed to encourage tendon regeneration and strengthen surgical outcomes.

The market for rotator cuff repair is evolving due to technological advancements. Minimally invasive arthroscopic procedures improve patient outcomes by increasing accuracy and speeding up recovery. Advanced suture anchors and bioabsorbable materials are two instances of innovations that speed up healing and reduce the possibility of complications. In July 2025, Inovedis Inc. completed 50 successful U.S. surgeries using its SINEFIX Rotator Cuff Repair System, marking a milestone in tendon-to-bone healing technology.

The market is expanding due to the world's aging population, which increases the risk of shoulder tendon injuries due to degenerative changes in shoulder muscles and tendons. As degenerative shoulder conditions become more common, there is a greater need for surgical procedures, which drives market growth.According to a January 2025 article in the Ewha Medical Journal, shoulder pain is becoming more common in older adults. Approximately 65% of people 60 years of age or older report having shoulder pain, and those over 60 have a much higher incidence of related shoulder tendon reconstruction disease than people under 60.

The use of orthobiologics in rotator cuff repair is growing because of their capacity to promote tissue regeneration and improve tendon healing. Platelet-rich plasma, stem cells, and bone marrow aspirates are examples of biologic therapies that enhance recovery results and lower the risk of re-injury. The increasing use of these innovative treatments is stimulating innovation and market expansion in the sector.In June 2025, the Orthobiologics Research Initiative launched a clinical study evaluating microfragmented adipose tissue (MFAT) injections for partial shoulder tendon tears. The minimally invasive therapy aims to promote healing and reduce the need for shoulder surgery.

Pipeline Innovation in Rotator Cuff Repair

The rotator cuff repair market is witnessing substantial growth driven by a robust pipeline of biologically enhanced implants, regenerative scaffolds, and novel augmentation strategies to improve healing outcomes and reduce re-tear rates. Advancements in biomaterials, tissue engineering, and biologics are creating opportunities for technological solutions that promote stronger tendon-to-bone integration and faster recovery, positioning innovation as a key driver of market expansion. This continuous R&D activity, coupled with increasing surgeon adoption of biologically active repair techniques, highlights the key role of pipeline developments in shaping the future trajectory of the market.

Future Trajectory of the Market

Company Name

Product

Stage / Status

Key Features

BioEnthesis

BioEnthesis implant

Phase II clinical trial (pre-market)

A sponge scaffold (human tissue) with two layers: one soft tissue layer that merges with tendon, and a hard tissue layer to allow stem cell ingress from the bone marrow. Used in augmenting rotator cuff repair vs standard surgery.

HARBOR MEDTECH, INC.

PROcuf Bioimplant

In partnership with Bioventus, Harbor anticipated FDA clearance in 2022.

BPMatrix is mounted on patented woven sutures for arthroscopic rotator cuff repair to accelerate healing.

Case Study

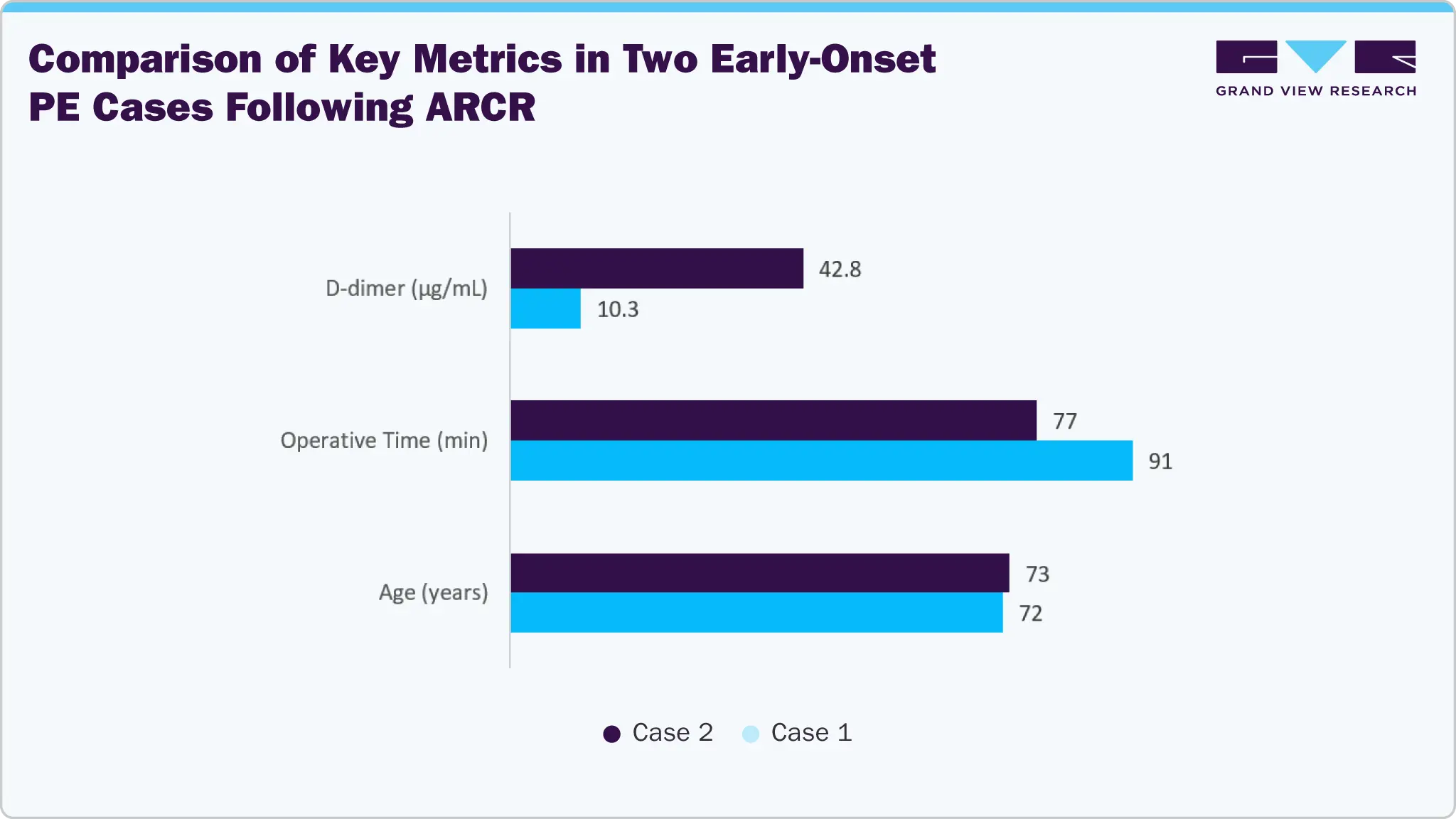

Title: Two Cases of Early-Onset Asymptomatic Pulmonary Embolism Following ARCR

Abstract: Abstract: Two elderly female patients developed asymptomatic pulmonary embolism (PE) with deep vein thrombosis (DVT) shortly after arthroscopic rotator cuff repair (ARCR), despite low-risk profiles. Mild oxygen desaturation led to D-dimer testing and CT confirmation. Both were treated with direct oral anticoagulants and showed good postoperative recovery. These cases emphasize the importance of vigilance in monitoring even low-risk patients.

Introduction: ARCR is widely used as a minimally invasive procedure. PE and DVT are indications for postoperative venous thromboembolism (VTE), which is uncommon but can happen suddenly, especially in older patients. Monitoring oxygen saturation and D-dimer levels is essential for early detection.

Case Presentation:

-

Case 1: 72-year-old female; lateral decubitus; operative time 91 min; D-dimer 10.3 µg/mL. CT: PE + bilateral soleus vein DVT. Treated with DOAC; discharged after 4 weeks with functional recovery.

-

Case 2: 73-year-old female; operative time 77 min; D-dimer 42.8 µg/mL. CT: multiple pulmonary emboli + right soleus vein DVT. Treated with heparin → DOAC; discharged after 4 weeks with functional recovery.

Discussion: Early-onset PE occurs within 24 hours post-ARCR, even in patients assessed as low risk. Factors such as advanced age, surgical positioning, and analgesia methods may contribute. Routine postoperative oxygen saturation and D-dimer monitoring enable early diagnosis and treatment, improving outcomes and preventing severe complications.

Emerging Technologies and Trends in the Rotator Cuff Repair Industry

Advanced surgical instruments, biologic treatments, and digital integration are driving rapid innovation in the shoulder tendon reconstruction sector. Improved suture anchors, bioinductive scaffolds, and minimally invasive arthroscopic techniques are speeding up recovery and increasing results. The use of orthobiologics, such as stem cell therapies and platelet-rich plasma, to hasten tendon healing and reduce re-tear rates is growing. Accurate surgical planning and execution are becoming possible through the integration of digital imaging, navigation systems, and augmented reality. The Integrity Implant System, a scaffold made of hyaluronic acid for rotator cuff and other tendon repairs, was fully introduced by Anika Therapeutics in the U.S. in July 2024. Due to high surgeon interest and commercial demand, more than 300 surgeries were performed during the limited release.

Pricing Trends in Rotator Cuff Repair

The rotator cuff arthroscopic repair cost varies considerably across care settings, with average prices typically higher in outpatient hospitals than in ambulatory surgery centers. Hospital procedures often exceed USD 9,000-12,000, while surgery centers range around USD 5,500-7,500, highlighting a clear differential influencing patient and payer preferences. This cost disparity shapes the competitive landscape, as providers and insurers increasingly seek value-driven solutions that balance clinical efficacy with affordability. High procedure costs reinforce demand for biologically enhanced implants, regenerative scaffolds, and advanced fixation systems that improve healing outcomes while reducing re-operation risks. As cost pressures intensify, manufacturers positioned to deliver innovations that shorten operating times, lower complications, and enable quicker recovery are expected to gain stronger adoption, making pricing dynamics a key driver in the evolution of the rotator cuff repair market.

Market Concentration & Characteristics

The rotator cuff repair industry is highly innovative, with heavy R&D investments in the minimally invasive field, bioinductive implants, and regenerative scaffolds. Technologically, firms are combining new imaging and navigation technologies to improve the accuracy of surgery. These advancements are intended to provide solutions for unmet needs, including high re-tear rates and variability in healing, in which technology differentiation is a major competitive lever. According to a report by OrthoFeed in April 2024, a Brazilian surgeon performed a shoulder arthroscopy procedure using Apple's Vision Pro, which helped with shoulder tendon repair by offering a real-time, high-resolution representation of the operation wound.

The market is witnessing moderate M&A activity among the larger players in orthopedics as they acquire smaller firms focused on biologics and tendon repair solutions. The deals are allowing companies to speed up access to new technology and diversified portfolios in sports medicine. But the action is still targeted, not pervasive, and it’s a few key strategic plays that are really defining where competition stands.

Regulatory oversight plays a crucial role in the medical device industry for launching new products such as biologics and innovative implant systems, as mandatory approvals from the FDA and CE Mark are required. Traditional suture anchors face fewer regulatory challenges, while regenerative and biologic adjuncts endure evolving scrutiny. Compliance with safety and efficacy standards is essential for determining launch timelines and influencing physician adoption in various regions.

Market players are focusing their training efforts on more than just rotator cuff repair devices. They are focusing more on surgeon training, surgical digital support, and complete postoperative rehabilitation programs. The objectives are to foster brand loyalty and simplify surgical treatment pathways. They aim to achieve this by providing integrated support throughout the surgical care continuum. The expansion of these add-on services has been slow, but the pace is sharpening as companies try to consolidate their foothold in the market.

Growth in the rotator cuff repair market is driven by steady regional expansion, as new clinics open from coastal cities to small-town surgical centers. Sports injury cases are rising in Asia-Pacific and Latin America, and hospitals there are adding new equipment, yet adoption still lags behind the U. S. and Western Europe, where operating rooms stay active. Companies are focusing on growth in these emerging regions with training programs and distributor partnerships.

Product Insights

The shoulder implants / fixation devices segment dominated the rotator cuff repair market with the largest revenue share of 42.78% in 2024.The segment’s dominance is attributed to the widespread use of suture anchors, screws, and knotless fixation systems that offer enhanced stability and faster healing, coupled with continuous innovations in bioabsorbable and biocompatible materials that improve patient outcomes and reduce revision surgery rates.In June 2024, a study published in Science Advances introduced a python tooth-inspired fixation device for rotator cuff repair, which nearly doubled repair strength compared to standard suturing methods, signaling a potential advancement in fixation technology.

The orthobiologics segment is anticipated to grow at the fastest CAGR over the forecast period,due to the increasing use of biologic augmentation techniques in shoulder tendon repair. To promote tendon healing, surgeons are increasingly employing bioinductive patches, bone marrow aspirate concentrate (BMAC), and platelet-rich plasma (PRP). The persisting issue of high re-tear rates and incomplete healing after using traditional repair techniques is addressed by these solutions. In August 2023, Anika Therapeutics received FDA 510(k) clearance for its Integrity Implant System, a hyaluronic acid-based patch designed to augment reconstruction, offering improved tendon strength and regenerative capacity over first-generation collagen patches.

Treatment Type Insights

The surgical/curative treatment segment dominated the rotator cuff repair industry with the largest revenue share of 54.20% in 2024.The dominance of this segment is driven by the high cost of surgical interventions, growing preference for minimally invasive arthroscopic procedures, and the need for definitive repair in full-thickness tears. The segment is expected to maintain its lead throughout the forecast period owing to continuous improvements in surgical outcomes and expanding adoption in outpatient settings.To promote enthesis healing at the tendon-bone interface, Tetrous, Inc. performed the first surgical cases utilizing its EnFix TAC demineralized bone fiber implants for shoulders in May 2024. The product, which comes in two varieties, expands upon the EnFix line and has been utilized in more than 200 surgeries in Australia and the U.S.

The pharmaceutical / preventive treatment segment is anticipated to grow at the fastest CAGR over the forecast period, due to growing interest in non-surgical treatment of tendon injuries. Patients looking for alternatives to invasive surgery are increasingly turning to preventive measures such as biologic agents, injectable therapies, and anti-inflammatory medications. By enhancing pain management and functional recovery, these therapies seek to postpone or lessen the need for surgical intervention. According to a January 2025 study in BMC Musculoskeletal Disorders, patients with tears fared better with percutaneous orthobiologic treatment using bone marrow concentrate than with at-home exercise therapy. MRI results further supported the orthobiologic group's superior healing.

Injury Severity Insights

The partial thickness tear segment dominated the rotator cuff repair market with the largest revenue share of 61.71% in 2024. This dominance is driven by the higher prevalence of partial tears compared to full-thickness injuries, earlier diagnosis due to improved imaging technologies, and growing preference for minimally invasive repair techniques that allow faster recovery and reduced postoperative complications. In January 2025, a study published in JSES International reported that partial-thickness tears accounted for about 23-28% of all shoulder tendon reconstructions in the U.S., highlighting significant variability in treatment practices and a frequent reliance on nonoperative management before surgery.

The full-thickness tear segment is anticipated to grow at the significant CAGR over the forecast period due to the increasing frequency of severe injuries among athletes and aging populations. These situations predominantly require surgery, which increases the need for biologic augmentation, suture anchors, and advanced repair implants. Higher treatment volumes are also the outcome of early diagnosis and increased awareness. Global adoption rates for full-thickness tear repair are anticipated to rise as surgical results continue to improve.In contrast to traditional repair alone, a case report published in April 2025 described the use of a bioinductive collagen implant (Regeneten) to supplement partial repair of a full-thickness shoulder tendon tear in a 66-year-old patient. This procedure demonstrated better tendon healing and a lower risk of retear.

Approach/Technique Insights

The arthroscopic segment dominated the rotator cuff repair industry with a revenue share of 73.21% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This is attributed to growing adoption of minimally invasive procedures, faster patient recovery, improved surgical precision with advanced arthroscopic instruments, and reduced postoperative complications compared with open surgery. Increasing surgeon training programs and favorable reimbursement policies are supporting broader adoption of arthroscopic techniques worldwide. In April 2025, the Trials journal released the protocol for the ARC (Australian Rotator Cuff) trial, which is a randomized, placebo-controlled study aimed at comparing arthroscopic repair with no repair in terms of alleviating shoulder pain and enhancing function in patients with full-thickness, non-acute tears. The research focuses on evaluating clinical effectiveness, safety, and cost-effectiveness, with outcomes measured after six months.

The open surgery segment is anticipated to grow at a significant CAGR over the forecast period. In severe cases, open surgery continues to be a dependable method for obtaining long-lasting repairs, although minimally invasive techniques are becoming more and more popular. Improvements in surgical methods and implant architecture are lowering the incidence of complications and improving patient outcomes. The open surgery market will keep on expanding steadily as long as there is a clinical need to treat difficult injuries. The FDA 510(k) cleared Arcuro Medical's SuperBall-RC system in February 2025, allowing surgeons to improve the results of shoulder injuries. The device will begin a limited user release in Q2 2025, with a full launch scheduled for the second half of 2025.

End-use Insights

The hospitals segment dominated the rotator cuff repair market with a revenue share of 56.60% in 2024. This dominance is attributed to the availability of advanced surgical infrastructure, higher patient inflow for complex and full-thickness tear repairs, and broader reimbursement coverage for inpatient procedures. The segment is anticipated to sustain its lead as hospitals remain the primary setting for high-cost surgeries and biologic-enhanced interventions.In July 2024, a Visakhapatnam hospital performed a rare shoulder arthroscopic repair using the REGENETEN implant on a 30-year-old patient with persistent shoulder pain and a confirmed tear. The procedure restored mobility after conservative treatment had failed for six months.

Theambulatory surgical centers (ASCs) segment is expected to grow at the fastest CAGR during the forecast period due to adoption driven by convenience, cost-effectiveness, and shorter patient stays. The shift in the delivery of reconstruction procedures from hospital to outpatient settings, supported by improvements in minimally invasive techniques, is a key driver propelling the market's expansion. ASCs are appealing to payers and patients equally because they provide faster recovery times and lower overall treatment costs. In June 2025, Smith+Nephew and Standard Health opened the UK's first Orthopaedic Ambulatory Surgery Center, which provides innovative joint replacement and repair services. Over the next five years, the center hopes to add more locations to better serve both NHS and private patients.

Regional Insights

North America dominated the rotator cuff repair market with a revenue share of 47.38% in 2024, driven by the high prevalence of degenerative shoulder disorders in aging populations, strong adoption of advanced arthroscopic repair techniques, and widespread use of orthobiologics. The region benefits from well-established healthcare infrastructure, favorable reimbursement policies, and high patient awareness of surgical options. In November 2023, Anika Therapeutics completed the first U.S. surgeries using its Integrity Implant System, a hyaluronic acid-based scaffold designed to support tendon healing in reconstruction.

U.S. Rotator Cuff Repair Market Trends

The U.S. dominated the North America rotator cuff repair industry in 2024, due to its high volume of procedures, established healthcare system, and robust presence of top orthopedic device manufacturers. New guidelines for shoulder tendon injuries were published by the American Academy of Orthopaedic Surgeons (AAOS) in August 2025. The revision emphasizes the effectiveness of biologic augmentation in lowering retears and enhancing results, including bioinductive implants and human dermal allografts. Updates also address the use of slings, the timing of mobilization, the limited use of corticosteroid injections, and surgical versus non-surgical care.

Europe Rotator Cuff Repair Market Trends

The rotator cuff repair industry in Europe is expected to grow significantly over the forecast period. An aging population is strengthening Europe, an increase in the frequency of sports injuries, and an expanded range of minimally invasive surgical procedures. In order to support its CE Mark submission, Inovedis GmbH conducted a pre-market clinical study in Tübingen, Germany, in December 2023, treating the first patients with its SINEFIX Rotator Cuff Repair System. In comparison to conventional suture anchor techniques, the system seeks to streamline surgery, enhance tendon healing, and maximize patient outcomes.

The rotator cuff repair market in the UK is expected to grow significantly during the forecast period due to increased demand from both active younger patients and the elderly population. The government's emphasis on reducing surgical wait times and the growth of specialty orthopedic centers are fueling the market.For patients waiting for reconstruction, a pilot randomized controlled trial in six NHS hospitals in England in November 2023 compared physiotherapist-led exercise to standard care. The trial was found to be feasible, although many patients did not receive surgery within six months. According to the study, a larger trial should be planned in order to inform clinical judgment.

Asia Pacific Rotator Cuff Repair Market Trends

The Asia Pacific rotator cuff repair industry is expected to register the fastest CAGR over the forecast period. Growing awareness of advanced treatment options, better surgical infrastructure, and rising healthcare spending are among the factors contributing to increased market penetration in emerging economies. The Smith+Nephew REGENETEN Bioinductive Implant, an arthroscopy-administered collagen-derived treatment for ruptures, was introduced in Japan in October 2023.

China rotator cuff repair market is anticipated to register considerable growth during the forecast period. A significant patient base, an increase in shoulder injuries, and government investments in enhancing orthopedic care capabilities are several variables contributing to the market's expansion In May 2024, a systematic review and meta-analysis published in Medicine reported that arthroscopic reconstruction combined with platelet-rich plasma (PRP) significantly reduced retearing rates (16.5% vs. 23.6%) and improved functional outcomes across 21 randomized controlled trials involving 1,359 patients.

Latin America Rotator Cuff Repair Market Trends

The Latin America rotator cuff repair industry is anticipated to witness considerable growth over the forecast period. Growing access to orthopedic care and an increase in the frequency of sports injuries are expected to fuel significant growth in the Latin American market over the forecast period. In January 2022, Revista Brasileira de Ortopedia published an article analyzing arthroscopic repair, showing that double row fixation improves anterior shoulder strength, particularly in extensive injuries, while pain and overall function remain similar to single row repair.

The Argentina rotator cuff repair market is anticipated to register considerable growth during the forecast period. Growing awareness of minimally invasive repair methods and the country's private healthcare infrastructure are driving this market. STAR Sports Medicine made its debut in the Latin American market at the AAA-SLARD 2024 congress in Buenos Aires in April 2024. The company's newest innovations, such as meniscal repair solutions, reconstructive surgery for the ACL, and repair, were demonstrated in person to surgeons and partners. The launch emphasizes STAR's dedication to improving the care of orthopedic patients and fortifies the organization's position in the area.

Middle East & Africa Rotator Cuff Repair Market Trends

The Middle East and Africa rotator cuff repair industry is anticipated to witness considerable growth over the forecast period. This is increasing as a result of increased musculoskeletal disorders and better healthcare investments. In August 2025, Farwaniya Hospital in Kuwait carried out the first shoulder tendon repair in the nation using a biological patch and a fully arthroscopic procedure. In order to address chronic tendon tears that are unmanageable with traditional repair, the patch serves as a scaffold to promote tendon regeneration. For patients with serious shoulder injuries, the innovation is anticipated to increase healing rates, hasten recovery, and broaden treatment options.

The UAE rotator cuff repair marketis anticipated to register considerable growth during the forecast period. Robust government healthcare programs, medical tourism, and growing investments in state-of-the-art orthopedic facilities influence this trend. Burjeel Holdings opened a new orthopedic facility in September 2024, increasing access to the newest bone and joint care available in Abu Dhabi.

Key Rotator Cuff Repair Company Insights

Key participants in the rotator cuff repair industry are focusing on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and expanding their business footprints.

Key Rotator Cuff Repair Companies:

The following are the leading companies in the rotator cuff repair market. These companies collectively hold the largest market share and dictate industry trends.

- Smith+Nephew

- Arthrex, Inc.

- DePuy Synthes (Johnson & Johnson)

- CONMED Corporation

- Stryker

- Aevumed, Inc.

- Atreon Orthopedics

- Zimmer Biomet

- Osteocare Medical Pvt Ltd.

- Auxein

Recent Developments

-

In February 2025, Atreon Orthopedics received FDA 510(k) clearance and launched the BioCharge Autobiologic Matrix, a fully resorbable synthetic scaffold for rotator cuff repair. The implant enhances tendon healing, reinforces the suture-tendon interface, and reduces re-tear risk. It is designed for simplified arthroscopic implantation, improving surgical efficiency and patient outcomes.

-

In December 2024, Atreon Orthopedics announced that its ROTIUM Bioresorbable Wick had been used in over 10,000 rotator cuff surgeries, highlighting advancements in tendon-bone healing technology.

-

In July 2023, Tetrous Inc. performed the first Australian surgeries with its EnFix RC rotator cuff implant, boosting competition in medicine devices.

Rotator Cuff Repair Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 941.57 million

Revenue forecast in 2033

USD 1,689.40 million

Growth rate

CAGR of 7.58% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, treatment type, injury severity, approach/ technique, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Smith+Nephew; Arthrex, Inc.; DePuy Synthes (Johnson & Johnson); CONMED Corporation; Stryker; Aevumed, Inc.; Atreon Orthopedics; Zimmer Biomet; Osteocare Medical Pvt Ltd.; Auxein

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rotator Cuff Repair Market Report Segmentation

This report forecasts revenue growth and provides at the global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global rotator cuff repair market report based on product, treatment type, injury severity, approach/technique, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Suture Anchors

-

Orthobiologics / Biologics

-

Shoulder Implants / Fixation Devices

-

Surgical Instruments & Kits

-

Others

-

-

Treatment Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Surgical / Curative Treatment

-

Physiotherapy / Palliative Treatment

-

Pharmaceutical / Preventive Treatment

-

-

Injury Severity Outlook (Revenue, USD Million, 2021 - 2033)

-

Full-Thickness Tear

-

Partial-Thickness Tear

-

-

Approach/Technique Outlook (Revenue, USD Million, 2021 - 2033)

-

Arthroscopic

-

Open Surgery

-

Mini-Open Surgery

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Clinics / Orthopedic Centers

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.