- Home

- »

- Homecare & Decor

- »

-

RTA Furniture Market Size Report, 2030GVR Report cover

![RTA Furniture Market Size, Share & Trends Report]()

RTA Furniture Market Size, Share & Trends Analysis Report By Material (Wood, Glass, Steel, Others), By Application (Home, Office), By Product, By Distribution Channel, By Region And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-641-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

RTA Furniture Market Size

The global RTA furniture market size was valued at USD 15.99 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.2 % from 2024 to 2030. As more people move into apartments and smaller homes, there is a need for versatile, space-saving furniture solutions. RTA (Ready-to-assemble) furniture offers modular and compact designs that fit well into limited spaces, providing functionality and style. This adaptability drives the demand for RTA furniture in the market.

Flat-pack designs allow more efficient space use in shipping containers and retail environments, reducing logistics costs. This efficiency is particularly beneficial for e-commerce platforms and retail stores, which manage inventory more effectively and offer a wider range of products. Consumers also benefit from the convenience of compact packaging, which is easier to handle and fits into smaller vehicles. This convenience makes transporting and storing goods easier, driving demand in the market.

Brands increasingly invest in research and development to innovate and offer a wider range of stylish, functional, and affordable RTA furniture options. Collaborations with popular online retailers and establishing user-friendly websites enhance accessibility and customer reach, facilitating global sales. Additionally, many companies are expanding their physical presence by opening new stores and distribution centers in high-demand regions, ensuring faster delivery and better customer service. For instance, in November 2021, Tanger Med Zones launched a commercial outlet project in northern Morocco. IKEA, which designs and offers ready-to-assemble furniture, began construction on over three hectares, covering 19,000 square meters.

Material Insights

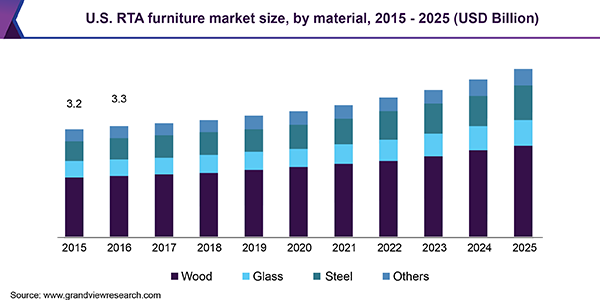

The wood material segment dominated the market and accounted for a market revenue share of 54.6% in 2023. The manufacturing process for wood-based RTA furniture is relatively short. Wood can easily be cut, shaped, and joined, facilitating efficient production and assembly. Additionally, advancements in engineering and technology have improved the precision of cutting and assembly processes, resulting in better-quality finished products. This ease of manufacturing contributes to the widespread adoption of wood in RTA furniture.

The steel material segment is expected to witness the fastest CAGR over the forecast period. Steel supports substantial weight and withstands significant stress without bending or breaking. This robustness makes it an ideal material for furniture that needs to tolerate heavy use. Moreover, Steel furniture's resistance to environmental factors such as moisture, pests, and UV rays makes it a practical choice for furniture that needs to withstand varying conditions.

Application Insights

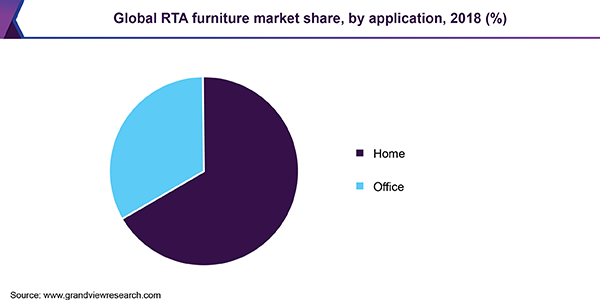

The home segment accounted for the largest market revenue share in 2023. RTA furniture is designed to be easy to assemble, which requires homeowners who prefer a straightforward, do-it-yourself approach. The simplified assembly process, often supported by clear instructions and minimal tools, allows consumers to quickly set up their furniture without needing professional help. This convenience is particularly valuable for those who move frequently or want DIY projects.

The office segment is anticipated to register a significant CAGR over the forecast period. RTA furniture provides flexibility through modular designs and configurable pieces that are rearranged or reconfigured as necessary. This adaptability allows businesses to easily modify their office layout to accommodate new team structures, changes in workflow, or growing company needs. The flexibility of RTA furniture enables businesses to expand or downsize their office space efficiently without the need for extensive renovations.

Product Insights

The table segment accounted for the largest market revenue share in 2023. Tables are essential for optimizing space in any room. RTA tables come in compact, space-saving designs for smaller homes, apartments, or offices. Features such as foldable or extendable tables offer flexibility for maximizing space usage. This space optimization is particularly valuable in environments where efficient use of space is crucial. Additionally, RTA tables are available in various styles and sizes, such as dining tables, desks, coffee tables, and console tables, each designed to meet specific needs. The ability to choose from diverse designs and functions ensures that consumers find tables that perfectly suit their home or office use requirements.

The sofa segment is anticipated to register the fastest CAGR over the forecast period. RTA beds feature space-saving designs for smaller rooms or apartments. Furniture includes built-in storage solutions, such as drawers or under-bed compartments, which maximize available space and keep the bedroom organized. These space-efficient designs help consumers make the most of their living areas. Additionally, significant RTA beds offer customization features, such as adjustable headboards or interchangeable components, allowing consumers to upgrade the bed to their preferences.

Distribution Channel Insights

The home centers distribution channel accounted for the largest market revenue share in 2023. Home centers offer a wide range of products, including various types of RTA furniture. This extensive selection allows consumers to find the required furniture in one location. The wide variety enables customers to compare different styles, materials, and price points easily, simplifying the process of choosing products that fit their needs and preferences. Additionally, in-store expertise assists consumers in navigating the options available, understanding product features, and making informed decisions, driving demand for home centers in the market.

The online distribution channel is anticipated to register the fastest CAGR over the forecast period. Consumers shop RTA furniture from the comfort of their homes anytime without visiting physical stores. This accessibility is particularly valuable for busy individuals, those who prefer to avoid crowded shopping environments, or those who live in areas with limited local furniture options. Online shopping provides an easy experience, allowing customers to browse, compare, and purchase products.

Regional Insights & Trends

The North America RTA furniture market is expected to grow significantly over the forecast period. RTA furniture offers flexibility and customization, which are demanded by North American consumers who value personalization in their home decor. Many RTA furniture parts are easily modified or expanded to suit changing needs and preferences. This adaptability is particularly beneficial in multi-functional living spaces where furniture needs to serve multiple purposes. The ability to mix and match different components to create unique configurations is a significant driver for this market.

U.S. RTA Furniture marketTrends

The U.S. RTA furniture market is expected to witness significant growth over the forecast period. Increasing awareness of environmental issues has led U.S. consumers to pursue more sustainable and eco-friendly furniture options. RTA furniture manufacturers use sustainable materials, reduce waste through efficient manufacturing processes, and offer easier transport products, lowering carbon footprint. Additionally, RTA furniture often uses sustainable materials, and its flat-packed design reduces transportation emissions and packaging waste. These factors drive the demand for RTA furniture in the U.S. market.

Europe RTA Furniture Market Trends

The Europe RTA furniture market accounted for the largest revenue share of 33.3% in 2023. Europe is densely populated in urban areas and smaller living spaces, particularly in major cities. The trend toward urbanization and compact living spaces drives the demand for space-saving furniture solutions. RTA furniture fits into small apartments and homes with its modular and customizable designs. Its flexibility allows consumers to optimize their living areas, fueling the growth of the Europe market.

The UK RTA furniture market is expected to witness significant growth over the forecast period. Well-established retailers such as IKEA and others have extensive distribution networks and strong supply chain capabilities, ensuring wide availability and fast delivery of RTA furniture nationwide. These retailers enhance consumer assurance through comprehensive product ranges, competitive pricing, and exceptional customer service.

Middle East and Africa RTA Furniture Market Trends

The Middle East and Africa region is expected to witness the fastest CAGR over the forecast period. RTA furniture is more cost-effective due to lower manufacturing, shipping, and storage costs. This affordability makes it accessible to a wider range of consumers, including those with limited budgets. Hotels, resorts, and residential developments also require large quantities of stylish, durable, and cost-effective furniture, making it a prevalent choice for bulk purchases in these sectors. The cost savings associated with RTA furniture led to individual buyers and bulk purchasers, such as property developers and hospitality businesses.

The Saudi Arabia RTA furniture market is anticipated to witness significant growth over the forecast period. Increasing internet and smartphone usage has led to a surge in online shopping. Consumers browse, compare, and purchase RTA furniture from the comfort of their homes. Online platforms provide detailed product information, customer reviews, and various options. Expanding e-commerce platforms has made RTA furniture more accessible to a wider audience, driving its demand in Saudi Arabia.

Key Company & Market Share

Key industry players operating in the RTA furniture market include Inter IKEA Systems B.V., Dorel Industries, Simplicity Sofas, Whalen Furniture and others.

- Inter IKEA Systems B.V. is the global franchisor and owner of the IKEA Concept, which designs and sells ready-to-assemble furniture, kitchen appliances, and home accessories. The company's extensive product offerings include furniture for living rooms, bedrooms, kitchens, and offices.

- Dorel Industries Inc. designs and manufactures a diverse range of consumer products. Dorel operates brands such as Dorel Juvenile and Dorel Home. It provides functional furniture solutions for various living spaces, including bedrooms, living rooms, and office furniture.

Key RTA Furniture Companies:

The following are the leading companies in the rta furniture market. These companies collectively hold the largest market share and dictate industry trends.

- Inter IKEA Systems B.V.

- Dorel Industries

- Morris Home Furniture.

- Steinhoff International

- Tvilum A/S

- Simplicity Sofas

- Home Reserve

- Whalen Furniture

- Fabritec (EUROSTYLE)

- Bush Home

Recent Developments

-

In June 2023, the Pioneer Woman introduced a ready-to-assemble (RTA) furniture line for Walmart.com. The product line includes kitchen, dining room, and bedroom pieces constructed from wood and veneers.

-

In November 2022, Ellementry introduced a handcrafted furniture collection. The 'Old World' collection includes retro-style dark mango wood furniture, ready-to-assemble bedside drawers, double-drawer cabinets, writing desks, console tables, coffee tables, and towel racks.

RTA Furniture Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.04 Billion

Revenue forecast in 2030

USD 25.80 Billion

Growth Rate

CAGR of 7.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, Application, Product, Distribution Channel, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Japan, China, India, Brazil, Argentina, South Africa, South Arabia

Key companies profiled

Inter IKEA Systems B.V., Dorel Industries, Morris Home Furniture, Steinhoff International, Tvilum A/S, Simplicity Sofas, Home Reserve, Whalen Furniture, Fabritec (EUROSTYLE), Bush Home

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the RTA furniture market report based on material, application, product, distribution channel, and region.

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Wood

-

Glass

-

Steel

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Home

-

Office

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Table

-

Chair

-

Beds

-

Sofa

-

Storage

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Specialty Stores

-

Home Centers

-

Flagship Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

South Arabia

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."