Ready To Drink Premixes Market Summary

The global ready to drink premixes market size was valued at USD 18.34 billion in 2018 and is projected to reach USD 25.96 billion by 2025, growing at a 4.5% of value from 2019 to 2025. Increasing popularity of Ready-To-Drink (RTD) beverages and demand for high strength premixes are projected to drive the market.

Key Market Trends & Insights

- North America held the largest share of the global market in 2018.

- Asia Pacific holds a considerable share in the global market.

- On the basis of type, the RTDs type segment is expected to witness the fastest growth rate over the forecast period.

- On the basis of distribution channel, stored based segment anticipated to hold the largest share in the market as they offer one-stop shopping experience.

Market Size & Forecast

- 2018 Market Size: USD 18.34 Billion

- 2025 Projected Market Size: USD 25.96 Billion

- CAGR (2019-2025): 4.5%

- North America: Largest market in 2018

Moreover, changing lifestyles and demand for low alcohol content flavored drinks are expected to fuel the RTD/high strength premixes market growth further. The rising popularity of healthy alcoholic drinks is also driving product demand. In addition, rising acceptance of ethnic drinks in developed regions and the advent of alcoholic high-strength premixes with natural and health-promoting ingredients are anticipated to propel the product demand. Furthermore, growing investments by bars and pubs in low spirit flavored beverages will boost the product demand.

On the other hand, factors, such as religious or cultural beliefs in several countries, heavy taxation and duties, and adverse health effects of alcohol may hinder the market growth. In addition, stringent rules and regulations on the advertising of alcoholic products and a growing number of anti-alcohol campaigns are also having a negative impact on the market growth.

Furthermore, the easy availability of substitute products is grabbing consumer attention. For instance, drinks like Cloud 9 and Red Bull are gaining popularity across the globe. North America region led the global high strength premixes market in 2018 and is projected to expand further at a relatively high CAGR from 2019 to 2025.

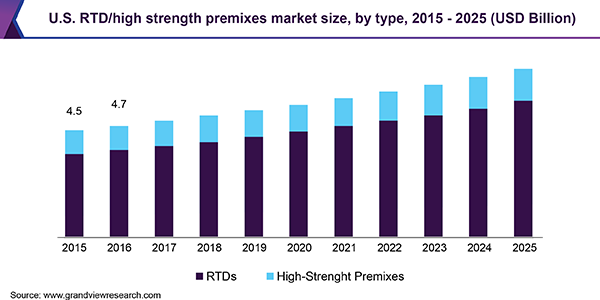

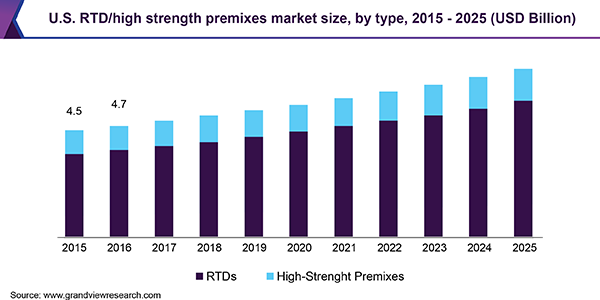

Type Insights

On the basis of type, the market has been segmented into RTDs and High-Strength Premixes. The RTDs type segment is expected to witness the fastest growth rate over the forecast period. It is also projected to be the largest segment on account of rising demand for alcoholic beverages, due to their low alcohol content, from bars and pubs across the globe. Effective use of flavors and various combinations in RTDs beverages have driven their demand.

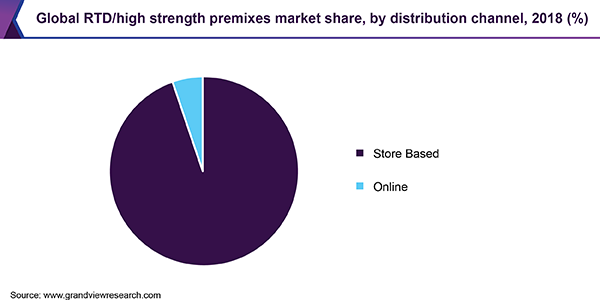

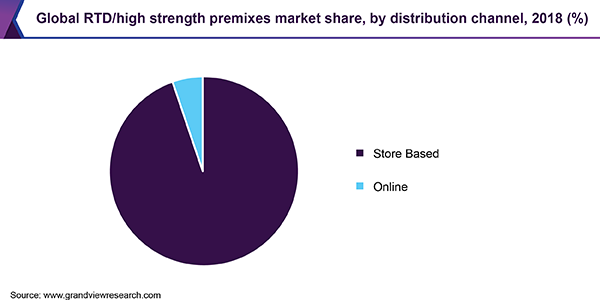

Distribution Channel Insights

On the basis of distribution channel, the market is bifurcated into Stored Based and Online. Stored Based are anticipated to hold the largest share in the market as they offer one-stop shopping experience. Moreover, option of bulk purchases at wholesale price in such stores will drive the segment growth further.

Thus, many manufacturers are focusing on improving their storage infrastructure and targeted marketing of the specialty stores they own or are partner with. However, the online distribution channel is also anticipated to witness significant growth over the forecast period owing to the increasing popularity of e-commerce platforms, such as Amazon.com, and the number of smartphone and internet users, especially in the developing regions.

Regional Insights

On the basis of region, the market has been segmented into North America, Europe, Middle East & Africa, Asia Pacific, and Central & South America. North America held the largest share of the global market in 2018. It is expected to retain its leading position throughout the forecast years due to the rising demand for RTDs in countries, such as the U.S. and Canada.

Europe is also likely to be one of the major regional markets over the forecast period owing to growing product demand in the region. Changing lifestyles and rising alcohol consumption in the region are several other major factors driving the product demand. Asia Pacific also holds a considerable share in the global market.

Ready To Drink Premixes Market Share Insights

Prominent companies in the market have undertaken various business strategies like mergers and acquisitions, business expansion, strategic alliances, and horizontal and vertical integrations to gain a competitive advantage. For instance, Brown-Forman acquired BenRiach Distillery Co. Ltd., which brought three Single Malt Scotch Whiskey brands into Brown-Forman’s product portfolio.

Companies also invest in R&D activities to expand their product portfolio. For instance, in 2017, Asahi Group Holdings invested around USD 103 million in R&D. Some of the major companies in the market are Suntory Holdings, Mark Anthony Brands, Brown Forman Corp., Bacardi and Co. Ltd., Halewood International, Diageo Plc, and Asahi Group Holdings Ltd.

Report Scope

|

Attribute

|

Details

|

|

Base year for estimation

|

2018

|

|

Actual estimates/Historical data

|

2015 - 2017

|

|

Forecast period

|

2019 - 2025

|

|

Market representation

|

Revenue in USD Billion and CAGR from 2019 to 2025

|

|

Regional scope

|

North America, Europe, Asia Pacific and Central and South America, and Middle East and Africa

|

|

Country scope

|

U.S., U.K., Japan, Brazil, and South Africa

|

|

Report coverage

|

Revenue forecast, company share, competitive landscape, and growth factors and trends

|

|

15% free customization scope (equivalent to 5 analyst working days)

|

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

|

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global ready to drink premixes market report on the basis of type, distribution channel, and region:

-

Type Outlook (Revenue, USD Billion, 2015 - 2025)

-

RTDs

-

High-Strength Premixes

-

Distribution Channel Outlook (Revenue, USD Billion, 2015 - 2025)

-

Regional Outlook (Revenue, USD Billion, 2015 - 2025)