- Home

- »

- Automotive & Transportation

- »

-

Rubber Tired Gantry Crane Market Size, Share Report, 2030GVR Report cover

![Rubber Tired Gantry Crane Market Size, Share & Trends Report]()

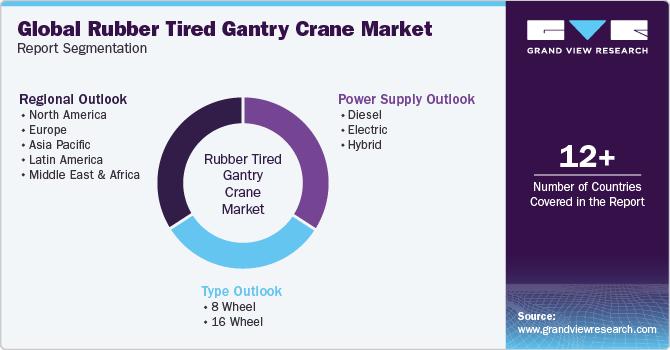

Rubber Tired Gantry Crane Market Size, Share & Trends Analysis Report By Type (8 Wheel, 16 Wheel), By Power Supply (Diesel, Electric, Hybrid), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-920-3

- Number of Report Pages: 138

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Rubber Tired Gantry Crane Market Trends

The global rubber tired gantry crane market size was valued at USD 1.26 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.5% from 2023 to 2030. Multiple advantages, such as low operating costs and technological advancements, are expected to stimulate the usage of rubber tired gantry cranes. Technologies such as automation and wireless communication enable the market to attain operational efficiencies. Emerging economic countries, including Mexico, Colombia, India, and China, are expected to provide adequate opportunities for market growth. The increasing trend of transshipments has led to the development of port infrastructure in these regions due to the rise in container traffic.

Favorable government initiatives for developing ports, such as port capacity expansion and infrastructure development, propel the demand for rubber tired gantry (RTG) cranes. The expansion of the Panama Canal has further led to an increase in global container shipping traffic that enables ports to employ high-capacity container handling equipment. The high cost of installation and maintenance services is expected to restrain the market. Moreover, upgrading existing equipment adds to the organization's expenses.

The growing population in emerging economies has led to an increase in the demand for goods and raw materials. It has subsequently contributed to a significant increase in trade volumes across the developing regions, thereby leading to investments in the development of port infrastructure. Furthermore, the increase in vessel size due to rising trade volumes has led to the implementation of sophisticated container-handling equipment such as rubber tired gantry cranes. These cranes offer effective container management capabilities owing to high operational efficiency.

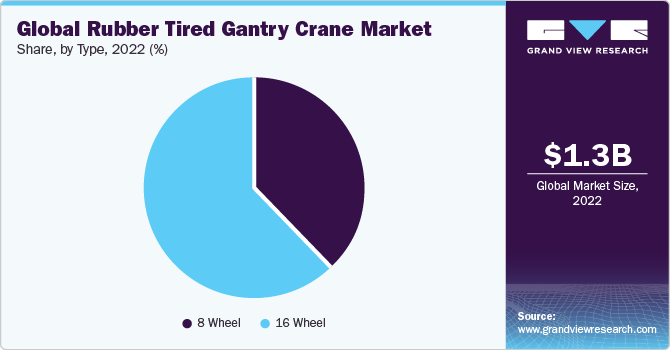

Type Insights

The 16-wheeler RTG segment dominated the rubber tired gantry crane market with a revenue share of 62.1% in 2022. The low maintenance costs incurred due to the low cost of spare parts are a significant factor in the growth of these cranes. Moreover, many wheels lead to convenient maneuverability and increased driver safety.

The 8-wheeler RTC segment is expected to expand significantly from 2023 to 2030. The growth is attributed to its design and features, making it suitable for various applications and industries, including container terminals, intermodal yards, and industrial facilities. The crane's ability to efficiently handle heavy loads and maneuver in tight spaces contributes to its increased demand. Additionally, the flexibility and mobility provided by the rubber tires allow for easy movement and positioning of the crane, making it a versatile choice for different working environments.

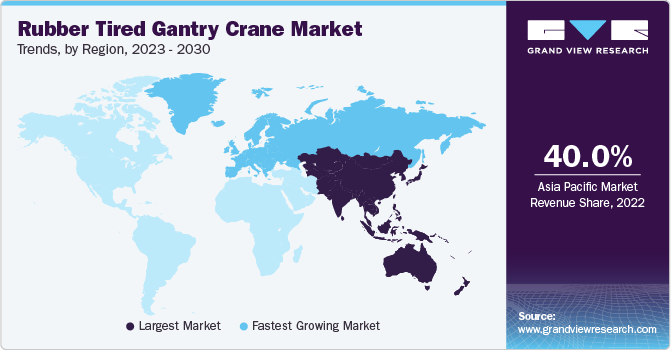

Regional Insights

Asia Pacific is the leading region with a market share of 40.0% in 2022. Regions such as the Asia Pacific have witnessed a surge in inter-regional trade due to increased exports, mainly from China and India. It has enabled the regional government to invest in developing port infrastructure to manage incoming and outgoing container traffic. Furthermore, governments in various regions are inclined toward port expansion.

Europe is expected to witness significant growth in this market from 2023 to 2030. Ports in Europe have adopted electric RTGs to reduce pollution and greenhouse gas emissions. Government regulations, such as verifying carbon emissions in maritime transportation, have enabled electric container handling equipment adoption. Furthermore, financial transparency regarding port investments has enabled port authorities to invest in port infrastructure strategically.

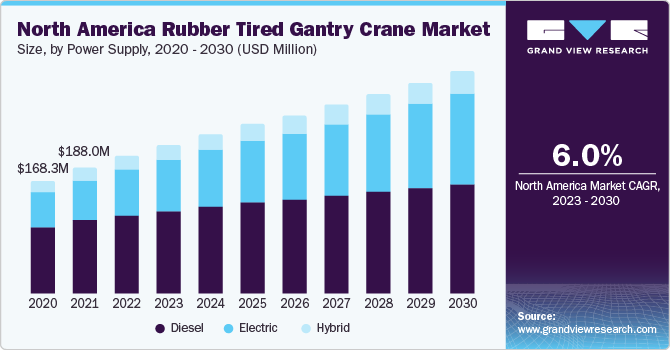

Power Supply Insights

Diesel-powered RTG dominated the global market with a revenue share of 55.6% in 2022. This growth is attributed to the high power and torque, long operating range, established infrastructure & support system, and lower initial investment costs. These factors have made them reliable and preferred for applications requiring heavy lifting and continuous operation. However, with an increasing focus on environmental sustainability, the market is likely to see a shift toward alternative power sources, such as electric or hybrid RTGs, in the future.

Electric RTG is anticipated to be the fastest-growing segment, registering a CAGR of 7.8% over the forecast period. Electric RTGs reduce the need for engine component maintenance. They can save up to 600 liters of engine oil per year. They have lower maintenance costs and reduced downtime. Regions like Europe, where the government has imposed strict air pollution and emission control regulations, have witnessed increased adoption of electric RTGs. They help reduce company expenses by eliminating hydraulic and engine oil usage.

Key Companies & Market Share Insights

The industry players are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. For instance, in July 2022, Kalmar, a part of Cargotec, launched a new generation of rubber tired gantry crane models. These cranes feature a modular design that is stronger, lighter, and simpler, providing customers with a highly efficient and eco-friendly solution for container handling. The new RTG models incorporate intelligent features, including anti-sway technology, improved cabin design, and a redesigned crane management system (CMS) for better performance, usability, and maintenance. This latest offering from Kalmar sets a new benchmark for productivity, safety, and sustainability in container handling operations.

Key Rubber Tired Gantry Crane Companies:

- Anupam Industries Limited

- ELECTROMECH MATERIAL HANDLING SYSTEMS (INDIA) PVT. LTD.

- Cargotec

- Konecranes

- Liebherr-International Deutschland GmbH

- Mi-Jack

- Reva Industries Limited

- SANY Group

- Shanghai Zhenhua Heavy Industries Co., Ltd.

- TNT Crane & Rigging

Recent Developments

-

In June 2023, Mi-Jack introduced its latest innovation in concrete and steel handling applications: the semi-autonomous operation of Travelift RTG cranes. With this new technology, multiple machines can now function without an operator. Combined with an auto-spreader, the process becomes even safer and more efficient as there is no requirement for rigging. This solution enhances productivity and improves overall operational efficiency in concrete and steel handling.

-

In January 2023, in collaboration with systems integrator ABB, Kuenz, an Austrian crane builder, was awarded a significant contract to supply 20 sideloaded stacking automated cranes for Baltic Hub's new T3 terminal, currently being constructed. Baltic Hub is a rapidly growing terminal in the Baltic Sea and holds strategic importance for the renowned international port group PSA. The contract was finalized in September 2022 and served to strengthen and extend the longstanding partnership between Kuenz and PSA.

-

In January 2022, PACECO CORP was awarded a contract by ITS for the purchase of 5 PACECO-MITSUI RTG Transtainer Cranes and five recent 65 Long Ton capacity PACECO-MITSUI Ship to Shore Portainer Cranes. These cranes were planned to be deployed at the terminal in California's Long Beach as part of a comprehensive modernization and capacity expansion project. The objective is to enhance the terminal's capabilities to handle larger vessels, with a capacity of up to 24,000 TEUs and a width of 25 containers.

Rubber Tired Gantry Crane Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.36 billion

Revenue forecast in 2030

USD 1.98 billion

Growth rate

CAGR of 5.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, power supply, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Spain; Italy; China; India; Japan; Australia; South Korea; Brazil; Mexico; UAE; Saudi Arabia; South Africa

Key companies profiled

Anupam Industries Limited; ELECTROMECH MATERIAL HANDLING SYSTEMS (INDIA) PVT. LTD.; Cargotec; Konecranes; Liebherr-International Deutschland GmbH; Mi-Jack; Reva Industries Limited; SANY Group; Shanghai Zhenhua Heavy Industries Co., Ltd.; TNT Crane & Rigging

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rubber Tired Gantry Crane Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global rubber tired gantry crane market report on the basis of type, power supply, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

8 Wheel

-

16 Wheel

-

-

Power Supply Outlook (Revenue, USD Million, 2017 - 2030)

-

Diesel

-

Electric

-

Hybrid

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East And Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global rubber tired gantry crane market size was estimated at USD 1.26 billion in 2022 and is expected to reach USD 1.36 billion in 2023.

b. The global rubber tired gantry crane market is expected to grow at a compound annual growth rate of 5.5% from 2023 to 2030 to reach USD 1.98 billion by 2030.

b. The Asia Pacific dominated the rubber tired gantry crane market with a share of 40% in 2022. This is attributable to a surge in inter-regional trade due to an increase in exports, mainly from China and India. This has enabled the regional government to invest in the development of port infrastructure to manage the incoming and outgoing container traffic.

b. Some key players operating in the rubber tired gantry crane market include Anupam Industries Limited, Konecranes, SANY GROUP, TNT Crane & Rigging, Liebherr, ElectroMech Material Handling Systems (India) Pvt. Ltd., Kalmar, Mi-Jack Products, Shanghai Zhenhua Heavy Industries Co., Ltd., and Reva Industries Ltd.

b. Key factors that are driving the market growth include growing seaborne trade, increasing advancements in the technology, and growing adoption of electrified RTG (e-RTG).

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."