Rugs Market Size & Trends

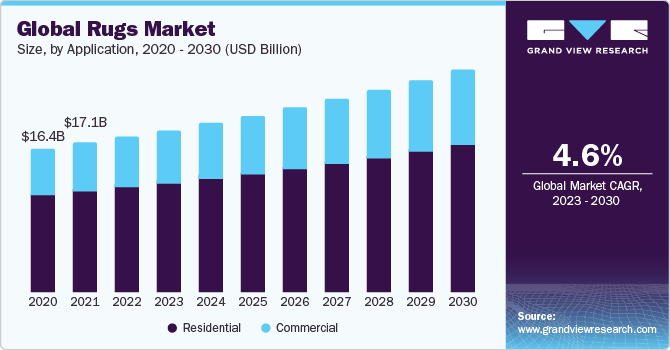

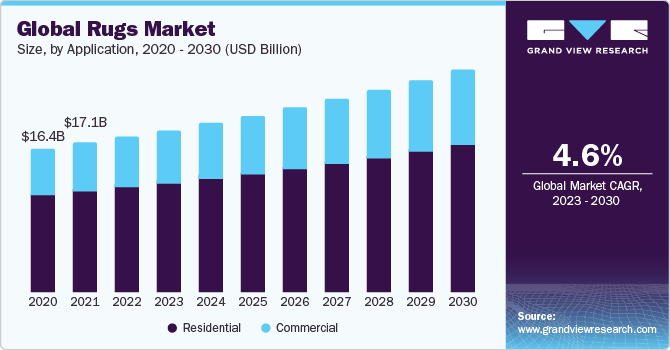

The global rugs market size was valued at USD 17,785.5 million in 2022 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.6% from 2023 to 2030. The surge in consumer interest towards interior decoration, combined with an increase in per capita disposable income, is expected to drive the rugs market in the coming years. The expansion of the transportation and construction sectors also stands as a significant growth driver. Consumers' preference for non-geometrical designer patterns and vibrant, bold colors in rugs is projected to further stimulate the global market for rugs over the forecast period.

In 2020, governments worldwide enforced travel restrictions and lockdown measures to curb the spread of the coronavirus. These measures had significant repercussions on the supply chain of raw materials, affecting the production of rugs. The commercial sector experienced a drop in demand for these products due to the closure of restaurants, hotels, and offices.

The increasing awareness of environmental sustainability has led to a greater demand for rugs made from natural fibers, organic materials, and eco-friendly dyes. Consumers are increasingly seeking products that align with their values. Moreover, manufacturers are prioritizing the introduction of novel products to meet the growing consumer demand for distinctive and environmentally-friendly options. For example, in October 2022, Crate & Barrel, a home décor manufacturer based in the U.S., unveiled an artisan-crafted rug line featuring 90 fresh patterns. These rugs incorporate gentle color palettes, a diverse range of sizes, and utilize premium materials like viscose for enhanced quality.

The market has seen a notable rise in the availability of technologically advanced products, driven by trends favoring convenience, distinctive thematic designs, and tailored options in both residential and commercial domains. Manufacturers are actively engaged in introducing innovative products to meet rising demand, thereby propelling market expansion. For example, in July 2021, Ruggable, a prominent rugs manufacturer, introduced The New Vintage Collection, comprising 14 living room and kitchen rugs that are machine washable.

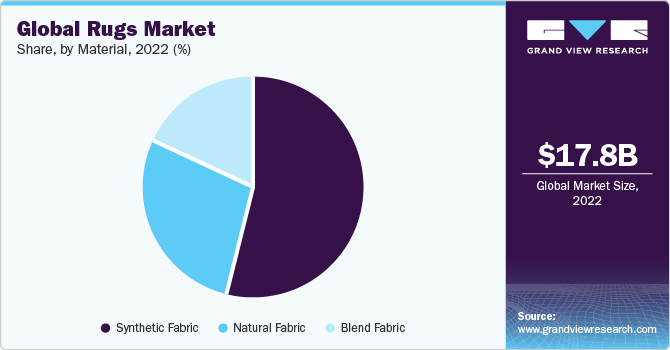

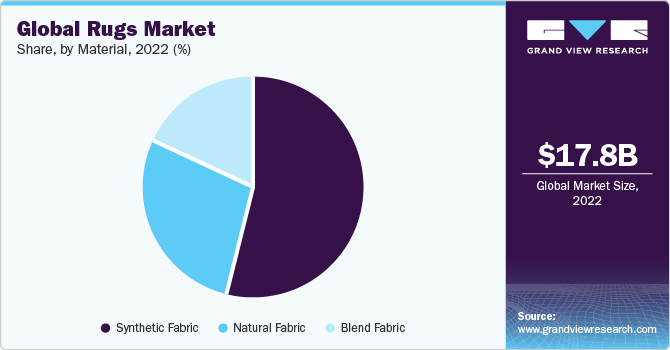

Material Insights

Based on material, the rugs market is segmented into natural fabric, synthetic fabric, and blend fabric. The natural fabric segment is the fastest-growing segment during the forecast period. Natural fibers are derived from plants or animals and have gained popularity in the rug-making industry due to their eco-friendly and sustainable characteristics. Moreover Handmade rugs using natural fabric, especially those crafted using traditional techniques, continue to be highly valued for their craftsmanship and artistry.

Application Insights

On the basis of application, the market is segmented into residential, and commercial. Residential was the largest application in 2022. A rise in housing construction and a growing focus on home improvement endeavors, including the replacement of aging or outdated rugs, are expected to drive demand. Installing new rugs can enhance a home's overall look and increase its market value. In newly constructed residences, rugs are preferred due to their reasonable pricing, straightforward installation, and pleasing appearance.

Distribution Channel Insights

Based on distribution channels, the rugs market is segmented into hypermarkets/supermarkets, specialty stores, online, and others. The hypermarket/ supermarket segment was the largest sales channel in 2022. Hypermarkets and supermarkets often have the advantage of economies of scale, allowing them to offer competitive prices on their rug offerings. This can be appealing to cost-conscious consumers. These retail establishments frequently run promotions, discounts, and sales events, providing opportunities for consumers to purchase rugs at reduced prices or as part of special deals. This is propelling the market growth.

Regional Insights

North America accounted for the largest market share in 2022. The substantial surge in construction and housing ventures, notably in the U.S., stands as a key driver propelling the rugs market's expansion over the forecast period. There is a strong consumer interest in interior decoration, which is significantly driving the market's growth in the U.S. Furthermore, the increasing number of renovation and remodeling projects within the real estate sector in the region has led to a substantial demand for rugs in recent years.

Competitive Insights

Key players operating in the market are Mohawk Industries, Inc., Shaw Industries Group, Inc., Tarkett S.A, The Dixie Group Inc., Milliken & Company, Tai Ping Carpets International Limited, Interface Inc., Oriental Weavers Carpet Co., Victoria Plc, and Lowe's Companies Inc The market participants are constantly working towards new product development, M&A activities, and other strategic alliance to gain new market avenues. The following are some instances of such initiatives:

-

In March 2022 FLOR, a premium brand specializing in area rugs for homes, offices, and diverse environments, unveiled its groundbreaking Spring Collection featuring the inaugural carbon-negative area rugs. Drawing inspiration from the natural world, these rugs seamlessly blend contemporary design with a minimal environmental footprint, culminating in a final product that harmonizes longevity, aesthetic appeal, and a net-negative carbon impact.

-

In September 2022, Jacaranda, the U.K.-based rugs and carpet brand, partnered with Tencel to introduce Seoni, the inaugural assortment of handwoven rugs and carpets crafted entirely from authentic carbon-neutral Tencel lyocell fibers. This innovative collection aims to enhance the sustainability of home decor and furnishings.