- Home

- »

- Clothing, Footwear & Accessories

- »

-

Safety Eyewear Market Size, Share, Industry Report, 2030GVR Report cover

![Safety Eyewear Market Size, Share & Trends Report]()

Safety Eyewear Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Prescription, Non-Prescription), By Application (Oil & Gas, Construction), By Distribution Channel (B2B, D2C), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-864-0

- Number of Report Pages: 169

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Safety Eyewear Market Summary

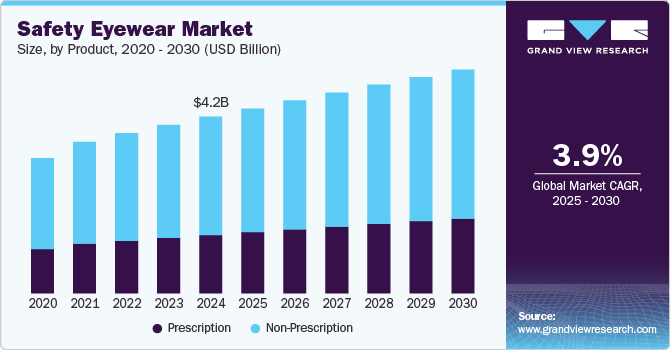

The global safety eyewear market size was estimated at USD 4,189.6 million in 2024 and is projected to reach USD 5,306.0 million by 2030, growing at a CAGR of 3.9% from 2025 to 2030. The market for global safety eyewear is being driven by a combination of stringent workplace safety regulations, increased awareness of eye protection, and technological advancements in eyewear design.

Key Market Trends & Insights

- In terms of region, Europe was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, non-prescription accounted for a revenue of USD 2,932.4 million in 2024.

- Prescription is the most lucrative pricing segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4,189.6 Million

- 2030 Projected Market Size: USD 5,306.0 Million

- CAGR (2025-2030): 3.9%

- Europe: Largest market in 2024

Governments and regulatory bodies across the world are enforcing strict safety standards to reduce occupational hazards, particularly in high-risk industries like construction, manufacturing, and mining. Compliance with these regulations necessitates the use of safety eyewear, propelling demand. Moreover, as awareness of occupational health and safety grows, companies are increasingly investing in personal protective equipment (PPE) to safeguard their employees, which includes high-quality safety eyewear.

Technological advancements also play a significant role in driving the safety eyewear industry. Innovations such as anti-fog and anti-scratch coatings, improved impact resistance, and the integration of smart features like head-up displays enhance the functionality and appeal of safety eyewear. These advancements improve the eyewear's protective qualities and increase user comfort and convenience, leading to higher adoption rates. Moreover, developing stylish and aesthetically pleasing designs is helping overcome resistance to wearing safety eyewear, especially among younger workers.

Eye protection is crucial in industries like healthcare due to potential exposure to infectious diseases, chemicals, and other hazards. The COVID-19 pandemic has underscored the importance of protective eyewear in preventing the spread of infections, leading to increased demand in both medical and general public settings. The growing trend of industrial automation and the use of advanced machinery, which pose significant eye injury risks, further contribute to the industry’s expansion.

In October 2023, Bollé Safety, a leading manufacturer of protective eyewear, launched a new collection of safety goggles called Globe for industrial workers. The Globe collection features a wraparound design that provides a wide field of vision and offers protection against dust, splashes, and impacts. The goggles are designed to be comfortable and compatible with other personal protective equipment (PPE), such as hard hats and face masks. The Globe collection has various lens tints to suit different lighting conditions and work environments.

Product Insights

Non-prescription safety eyewear accounted for 67.07% of global revenues in 2024. It can be worn by anyone, regardless of their vision requirements, making it a versatile option for a wide range of industries and activities. Moreover, it is typically more affordable than prescription safety eyewear, which needs to be customized to the user's specific vision needs. This appeals to both employers and individuals looking to comply with safety regulations without incurring high costs.

The prescription safety eyewear industry is projected to grow at a CAGR of 4.1% from 2025 to 2030. Prescription safety eyewear is designed to provide eye protection while correcting vision with prescription lenses. These are specifically made for individuals who require vision correction, such as those who are nearsighted, farsighted, or have astigmatism. Recognizing the importance of vision clarity and comfort in hazardous work environments has led to a greater focus on providing prescription safety eyewear options. Employers and safety managers understand the need to ensure that workers with vision issues have access to properly fitting protective eyewear that allows them to see clearly and perform their tasks safely.

Application Insights

Industrial manufacturing accounted for a market share of 32.17% of global safety eyewear revenues in 2024. The rapid growth of the industrial manufacturing sector is a key driver for the safety eyewear industry. Industrial manufacturing involves a range of operations, such as processing, assembling, and finishing, which expose workers to various hazards like dust particles, harmful chemicals, and dangerous light radiation. This increases the demand for safety eyewear in the industrial manufacturing industry. The availability of various types of eyewear, such as goggles, visors, and glasses, required for job safety is another factor that positively affects the uptake of safe eyewear in the industrial manufacturing sector. Key manufacturers are focused on delivering customized safety eyewear to boost product adoption among employees.

Construction is projected to grow at a CAGR of 4.5% from 2025 to 2030. The construction industry is a major end user of safety eyewear due to the high risk of potential eye injuries workers face. As construction activities continue to expand, especially in developing regions, the need for protective equipment like safety glasses is expected to rise. One key factor driving the demand for safety eyewear in construction is the exposure to flying dust, debris, and hazardous materials that can cause eye injuries. Heavy machinery and equipment operation also increases the risk of eye accidents, making safety glasses a crucial piece of personal protective equipment for construction workers.

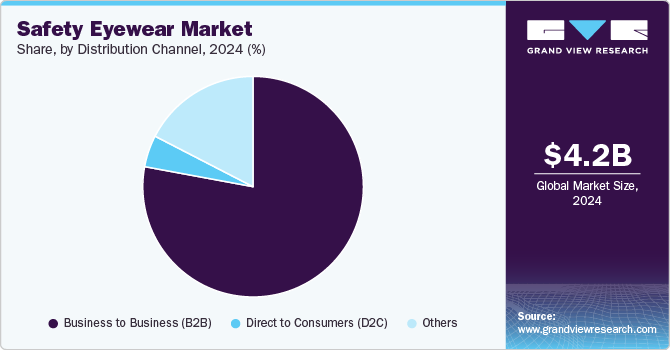

Distribution Channel Insights

Sales of safety eyewear through B2B channels accounted for 77.92% of global revenue shares in 2024. Strict workplace safety regulations and standards imposed by government agencies and industry bodies have mandated the use of safety eyewear across many industries, creating significant demand for these products through the B2B channel as companies procure them to meet regulatory compliance. Safety eyewear manufacturers and distributors often provide customized solutions and value-added services to business customers, including conducting safety assessments, offering prescription eyewear programs, providing training, and delivering maintenance and repair services. The ability to offer these tailored B2B services has made the B2B channel attractive for safety eyewear providers to expand their reach and cultivate long-term relationships with corporate clients.

The sales of safety eyewear through D2C channels are anticipated to grow at a CAGR of 2.9% from 2025 to 2030. The convenience and accessibility of the DTC model allow consumers to purchase safety eyewear directly from manufacturers or online retailers, eliminating the need to visit physical stores. This appeals to busy professionals and workers who value the ability to easily obtain their required safety gear without disrupting their schedules. In addition, DTC platforms often offer a wider range of customization options, enabling consumers to tailor their safety eyewear to their specific needs and preferences. This includes choosing from a variety of frame styles, lens types, and additional features like anti-fog or scratch-resistant coatings. By cutting out intermediaries, DTC brands can often offer safety eyewear at more competitive prices than traditional retail channels, making high-quality protective eyewear more accessible to a broader range of consumers, especially those in price-sensitive industries.

Regional Insights

The safety eyewear market in North America accounted for a share of 28.93% of the global revenue in 2024. There is an increasing awareness of workplace safety and the importance of protecting employees from potential hazards. This increased awareness is driven by stringent occupational safety regulations and standards set by organizations such as the Occupational Safety and Health Administration (OSHA) in the U.S. and the Canadian Centre for Occupational Health and Safety (CCOHS). These regulations mandate using appropriate personal protective equipment (PPE), including safety eyewear, to prevent workplace injuries.

U.S. Safety Eyewear Market Trends

The safety eyewear market in the U.S. is projected to grow at a CAGR of 4.0% from 2025 to 2030. The increasing need for safety eyewear, such as goggles and glasses, in workplaces across the U.S., is primarily driven by regulatory standards that mandate the use of protective gear to minimize workplace hazards, ensure compliance, and safeguard employee well-being. According to the Centers for Disease Control and Prevention (CDC), around 2,000 U.S. workers sustain work-related eye injuries each day that require medical attention. More than 100 of these injuries result in one or more days away from work. Approximately 10% to 20% of work-related eye injuries will result in temporary or permanent vision loss. The most eye injuries occur in the 18-45 age group (35%).

Europe Safety Eyewear Market Trends

The safety eyewear market in Europe is projected to grow at a CAGR of 3.5% from 2025 to 2030. In Europe, the emphasis on safety workwear across various industries stems from stringent regulations to safeguard workers from occupational hazards. Industries such as construction, manufacturing, healthcare, mining, and oil & gas enforce mandatory safety gear and eyewear requirements to mitigate risks effectively. According to the 2021 Labour Force Survey, 4,410 people in the UK suffered from non-fatal eye injuries, with most of the surveyed people reporting eye injuries and vision loss in one or both eyes. Such instances clearly indicate the increased need for safety eyewear in workplaces, a factor that is likely to propel market growth over the forecast period.

Asia Pacific Safety Eyewear Market Trends

The safety eyewear market in Asia Pacific is projected to grow at a CAGR of 4.5% from 2025 to 2030. This market is significantly driven by rapid industrialization in countries like China, India, and Southeast Asia. This industrial growth spans sectors such as manufacturing, construction, and mining, where stringent safety protocols, including the use of protective eyewear, are essential to mitigate workplace hazards such as debris, chemicals, and UV exposure. According to the International Labor Organization, the largest employment sectors in Asia Pacific are agriculture, forestry, and fishing; manufacturing; and wholesale and retail trade. These sectors collectively employed over 1.1 billion workers in 2021, accounting for 60% of the region's nearly 1.9 billion workforce.

Key Safety Eyewear Company Insights

The global market's competitive landscape is characterized by the presence of well-established brands, niche market players, and emerging companies, each vying for market share through innovation, brand loyalty, and strategic collaborations. To grow in the market, market players are focusing on increasing investments in R&D, expanding distribution channels, and implementing targeted marketing campaigns.

Key Safety Eyewear Companies:

The following are the leading companies in the safety eyewear market. These companies collectively hold the largest market share and dictate industry trends.

- Kimberly-Clark Corp.

- MCR Safety

- Honeywell International, Inc.

- UVEX Winter Holding GmbH & Co., KG

- Medop SA

- The 3M Company

- Bollé Safety

- Radians, Inc.

- Pyramex Safety Products LLC

- Gateway Safety, Inc.

- Wolf Peak International, Inc. (Edge Eyewear)

- HexArmor

- Encon Safety Products, Inc.

- SafeVision, LLC

- Ergodyne (Tenacious Holdings, Inc.)

Recent Developments

-

In April 2024, Popticals, a premium eyewear brand, launched the POPZULU Ops Edition, a line of ballistic glasses and safety eyewear. POPZULU is designed for tactical and industrial environments, offering full-scale defense with lenses engineered to shield and a frame that can collapse into a pocket-sized hard-shell case. The POPZULU sunglasses feature an innovative frame design and patented FL2 Micro-Rail System technology for collapsibility. They are crafted using high-quality materials like Hydrophobic Ri-Pel coating, Grilamid TR90 for lightweight and durability, and Impacto lenses from Carl Zeiss Vision that are 5X more resistant to hits and stresses than polycarbonate.

-

In April 2024, Innovative Eyewear, Inc. announced filing two new U.S. patent applications related to its new Lucyd Armor smart safety glasses product, which is planned for introduction in mid-2024. The utility patent application covers the product's functional aspects, while the design patent application covers its ornamental design.

-

In March 2024, Protective Industrial Products (PIP), a leader in personal protective equipment, acquired Scope Optics Pty Ltd., a safety eyewear company based in Australia. By incorporating Scope Optics' safety eyewear into its existing portfolio of eye protection brands, PIP is adding a wider selection of premium designs, advanced lens technologies, and exceptional value to serve its customers better. The acquisition of Scope Optics is another example of PIP's proven acquisition strategy to strengthen its portfolio of head-to-toe PPE solutions.

Safety Eyewear Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.38 billion

Revenue forecast in 2030

USD 5.31 billion

Growth rate

CAGR of 3.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia & New Zealand; Brazil; Mexico; South Africa

Key companies profiled

Kimberly-Clark Corp.; MCR Safety; Honeywell International, Inc.; UVEX Winter Holding GmbH & Co., KG; Medop SA; The 3M Company; Bollé Safety Radians, Inc.; Pyramex Safety Products LLC; Gateway Safety, Inc.; Wolf Peak International, Inc. (Edge Eyewear); HexArmor; Encon Safety Products, Inc.; SafeVision, LLC; Ergodyne (Tenacious Holdings, Inc.)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Safety Eyewear Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global safety eyewear market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription

-

Up to USD 10

-

USD 10 to USD 20

-

USD 20 to USD 40

-

USD 40 to USD 70

-

Above USD 70

-

-

Non-Prescription

-

Up to USD 25

-

USD 25 to USD 50

-

USD 50 to USD 100

-

USD 100 to USD 150

-

Above USD 150

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Construction

-

Industrial Manufacturing

-

Military

-

Public Sectors

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Business to Business (B2B)

-

Direct to Consumers (D2C)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global safety eyewear market size was estimated at USD 4.00 billion in 2023 and is expected to reach USD 4.19 billion in 2024.

b. The global safety eyewear market is expected to grow at a compounded growth rate of 4.0% from 2024 to 2030 to reach USD 5.31 billion by 2030.

b. Non-prescription safety eyewear accounted for a market share of 67.1% of the global revenues in 2023. Non-prescription safety eyewear can be worn by anyone, regardless of their vision requirements, making them a versatile option for a wide range of industries and activities

b. Some key players operating in the safety eyewear market include Kimberly-Clark Corp., MCR Safety, Honeywell International, Inc., UVEX Winter Holding GmbH & Co., KG, Medop SA, The 3M Company, Bollé Safety Radians, Inc., Pyramex Safety Products LLC, Gateway Safety, Inc., Wolf Peak International, Inc. (Edge Eyewear), HexArmor, Encon Safety Products, Inc., SafeVision, LLC, Ergodyne (Tenacious Holdings, Inc.)

b. Key factors that are driving the safety eyewear market growth include combination of stringent workplace safety regulations, increased awareness of eye protection, and technological advancements in eyewear design

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.