Sailing Jackets Market Size & Trends

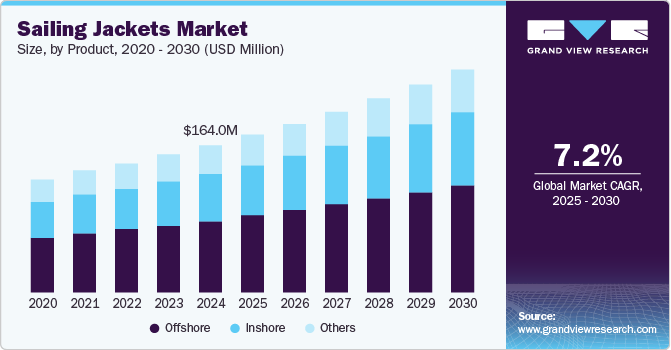

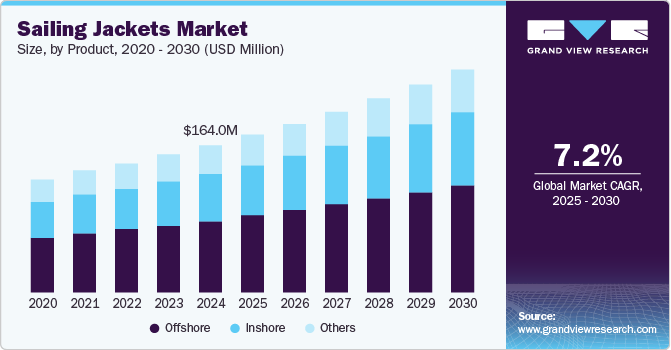

The global sailing jackets market size was valued at USD 164.0 million in 2024 and is projected to grow at a CAGR of 7.2% from 2025 to 2030. This is due to increased participation in water sports and recreational sailing activities. As more individuals seek outdoor adventures and water-based leisure activities, the demand for high-quality sailing jackets has surged. This trend is particularly prominent in regions with a strong maritime culture and a growing interest in sailing as a sport and recreational activity.

In addition, technological advancements in material science have also played a crucial role in propelling the market forward. Innovations in fabric technology have led to the development of sailing jackets that offer superior waterproofing, breathability, and durability. These advancements ensure that sailors remain comfortable and protected in various weather conditions, enhancing their overall sailing experience. Incorporating lightweight, flexible, and high-performance materials has made sailing jackets more appealing to professional sailors and casual enthusiasts.

Furthermore, the rising awareness and emphasis on sustainability have increasingly led manufacturers to incorporate environmentally friendly materials and production processes. For instance, the use of bio-based materials and the elimination of harmful chemicals, including perfluorocarbons (PFCs), in the manufacturing process have gained traction. This shift towards sustainability has additionally helped companies differentiate themselves in a competitive market.

Product Insights

The offshore segment led the market with the dominant share of 48.8% in 2023. The market surge can be credited to the increasing participation in offshore sailing activities, which demand specialized gear to ensure safety and comfort in harsh marine environments. Offshore sailing jackets are designed to withstand extreme weather conditions, protecting sailors against wind, rain, and cold temperatures.

Inshore sailing jackets are expected to boost over the forecast period owing to the growing popularity of inshore sailing activities, which include near-shore or inland sailing such as lake or river sailing. These activities require specialized gear that offers mobility, comfort, and basic protection against light rain and wind. Inshore sailing jackets are designed to meet these specific needs, making them highly sought after by amateur and professional sailors.

End Use Insights

Men dominated the segment in 2023 due to rising disposable income and the increasing popularity of sailing as a recreational activity. Women are projected to grow at the fastest CAGR of 7.8% over the forecast period.

The anticipated growth can be attributed to the increasing participation of women in sailing and other water sports. With more women engaging in these activities, the demand for high-quality, durable, and stylish sailing jackets tailored to their specific needs is expected to surge significantly.

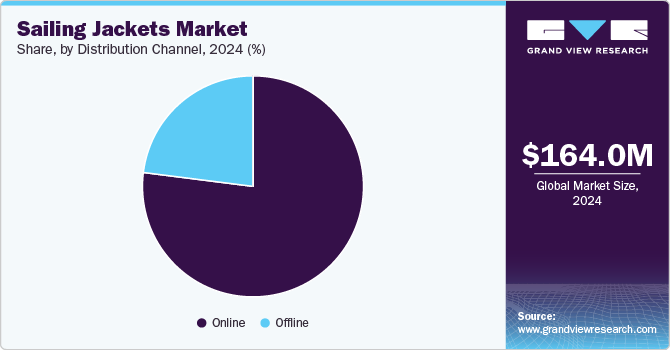

Distribution Channel Insights

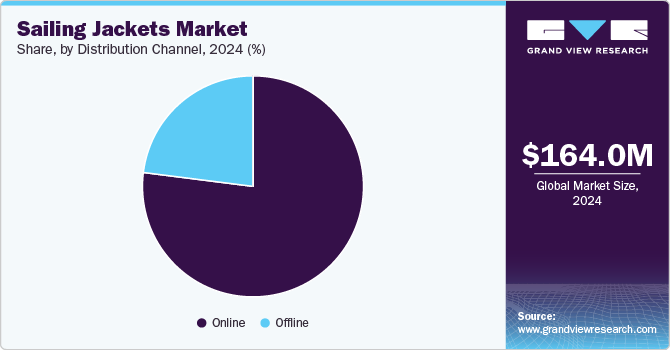

Online distribution channels held the dominant market share in 2023 owing to the increasing penetration of the internet and the rising number of smartphone users worldwide. This has made online shopping more accessible and convenient for consumers, allowing them to browse and purchase sailing jackets from the comfort of their homes. Moreover, the growing influence of social media and digital marketing has driven the market growth. Social media platforms provide a powerful tool for brands to engage with their audience, showcase their products, and build brand loyalty.

The offline segment is expected to grow at a CAGR of 8.9% over the forecast period. In addition to the tangible shopping experiences that brick-and-mortar stores provide, personalized customer service offered in these outlets has significantly boosted market growth. Moreover, retailers often organize product demonstrations, sailing workshops, and promotional sales events to attract customers and boost sales.

Regional Insights

The North American sailing jackets market dominated with a 40.7% share of the global revenue in 2024, owing to the region’s extensive coastline and strong sailing culture. The region has many sailing enthusiasts and professional sailors, boosting the demand for high-quality sailing jackets. The popularity of sailing as a recreational and competitive sport has continued to grow, further driving market expansion.

U.S. Sailing Jackets Market Trends

The sailing jackets market in the U.S. was driven by the increasing popularity of sailing as a recreational activity in 2024. With access to numerous lakes, rivers, and coastal areas, sailing attracted diverse participants, including weekend hobbyists. This growing interest in sailing has spurred demand for high-quality gear, including sailing jackets, as enthusiasts seek to enhance their comfort and performance on the water. In addition, recreational yachting is one of the most popular leisure activities in the U.S. Lenient regulations have fueled the adoption of yachting as a sport.

Europe Sailing Jackets Market Trends

The European sailing jackets market accounted for 38.1% of the market share in 2024, owing to the region’s rich maritime heritage and the popularity of sailing. Countries including the UK, Germany, France, and Italy have a high demand for sailing jackets, driven by numerous sailing events and a strong sailing culture. The vibrant tourism industry in Europe has significantly contributed to the market’s growth, as tourists often engage in sailing activities and require appropriate gear.

Asia Pacific Sailing Jackets Market Trends

The Asia Pacific sailing jackets market held a 12.6% share in 2024. The market surge was majorly driven by rising disposable income and the increasing popularity of outdoor activities. As more individuals have the financial means to invest in high-quality sailing gear, the demand for premium sailing jackets has considerably surged.

Key Sailing Jackets Company Insights

Key global sailing jacket manufacturers include Helly Hansen, Musto Limited, Gill North America Inc., and others. These players have increasingly engaged in acquisitions and mergers to expand their businesses.

-

Helly Hansen is a renowned Norwegian manufacturer and retailer of professional-grade outdoor clothing and sports equipment. Helly Hansen’s product range includes technical sailing and performance ski apparel, premium workwear, and survival and rescue gear.

-

Gill North America Inc. is a leading provider of technical sailing clothing and accessories, catering to both professional sailors and recreational water sports enthusiasts.

Key Sailing Jacket Companies:

The following are the leading companies in the sailing jacket market. These companies collectively hold the largest market share and dictate industry trends.

- Helly Hansen

- Musto Limited

- Gill North America Inc.

- HENRY-LLOYD

- Zhik

- SLAM.COM

- GUYCOTTEN.FR

- Patagonia, Inc.

- North Sails

- Sail Racing

Recent Developments

-

In June 2024, Musto launched Flexilite Cooling range in the Musto dinghy collection. This cutting-edge sailing apparel is designed to keep athletes cool, dry, or warm, depending on the day’s conditions.

-

In April 2024, Zhik launched a pioneering high-performance wetsuit range that is free of neoprene. The product is made from sustainable, plant-based Yulex rubber.

Sailing Jackets Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 175.4 million

|

|

Revenue forecast in 2030

|

USD 248.3 million

|

|

Growth Rate

|

CAGR of 7.2% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Report updated

|

October 2024

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, End Use, Distribution Channel, and Region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, Germany, UK, France, Spain, Italy, China, Japan, India, Australia, South Korea, Brazil, South Africa

|

|

Key companies profiled

|

Helly Hansen; Musto Limited; Gill North America Inc.; HENRY-LLOYD; Zhik; SLAM.COM; GUYCOTTEN.FR; Patagonia, Inc.; North Sails; Sail Racing

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Sailing Jackets Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sailing jackets market report based on product, end use, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)