- Home

- »

- Next Generation Technologies

- »

-

Sales Force Automation Software Market Size Report, 2030GVR Report cover

![Sales Force Automation Software Market Size, Share & Trends Report]()

Sales Force Automation Software Market Size, Share & Trends Analysis Report By Deployment (Cloud, On-premise), By Enterprise Size, By Application, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-496-3

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global sales force automation software market size was valued at USD 9.25 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 8.7% from 2023 to 2030. The rapidly evolving business landscape, utilizing innovative technologies, has become a strategic requirement for firms seeking to continue being competitive and relevant. The expansion of the market can be attributed to a combination of factors such as data-driven decision-making, adoption of remote work patterns, and reduced operational cost that collectively promotes its adoption, resulting in greater operational efficiency, improved customer interactions, and competitive advantage.

Artificial Intelligence (AI) and Machine Learning (ML) have instantly become essential components of current Sales force automation systems. Chatbots and virtual assistants powered by AI improve customer engagement by responding instantly to inquiries, guiding consumers through product catalogs, and guiding them in making purchases. Technology has emerged as a driving factor behind increased productivity, improved client interaction, and streamlined processes in the ever-changing sales industry. Sales force automation (SFA) is at the forefront of this technological revolution, changing the method by which companies approach sales procedures.

Moreover, voice technologies and Natural Language Processing (NLP) are changing the process by which salespeople engage with sales force automation systems. Voice-activated assistants, such as those built into smart gadgets such as audio devices, smart speakers, and smartphones, allow salesmen to access information hands-free by enhancing efficiency. Sales force automation software emerged as a driving force for increased efficiency by automating time-consuming and repetitive operations. Sales force automation software allows sales teams from monotonous administrative tasks with features ranging from automated lead monitoring to order processing. This enhanced productivity enables sales professionals to focus their efforts on high-value tasks such as customer relationship building, strategic planning, and deal closing. As a result, productivity and revenue generation have increased drastically.

Sales teams that employ traditional procedures are hesitant to adopt new technologies. Overcoming this resistance necessitates the use of effective change management approaches. Informative communication about the benefits of Sales force automation software, customized training programs, and incorporating staff in decision-making may all contribute to smooth the transition and adoption of Sales force automation software. Adding on, Sales force automation software collects a large amount of data from multiple customer touch points, and this data is available through various devices in a cloud deployment. Thus, data privacy and security are a concern hindering the growth of the software.

Moreover, governments are implementing rules and regulations such as the GDPR (General Data Protection Regulation) to improve the regulatory framework. This, combined with the launch of advanced automation solutions from the major players, which comprise two-factor authentication and security checks, are expected to overcome data security concerns, driving the market growth during the forecast period. It is projected that the trend toward remote work and mobile sales teams will continue to grow. Future, sales force automationsoftware will certainly prioritize seamless mobility, allowing sales teams to access information, collaborate, and accomplish activities from anywhere. This evolution reflects the changing nature of work and the requirement for flexibility.

Deployment Insights

The cloud segment accounted for the largest market share of 67.4% in 2022 of the sales force automation software market. To improve sales processes, cloud-based SFA solutions have started to integrate AI and ML capabilities. These technologies use customer data analysis to automate repetitive operations, forecast customer behavior, and provide insights. The integration of cloud-based SFA systems with other cloud services such as CRM, marketing automation, and communication tools was intended to provide an effortless interface. The connectivity eased procedures and improved data flow. Cloud-based SFA systems aim to adopt more advanced security procedures such as multi-factor authentication, data segregation, encryption, and regular software updates to ensure the safety of sensitive customer information as long as privacy concerns are prevalent.

The on-premise segment is expected to grow at a CAGR of 7.1% during the forecast period. Stringent regulations related to data security and compliance have been implemented in some industries, including healthcare, finance, and government. On-premise solutions assist enterprises meet legal obligations by giving them more control over their data and ensuring that it stays on their property. On-premise software frequently enables greater customization to match certain corporate demands and processes. Businesses with specialized needs or intricate workflows may select on-premise solutions so they're able to customize the software to their particular requirements.

Enterprise size Insights

The large enterprises segment accounted for the largest market share of 62.6% in 2022of the market and is projected to continue its dominance during the forecast period. Large enterprise sales teams require robust onboarding and training procedures. Sales force automation software facilitates large enterprises by organizing standardized training sessions to ensure every individual on the team learns how to use the platform efficiently. Large enterprises in the Asia-Pacific and North America region, are steadily adopting Sales force automation solutions as they experience economic expansion and digital change. The diverse business environment in the region has produced a diversity of adoption rates. Further, the growing complexity of the business environment coupled with a rising need to make the sales process more customer-centric by getting close to the customer through various marketing channels stimulated the demand for sales force automation software.

The SME segment is expected to grow at a CAGR of 9.5% during the forecast period of the sales force automation software market. Sales force automation software equalizes equal opportunities for SMEs by offering them access to technologies and resources that were previously only available to larger enterprises. This provides SMEs the ability to compete effectively and offer a comparable level of participation and services. Further, sales force automation software minimizes the need for intensive manual interventions, assisting SMEs to optimize the most effective use of their limited workforce and their limited resources. With the advancement of technology, SMEs are considering sales force automation software installation as they become more considerate of how it aids in improving client interactions and optimizing their sales operations.

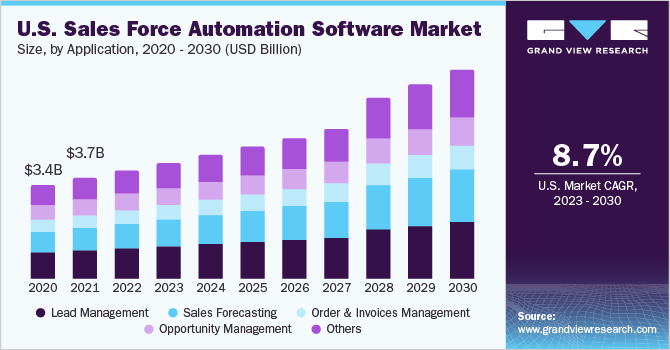

Application Insights

The lead management segment accounted for the largest market share of 28.6% in 2022 of the sales force automation software market. Lead management in sales force automation promotes collaboration between marketing and sales teams by enabling both to access the same lead data and collaborate efficiently in converting leads. sales force automation enables businesses to monitor the origin of each lead, assisting them in determining which marketing efforts or channels are generating the most valuable leads. Implementing lead management inside sales force automation eliminates the danger of leads falling through the cracks or going lost, ensuring that each lead is followed up on effectively. These capabilities are driving the demand for the application, boosting the growth of the sales force automation software market during the forecast period.

The sales forecasting segment is expected to grow at a CAGR of 10.1% during the forecast period of the sales force automation software market. Sales forecasting offers a real-time view of data for past and current sales trends and gives accurate sales forecasts that the user helps the organization to capitalize on the growth opportunity. With developments such as big data analytics, artificial intelligence, machine learning, and predictive analytics, the capabilities of sales forecasting applications are expected to be enhanced. This shall boost the demand for the application. Key players in the market are announcing AI feature-based sales force automation solutions, which is further escalating the demand.

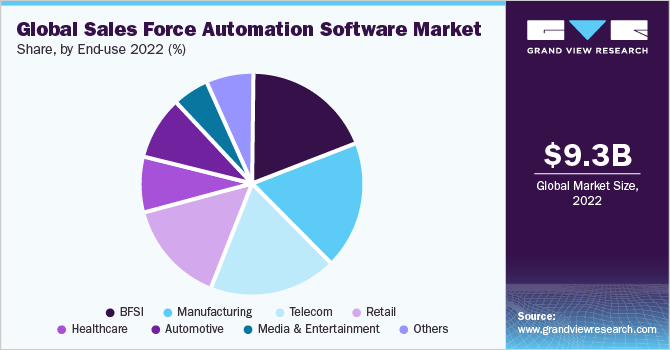

End-use Insights

The BFSI segment accounted for the largest market share of 18.9% in 2022 of the sales force automation software market. BFSI is strongly reliant on trust among consumers and building relationships. sales force automation provides personalized communication, allowing sales teams to comprehend individual financial goals and offer tailored solutions. BFSI firms provide a wide range of products and services. sales force automation enables cross-selling and upselling by providing insights into clients' financial portfolios, allowing sales teams to offer complimentary services. sales force automation facilitates the integration of various interactions for a more seamless customer experience. sales force automation enables advisors in managing client connections, track investments, and offer timely advice as it involves wealth management and financial advising services.

The retail segment is expected to grow at a CAGR of 9.7% during the forecast period of the sales force automation software market.Sales Force Automation software integration within the retail industry has become a strategic requirement for improving customer interaction, optimizing sales processes, and driving growth in a highly competitive environment. sales force automation software allows merchants to collect customer data and preferences, enabling businesses to provide customized recommendations, offers, and marketing messages. With a growing emphasis on data security and privacy, sales force automation systems provide secure means for managing and protecting consumer data. sales force automation delivers realistic sales projections to merchants, assisting with inventory management, personnel decisions, and general business planning.

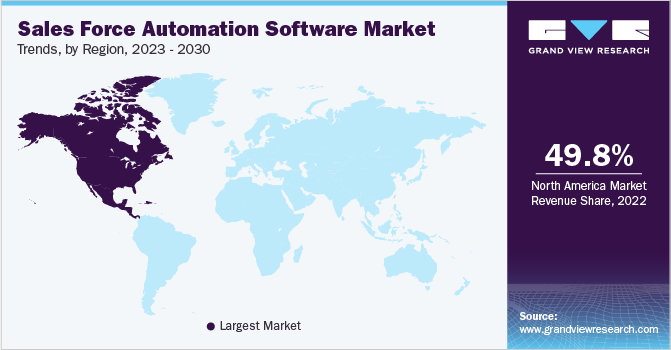

Regional Insights

North America held the largest market share of 49.8% in 2022 of the sales force automation software market. North America has cutting-edge technological infrastructure, such as high-speed internet, broad mobile connectivity, and access to cutting-edge software solutions. This has aided North America in adopting the sales force automation system and integration simpler. The U.S. has been a leader in the adoption of sales force automation solutions in a variety of industries, including technology, healthcare, banking, manufacturing, and retail. With a strong emphasis on innovation and client-centric initiatives, businesses in the U.S. recognize the benefits of sales force automation in optimizing sales processes, improving customer connections, and obtaining a competitive advantage.Businesses have embraced sales force automation as a tool to improve their sales processes, customer engagement, and overall business success due to the region's technology competence, competitive landscape, and customer-centric strategy.

Middle East & Africa is expected to register growth at a CAGR of 9.0% over the forecast period of the sales force automation software market. The region’s software market growth is attributed to the adoption of advanced technology, a competitive market, and a consumer-centric approach, businesses have embraced sales force automation as a tool to improve their sales processes, client retention, and overall business success. Some countries, particularly those in the Gulf Cooperation Council (GCC), have made significant investments in digital infrastructure, making them more open to sales force automation adoption. The dominance of mobile technology in the MEA region has resulted in the development of mobile-friendly sales force automation solutions. Mobile apps and platforms are critical for allowing distant sales teams and reaching customers.

Key Companies & Market Share Insights

The key market players in the market in 2022 include Salesforce.com, Inc., Microsoft Corporation, Oracle Corporation, and others. Intense competition among leading players for introducing advanced and innovative products is encouraging companies to invest in the research and development of products and automation of processes. Companies are adopting strategies to leverage new opportunities in the market and target new customers by developing customized products.

For instance, in March 2023, the HubSpot CRM launched new tools that are powered by artificial intelligence ChatSpot.ai and content assistance which aimed in helping customers to save time while building better networks. HubSpot’s investments in AI include predictive AI, content optimization, data quality tooling, conversation intelligence, data enrichment, and more. With the help of industry-leading artificial intelligence systems from content assistant, OpenAI, and ChatSpot.ai enhanced productivity for sales, marketing, and customer service professionals. Some prominent players in the sales force automation software market include:

-

Aptean, Inc.

-

Bpm'online

-

CRMNEXT

-

Freshsales

-

HubSpot CRM

-

INFOR, INC.

-

Isightly

-

Microsoft Corporation

-

Nimble

-

Oracle Corporation

-

Pipedrive

-

Salesforce.com, Inc.,

-

SAP SE

-

SugarCRM

-

Zoho Corporation

Sales Force Automation Software Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.02 billion

Revenue forecast in 2030

USD 17.94 billion

Growth rate

CAGR of 8.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Content updated

September 2023

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Deployment, enterprise size, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; France; Germany; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Aptean, Inc.; Bpm'online; CRMNEXT; Freshsales; HubSpot CRM; INFOR, INC.; Isightly; Microsoft Corporation; Nimble; Oracle Corporation; Pipedrive; Salesforce.com, Inc.; SAP SE; SugarCRM; Zoho Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sales Force Automation Software Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 - 2030. For the purpose of this study, Grand View Research has segmented the global sales force automation software market report on the basis of deployment, enterprise size, application, end-use, and region.

-

Deployment Outlook (Revenue; USD Billion; 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue; USD Billion; 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

Application Outlook (Revenue; USD Billion; 2018 - 2030)

-

Lead Management

-

Sales Forecasting

-

Order & Invoices Management

-

Opportunity Management

-

Others

-

-

End-use Outlook (Revenue; USD Billion; 2018 - 2030)

-

BFSI

-

Retail

-

Healthcare

-

Telecom

-

Manufacturing

-

Automotive

-

Media & Entertainment

-

Others

-

-

Region Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sales force automation software market size was estimated at USD 9.25 billion in 2022 and is expected to reach USD 10.02 billion in 2023.

b. The global sales force automation software market is expected to witness a compound annual growth rate of 8.7% from 2023 to 2030 to reach USD 17.94 billion by 2030.

b. Some key players operating in the sales force automation software are Aptean, Inc.; Bpm'online; CRMNEXT; Freshsales; HubSpot CRM; INFOR, INC.; Isightly; Microsoft Corporation; Nimble; Oracle Corporation; Pipedrive; Salesforce.com, Inc.; SAP SE; SugarCRM; and Zoho Corporation.

b. Lead management segment accounted for the largest market share of 28.6% in 2022. The growth can be attributed to segments use to repetitively optimize campaigns across all the market channels such as email, SMS, social media, online, in-person mobile, and more on a single unified platform enabling to make quick and smart decisions.

b. Key factors that are driving the market growth are the increasing demand increasing demand for sales forecasting applications in the banking, retail, and IT & telecom sectors. Moreover, the use of artificial intelligence, machine learning and deployment of cloud technology is anticipated to foster the growth of the market over the coming years.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."