- Home

- »

- Next Generation Technologies

- »

-

Natural Language Processing Market, Industry Report, 2030GVR Report cover

![Natural Language Processing Market Size, Share & Trends Report]()

Natural Language Processing Market (2025 - 2030) Size, Share & Trends Analysis Report By Component, By Deployment, By Enterprise Size, By Type, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-020-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Natural Language Processing Market Summary

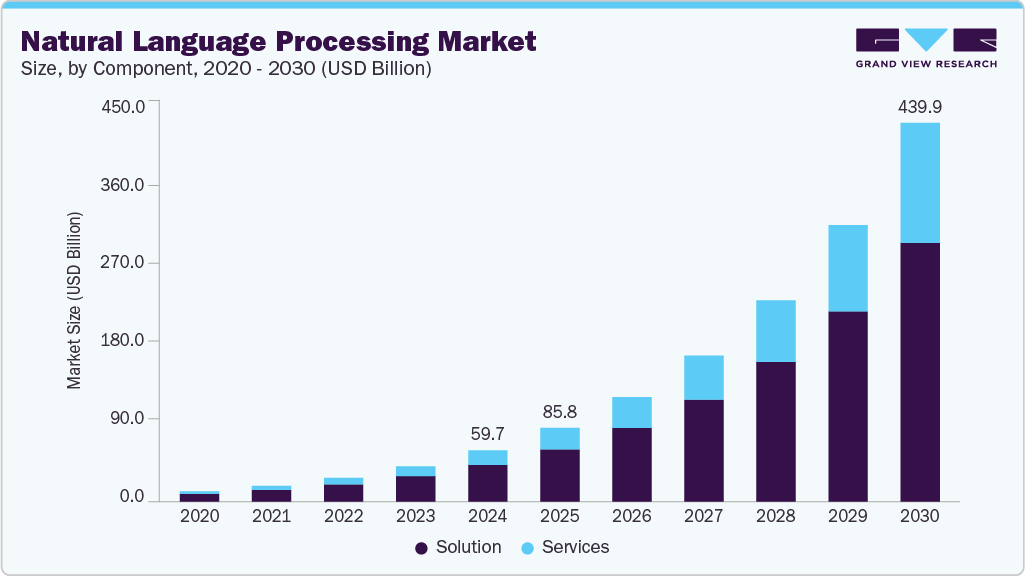

The global natural language processing market size was estimated at USD 59.70 billion in 2024 and is projected to reach USD 439.85 billion by 2030, growing at a CAGR of 38.7% from 2025 to 2030. The development of region-specific models is gaining traction across the natural language processing (NLP) industry.

Key Market Trends & Insights

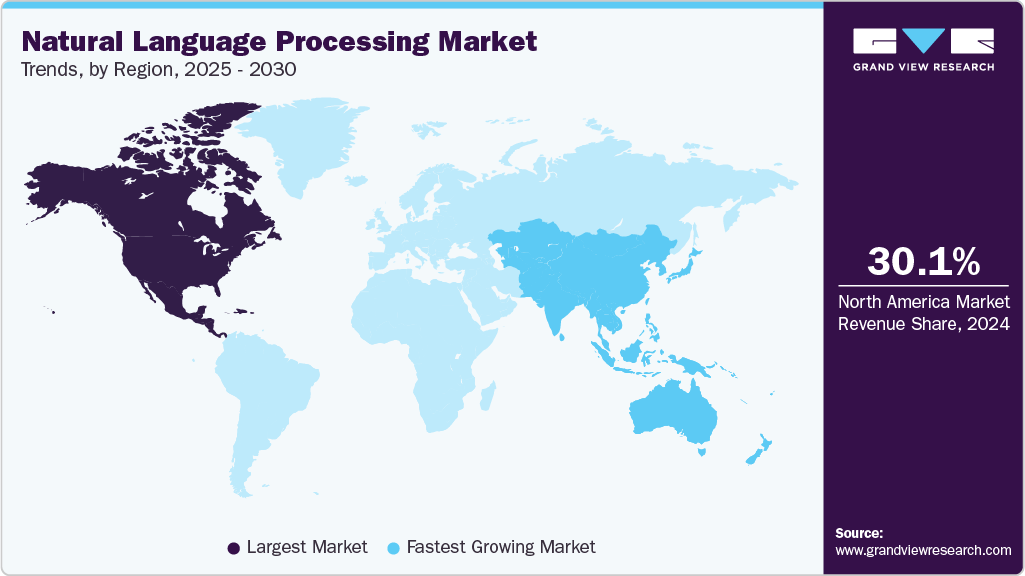

- North America held the largest revenue share of 30.1% in 2024.

- The U.S. natural language processing industry is expanding rapidly. The growth is driven by strong demand across sectors such as healthcare, finance, and retail.

- By component, the solution segment dominated the natural language processing industry with a revenue share of 71.5% in 2024.

- By Deployment, the on-premises segment accounted for the largest share of the natural language industry in 2024.

- By enterprise size, the large enterprises segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 59.70 Billion

- 2030 Projected Market Size: USD 439.85 Billion

- CAGR (2025-2030): 38.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Businesses are investing in language models that support local languages and dialects. These models incorporate cultural context to improve user engagement. This enhances the relevance of NLP solutions in target markets. Companies are seeing improved performance in localized applications. Such models also support compliance with local regulations and data governance standards. For instance, in July 2024, Fujitsu, an information and communications technology company, partnered with Cohere to develop Takane, a Japanese-language large language model (LLM) customized for enterprise use. This model emphasizes secure deployment in private cloud environments and is integrated into Fujitsu’s AI service, Kozuchi. Takane is based on Cohere’s Command R+ model, featuring retrieval-augmented generation (RAG) capabilities to mitigate hallucination.NLP is boosting the adoption of voice-enabled transactions. Companies are increasingly using voice for ordering, booking, and other real-time tasks. This approach enhances convenience and speeds up customer interactions. Businesses can improve service efficiency and satisfaction. Voice technology also opens new revenue channels by enabling seamless customer engagement. Its growing accuracy and accessibility are driving wider market acceptance. For instance, in June 2024, SoundHound AI Inc., a U.S.-based voice recognition company, acquired Allset Technologies Inc., an online ordering platform, to integrate voice AI into food ordering services across various devices. This move aims to create a seamless voice commerce ecosystem.

Increased customer demands for cloud-based technology and advancements in communication infrastructure are accelerating the natural language processing market growth. Natural language processing is the interface between humans and machines, and it comprises executing computer programs and analyzing data. Low cost, high scalability, and high usage of smart devices across industries are expected to contribute to the market expansion over the forecast period. Moreover, the expansion of the e-commerce industry and the perception of online sales channels are projected to drive the demand for NLP for enhancing consumer experience through personal attention and query handling.

Increasing demand for sentiment analytics and content management is augmenting the market expansion. Businesses can utilize sentiment analytics to offer their clients customized deals and discounts based on previous trends. Sentiment analytics is essential for examining consumer behavior and gauging the type of consumers. Moreover, Social media platforms are used by the retail and e-commerce industries because they are a major source of data for sentiment analytics, anticipation of demand and supply, and enhancement in the consumer experience.

Component Insights

The solution segment dominated the natural language processing industry with a revenue share of 71.5% in 2024. This dominance shows a strong demand for comprehensive NLP solutions in the market. Businesses are increasingly preferring integrated platforms that provide multiple functionalities. The solution segment comprises various software tools and services designed to meet diverse business needs. These solutions help organizations streamline operations and improve efficiency. The growth of this segment underscores the importance of end-to-end NLP offerings. It highlights how critical complete NLP solutions have become for industry players.

The service segment is experiencing significant growth over the forecast period. This growth is driven by increasing demand for NLP-related services. Companies are seeking expert support for implementation and maintenance. Services include consulting, integration, and ongoing management. The rise in cloud-based NLP solutions is also fueling this expansion. The service segment’s growth reflects its critical role in supporting NLP adoption. Moreover, growing complexity in NLP technologies is increasing reliance on specialized service providers.

Deployment Insights

The on-premises segment accounted for the largest share of the natural language industry in 2024. The on-premises NLP deployment offers full control, visibility, and authentication security controls over data. In addition, it is easier to scale to match corporate demand and improve efficiency with built-in redundancy. Owing to the increased adoption of cloud-based NLP, which is anticipated to fuel the market expansion, the cloud segment is expected to experience the fastest growth over the forecast period.

The advances in cloud computing have created a transformation by enabling the creation of cloud-based NLP applications. The competency of cloud-based solutions to handle huge data sets and provide an improved consumer experience has stimulated several businesses to opt for cloud-based deployment over on-premises. Since most enterprises do not have the infrastructure and networks capable of handling large datasets, there is a massive demand for cloud-based deployment in the NLP market.

Enterprise Size Insights

The large enterprises segment held the largest revenue share in 2024. It is attributable to the strong demand for predictive approaches to maintain data security. Most businesses have already adopted natural language processing-based tools for processing their data in the cloud, owing to easy availability and scalability. However, owing to the expensive infrastructure setup costs and lack of knowledge regarding the extensive benefits of NLP on various fronts, the adoption of natural language generation technologies has been relatively low in SMEs.

The small and medium enterprises segment is expanding its presence in the natural language processing market steadily. The company is leveraging data-driven solutions to support natural language processing applications. It offers services that include AI integration, data analytics, and language-based automation. This diversification enhances its positioning within the broader NLP ecosystem. Investments in advanced technologies and innovation are fueling its growth in this space. Small and medium enterprises are also forming strategic partnerships to strengthen their NLP capabilities and reach. Technical expertise and a flexible approach are supporting long-term expansion in the NLP industry.

Type Insights

The statistical NLP segment held the largest revenue share in 2024. Statistical NLP held a dominant position in the market. It accounted for a major share due to its proven effectiveness. This approach relies on large datasets to analyze and generate language patterns. Businesses prefer it for its scalability and accuracy. Statistical methods support a wide range of applications, from machine translation to sentiment analysis. Advancements in computing power have further boosted its performance. Its reliability and versatility continue to drive strong adoption across industries.

The hybrid approach combines the best rule-based and machine-learning approaches and combines natural language processing, machine learning, and human input. Accurate analysis is guided by human expertise, but machine learning makes scaling that analysis simple. With a combination of rule-based and statistical NLP technologies in a hybrid way, organizations can utilize the features and advantages of both technologies. While using the hybrid approach in NLP, there are various options available to choose the best course for managing data and accelerating business decisions.

Application Insights

The automatic summarization segment held the largest revenue share in 2024. It captured a significant share due to its wide-ranging applications. Organizations use it to retrieve structured information from unstructured text sources. This function supports business intelligence, automation, and compliance efforts. High demand from sectors such as finance, healthcare, and legal is driving growth. Improved accuracy and processing speed have enhanced its adoption. Data extraction remains a core capability in enterprise NLP solutions.

Sentiment analysis is experiencing strong growth in the natural language processing market. Businesses are using it to understand customer opinions and improve decision-making. It helps analyze feedback from social media, reviews, and surveys. The demand is rising across sectors such as retail, finance, and healthcare. Advancements in machine learning have improved sentiment detection accuracy. Companies are also integrating sentiment analysis into real-time customer service platforms. Its ability to deliver actionable insights is driving widespread adoption.

End Use Insights

The healthcare segment dominated the natural language processing industry with the largest revenue share in 2024. The sector accounted for a major share due to high data volumes and complex documentation needs. NLP is widely used in electronic health records, clinical documentation, and patient data analysis. It improves workflow efficiency, enhances diagnostics, and supports better patient outcomes. Rising demand for automation and data-driven decisions is fueling adoption. Regulatory requirements also encourage the use of NLP for accurate reporting and compliance. Healthcare continues to be a primary growth driver.

The IT & telecommunication segment is projected to witness the fastest CAGR during the forecast period. The field of communications can benefit greatly from natural language processing technologies. An NLP engine can automatically fix grammatical errors in messaging applications and can also be used to analyze and parse various languages. As a result, a comprehensive system that automatically parses texts in any language can be offered. Problems on the consumer side would be automatically debugged just by a message from the customer. The "AMITIES" project in Europe is a well-known example of how NLP is used in the telecom industry. It facilitates an easier billing system for the customers. Moreover, telecom users communicate with the system directly.

Regional Insights

North America held the largest revenue share of 30.1% in 2024. The natural language processing market in North America is expanding as organizations prioritize AI-driven communication tools. Businesses across healthcare, financial services, and retail are integrating NLP to streamline operations and enhance customer engagement. The growing use of cloud platforms and enterprise applications is boosting adoption. Advancements in machine learning and speech recognition are further supporting growth.

U.S. Natural Language Processing Market Trends

The U.S. natural language processing industry is expanding rapidly. The growth is driven by strong demand across sectors such as healthcare, finance, and retail. Enterprises are adopting NLP to enhance customer experience and automate operations. Advanced infrastructure and high digital adoption support market development. Government initiatives and research funding are also accelerating innovation. The U.S. remains a key contributor to global NLP advancements.

Europe Natural Language Processing Market Trends

The natural language processing industry in Europe is showing steady growth. Adoption is increasing across industries such as banking, healthcare, and public services. Multilingual capabilities are a key focus due to the region’s linguistic diversity. Regulatory support for AI and data privacy is shaping responsible NLP deployment. Europe is emerging as a strong hub for NLP innovation and adoption. Cross-border collaborations and EU-backed AI programs are further accelerating regional market development.

Asia Pacific Natural Language Processing Market Trends

The Asia Pacific natural language processing industry is projected to expand at the fastest CAGR over the forecast period. The growth is attributable to the increasing smartphone usage, rapid technological advancements, the digitalization of economies, and government initiatives in the developing countries in the region. Furthermore, this region holds leading positions in advanced industries such as robotics and has a strong IT infrastructure, software, and service offerings. These factors would create profitable growth prospects for the NLP market.

Key Natural Language Processing Company Insights

Some of the key companies in the natural language processing market include 3M; Apple Inc.; Amazon Web Services, Inc.; Baidu Inc.; Crayon Data; and Google LLC. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Apple Inc. focuses on advancing natural language processing (NLP) to improve Siri’s ability to understand and respond naturally in conversations. It emphasizes on-device processing to protect user privacy while enhancing language comprehension. Apple applies NLP in features such as predictive text and translation across its devices. The company works on making conversational AI more context-aware and personalized for users.

-

Amazon Web Services, Inc. offers various NLP services through its cloud platform, such as Amazon Comprehend for text analysis and Amazon Lex for creating conversational interfaces. AWS provides scalable tools that support chatbots, sentiment analysis, and language translation. The company improves these services using deep learning to boost accuracy and efficiency. AWS’s NLP solutions help businesses automate tasks and extract insights from large amounts of text data.

Key Natural Language Processing Companies:

The following are the leading companies in the natural language processing market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Apple Inc.

- Amazon Web Services, Inc.

- Baidu Inc.

- Crayon Data

- Google LLC

- Health Fidelity

- IBM Corporation

- Inbenta

- IQVIA

- Meta Platforms Inc.

- Microsoft

- Oracle

- SAS Institute Inc.

Recent Developments

-

In May 2025, Twilio Inc., a U.S.-based cloud communications company, announced a partnership with Microsoft to accelerate conversational AI solutions using Microsoft Azure AI Foundry and Twilio’s customer engagement platform. This partnership aims to enhance AI-driven customer interactions through advanced multi-channel AI agents and improved contact center capabilities.

-

In May 2025, Apple Inc. partnered with OpenAI to integrate ChatGPT into its devices through Apple Intelligence, enhancing Siri and offering advanced AI features while maintaining strong user privacy. This partnership aims to bring generative AI to billions of Apple users, balancing innovative capabilities with cautious data handling and user consent.

Natural Language Processing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 85.76 billion

Revenue forecast in 2030

USD 439.85 billion

Growth rate

CAGR of 38.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Component, deployment, enterprise size, type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; Brazil

Key companies profiled

3M; Apple Inc.; Amazon Web Services, Inc.; Baidu Inc.; Crayon Data; Google LLC; Health Fidelity; IBM Corporation; Inbenta; IQVIA; Meta Platforms Inc.; Microsoft; Oracle; SAS Institute Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Natural Language Processing Market Report Segmentation

This report offers revenue growth forecasts at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global natural language processing market report based on component, deployment, enterprise size, type, application, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-Premises

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Statistical NLP

-

Rule Based NLP

-

Hybrid NLP

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sentiment Analysis

-

Data Extraction

-

Risk And Threat Detection

-

Automatic Summarization

-

Content Management

-

Language Scoring

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT & Telecommunication

-

Healthcare

-

Education

-

Media & Entertainment

-

Retail & E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global natural language processing market size was estimated at USD 59,703.0 million in 2024 and is expected to reach USD 85,765.3 million in 2025.

b. The global natural language processing market is expected to grow at a compound annual growth rate of 38.7% from 2025 to 2030 to reach USD 4,39,854.5 million by 2030.

b. North America dominated the NLP market with a share of 30.1% in 2024. This is attributable to strong technological infrastructure, widespread AI adoption, and significant investments in research and development.

b. Some key players operating in the natural language processing market include 3M, Apple, AWS, Baidu, Google LLC, IBM Corporation, Meta, Microsoft, Oracle Inc., Inbenta, and IQVIA.

b. Key factors that are driving the market growth include increasing adoption of a cloud-based solution, emerging demand for cloud based solution, and increasing demand for text based analytics

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.