- Home

- »

- IT Services & Applications

- »

-

Sales Performance Management Market Size Report, 2030GVR Report cover

![Sales Performance Management Market Size, Share & Trends Report]()

Sales Performance Management Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment, By Enterprise Size, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-437-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sales Performance Management Market Summary

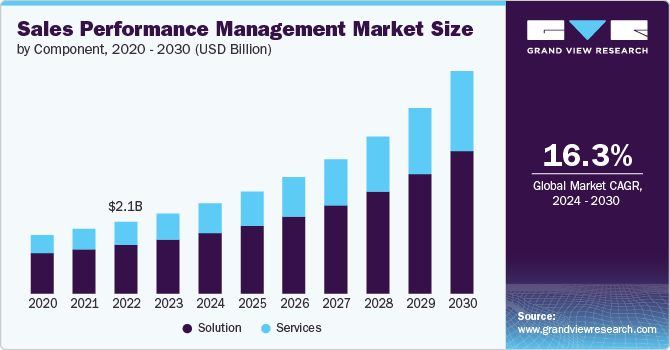

The global sales performance management market size was estimated at USD 2.36 billion in 2023 and is projected to reach USD 6.53 billion by 2030, growing at a CAGR of 16.3% from 2024 to 2030. Several key factors drive the market growth. One of the primary drivers is the increasing adoption of advanced technologies like artificial intelligence (AI) and machine learning (ML), which enable organizations to optimize their sales processes through predictive analytics and data-driven decision-making.

Key Market Trends & Insights

- North America held the major share of over 41% of the market in 2023.

- The sales performance management (SPM) market in the U.S. is expected to grow significantly from 2024 to 2030.

- By component, the solutions segment accounted for the largest market share, over 67%, in 2023.

- By enterprise size, the large enterprises segment accounted for the largest market share of over 62% in 2023.

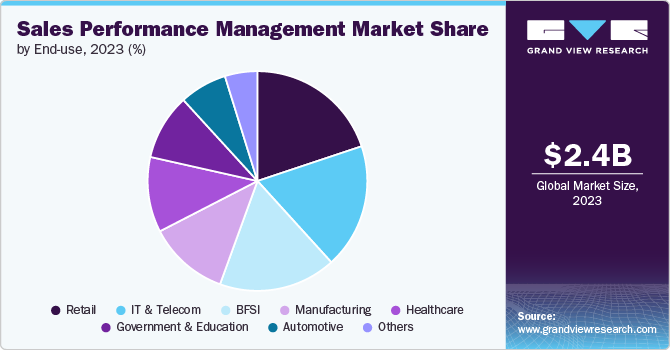

- By technology, the retail segment accounted for the largest market share of over 19% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.36 Billion

- 2030 Projected Market Size: USD 6.53 Billion

- CAGR (2024-2030): 16.3%

- North America: Largest market in 2023

Moreover, the rising need for organizations to enhance sales effectiveness and align sales strategies with business objectives has spurred demand for comprehensive sales performance management (SPM) solutions. The growing complexity of sales operations, coupled with the need for compliance with regulatory requirements, is further fueling the market as companies seek to streamline sales processes, improve transparency, and boost overall performance. Finally, the proliferation of cloud-based solutions has made SPM more accessible and scalable, encouraging adoption across a broader range of industries and company sizes.

The increasing adoption of advanced technologies such as AI and ML drives the market's growth significantly. These technologies enable organizations to harness vast amounts of sales data, providing actionable insights that improve decision-making and strategy formulation. AI and ML facilitate predictive analytics, allowing companies to accurately forecast sales outcomes, optimize sales quotas, and identify performance bottlenecks. By automating complex processes, such as incentive compensation management and territory planning, these technologies enhance efficiency and reduce errors, improving sales productivity. Moreover, AI-driven insights help personalize training and coaching for sales teams, further contributing to improved sales performance and market growth.

The rising need for organizations to enhance sales effectiveness and align sales strategies with overarching business objectives has significantly spurred demand for comprehensive Sales Performance Management (SPM) solutions. In an increasingly competitive business environment, companies are under pressure to maximize the efficiency of their sales operations and ensure that sales activities directly contribute to achieving strategic goals. SPM solutions provide the necessary tools to monitor, analyze, and optimize sales performance, enabling organizations to ensure that sales targets are met and aligned with broader business objectives. By offering capabilities such as real-time performance tracking, incentive management, and strategic alignment, SPM solutions help organizations drive sales effectiveness, foster accountability, and achieve sustainable growth, fueling widespread adoption.

Component Insights

The solutions segment accounted for the largest market share, over 67%, in 2023. For SPM solutions, the primary driver is the increasing need for organizations to optimize and streamline their sales operations. As businesses strive to enhance sales effectiveness, SPM solutions offer comprehensive tools for managing and analyzing sales performance, setting realistic quotas, and aligning sales activities with broader business objectives. Leveraging advanced technologies such as AI & ML within these solutions enables companies to gain valuable insights, forecast trends, and make data-driven decisions, which are crucial for maintaining competitive advantage in today's dynamic market.

The services segment is anticipated to grow at the fastest CAGR over the forecast period. The adoption of SPM services is primarily fueled by the growing demand for specialized expertise and support in implementing and managing SPM systems. As SPM solutions become more sophisticated, organizations often seek external services to ensure effective deployment, integration, and customization of these tools to meet specific business needs. Furthermore, SPM services provide ongoing maintenance, training, and optimization, allowing companies to fully capitalize on the capabilities of their SPM solutions while minimizing the burden on internal resources. This reliance on expert services ensures that organizations can continuously improve their sales performance management practices, driving sustained growth and success.

Deployment Insights

The cloud segment accounted for the largest market share in 2023. For cloud-based SPM, the primary driver is flexibility, scalability, and accessibility. Cloud solutions allow organizations to quickly deploy and scale their SPM systems without significant upfront investment in infrastructure. The inherent flexibility of cloud platforms allows companies to adjust their SPM capabilities as their business needs evolve while enabling remote access, which is increasingly important in today’s global and hybrid work environments. In addition, cloud-based SPM solutions often include regular updates and advanced features, such as artificial intelligence and machine learning integration, without extensive in-house IT support, making them an attractive option for organizations seeking to remain agile and competitive.

The on-premises segment is anticipated to expand at a compound annual growth rate of over 11% during the forecast period. The need for control, security, and customization primarily drives the adoption of on-premises SPM. Organizations with stringent data security requirements or those operating in highly regulated industries often prefer on-premises solutions to maintain direct control over their data and infrastructure. On-premises SPM allows for greater customization to meet specific organizational processes and compliance standards, offering a tailored approach that cloud solutions may not always provide. Moreover, businesses with established IT infrastructure and resources may opt for on-premises solutions to leverage their existing investments and ensure seamless integration with other on-site systems, ensuring a cohesive and secure sales performance management environment.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share of over 62% in 2023. The primary driver of growing adoption among large enterprises is efficiently managing complex and extensive sales operations. These organizations often operate across multiple regions and markets, with large, diverse sales teams requiring coordinated strategies and consistent performance monitoring. SPM solutions provide the tools for large enterprises to manage and analyze vast amounts of sales data, ensure compliance with regulatory standards, and optimize sales incentives and territories. By adopting SPM, large enterprises can achieve greater alignment between sales performance and corporate objectives, leading to enhanced productivity and profitability.

The small & medium enterprises segment is anticipated to expand at the fastest CAGR during the forecast period. The adoption of SPM among SMEs is driven by the need to enhance sales efficiency and competitiveness with limited resources. SMEs often face the challenge of maximizing sales outcomes with smaller teams and tighter budgets. SPM solutions allow these businesses to streamline their sales processes, set clear and achievable sales targets, and gain insights into performance trends without requiring substantial investment in infrastructure. Furthermore, the scalability of modern SPM solutions allows SMEs to adopt tools that grow with their business, providing them with the flexibility to enhance their sales management capabilities as they expand. This enables SMEs to compete more effectively in their respective markets and drive sustainable growth.

End-use Insights

The retail segment accounted for the largest market share of over 19% in 2023. In the retail sector, the primary driver is the need to manage large, dynamic sales forces and optimize performance across various channels. Retailers operate in a highly competitive environment where customer behavior constantly evolves, requiring agile and responsive sales strategies. SPM solutions help retailers track real-time sales performance, manage incentive programs, and align sales targets with business objectives across physical stores, e-commerce platforms, and other sales channels. By adopting SPM, retail businesses can enhance customer engagement, improve sales outcomes, and maintain a competitive edge in a fast-paced market.

The IT & telecom segment is anticipated to grow at the highest CAGR during the forecast period. In the IT & telecom sector, the adoption of SPM is driven by the complexity of managing extensive sales networks, technical products, and long sales cycles. Companies in this sector often deal with intricate product offerings and high-value contracts, necessitating precise sales forecasting, quota management, and incentive compensation. SPM solutions enable IT & telecom firms to streamline these processes, ensuring that sales teams are motivated and aligned with corporate goals. Furthermore, analyzing performance data and predicting sales trends is critical in this industry, where technological advancements and market demands shift rapidly. As a result, SPM adoption in the IT & telecom sector is essential for driving growth, optimizing resource allocation, and staying competitive in a technologically driven landscape.

Regional Insights

North America held the major share of over 41% of the market in 2023. The market is marked by a strong trend towards integrating AI and machine learning. Companies increasingly leverage these technologies to enhance predictive analytics, automate incentive management, and drive data-driven decision-making to improve overall sales efficiency and effectiveness.

U.S. Sales Performance Management Market Trends

The sales performance management (SPM) market in the U.S. is expected to grow significantly from 2024 to 2030. A key trend within the SPM market in the U.S. is the growing adoption of cloud-based solutions. Businesses across various industries prioritize flexibility and scalability, opting for cloud platforms that enable remote access, real-time data analysis, and seamless integration with other enterprise systems, which are critical in a highly competitive and evolving market.

Europe Sales Performance Management Market Trends

The sales performance management (SPM) market in Europe is growing significantly at a CAGR of 16% from 2024 to 2030. In Europe, the SPM market is trending towards a heightened focus on regulatory compliance and data privacy. Organizations increasingly adopt SPM solutions that enhance sales performance, ensure adherence to stringent data protection laws, such as GDPR, and provide robust features for maintaining transparency and accountability in sales operations.

Asia Pacific Sales Performance Management Market Trends

The sales performance management (SPM) market in Asia Pacific is growing significantly at a CAGR of over 17% from 2024 to 2030. The market is experiencing rapid growth driven by the region's digital transformation and the rising adoption of mobile-enabled solutions. Companies in this region increasingly turn to cloud-based and mobile-friendly SPM tools to manage their diverse and expanding sales forces, capitalize on the growing market opportunities, and stay competitive in a dynamic and fast-growing economic environment.

Key Sales Performance Management Company Insights

Key players operating in the network emulator market include Anaplan, Inc., Conga, IBM, Iconixx, NICE, Oracle, Salesforce, Inc., SAP SE, Varicent, and Xactly. The companies focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Sales Performance Management Companies:

The following are the leading companies in the sales performance management market. These companies collectively hold the largest market share and dictate industry trends.

- Anaplan, Inc.

- Conga

- IBM

- Iconixx

- NICE

- Oracle

- Salesforce, Inc.

- SAP SE

- Varicent

- Xactly

Recent Developments

-

In November 2023, Xactly, a leading provider of intelligent revenue solutions, announced four innovations in its Fall 2023 release. These innovations enhance agility in Sales Performance Management (SPM) and Revenue Intelligence. Building on the recent introduction of Xactly Extend, the next-gen calculation engine, and advanced pipeline analytics, these new offerings further demonstrate Xactly's commitment to delivering cutting-edge solutions for its customers.

-

In December 2021, Varicent, a provider of Sales Performance Management (SPM) software, announced the latest enhancements to its industry-leading Incentive Compensation Management (ICM) solution. These improvements, informed by industry trends and customer feedback, further refined the award-winning SPM solution, enhancing its ability to streamline sales compensation and planning. With the introduction of the new Data Module function, administrators using Varicent ICM now benefit from a centralized management studio, enabling streamlined access to all compensation and sales data in one location. This consolidation reduces unnecessary procedures and minimizes errors.

Sales Performance Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.64 billion

Revenue forecast in 2030

USD 6.53 billion

Growth rate

CAGR of 16.3% from 2024 to 2030

Actual data

2018 - 2022

Base Year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Anaplan, Inc.; Conga; IBM; Iconixx; NICE; Oracle; Salesforce, Inc.; SAP SE; Varicent; Xactly

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sales Performance Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the sales performance management (SPM) market report based on component, deployment, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Incentive Compensation Management

-

Territory Management

-

Sales Monitoring and Planning

-

Sales Analytics

-

Others

-

-

Services

-

Integration & Deployment

-

Support & Maintenance

-

Training & Consulting

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Automotive

-

IT & Telecom

-

Healthcare

-

Retail

-

Manufacturing

-

Government & Education

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global sales performance management market size was estimated at USD 2.36 billion in 2023 and is expected to reach USD 2.64 billion in 2024

b. The global sales performance management market is expected to grow at a compound annual growth rate of 16.3% from 2024 to 2030 to reach USD 6.53 billion by 2030

b. North America dominated the sales performance management market with a market share of 41.94% in 2023. In North America, the sales performance management (SPM) market is marked by a strong trend towards integrating AI and machine learning. Companies are increasingly leveraging these technologies to enhance predictive analytics, automate incentive management, and drive data-driven decision-making to improve overall sales efficiency and effectiveness.

b. Some key players operating in the sales performance management market include Anaplan, Inc., Conga, IBM, Iconixx, NICE, Oracle, Salesforce, Inc., SAP SE, Varicent, and Xactly.

b. Several key factors drive the growth of the sales performance management (SPM) market. One of the primary drivers is the increasing adoption of advanced technologies like artificial intelligence (AI) and machine learning (ML), which enable organizations to optimize their sales processes through predictive analytics and data-driven decision-making. Additionally, the rising need for organizations to enhance sales effectiveness and align sales strategies with business objectives has spurred demand for comprehensive SPM solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.