- Home

- »

- Food Additives & Nutricosmetics

- »

-

Salicylic Acid Market Size & Share, Industry Report, 2030GVR Report cover

![Salicylic Acid Market Size, Share & Trends Report]()

Salicylic Acid Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Pharmaceutical, Food & Preservatives, Cosmetics), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: 978-1-68038-111-5

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Salicylic Acid Market Summary

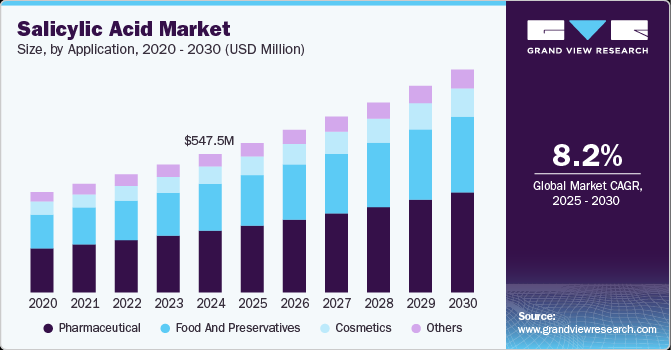

The global salicylic acid market size was valued at USD 547.5 million in 2024 and is projected to reach USD 880.4 million by 2030, growing at a CAGR of 8.2% from 2025 to 2030. The market growth can be attributed to the increasing applications of salicylic acid in industries such as pharmaceuticals, skincare, and food preservatives.

Key Market Trends & Insights

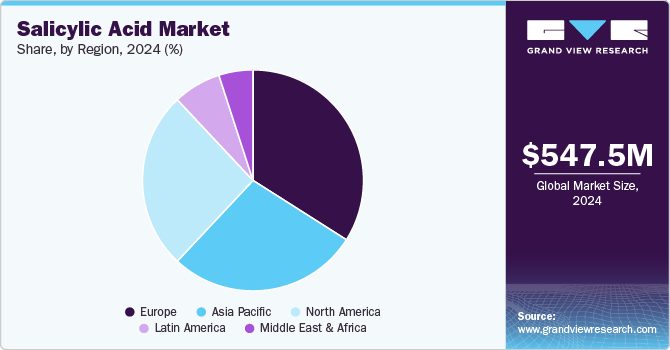

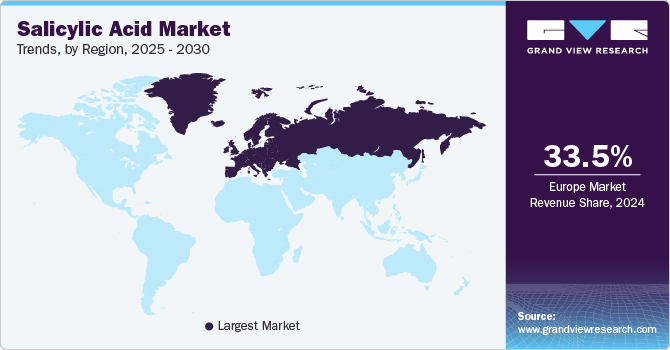

- Europe salicylic acid market dominated the market and accounted for the revenue share of 33.5% in 2024.

- The U.S. salicylic acid market dominated North America with the largest revenue share in 2024.

- Based on application, the pharmaceutical segment accounted for the largest market share of 45.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 547.5 Million

- 2030 Projected Market Size: USD 880.4 Million

- CAGR (2025-2030): 8.2%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Salicylic acid has anti-inflammatory, antimicrobial, and exfoliating properties, which drives its uses in acne treatments, anti-dandruff shampoos, and other skincare products. The growing prevalence of dermatological conditions, such as acne, psoriasis, calluses, corns, keratosis pilaris, and warts in adolescents and young adults is a significant demand driver for this market. According to the information published by the American Academy of Dermatology Association, acne remains one of the most widespread skin conditions, impacting around 50 million individuals in the U.S. The significant benefits of salicylic acid in treating acne are expected to drive further demand in the market.

In addition, salicylic acid is used in the pharmaceutical industry to manufacture various drugs, such as aspirin (acetylsalicylic acid). This further boosts its demand in the industry, especially in regions with high geriatric populations, where the need for pain relief and anti-inflammatory drugs is high. According to the information published by the World Health Organization in October 2024, approximately one in every six people is estimated to be 60 and above by 2030. This rising proportion of the geriatric population is further expected to drive demand for salicylic acid in the pharmaceutical industry and drive market growth.

In the food and preservatives sector, salicylic acid can help inhibit bacterial growth, improve shelf stability, and maintain food safety, especially in processed products. Its preservative properties can extend freshness and ensure the quality of packaged foods. The increasing demand for processed and convenient food due to changing lifestyles further drives the demand for salicylic acid.

Application Insights

The pharmaceutical segment accounted for the largest market share of 45.0% in 2024 attributed to the increasing applications of salicylic acid in the development of various pain management medicines. The companies are also developing different salicylic acid formulations for pharmaceutical use. For instance, in June 2024, Flychem announced the launch of its high purity encapsulated salicylic acid, KOSAVA that can be used for pharmaceutical formulations.

The cosmetics segment is expected to grow at the fastest CAGR over the forecast period from 2024 to 2030. Salicylic acid is considered effective in managing acne and other common dermatological issues, which has led to its increased use in facial cleansers, serums, toners, sprays, and other products, especially in anti-acne and anti-aging product lines, driving the segment growth. For instance, in February 2024, the PanOxyl brand of Crown Laboratories, Inc. announced the launch of its Acne Banishing Body Spray with 2% Salicylic Acid, which can help unclog pores and clear blemishes. Such increasing applications of salicylic acid in the cosmetics industry are expected to boost the segment growth over the forecast period.

Regional Insights

The North America salicylic acid market accounted for a significant market revenue share in 2024. The growing emphasis on skincare and awareness regarding active ingredient products such as salicylic acid are major factors driving the market growth in the region. In addition, the growing proportion of the geriatric population and the increasing prevalence of chronic diseases further drive the demand for salicylic acid in the pharmaceutical industry.

U.S. Salicylic Acid Market Trends

The U.S. salicylic acid market dominated North America with the largest revenue share in 2024. Evolving consumer preferences and growing demand for effective personal care products and pharmaceutical solutions are driving the development & launch of advanced products in the market. For instance, Vichy, a Europe-based company, expanded in the U.S. in November 2024 with the launch of its shampoo that combines salicylic acid and selenium sulfide.

Europe Salicylic Acid Market Trends

Europe salicylic acid market dominated the market and accounted for the revenue share of 33.5% in 2024. The increasing demand for advanced skin care products, the presence of key cosmetics companies such as The Ordinary (DECIEM Beauty Group Inc.), L’Oréal S.A., and their development activities in the region are boosting the demand for salicylic acid in the market. The rising R&D investments in the region are further expected to drive market growth. For instance, according to Cosmetics Europe, approximately 77 scientific innovation facilities conducted research on cosmetics and personal care.

The salicylic acid market in Germany accounted for a significant share in 2024, owing to the growth of the country's pharmaceutical and personal care industry. According to Cosmetics Europe, Germany was Europe's largest cosmetics and personal care market. In addition, the growing health consciousness in the country and a preference for scientifically backed ingredients are further expected to drive market growth over the forecast period.

The UK market is expected to grow significantly over the forecast period from 2025 to 2030, owing to the presence of key cosmetics companies and the launch of new and advanced products in the market. For instance, the Ordinary launched its body care range with its most coveted ingredients, including salicylic acid, in September 2024. The development of such products is further expected to drive market growth in the country.

Asia Pacific Salicylic Acid Market Trends

Asia Pacific salicylic acid market is expected to register the fastest CAGR over the forecast period attributed to the increasing urbanization, rising disposable incomes, and a growing awareness of skincare and beauty in the region. In addition, a large population base and economic growth in countries such as China, India, and Japan are expected to drive the demand for salicylic acid-based skincare and pharmaceutical products. The increasing prevalence of acne and increasing consciousness, especially among teenagers and young adults, is a major driver for the growing demand for skincare, which is further likely to drive market growth.

The salicylic acid market in China dominated the Asia Pacific salicylic acid market in 2024. Rising urbanization and disposable income in the country are major factors driving market growth. For instance, according to information published by the U.S. Department of Agriculture, the urbanization rate in China was 66.1%, and resident per capita disposable income increased by 6.3% in 2023.

The India salicylic acid market is expected to grow significantly over the forecast period owing to the growth of sectors such as pharmaceuticals and food processing with wide salicylic acid applications. For instance, according to information published by the India Brand Equity Foundation, the food processing industry contributes about 32% to the food market and is one of the largest industries in the country.

Key Salicylic Acid Company Insights

Some key companies operating in the global salicylic acid market include Thermo Fisher Scientific Inc., Alta Laboratories Ltd, and Siddharth Carbochem Products Ltd. These players are focusing on various strategies, such as developing and launching advanced products, mergers and acquisitions, and research to gain a competitive edge in the market.

-

Thermo Fisher Scientific Inc. is a global company serving a wide range of industries, including pharmaceuticals, biotechnology, and chemicals. The company provides laboratory equipment, reagents, and consumables and also produces and distributes high-quality salicylic acid, which is used in various applications such as skin care, pharmaceuticals, and chemical synthesis.

-

Siddharth Carbochem Products Ltd. is an India-based company that produces and distributes a wide range of chemicals, including salicylic acid and its derivatives. The company specializes in providing high-quality chemical products for pharmaceuticals, food, and cosmetics industries.

Key Salicylic Acid Companies:

The following are the leading companies in the salicylic acid market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc

- Alta Laboratories Ltd

- Siddharth Carbochem Products Ltd.

- Zhenjiang Gaopeng Pharmaceutical CO,.Ltd.

- Novocap SA

- Hebei Jingye Medical Technology Co.

Recent Developments

-

In July 2024, Re’equil announced the launch of its Skin Clarifying Serum with Encapsulated Salicylic Acid and Granactive ACNE.

-

In December 2023, Dove introduced its range of serum body washes, which included Acne Clear, which contained a 1% clearing salicylic acid acne treatment that can help clear and prevent acne.

Salicylic Acid Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 592.3 million

Revenue forecast in 2030

USD 880.4 million

Growth rate

CAGR of 8.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, Japan, India, Australia, Brazil, South Africa, Saudi Arabia

Key companies profiled

Thermo Fisher Scientific Inc, Alta Laboratories Ltd, Siddharth Carbochem Products Ltd., Zhenjiang Gaopeng Pharmaceutical CO,.Ltd., Novocap SA, Hebei Jingye Medical Technology Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Salicylic Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global salicylic acid market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Food & preservatives

-

Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.