Sand Market Size & Trends

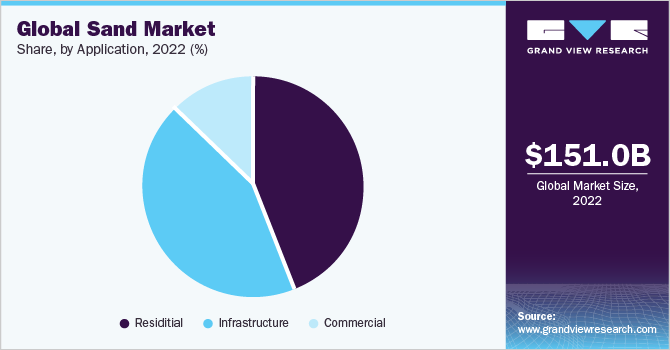

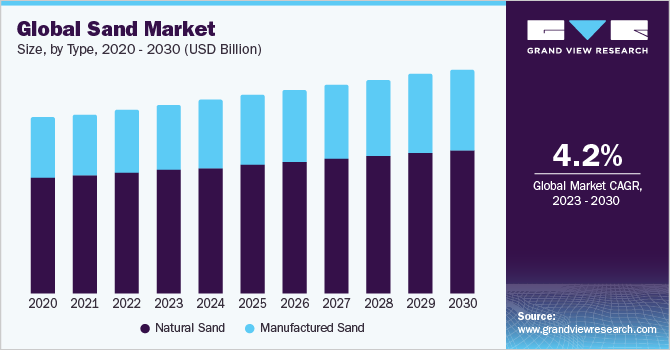

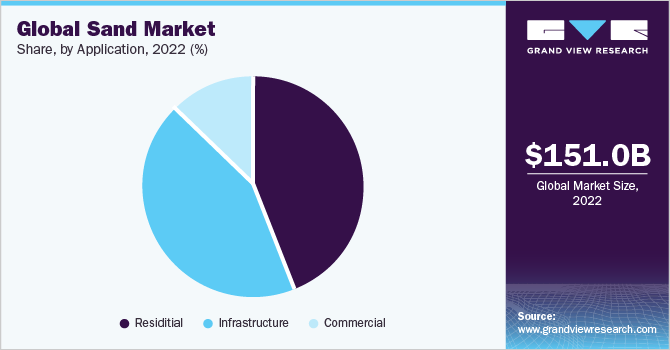

The global sand market size was valued at USD 151.00 billion in 2022 and is expected to grow at a CAGR of 4.2% over the forecast period. Sand is a vital component in the construction industry, utilized in the production of concrete and mortar. The growth of the market is being driven by the ongoing global expansion of urbanization and infrastructure development.

The COVID-19 pandemic has had a negative impact on the growth of the sand market. One of the major effects of the pandemic on the sand market has been the slowdown in the construction industry. Worldwide lockdowns, social distancing measures, and economic uncertainty have led to delays and suspensions of construction projects, which has reduced the demand for construction sand. For example, a survey conducted by the Associated General Contractors of America (AGC) found that in the U.S., 68% of contractors had witnessed a project being canceled due to the pandemic.

The infrastructure industry is witnessing rising investments worldwide, which is expected to drive market growth during the forecast period. For instance, in November 2021, the U.S. government passed a Bipartisan plan worth USD 1 trillion to upgrade the country's infrastructure, including airports, railways, and roadways. This infrastructure upgrade is expected to be completed by 2025.

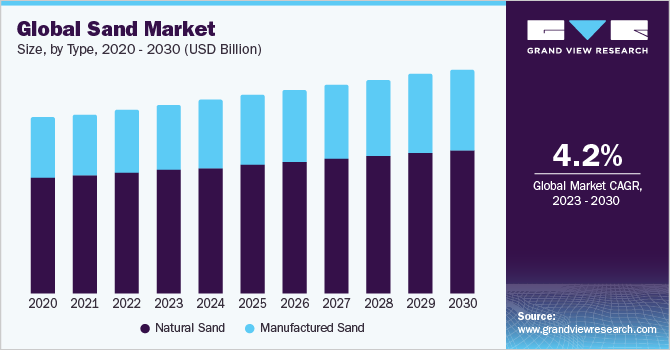

Type Insights

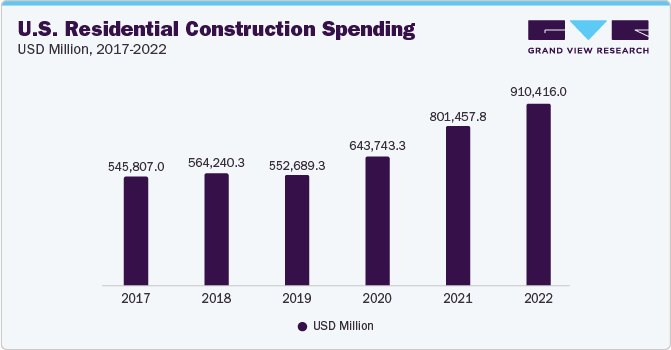

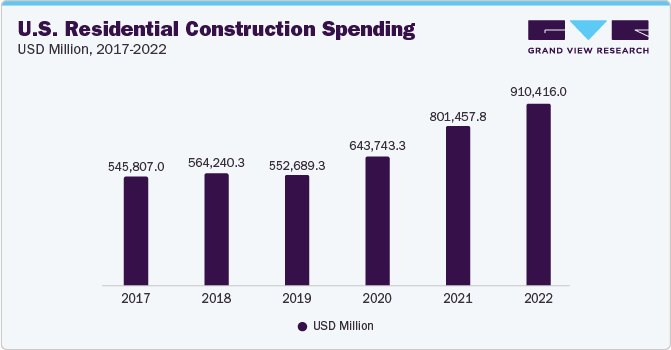

Based on the type, it is segmented into natural sand and manufactured sand. The natural sand segment held the largest market share in 2022. The shape of natural sand makes it an excellent choice for use as fine aggregate in concrete. In the construction industry, natural sand particles are widely preferred due to their well-rounded shape, which is almost spherical. This shape reduces the percentage of voids within the concrete mixture, eliminating the need for additional paste to fill these voids. Moreover, the well-shaped natural sands are ideal for enhancing the workability of the mixture. Rising residential construction spending across the world is driving the demand for sand. Table Below showcases the construction spending of the U.S. from 2017 - 2022.

Application Insights

Based on the application segment, it is residential, commercial, and infrastructure. The ambulatory commercial segment is expected to grow at the fastest CAGR over the forecast period. The growth of the hospitality industry, including hotels, resorts, and restaurants, is contributing to the growth of this segment. For instance, in September 2023, Marjan, a prominent developer in Ras Al Khaimah, UAE, announced that a new W Hotel will be launched on Al Marjan Island in the UAE by 2027.

Regional Insights

The market was dominated by the Asia Pacific region in 2022. Increased investments in the infrastructure, residential and commercial sectors of developing economies such as China and India are expected to contribute to market growth. For example, the Indian government has allocated INR 10.00 trillion (USD 0.12 trillion) for FY24 towards infrastructure spending, representing a 33% increase from the previous year, which is likely to have a positive impact on the market.

Competitive Insights

Key players operating in the market are Chaney Enterprises, G3 Enterprises, Inc, Allied Materials, Bernardi Building Supply, SRINATH ENTERPRISE, MANGAL MINERALS, Vulcan Materials Company, and Hutcheson Sand & Mixes. The market players are constantly engaged in developing new products, carrying out M&A activities, and forming strategic alliances to explore new market opportunities. The following are some instances of strategic initiatives:

-

In January 2023, Coal India announced that it is going to commission 5 M-Sand Plants in India by 2024. Four plants are expected to have a combined production capacity of 5,500 cum/day.

-

In February 2023, Xinyi Solar Energy Holding Co., Ltd announced that it is going to invest USD 3 billion in a silica sand mining plant in Bangka-Belitung Islands, Indonesia.