- Home

- »

- Next Generation Technologies

- »

-

Satellite IoT Market Size And Share, Industry Report, 2033GVR Report cover

![Satellite IoT Market Size, Share & Trends Report]()

Satellite IoT Market (2025 - 2033) Size, Share & Trends Analysis Report By Service (Direct to Satellite, IoT Satellite Backhaul), By End Use (Transport and Logistics, Energy & Utilities), By Organization Size, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-382-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Satellite IoT Market Summary

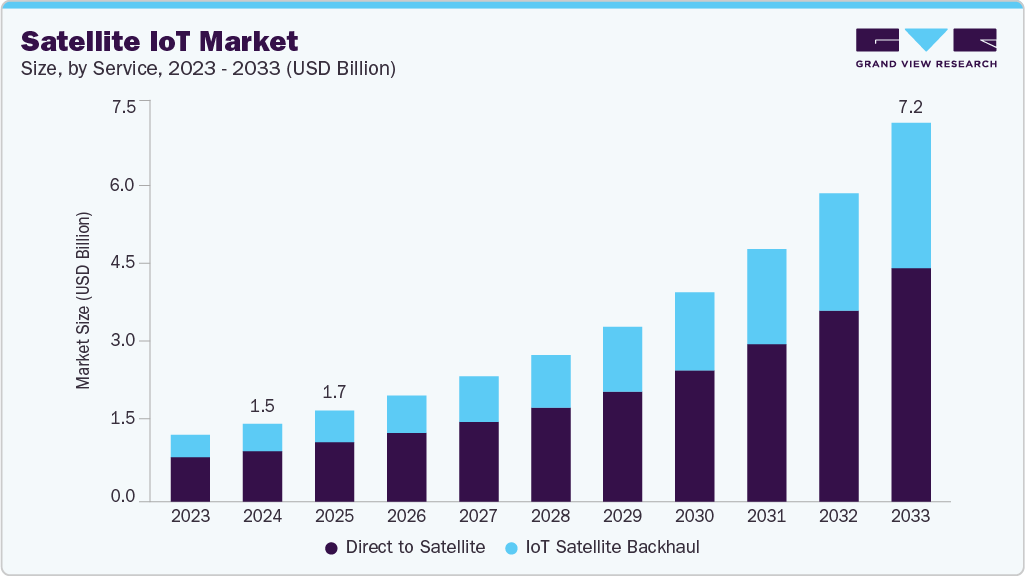

The global satellite IoT market size was estimated at USD 1,489.7 million in 2024 and is projected to reach USD 7,231.6 million by 2033, growing at a CAGR of 19.5% from 2025 to 2033. The market growth is primarily driven by the increasing demand for remote monitoring and asset tracking across different industries.

Key Market Trends & Insights

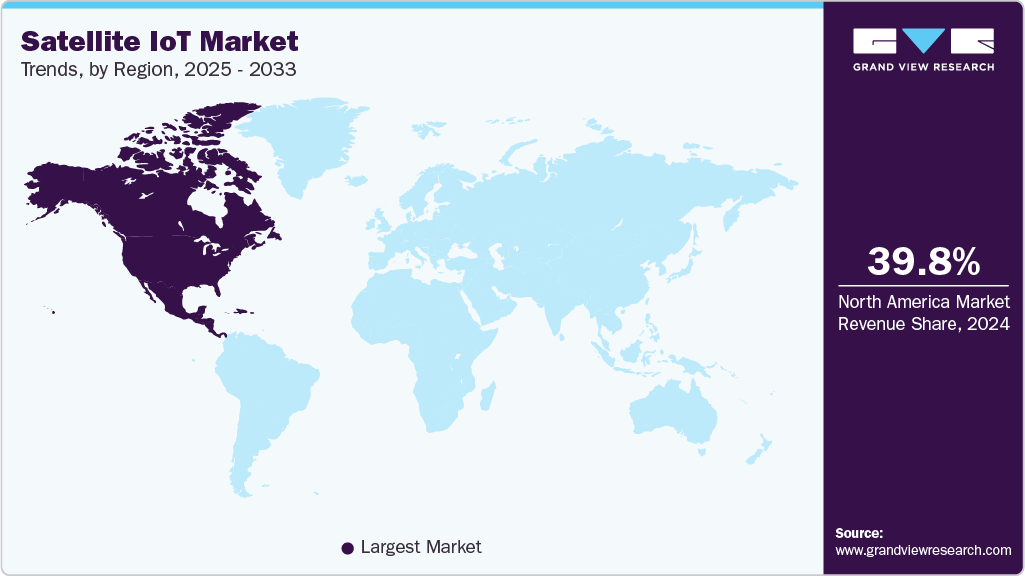

- North America dominated the global satellite IoT market with the largest revenue share of 39.8% in 2024.

- The satellite IoT market in the U.S led the North America market and held the largest revenue share in 2024.

- By service, the direct-to-satellite segment led the market with the largest revenue share of 65% in 2024.

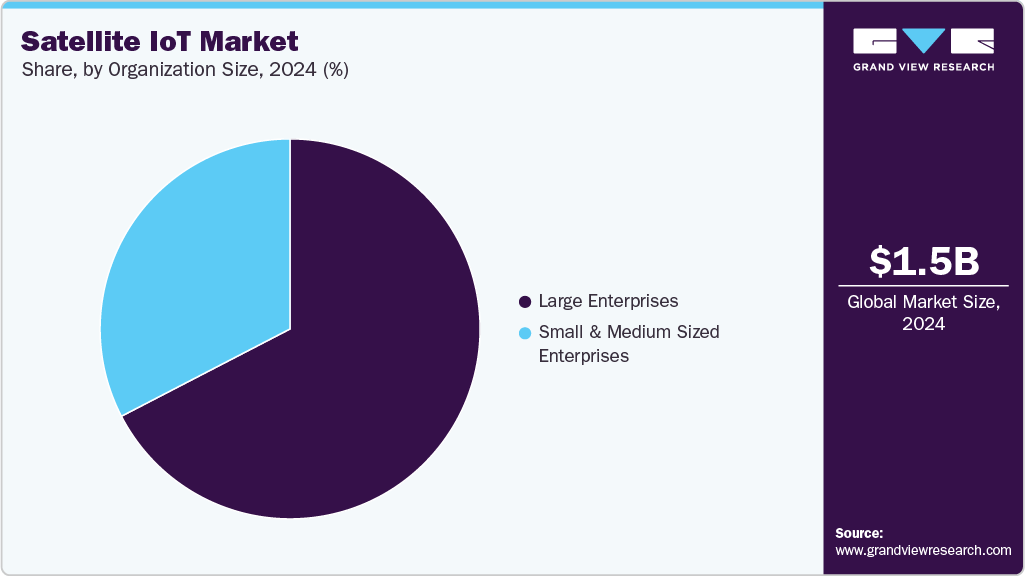

- By organization size, the large enterprises segment led the market with the largest revenue share of 67.4% in 2024.

- By end use, the transport and logistics segment led the market with the largest revenue share of 19.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,489.7 Million

- 2033 Projected Market Size: USD 7,231.6 Million

- CAGR (2025-2033): 19.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The growing adoption of low-power, wide-area satellite networks to enable connectivity in remote and underserved regions is expected to drive the market growth. The market growth is primarily driven by the increasing reliance on IoT devices to monitor, control, and optimize operations. Satellite IoT provides connectivity in remote and underserved areas where terrestrial networks are unavailable or unreliable. This capability enables seamless data transmission and device management, ensuring continuous operation and improving efficiency, thereby driving the market growth.The rising demand for reliable, always-on connectivity in remote and harsh environments is significantly fueling the market growth. Industries such as mining, oil & gas, and offshore energy increasingly rely on satellite-enabled IoT devices to monitor equipment performance, track asset locations, and ensure worker safety in areas where terrestrial networks are unavailable. This capability allows real-time data transmission from distant sites, enabling faster decision-making, reducing downtime, and improving operational efficiency, thereby accelerating market adoption.

In addition, the rapid expansion of global supply chains and cross-border trade is becoming a major growth driver for the market. Logistics and transportation companies are adopting satellite IoT solutions to track shipments across oceans, deserts, and rural highways, ensuring end-to-end visibility and reducing the risk of cargo loss or delays. Advanced sensors integrated with satellite IoT networks enable continuous monitoring of cargo conditions critical for sensitive goods like pharmaceuticals and perishable foods. This level of real-time oversight enhances operational transparency and compliance with global trade regulations, further boosting the satellite IoT industry growth.

Furthermore, the increasing focus on environmental monitoring and climate change mitigation is creating robust demand for the satellite IoT industry. Governments, research institutions, and environmental agencies deploy these solutions to collect data on deforestation, water quality, air pollution, and wildlife migration patterns. Integration of AI-driven analytics with satellite IoT platforms enables predictive modeling and early detection of environmental threats, facilitating timely interventions.

Moreover, rising investments in smart agriculture and precision farming are enhancing the adoption of satellite IoT solutions. Farmers and agribusinesses use satellite-connected sensors and machinery to monitor soil moisture, crop health, and weather conditions in real time, optimizing irrigation schedules and fertilizer usage. This data-driven approach increases yield, reduces resource wastage, and minimizes environmental impact. Integration with cloud-based platforms allows farmers to access insights from anywhere, enabling efficient farm management even in rural regions with no cellular coverage. These technological and infrastructural advancements in agriculture are ensuring long-term cost efficiency and sustainability, further propelling the growth of the satellite IoT industry.

Service Insights

The direct to satellite segment led the market with the largest revenue share of 64.3% in 2024, driven by advancements in satellite technology and increasing demand for global connectivity. Companies are leveraging low Earth orbit (LEO) satellites to provide reliable, low-latency connections directly to IoT devices, bypassing traditional ground-based infrastructure. This expansion is driven by the need for seamless communication in remote areas, enhancing applications in industries such as agriculture and environmental monitoring. The market is experiencing heightened investment and technological advancements, accelerating its growth and broadening its application scope.

The IoT satellite backhaul segment is expected to witness at the fastest CAGR of 21% from 2025 to 2033. This growth is attributed to the increasing need for reliable and widespread connectivity in remote and underserved regions. The demand for efficient data transmission and real-time application communication drives the market growth. Advancements in satellite technology and LEO satellite deployment enhance coverage and reduce latency, further boosting the segment. The rise in IoT device adoption globally fuels the expansion of IoT satellite backhaul services, thereby driving the segment growth.

Organization Size Insights

The large enterprises segment accounted for the largest market share in 2024, owing to the rising demand for global connectivity, asset tracking, and remote monitoring solutions. These enterprises leverage satellite IoT for real-time data collection and analysis, improving operational efficiency and decision-making. The expanding use of satellite IoT in logistics, agriculture, and energy industries is driving this growth. Advancements in satellite technology and reduced costs make it more accessible for large enterprises to adopt and integrate IoT solutions, thereby driving segment growth.

The small & medium enterprises (SMEs) segment is expected to witness at the fastest CAGR from 2025 to 2033. The segment growth is due to the increasing affordability and accessibility of satellite technology. These enterprises leverage satellite IoT solutions for asset tracking, remote monitoring, and agricultural management applications. The advancements in satellite technology have reduced costs, making it feasible for SMEs to integrate these solutions. This trend is further propelled by the rising demand for efficient, real-time data across various sectors, enhancing operational efficiencies and competitive advantage for SMEs, further driving the segment growth in the satellite IoT Industry.

End Use Insights

The transport and logistics segment accounted for the largest market share in 2024, primarily driven by the growing need for real-time tracking, fleet management, and cargo condition monitoring across global supply chains. The integration of satellite IoT solutions enhances route optimization, predictive maintenance, and compliance with international safety regulations, reducing operational costs and improving delivery reliability. Rising e-commerce volumes, cross-border trade expansion, and increasing adoption of multimodal transport systems are further accelerating the deployment of satellite IoT in the transport and logistics sector, solidifying its dominance in the segment.

The agriculture segment is expected to witness at the fastest CAGR from 2025 to 2033. The growth is fueled by the increasing adoption of precision farming techniques. Satellite IoT enables real-time monitoring of crop health, soil conditions, and weather patterns, enhancing productivity and efficiency. Farmers are leveraging these technologies to optimize resource use, reduce costs, and improve yields. Integrating satellite IoT with other emerging technologies, such as drones and AI, further drives the agriculture segment's growth.

Regional Insights

North America Satellite IoT Market Trends

North America dominated the satellite IoT market with the largest revenue share of 39.8% in 2024, primarily driven by increased investment in technological infrastructure by both the public and private sectors. The region benefits from a strong ecosystem of tech innovators and startups focusing on integrating IoT with satellite communication to address the need for remote area connectivity and advanced defense and security systems. The growing demand for IoT applications in logistics and environmental monitoring propels market expansion, further supporting market growth in North America.

U.S. Satellite IoT Market Trends

The satellite IoT market in the U.S. accounted for the largest market revenue share in North America in 2024. The U.S. is leading the market with its robust aerospace and defense sectors, driving demand for advanced satellite communications and IoT integration. Significant investments in R&D and a strong push for connectivity in remote and rural areas further bolster the market's growth, thereby strengthening the overall development of the satellite IoT industry in the country.

Europe Satellite IoT Market Trends

The satellite IoT market in Europe accounted for a significant market share of over 27% in 2024. In Europe, the market is driven by a strong emphasis on sustainability, smart city projects, and stringent regulatory frameworks aiming for high environmental standards. The push towards IoT-enabled satellite technology for efficient resource management and urban development to meet climate goals is fostering innovation and cross-sector partnerships in the satellite IoT industry.

The UK satellite IoT market is expected to grow at a significant CAGR during the forecast period. The market growth in the UK is fueled by its focus on environmental monitoring and smart city initiatives that require advanced IoT solutions. The supportive regulatory framework and investments in space and digital infrastructure stimulate market development. This favorable environment is propelling expanded adoption of scalable, low-latency satellite IoT technologies across various sectors in the UK.

The satellite IoT market in Germany is driven by the country’s strong automotive sector and leadership in Industry 4.0, where satellite IoT plays a crucial role in enhancing logistics and supply chain management. Germany’s commitment to innovation and technology-driven environmental policies is accelerating the adoption of satellite IoT solutions to improve industrial connectivity and real-time monitoring. This focus on digital transformation and sustainable development is propelling significant growth in the satellite IoT industry within Germany.

Asia Pacific Satellite IoT Market Trends

The satellite IoT market in the Asia Pacific is expected to grow at the fastest CAGR of over 23% from 2025 to 2033, fueled by vast rural expanses and the urgent need for reliable remote connectivity solutions. Countries in the region are witnessing significant government investments in space and satellite technologies to strengthen telecommunications infrastructure, which is critical for disaster management and expanding broadband coverage. Increasing partnerships between global satellite service providers and regional telecom operators and supportive policies for deploying satellite-enabled IoT networks reinforce the region’s leadership in the satellite IoT industry.

The Japan satellite IoT market is gaining momentum, driven by the country’s advanced disaster management capabilities and growing focus on elderly care solutions. Japan’s strong technological innovation ecosystem, combined with substantial government investments in space technologies and IoT integration, is fostering the development of highly reliable and resilient connectivity solutions. These efforts are enabling enhanced real-time monitoring and improved quality of life for an aging population, thereby strengthening the market’s growth trajectory across the country.

The satellite IoT market in China is rapidly expanding. China’s rapid advancements in space technology and strong government-led digital infrastructure development initiatives drive large-scale adoption of satellite IoT solutions. The widespread integration of satellite IoT in environmental monitoring, such as air quality assessment, water resource management, and forest fire detection, enhances nationwide sustainability efforts. These advancements, supported by state-backed investment and a thriving domestic satellite manufacturing sector, propel the country’s market growth.

Key Satellite IoT Company Insights

Some of the key players operating in the market include Northrop Grumman Corporation and Thales S.A. among others.

-

Northrop Grumman Corporation is a global aerospace and defense technology company that commands a presence in the satellite IoT industry owing to its innovative solutions and persistent focus on meeting its customers' critical needs. It operates across multiple segments, including aerospace systems, mission systems, and defense services, providing advanced technologies that support national security and commercial enterprises in the satellite IoT industry.

-

Thales S.A. is a major technology company based in Paris, France. It focuses on key sectors like defense, aerospace, transportation, and digital security and is dedicated to creating innovative solutions for a safer world. With a strong emphasis on research and development, Thales aims to support its customers by providing information and tools to make smart decisions and respond effectively in tough situations.

Myriota Pty Ltd. and Kepler Communications Inc. are some of the emerging market participants in the satellite IoT industry.

-

Myriota Pty Ltd. is an emerging leader specializing in satellite IoT connectivity for remote and hard-to-reach locations. Its proprietary technology platform delivers reliable, low-cost, and ultra-low-power communications for small-scale IoT devices, enabling long-battery-life operation across industries such as agriculture, mining, and logistics. Myriota’s focus on scalable, energy-efficient solutions is driving adoption in applications where traditional networks are unavailable, solidifying its position as a key innovator in the global market.

-

Kepler Communications Inc. is a fast-growing player revolutionizing satellite communications with its high-capacity, global data network. Based in Toronto, Canada, Kepler is building an advanced infrastructure to ensure seamless data transfer for devices anywhere from remote industrial sites to dense urban hubs. Its technology bridges the connectivity gap for IoT and broadband applications, offering robust, real-time services that cater to industries with critical data needs, establishing Kepler as a significant force in the satellite IoT industry.

Key Satellite IoT Companies:

The following are the leading companies in the satellite IoT market. These companies collectively hold the largest market share and dictate industry trends.

- ORBCOMM Inc.

- Globalstar, Inc.

- Inmarsat Group

- Iridium Satellite LLC

- Thales S.A.

- Airbus SE

- EUTELSAT COMMUNICATIONS SA

- Northrop Grumman Corporation

- Swarm Technologies Inc.

- Kepler Communications Inc.

- Myriota Pty Ltd.

- OQ Technology

Recent Developments

-

In July 2025, Iridium Satellite LLC introduced the Arduino-compatible Iridium Certus 9704 Launch Pad Developer Board, equipped with an embedded satellite transceiver, battery, antenna, microSD interface, and USB-C connectivity for rapid prototyping. In the satellite IoT industry, this developer board enables innovators and enterprises to design and deploy custom IoT solutions. By streamlining hardware integration and reducing development time, the platform is poised to accelerate the creation of next-generation satellite IoT devices.

-

In July 2025, Thales S.A. unveiled a ready-to-use certified eSIM and IoT connectivity solution, enhancing secure and scalable device integration across industries such as automotive and agriculture. This solution can enable seamless global connectivity for remote assets, ensuring that IoT devices are deployed in secure areas and have continuous communication. This capability is particularly valuable for applications like real-time fleet tracking and agricultural monitoring, significantly improving operational efficiency.

-

In March 2025, ORBCOMM Inc. introduced major enhancements to its OGx satellite IoT service, enabling support for larger and faster data transmissions at reduced costs. By lowering transmission costs and improving throughput, OGx empowers solution providers to deploy more sophisticated IoT applications, enhancing operational efficiency and expanding the satellite IoT industry.

Satellite IoT Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,738.2 million

Revenue forecast in 2033

USD 7,231.6 million

Growth rate

CAGR of 19.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

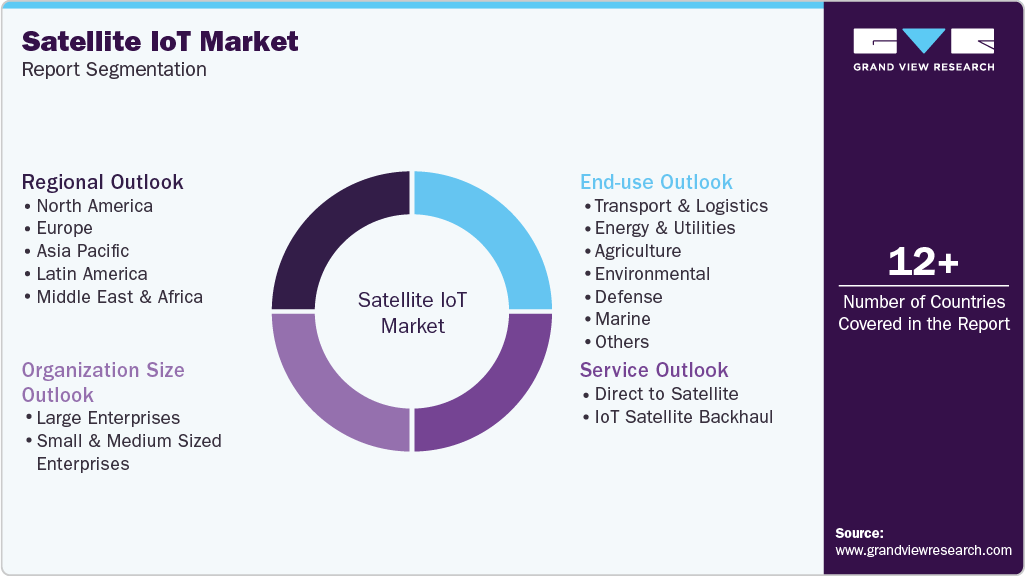

Service, organization size, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

ORBCOMM Inc.; Globalstar, Inc.; Inmarsat Group; Iridium Satellite LLC; Thales S.A.; Airbus SE; EUTELSAT COMMUNICATIONS SA; Northrop Grumman Corporation; Swarm Technologies Inc.; Kepler Communications Inc.; Myriota Pty Ltd.; OQ Technology

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Satellite IoT Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global satellite IoTmarket report based on service, organization size, end use, and region:

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Direct to Satellite

-

IoT Satellite Backhaul

-

-

Organization Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprises

-

Small & Medium Sized Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Transport and Logistics

-

Energy & Utilities

-

Agriculture

-

Environmental

-

Defense

-

Marine

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global satellite IoT market size was estimated at USD 1,489.7 million in 2024 and is expected to reach USD 1,738.2 million in 2025.

b. The global satellite IoT market is expected to grow at a compound annual growth rate of 19.5% from 2025 to 2033 to reach USD 7,231.6 million by 2033.

b. The North America region accounted for the largest share of over 40% in the satellite IoT market in 2024. It is expected to continue its dominance in the coming years, primarily driven by increased investment in technological infrastructure by both the public and private sectors.

b. Some key players operating in the satellite IoT market include primarily driven by increased investment in technological infrastructure by both the public and private sectors ORBCOMM Inc., Globalstar, Inc., Inmarsat Group, Iridium Satellite LLC, Thales S.A., Airbus SE, EUTELSAT COMMUNICATIONS SA, Northrop Grumman Corporation, Swarm Technologies Inc., Kepler Communications Inc., Myriota Pty Ltd., OQ Technology.

b. Key factors that are driving the satellite IoT market growth include driven by the rapid deployment of LEO satellite constellations, rising demand for remote monitoring in industries like agriculture and logistics, increasing adoption of hybrid satellite-terrestrial IoT networks, and growing regulatory and commercial focus on sustainable, low-latency connectivity solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.