- Home

- »

- Medical Devices

- »

-

Sclerotherapy Market Size And Share, Industry Report, 2030GVR Report cover

![Sclerotherapy Market Size, Share & Trends Report]()

Sclerotherapy Market (2025 - 2030) Size, Share & Trends Analysis Report By Agents (Detergents, Chemical Irritants, Osmotic Agents), By Type (Ultrasound Sclerotherapy), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-010-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sclerotherapy Market Size & Trends

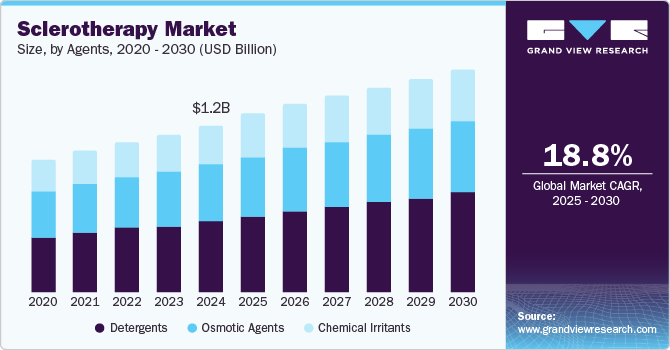

The global sclerotherapy market size was estimated at USD 1.15 billion in 2024 and is projected to grow at a CAGR of 4.4% from 2025 to 2030. The increasing prevalence of venous diseases, such as varicose veins and chronic venous insufficiency, which affect a significant portion of the population, drive the market. Patients seek effective and minimally invasive treatment options that address medical symptoms and enhance cosmetic appearance. Advancements in techniques and sclerosants further fuel the demand for sclerotherapy, improving treatment efficacy and safety. As healthcare systems evolve, the accessibility of these treatments is expected to rise, contributing to the sclerotherapy industry expansion. Hence, these factors further stimulating growth in the sclerotherapy market.

Advancements in sclerotherapy techniques and technologies are enhancing treatment efficacy and safety. Innovations such as foam sclerotherapy and ultrasound-guided procedures have improved the precision of injections and patient outcomes. These technological developments make the procedure safer and expand its applicability to a wider range of venous disorders. As healthcare providers adopt these advanced techniques, the overall acceptance and utilization of sclerotherapy are expected to rise, contributing to the sclerotherapy industry growth.

The increasing preference for minimally invasive procedures among patients is reshaping the landscape of the sclerotherapy industry. With benefits such as reduced recovery times, lower risks of complications, and minimal scarring compared to traditional surgical methods, more patients are opting for sclerotherapy as their choice of treatment. This trend is further supported by growing awareness and education about the procedure advantages, leading to higher patient compliance and demand. As healthcare infrastructure improves globally, access to these innovative treatments is expected to expand, driving further growth in the sclerotherapy market.

Agents Insights

The detergents segment dominated the market with a revenue share of 43.5% in 2024, driven by their proven efficacy and safety profile as sclerosing agents. Detergents are widely recognized for irritating the vein wall effectively, leading to the successful closure of varicose veins and other venous conditions. The FDA approval further enhances their credibility among healthcare providers, encouraging widespread adoption in clinical practice. In addition, the low risk of side effects associated with detergent sclerotherapy makes it a preferred choice for both patients and practitioners. The increasing incidence of venous diseases globally has also contributed to the rising demand for effective treatment options, solidifying the detergents segment leading position in the market.

The osmotic agents segment is expected to grow at a significant CAGR over the forecast period, fueled by their innovative approach to treating venous diseases. These agents leverage osmotic pressure to induce vein closure, offering a targeted and effective treatment option that minimizes damage to surrounding tissues. As healthcare professionals become more aware of the advantages of osmotic agents, including reduced side effects and improved patient outcomes, their utilization is likely to increase. Furthermore, ongoing research into new formulations and delivery systems is expected to enhance the effectiveness and safety of osmotic agents, driving their growth in the sclerotherapy industry.

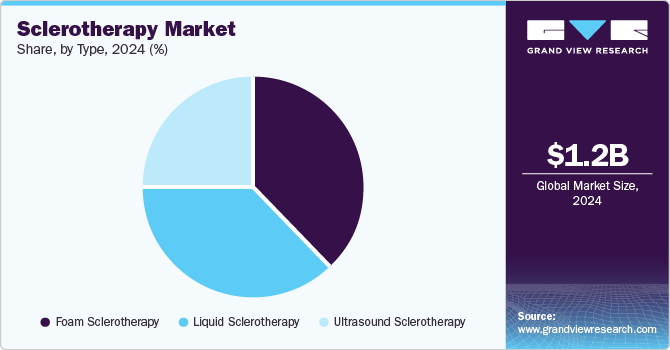

Type Insights

The foam sclerotherapy segment dominated the market with the largest revenue share in 2024, attributed to its ability to treat larger veins effectively. Foam formulations provide better visibility and contact with the vein wall than traditional liquid sclerosants, improving treatment outcomes. The growing preference among patients for minimally invasive procedures has further boosted the adoption of foam sclerotherapy. Moreover, clinical studies continue demonstrating its efficacy in treating various venous conditions, reinforcing its position as a leading treatment option in the sclerotherapy industry.

The ultrasound sclerotherapy segment is projected to grow at a significant CAGR over the forecast period due to advancements in imaging technology that enhance treatment precision. Real-time ultrasound guidance allows practitioners to accurately target affected veins, improving injection accuracy and overall treatment success rates. As awareness of these benefits increases among healthcare professionals, the adoption of ultrasound-guided sclerotherapy is expected to rise significantly. This trend is further supported by ongoing training and education initiatives aimed at enhancing practitioners skills in utilizing ultrasound technology for sclerotherapy.

Application Insights

The hemorrhoids segment dominated the market with the largest revenue share in 2024, driven by the high prevalence of hemorrhoids among adults. Hemorrhoids are a common ailment that often requires effective management options, and sclerotherapy offers a minimally invasive solution that appeals to patients seeking relief from discomfort. The increasing awareness about treatment options for hemorrhoids and the growing preference for non-surgical interventions further support this segment dominance in the market. In addition, healthcare providers are increasingly recommending sclerotherapy as a first-line treatment option for hemorrhoids due to its effectiveness and lower risk profile.

The varicose veins segment is expected to grow at a significant CAGR over the forecast period, which can be attributed to the rising incidence of varicose veins among aging populations. As more individuals seek effective treatments for this common condition, demand for sclerotherapy options is likely to increase. Furthermore, growing awareness regarding cosmetic concerns associated with varicose veins drives more patients toward considering sclerotherapy as a viable treatment option. The increasing availability of specialized clinics offering sclerotherapy treatments also contributes positively to this segment growth.

Regional Insights

North America sclerotherapy market dominated the global with a revenue share of 44.5% in 2024 due to advanced healthcare infrastructure and high patient awareness regarding venous treatments. The region benefits from well-established medical facilities and a strong presence of skilled practitioners specializing in minimally invasive procedures. In addition, favorable reimbursement policies enhance patient access to sclerotherapy treatments, further solidifying North America leading position in the market. The growing elderly population in North America also contributes significantly to the demand for effective venous disease treatments.

U.S. Sclerotherapy Market Trends

The U.S. sclerotherapy market dominated North America with a significant revenue share in 2024, fueled by a robust healthcare system and high demand for effective venous disease treatments. The availability of advanced medical technologies and a large population suffering from conditions such as varicose veins contribute significantly to market growth. Moreover, increasing investments in research and development drive innovative treatment modalities within the U.S., enhancing overall market dynamics. The presence of numerous specialized clinics dedicated to treating venous diseases further supports this trend.

Europe Sclerotherapy Market Trends

Europe sclerotherapy market held a substantial market share in 2024, driven by increasing investments in healthcare infrastructure and rising awareness about venous diseases. The region aging population contributes significantly to demand for effective treatment options such as sclerotherapy. Furthermore, ongoing research initiatives to improve treatment efficacy are expected to boost market growth across various European countries. Regulatory support for minimally invasive procedures also plays a crucial role in promoting sclerotherapy as an effective treatment option within Europe.

Asia Pacific Sclerotherapy Market Trends

Asia Pacific sclerotherapy market is expected to register the highest CAGR of 5.7% over the forecast period, which can be attributed to rapid urbanization and increasing healthcare access in emerging economies. The growing prevalence of venous diseases among urban populations drives demand for sclerotherapy. In addition, rising disposable incomes enable more individuals to seek medical interventions for aesthetic concerns related to venous conditions. The expansion of specialized clinics offering sclerotherapy services is also anticipated to contribute positively to market growth in this region.

The China sclerotherapy market dominates the Asia Pacific with a significant revenue share in 2024 due to its large population base and increasing awareness about venous health issues. The rapid development of healthcare facilities and investment in medical technologies enhance treatment accessibility across the country. Furthermore, government initiatives aimed at improving healthcare services contribute positively to market growth in China as more patients seek effective solutions for venous diseases. The rising prevalence of lifestyle-related factors contributing to venous disorders also plays a pivotal role in driving demand for sclerotherapy treatments within China.

Key Sclerotherapy Company Insights

Some key companies operating in the market include LGM Pharma; Troikaa; Viatris Inc.; Omega Pharmaceuticals Pvt. Ltd.; and Merz Pharma. Companies are undertaking strategic initiatives such as mergers, acquisitions, and product launches, to expand their market presence and address the evolving healthcare demands through sclerotherapy market.

-

LGM Pharma offers a range of products, including various sclerosing agents such as detergents, osmotic agents, and chemical irritants used in liquid and foam sclerotherapy procedures. The company also provides comprehensive contract development and manufacturing organization (CDMO) services, facilitating clients transition from concept to commercialization and ensuring timely market entry of their sclerotherapy-related products.

-

Troikaa Pharmaceuticals offers a range of products and solutions tailored for the sclerotherapy market. Its products include Dynapar AQ, a high-concentration diclofenac injection that utilizes aquatic technology for effective pain management, which is beneficial in sclerotherapy procedures. The company also provides Dynapar QPS, Xykaa Extend, and Troypofol. Dynapar QPS is the world’s first transdermal preparation of diclofenac, enhancing skin penetration for rapid pain relief, thus supporting patients undergoing sclerotherapy treatments.

Key Sclerotherapy Companies:

The following are the leading companies in the sclerotherapy market. These companies collectively hold the largest market share and dictate industry trends.

- LGM Pharma

- Troikaa

- Viatris Inc.

- Omega Pharmaceuticals Pvt. Ltd.

- Merz Pharma

- ENDO-FLEX GmbH.

- Perrigo Company plc

- Medi-Globe GmbH.

- Medtronic

- AngioDynamics

Recent Developments

-

In July 2024, Swizton Medcare announced a partnership with Medtronic to launch India’s first specialized clinic dedicated to the treatment of varicose veins. This initiative aims to enhance patient care by providing advanced diagnostic and therapeutic options for individuals suffering from venous diseases.

-

In August 2023, Viatris Inc. and Mapi Pharma Ltd. announced that the U.S. Food and Drug Administration (FDA) had accepted a New Drug Application (NDA) for GA Depot, a long-acting glatiramer acetate formulation intended for the treatment of Relapsing Multiple Sclerosis (MS).

Sclerotherapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.21 billion

Revenue forecast in 2030

USD 1.50 billion

Growth rate

CAGR of 4.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Agents,type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, UK, Germany, France, Italy, Spain, Norway, Denmark, Sweden,Japan, China, India, South Korea, Australia, Thailand, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

LGM Pharma; Troikaa; Viatris Inc.; Omega Pharmaceuticals Pvt. Ltd.; Merz Pharma; ENDO-FLEX GmbH.; Perrigo Company plc; Medi-Globe GmbH.; Medtronic; AngioDynamics.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

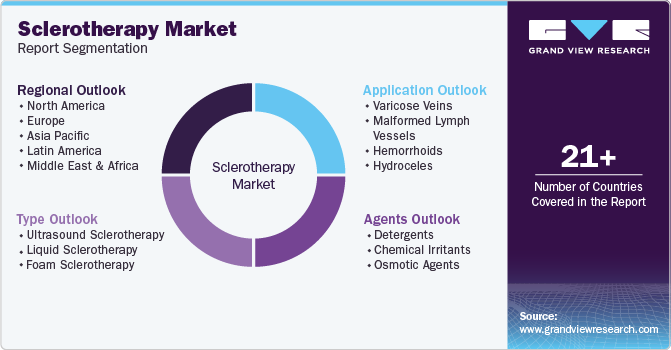

Global Sclerotherapy Market Report Segmentation

This report forecasts global, regional, and country revenue growth and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global sclerotherapy market report based on agents, type, application, and region:

-

Agents Outlook (Revenue, USD Billion, 2018 - 2030)

-

Detergents

-

Chemical Irritants

-

Osmotic Agents

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Ultrasound Sclerotherapy

-

Liquid Sclerotherapy

-

Foam Sclerotherapy

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Varicose Veins

-

Malformed Lymph Vessels

-

Hemorrhoids

-

Hydroceles

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the sclerotherapy market growth include a rising global geriatric population with an increased incidence of varicose veins, high technological advancements for the treatment of venous diseases, and high demand for less invasive procedures.

b. The global sclerotherapy market size was estimated at USD 1.15 billion in 2024 and is expected to reach USD 1.21billion in 2025.

b. The global sclerotherapy market is expected to grow at a compound annual growth rate of 4.4% from 2025 to 2030 to reach USD 1.5 billion by 2030.

b. North America dominated the sclerotherapy market with a share of 44.5% in 2024. This is attributable to rising geriatric population with varicose veins, high technological advancements pertaining to venous diseases, and high acceptance of minimally invasive procedures.

b. Some key players operating in the sclerotherapy market include BTG, Kreussler, LGM Pharma, Troikaa, Changan Tianyu group, Bioniche Pharma Group Ltd, Omega Pharmaceuticals, Merz Pharma, and Endo-Flex.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.