Scopolamine Market Size & Trends

The global scopolamine market size was valued at USD 385 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.75% from 2023 to 2030. The rising incidence of motion sickness and the increasing population of geriatrics are anticipated to boost the demand for scopolamine over the forecast period. Scopolamine is extensively utilized to prevent nausea and vomiting linked with motion sickness, chemotherapy, and surgery. Consequently, with the rising awareness in healthcare and an increasing demand for potent antiemetic drugs, the scopolamine market is projected to experience growth in the coming years.

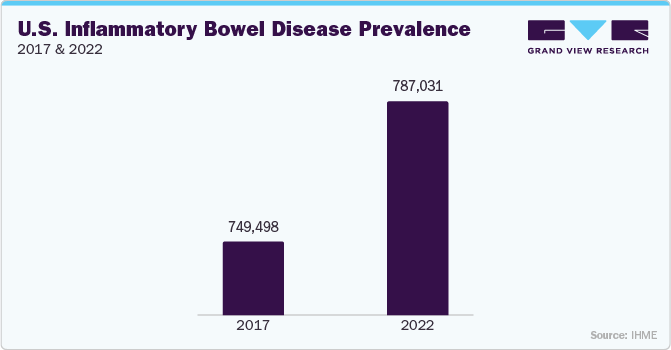

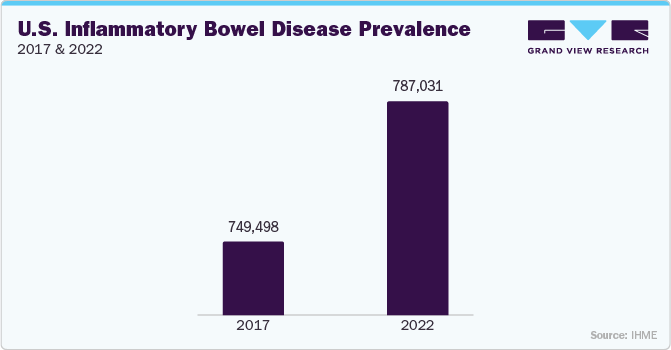

Scopolamine can also be used in the treatment of specific gastrointestinal conditions, including spastic muscle states, irritable bowel syndrome, and diverticulitis, among others. Moreover, increasing treatment trials on the drug to identify potential new applications have spurred the market growth. Recently, many studies have reported the use of scopolamine for the treatment of depressive disorders. According to an article published in the International Journal of Psychiatry in April 2021, most of the recent treatment trials on scopolamine have confirmed the antidepressant effects of the drug on unipolar and bipolar depression, wherein scopolamine was used as an alternative to ketamine in patients suffering from treatment-resistant depression.

In August 2022, Southwest Research Institute established an effective, entirely synthetic technique for the production of scopolamine. This compound, derived from plants, is widely used to combat nausea and vomiting associated with motion sickness and anesthesia. This breakthrough represents the initial occurrence where SwRI has completely synthesized a pharmaceutical compound derived from botanical sources. Thus, these advancements in research and clinical investigations are propelling the scopolamine market forward.

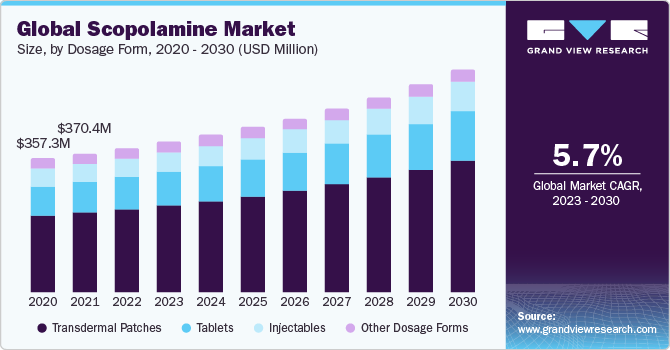

Dosage Form Insights

In 2022, the transdermal patches segment dominated the market and is estimated to have the fastest compound annual growth rate (CAGR) during the forecast period. Transdermal patches are extensively used for motion sickness treatment, primarily due to their user-friendly application, cost-efficiency, and widespread availability. These patches are affixed to the hairless skin behind the ear and are particularly useful in managing motion sickness induced by anesthesia during surgical procedures.

Scopolamine tablets demand is growing significantly due to their convenience and ease of use, providing a viable alternative to traditional forms of medication. This surge in acceptance can be further attributed to advancements in drug formulation and a surge in research and development efforts to enhance the drug's efficacy and minimize adverse effects.

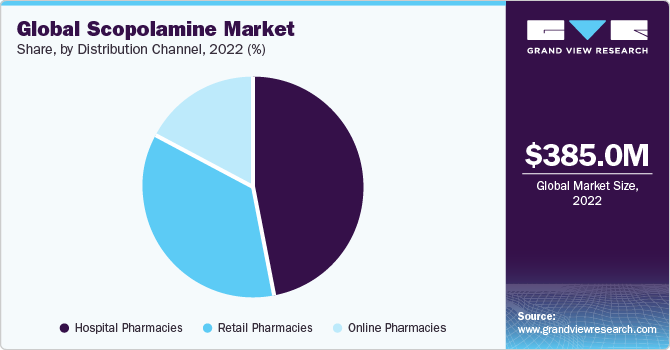

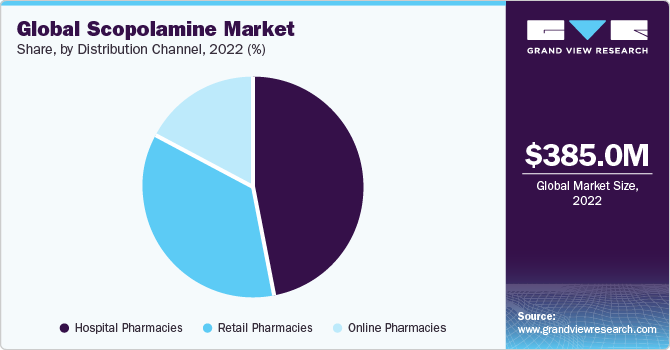

Distribution Channel Insights

Hospital pharmacies dominated the scopolamine market in terms of revenue in 2022. One of the key factors is that scopolamine is often used in hospital settings to manage vomiting and nausea in patients, especially those undergoing surgery, chemotherapy, or other medical procedures where these symptoms are common. Thus, the growing number of surgeries and admissions is anticipated to boost the demand for scopolamine over the forecast period.

The retail pharmacies segment is expected to exhibit the fastest CAGR over the forecast period. Retail pharmacies are usually the main point of distribution for several over the counter and prescription medications, including scopolamine patches or other forms of the drug. They play an important role in providing access to medications for the general population.

Regional Insights

In 2022, North America held the largest market share, benefiting from its well-established healthcare infrastructure. Moreover, the growth in research and development, the presence of key major players, and increasing investments in various research initiatives contribute to the market's expansion across the region.

Asia Pacific is projected to experience the fastest CAGR during the forecast period. This is attributed to the growing geriatric population, increasing healthcare expenditure, and a rising demand due to the growing number of surgeries, all of which propel the market in the region over the forecast period.

Key Companies & Market Share Insights

The high demand for scopolamine across multiple applications has created numerous market opportunities for major players to capitalize on. Some of the key players in the global scopolamine market include GlaxoSmithKline plc., Novartis AG, Caleb Pharmaceuticals, Inc., Perrigo Company plc., Alchem International, Phytex Australia, Baxter International Inc., Centroflora-Cms, Alkaloids of Australia, Myungmoon Pharma Co. LTD., and Fine Chemicals Corporation.

-

In June 2023, Defender Pharmaceuticals announced promising outcomes from a critical Phase III clinical trial evaluating the efficiency of intranasal scopolamine in preventing motion-induced nausea and vomiting.

-

In March 2022, Athira Pharma, Inc., utilized scopolamine, an innovative small molecule under consideration for Parkinson’s disease dementia, Alzheimer’s, and dementia with Lewy bodies. Additionally, they employed ATH-1020, a brain-penetrating small molecule candidate available in oral form, for addressing neuropsychiatric conditions.