- Home

- »

- Advanced Interior Materials

- »

-

Sealing And Strapping Packaging Tapes Market Report, 2030GVR Report cover

![Sealing And Strapping Packaging Tapes Market Size, Share & Trends Report]()

Sealing And Strapping Packaging Tapes Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Paper, Polypropylene), By Adhesive (Acrylic, Rubber, Silicone), By Application (Carton Sealing & Inner Packaging), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-597-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

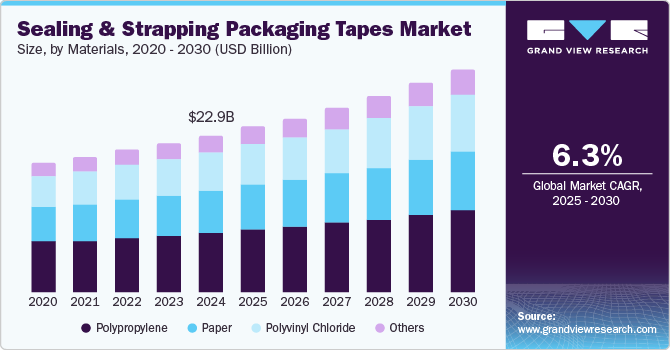

The global sealing and strapping packaging tapes market size was valued at USD 22.92 billion in 2024 and is expected to grow at a CAGR of 6.3% from 2025 to 2030. This growth is attributed to the rapid expansion, in which e-commerce has significantly increased the demand for secure packaging solutions to protect shipments. In addition, the rise in global trade and logistics necessitates reliable sealing and strapping options to ensure product safety during transport. Furthermore, innovations in tape materials, including sustainable options, further enhance performance and eco-friendliness, while the increasing emphasis on tamper-evident packaging contributes to market growth.

Sealing and Strapping Packaging Tapes are essential materials used to secure and protect products during shipping and storage. The expansion of the e-commerce sector is a major catalyst for growth in this market, as the increasing preference for online shopping drives the need for effective packaging solutions that ensure product safety during transit. This shift has prompted innovations in tape manufacturing, focusing on enhanced adhesives and materials that improve performance and sustainability. In addition, the emphasis on creating memorable unboxing experiences has led brands to prioritize high-quality packaging, further elevating the demand for these tapes.

Furthermore, the rising focus on sustainability significantly influences the market, with businesses under pressure to adopt eco-friendly practices. This trend has resulted in a growing demand for recyclable or biodegradable packaging materials, prompting manufacturers to develop environmentally friendly sealing and strapping tapes. Companies that embrace sustainable packaging meet regulatory requirements and foster brand loyalty among consumers who prioritize eco-conscious choices.

Moreover, the food and beverage industry is also crucial in driving demand for sealing and strapping packaging tapes. As consumer preferences shift towards packaged foods, manufacturers require reliable sealing solutions to maintain product freshness and comply with stringent safety regulations. High-quality packaging tapes are vital in ensuring food products remain secure during transportation, contributing to the market's overall growth.

Material Insights

The polypropylene segment led the market and accounted for the largest revenue share, 38.1%, in 2024. This growth is attributed to its advantageous properties, such as high abrasion resistance, flexibility, and water resistance. These characteristics make polypropylene an ideal choice for various packaging applications, particularly in e-commerce and logistics, where secure packaging is essential. Furthermore, the increasing demand for cost-effective and durable sealing solutions further enhances the preference for polypropylene, solidifying its position as a leading material in the market.

The polyvinyl chloride (PVC) segment is expected to grow at a CAGR of 7.4% over the forecast period, owing to its excellent sealing capabilities and durability. PVC tapes are known for their strong adhesion and resistance to environmental factors, making them suitable for heavy-duty applications. In addition, the rising focus on safety and tamper-evident packaging in sectors such as food and pharmaceuticals is boosting the demand for PVC-based sealing solutions. Furthermore, as manufacturers continue to innovate and improve PVC formulations, this segment is expected to maintain a significant share in the Sealing & Strapping Packaging Tapes Market.

Adhesive Insights

The rubber adhesive segment dominated the market and accounted for the largest revenue share of 38.8% in 2024, primarily driven by its exceptional bonding capabilities and versatility. Rubber adhesives provide strong adhesion on various surfaces, ensuring secure seals that are crucial for packaging integrity. In addition, their ability to offer clean removal without residue enhances their appeal across multiple industries, particularly in logistics and e-commerce, where reliable sealing is essential. Furthermore, the increasing focus on efficiency and performance in packaging solutions further drives the demand for rubber-based adhesives.

The silicone adhesive segment is expected to grow at a CAGR of 6.6% from 2025 to 2030, owing to its unique properties, including high-temperature resistance and durability. Silicone adhesives are ideal for applications requiring long-lasting adhesion under challenging conditions, making them suitable for heavy-duty packaging needs. Furthermore, their inherent flexibility allows for the effective sealing of irregular surfaces, which is increasingly important in diverse packaging environments. Moreover, as industries prioritize reliability and performance, the demand for silicone adhesives in sealing and strapping applications continues to rise, contributing significantly to market growth.

Application Insights

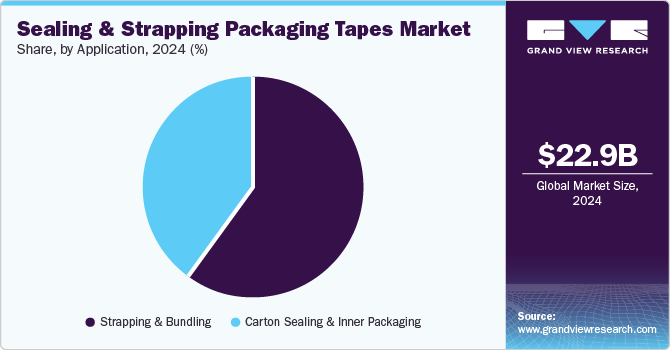

The strapping and bundling segment held the largest revenue share of 59.5% in 2024. This growth is attributed to the increasing need for secure and efficient packaging solutions. In addition, as logistics and manufacturing industries expand, the demand for robust strapping tapes to stabilize and secure bulky loads has surged. Furthermore, these tapes, often made from durable materials such as polypropylene or polyester, offer high tensile strength and tear resistance, ensuring safe handling and transporting goods throughout the supply chain.

The carton sealing & inner packaging application segment is expected to grow at a CAGR of 6.7% over the forecast period, primarily driven by the rising demand for reliable packaging in the e-commerce and retail sectors. As online shopping continues to thrive, businesses require effective sealing solutions to protect products during transit. In addition, carton sealing tapes provide strong adhesion and durability, ensuring that packages remain secure and intact until they reach consumers. Furthermore, the emphasis on tamper-evident packaging further drives the adoption of high-quality sealing tapes, making them essential for maintaining product integrity in various industries.

Regional Insights

The sealing and strapping packaging tapes market in North America held a significant revenue share and 24.1% in 2024, primarily driven by a thriving e-commerce industry. The increasing volume of online shopping necessitates effective packaging solutions to ensure product safety during transit. Advancements in adhesive technologies are enhancing tape performance, making them more appealing for various applications. As businesses prioritize operational efficiency and customer satisfaction, the demand for high-quality sealing and strapping tapes continues to rise in this region.

U.S. Sealing And Strapping Packaging Tapes Market Trends

The U.S. sealing and strapping packaging tapes market dominated the North American market and accounted for the largest revenue share in 2024 due to the robust e-commerce sector. With online retail sales surpassing one trillion dollars recently, there is an escalating need for reliable packaging solutions that ensure product safety during shipping. Furthermore, stringent regulatory standards are pushing companies toward high-quality packaging materials that comply with safety requirements. Moreover, this combination of factors positions the U.S. as a critical market for sealing and strapping packaging tapes moving forward.

Asia Pacific Sealing And Strapping Packaging Tapes Market Trends

The Asia Pacific sealing & strapping packaging tapes market dominated the global market and accounted for the largest revenue share of 36.8% in 2024. This growth is attributed to rapid industrialization and urbanization. In addition, the increasing demand for efficient and flexible packaging solutions, particularly in e-commerce and logistics, is driving the consumption of sealing and strapping tapes. Furthermore, the region benefits from a large workforce and locally sourced raw materials, which enhance production capabilities and reduce costs, making it a vital area for market expansion.

The sealing & strapping packaging tapes market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by a robust manufacturing sector and a growing middle class that seeks improved packaging solutions. In addition, the country's commitment to sustainable practices and advancements in tape technology are further propelling market growth. Furthermore, as a leading exporter of packaged goods, China requires high-quality sealing solutions to maintain product integrity during shipping, solidifying its position as a dominant force in the global market.

Middle East And Africa Sealing & Strapping Packaging Tapes Market Trends

The Middle East & Africa sealing & strapping packaging tapes market is expected to grow at a CAGR of 9.1% over the forecast period, owing to increasing industrialization and urban development. In addition, the rise in construction activities and infrastructure investments is boosting demand for reliable packaging solutions. Furthermore, the expanding retail sector, especially in countries such as the UAE and Saudi Arabia, emphasizes the need for efficient packaging for consumer goods, leading to greater adoption of sealing and strapping tapes across various applications.

Europe Sealing And Strapping Packaging Tapes Market Trends

The sealing & strapping packaging tapes market in Europe is expected to witness significant growth over the forecast period, driven by stringent regulations regarding packaging waste and sustainability. In addition, companies are increasingly focused on meeting environmental standards, which has led to a heightened demand for eco-friendly sealing solutions. Furthermore, the region's well-established logistics network and expanding e-commerce sector also necessitate efficient packaging methods, driving innovation and investment in sealing and strapping tapes to enhance performance while adhering to sustainability goals.

Germany sealing and strapping packaging tapes market held the largest revenue share in 2024 within the European market, due to its strong manufacturing base and emphasis on quality standards. In addition, the country’s focus on technological advancements in packaging solutions fosters innovation in tape production. Furthermore, Germany's commitment to sustainability drives demand for biodegradable and recyclable packaging materials, further propelling growth in the sealing and strapping tapes sector as companies adapt to changing consumer preferences.

Key Sealing And Strapping Packaging Tapes Market Company Insights

Key players in the global sealing & strapping packaging tapes industry include Intertape Polymer Group Inc., Nitto Denko Corporation, and others. These companies adopt various strategies to improve their market presence. These strategies include investing in research and development to innovate product offerings, forming strategic partnerships for expanded distribution, and focusing on sustainability to meet consumer demand for eco-friendly solutions. In addition, companies often engage in aggressive marketing campaigns and leverage advanced technologies to improve adhesive performance, ensuring they remain competitive in a rapidly evolving market landscape.

-

Avery Dennison Corporation manufactures products designed for various applications, such as carton sealing, bundling, and e-commerce packaging. Operating primarily in the packaging segment, Avery Dennison focuses on providing innovative solutions that enhance efficiency and reliability in packaging processes, catering to industries such as retail, logistics, and manufacturing.

-

Intertape Polymer Group Inc. specializes in developing and manufacturing a diverse array of packaging products, including sealing and strapping packaging tapes. The company offers solutions that cater to multiple applications, such as bundling, palletizing, and carton sealing. Operating within the packaging segment, the company emphasizes product quality and performance. It serves various industries, including construction, food and beverage, and consumer goods, with effective packaging solutions that ensure product safety during transit and storage.

Key Sealing And Strapping Packaging Tapes Companies:

The following are the leading companies in the sealing and strapping packaging tapes market. These companies collectively hold the largest market share and dictate industry trends.

- 3M Company

- tesa SE

- Avery Dennison Corporation

- Intertape Polymer Group Inc

- Nitto Denko Corporation

- Scapa Group plc

- Shurtape Technologies LLC,

- Bostik SA

- Saint-Gobain Performance Plastics Corporation

- Advance Tapes International Ltd.

Recent Developments

-

In September 2023, iTape announced the launch of its new 170E product, a versatile solution for sealing & strapping packaging tapes. This innovative tape offers better adhesion and durability, making it suitable for various applications, including heavy-duty packaging and bundling. Designed to enhance operational efficiency, the 170E tape is also environmentally friendly, aligning with industry trends towards sustainable packaging solutions.

-

In March 2023, Avery Dennison Performance Tapes expanded its 2023 Core Series Portfolio with four new products designed for sealing and strapping packaging tapes. This update enhanced the portfolio, now featuring 31 products across 11 adhesive categories, all backed by a two-year warranty. The new offerings include a low VOC acrylic tape for automotive applications, a foam bonding differential tape, and a Cold Tough aluminum foil tape, addressing industry challenges while promoting environmental sustainability and simplifying product selection for customers.

-

In February 2023, Tesa launched a new sustainable product, Tesa 51344, a paper-based tear tape designed for sealing and strapping packaging tapes in shipping envelopes and boxes. This innovative tape features a strong paper backing and high-tack adhesive, ensuring reliable performance while being fully recyclable alongside cardboard materials.

Sealing And Strapping Packaging Tapes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.23 billion

Revenue forecast in 2030

USD 32.95 billion

Growth rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Million Square Meters, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Materials, adhesive, application, region

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; China; India; Japan; Indonesia; Germany; UK; France; Italy; Spain; Brazil; Argentina

Key companies profiled

3M Company; tesa SE; Avery Dennison Corporation; Intertape Polymer Group Inc.; Nitto Denko Corporation; Scapa Group plc; Shurtape Technologies LLC,; Bostik SA; Saint-Gobain Performance Plastics Corporation; Advance Tapes International Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sealing And Strapping Packaging Tapes Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global sealing & strapping packaging tapes market report based on materials, adhesive, application, and region.

-

Materials Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Paper

-

Polypropylene

-

Polyvinyl Chloride

-

Others

-

-

Adhesive Type Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Acrylic

-

Rubber

-

Silicone

-

Others

-

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

Carton Sealing & Inner Packaging

-

Strapping & Bundling

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.