- Home

- »

- Next Generation Technologies

- »

-

Security Labels Market Size, Share & Trends Report, 2030GVR Report cover

![Security Labels Market Size, Share & Trends Report]()

Security Labels Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Material (Plastic, Foam, Foil, Paper), By Pattern, By Application, By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-385-1

- Number of Report Pages: 122

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Security Labels Market Summary

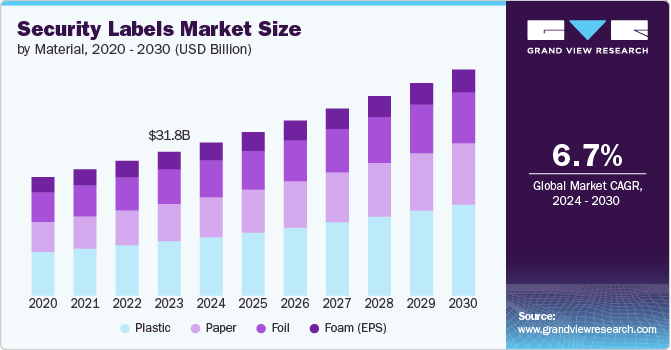

The global security labels market size was estimated at USD 31.85 billion in 2023 and is projected to reach USD 50.10 billion by 2030, growing at a CAGR of 6.7% from 2024 to 2030. The security labels market is witnessing robust growth driven by various factors, including increasing concerns over product authentication and anti-counterfeiting measures across multiple industries.

Key Market Trends & Insights

- The North America dominated with a revenue share of over 38.0% in 2023.

- The security labels market in the Asia Pacific region is anticipated to register rapid growth over the forecast period.

- Based on material, the plastic segment accounted for the largest market revenue share in 2023.

- Based on application, the boxes & cartons segment accounted for the largest market revenue share in 2023.

- Based on end user, the food & beverage industry segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 31.85 Billion

- 2030 Projected Market USD 50.10 Billion

- CAGR (2024-2030): 6.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

End users such as food and beverages, pharmaceuticals, electronics, and automotive are particularly significant contributors to this demand.

The rising prevalence of counterfeit products has compelled these industries to adopt advanced security measures to protect their brands and ensure consumer safety. In addition, the premium quality, minimal weight, and recyclability of security labels make them highly attractive to manufacturers, aligning with the growing consumer demand for sustainable packaging solutions.

The growing e-commerce sector has also significantly impacted the security labels market. With the surge in online shopping, the need for secure packaging to prevent tampering and ensure the safe delivery of products has become paramount. As a result, security labels have become an essential component in the logistics and supply chain management of e-commerce businesses. These factors collectively contribute to the promising growth trajectory of the security labels market, projecting a substantial increase in market value during the forecast period.

Furthermore, technological advancements, particularly in digital printing, have propelled the market. Digital printing offers high precision, customization, and cost-effectiveness, making it an ideal choice for producing security labels. This technology enables the incorporation of sophisticated security features such as QR codes, holograms, and RFID tags, which enhance product traceability and authentication.

Product Insights

The barcode segment led the market in 2023, accounting for over 39.0% share of the global revenue. Barcodes offer a cost-effective and reliable method for encoding product information, enabling quick scanning and data retrieval. This feature is crucial for industries such as retail, logistics, and manufacturing, where streamlined operations and accurate inventory control are essential. In addition, the integration of barcodes with advanced technologies, such as QR codes and RFID, has enhanced their functionality, allowing for improved product authentication and anti-counterfeiting measures.

The Radio Frequency Identification (RFIDs) segment is predicted to foresee significant growth in the coming years, driven by its superior capabilities in product tracking, inventory management, and anti-counterfeiting measures. RFID technology offers significant advantages over traditional methods by enabling real-time tracking and data retrieval without the need for line-of-sight scanning. In addition, the growing emphasis on supply chain transparency and the need to combat counterfeit products have further boosted the adoption of RFID technology. The integration of RFID with IoT has also expanded its application scope, offering advanced solutions for asset tracking and management.

Material Insights

The plastic segment accounted for the largest market revenue share in 2023. Plastic security labels are widely preferred across various industries, including food and beverages, pharmaceuticals, and logistics, due to their ability to withstand harsh environmental conditions, such as moisture, heat, and chemicals. This resilience ensures the longevity and reliability of the labels, making them ideal for products that require extended shelf life or exposure to challenging conditions. In addition, plastic labels offer excellent print quality and can incorporate advanced security features such as holograms, QR codes, and RFID tags, enhancing product authentication and traceability.

The paper segment is predicted to foresee significant growth in the coming years due to its affordability, ease of customization, and suitability for a wide range of applications. Paper labels are cost-effective, making them a popular choice for businesses seeking budget-friendly solutions while maintaining functional and aesthetic quality. Their versatility allows for high-quality printing, which is essential for incorporating various security features such as barcodes, QR codes, and holograms. In addition, paper labels are readily adaptable to different adhesive types and surfaces, making them ideal for numerous industries, including retail, logistics, and pharmaceuticals.

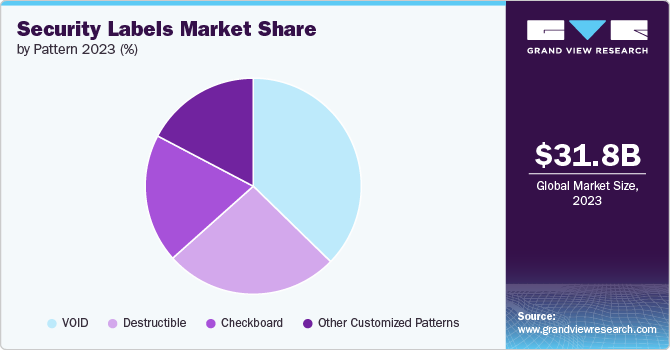

Pattern Insights

The VOID segment accounted for the largest market revenue share in 2023 due to its effective tamper-evident features and superior anti-counterfeiting capabilities. VOID labels are designed to reveal a "VOID" message or pattern when tampered with, providing a clear visual indication of any unauthorized access or tampering. This feature is highly valued across various industries, including pharmaceuticals, electronics, and consumer goods, where product integrity and security are paramount. The ability of VOID labels to protect against counterfeiting and theft while maintaining a high level of security makes them a preferred choice for manufacturers and distributors.

The destructible segment is anticipated to witness significant growth in the coming years. Destructible pattern labels are designed to break apart or leave a visible residue when removed, making them highly effective at preventing unauthorized access and tampering. This characteristic is crucial for industries where product integrity and protection are critical. The destructible nature of these labels ensures that any attempt to tamper with the product will result in irreversible damage to the label itself, providing clear evidence of tampering.

Application Insights

The boxes & cartons segment accounted for the largest market revenue share in 2023. Boxes and cartons are fundamental to transporting and storing a wide range of products, making them prime targets for tampering and counterfeiting. Security labels applied to these packaging types play a vital role in ensuring product integrity, preventing unauthorized access, and enhancing traceability. The high demand for tamper-evident and authentication solutions in sectors such as food and beverages, pharmaceuticals, and consumer goods has further propelled the use of security labels on boxes and cartons.

The bottles & jars segment is anticipated to witness significant growth in the coming years, primarily due to the critical need for product protection and consumer safety in the packaging of liquid and jarred goods. Security labels for bottles and jars help prevent tampering and counterfeiting by providing visible evidence if a product has been compromised. The labels often incorporate features such as tamper-evident seals, holograms, and QR codes, which enhance product security and facilitate easy verification. In addition, the growing consumer awareness regarding product safety and the increasing emphasis on regulatory compliance have driven the demand for robust security solutions in this segment.

End user Insights

The food & beverage industry segment accounted for the largest market revenue share in 2023. With rising incidences of food fraud, counterfeiting, and tampering, manufacturers and consumers alike are demanding enhanced security measures. Security labels, including tamper-evident and anti-counterfeit labels, provide a crucial solution by ensuring product integrity and authenticity throughout the supply chain. In addition, regulatory requirements for food safety and traceability have driven the adoption of these labels.

The healthcare & pharmaceutical industry segment is anticipated to exhibit the highest CAGR over the forecast period. With the proliferation of counterfeit drugs posing significant health risks, there is an increased emphasis on securing the pharmaceutical supply chain. Security labels, including tamper-evident and anti-counterfeit labels, play a vital role in verifying the authenticity of medications and medical devices. Regulatory mandates, such as serialization and track-and-trace systems, have further propelled the adoption of advanced security labeling solutions.

Regional Insights

North America dominated with a revenue share of over 38.0% in 2023, owing to a combination of stringent regulatory frameworks, high consumer awareness, and a robust industrial base. The region's stringent regulations, particularly in the pharmaceutical and food and beverage sectors, necessitate the use of advanced security labels to ensure product safety and authenticity. High consumer awareness about product tampering and counterfeiting has further driven demand for security labels. In addition, North America's strong industrial base, with numerous leading manufacturers in various sectors, has supported the widespread adoption of security labels.

U.S. Security Labels Market Trends

The U.S. security labels market is expected to grow at a CAGR of 4.9% from 2024 to 2030. The U.S. is home to numerous leading manufacturers and technology innovators, fostering the development and adoption of advanced security labeling solutions. In addition, strong consumer awareness about product safety and authenticity further bolsters the demand for security labels, solidifying the U.S.'s high share in the market.

Europe Security Labels Market Trends

The security labels market in the European region is expected to witness significant growth over the forecast period. European Union regulations, such as the Falsified Medicines Directive (FMD) for pharmaceuticals and strict labeling requirements for food and beverages, have driven the adoption of security labels. High consumer awareness about the risks of counterfeit products and a growing demand for verified, safe goods have further propelled the market.

Asia Pacific Security Labels Market Trends

The security labels market in the Asia Pacific region is anticipated to register rapid growth over the forecast period. The region's booming manufacturing sector, particularly in China and India, has increased the need for security labels to ensure product authenticity and safety across various industries, including pharmaceuticals, electronics, and consumer goods.

Key Security Labels Company Insights

Key security labels companies include 3M, AVERY DENNISON CORPORATION., CCL Industries, Zebra Technologies Corp., and Brady Worldwide, Inc. Companies active in the security labels market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ Pattern development. For instance, In May 2024, The Biden-Harris administration launched the U.S. Cyber Trust Mark initiative to enhance cybersecurity for smart devices.

This program aims to label smart products such as refrigerators, security cameras, and other internet-connected appliances that meet stringent federal cybersecurity standards. The initiative, proposed by FCC Chairwoman Jessica Rosenworcel, will help consumers make informed choices and ensure their devices are less vulnerable to hacking. It also includes a QR code linking to a national registry of certified devices for up-to-date security information.

Key Security Labels Companies:

The following are the leading companies in the security labels market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- AVERY DENNISON CORPORATION.

- CCL Industries

- Zebra Technologies Corp.

- Brady Worldwide, Inc.

- UPM-Kymmene Corporation

- Honeywell International, Inc.

- MEGA FORTRIS GROUP

- tesa Tapes (India) Private Limited

- Invengo Information Technology Co., Ltd.

Recent Developments

-

In March 2024, Resource Label Group, LLC, a comprehensive provider of packaging and label solutions including flexible packaging, pressure-sensitive labels, shrink sleeves, durable labels, folding cartons, and RFID/NFC technology, announced its acquisition of Labelcraft, which has facilities in Toronto, Canada, and Dallas, TX, U.S.

-

In February 2024, Coveris finalized a strategic acquisition in Central and Eastern Europe by purchasing S&K LABEL spol. s r.o. in the Czech Republic. This acquisition represents a significant opportunity for Coveris to ensure a supply of locally produced, high-quality labels, addressing both current and future demand for sustainable labeling solutions.

-

In January 2024, All4Labels Group GmbH launched INTEGRITAG, a new entity in Milan focused on secure and intelligent label solutions. This move enhances its global technological footprint by integrating advanced solutions such as RFID, holographic security, and high-security labeling. INTEGRITAG aims to optimize supply chain efficiencies, protect brands, and enhance consumer engagement.

Security Labels Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 33.92 billion

Revenue forecast in 2030

USD 50.10 billion

Growth rate

CAGR of 6.7% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, pattern, application, end user, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

3M; AVERY DENNISON CORPORATION.; CCL Industries; Zebra Technologies Corp.; Brady Worldwide, Inc.; UPM-Kymmene Corporation; Honeywell International, Inc.; MEGA FORTRIS GROUP; tesa Tapes (India) Private Limited; Invengo Information Pattern Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Security Labels Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global security labels market report based on product, material, pattern, application, end user, and region.

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Barcode

-

Holographic Labels

-

Radio Frequency Identification (RFIDs)

-

Electronic Article Surveillance (EAS)

-

Near Field Communication (NFC)

-

Others

-

-

Material Outlook (Revenue, USD Billion, 2017 - 2030)

-

Plastic

-

Foam (EPS)

-

Foil

-

Paper

-

-

Pattern Outlook (Revenue, USD Billion, 2017 - 2030)

-

VOID

-

Checkboard

-

Destructible

-

Other Customized Patterns

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Bottles & Jars

-

Boxes & Cartons

-

Bags & Pouches

-

Others

-

-

End User Outlook (Revenue, USD Billion, 2017 - 2030)

-

Food & Beverage Industry

-

Healthcare & Pharmaceutical Industry

-

Chemicals & Fertilizers Industry

-

Electrical & Electronics Industry

-

Personal Care & Cosmetics Industry

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global security labels market size was estimated at USD 31.85 billion in 2023 and is expected to reach USD 33.92 billion in 2024.

b. The global security labels market is expected to grow at a compound annual growth rate of 6.7% from 2024 to 2030 to reach USD 50.10 billion by 2030.

b. North America dominated the security labels market with a share of 38.9% in 2023, owing to a combination of stringent regulatory frameworks, high consumer awareness, and a robust industrial base.

b. Some key players operating in the security labels market include 3M, AVERY DENNISON CORPORATION., CCL Industries, Zebra Technologies Corp., Brady Worldwide, Inc., UPM-Kymmene Corporation, Honeywell International, Inc., MEGA FORTRIS GROUP, tesa Tapes (India) Private Limited, Invengo Information Pattern Type Co., Ltd.

b. Key factors that are driving the security labels market growth include the rise in counterfeiting across various industries and consumer awareness and demand for product safety.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.