- Home

- »

- Next Generation Technologies

- »

-

Security Services Market Size, Share & Trends Report, 2030GVR Report cover

![Security Services Market Size, Share & Trends Report]()

Security Services Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Managed Security Services, SaaS Security Services) By Application (BFSI, Healthcare), By Region (Asia Pacific, North America), And Segment Forecasts

- Report ID: GVR-4-68040-163-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Security Services Market Summary

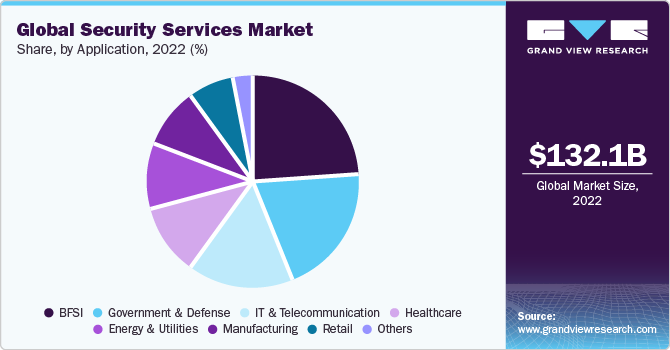

The global security services market size was estimated at USD 132.11 billion in 2022 and is projected to reach USD 212.36 billion by 2030, growing at a CAGR of 6.2% from 2023 to 2030. With increased possible threats in recent years, ranging from computer viruses & terrorism to organized crime & fraud, security has become important.

Key Market Trends & Insights

- North America held the highest share of 32.6% in 2022.

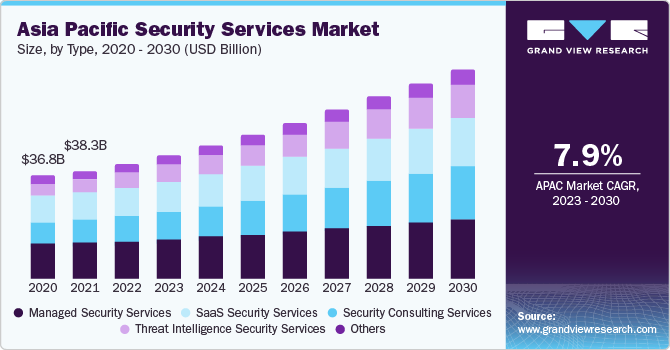

- Asia Pacific is anticipated to witness a CAGR of 7.9% from 2023 to 2030.

- By application, the BFSI segment held the highest revenue share of 24.2% in 2022.

- By type, the managed security services segment held a significant revenue share of 32.4% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 132.11 Billion

- 2030 Projected Market Size: USD 212.36 Billion

- CAGR (2023-2030): 6.2%

- North America: Largest market in 2022

As a result, the focus on security issues is increasing and the demand for security-related goods & services is steadily growing, giving rise to a wide range of economic activities in both the government domain and business sector. The advancement of technology is partially driving the market demand. A further significant factor contributing to security concerns is globalization.

For instance, growing international trade encourages more travel by passengers and freight. The expansion of air, rail, road, and maritime transportation raises the possibility of security lapses that lead to robberies and organized smuggling, which encourages governments to strengthen cross-border surveillance. Growing immigration reduces a nation's capacity to thwart covert threats and, in certain situations, increases the sense of unease among local populations. Communications and supply chains have become more global, specialized, and fragmented due to the increasing internationalization of production operations, creating unique vulnerabilities.

The technology used to perform security activities has grown significantly, which has coincided with an overall increase in security activity. Products for monitoring and identification, for instance, are estimated to be worth USD 15 billion. These goods, which consist of biometrics, perimeter control, and access control, form the "backbone" of business security systems. Subsequently, fostering the market growth. Furthermore, institutional, and organizational reforms have been implemented in response to the increased awareness of security concerns, and these changes are having.

They will continue to have a substantial influence on the volume and composition of the market for security products and services. Governments everywhere have been examining their national identification systems, from the processes of issuing them to the processes of having law enforcement or customs verify the legitimacy of the documents. Many public facilities and organizations have tightened their ID security as a result. In addition to passports, governments have been seeking to modernize other security documents, including driving licenses, voter registration cards, visas, and ID cards.

Application Insights

The BFSI segment held the highest revenue share of 24.2% in 2022. Revenues obtained by companies offering cloud security, biometric technologies, and endpoint detection and response to the BFSI sector make up the security services industry. The value of goods sold by the producers or manufacturers of the items, whether to third parties or directly to end-users, is known as "factory gate" value in this market. Cyberattacks, including skilled hackers carrying out premeditated breaches, thefts, invasions, data thefts, viruses, and phishing attacks, have increased in the BFSI industry causing major financial loss and anguish. Enforcing cyber security and preventing data breaches with endpoint detection and response (EDR), biometric technology, cloud security, code audit, and embedded system security evaluation is necessary due to the multiple planned breaches in the BSFI sector.

The healthcare segment is expected to hold the second-largest CAGR from 2023 to 2030 as in many health institutions, security problems are becoming more prevalent. The security system in any hospital protects the building physically. The market for healthcare security systems is mostly driven by the increased need to secure healthcare facilities. Information is more vulnerable in various health infrastructures. The security system enables both advanced monitoring and access control. The information may be verified and authenticated with the help of healthcare security solutions. The market for hospital security systems is also significantly influenced by the frequency of vandalism and security risks. The increasing data theft is leading to more adoption of security solutions.

Type Insights

The managed security services segment held a significant revenue share of 32.4% in 2022. The managed security services capabilities include exposure assessment, detection and response, security monitoring, and operational services specific to security technology implementation and consulting. MSS providers offer a wide range of engagement models with technology-based management-driven experience. Managed security services have become the systematic approach to growing business requirements. Outsourcing has become prevalent and viable for many SMEs and large enterprises.

Threat intelligence security services is expected to register a CAGR of 9.5% from 2023 to 2030. Rising cybercrime cases in both developed and emerging nations have raised concerns for companies. Governments and other large enterprises are attempting to close the gap between the amount of money spent on cybersecurity systems and the best outcome possible with the threat artifacts gathered to lessen or neutralize emerging threats. The applicability and usefulness of intelligence have led organizations to integrate contextual information and data points to determine relevant threats to the business and thus provide actionable strategies towards the same.

Regional Insights

North America held the highest share of 32.6% in 2022. Various initiatives by major players in the region are augmenting its growth. Moreover, significant growth of SaaS Security Services is augmenting market growth. Increasing secret organizational data, rise in cybercrime activities, and development of mobile device trends are the main factors driving regional market. The extensive usage of cloud technologies has augmented the demand for more dependable and affordable security solutions. Significant market prospects are created by the rise of e-business, growing awareness about data protection, the growing “bring-your-own-device (BYOD)” trend, and acceptance of managed security measures.

Asia Pacific is anticipated to witness a CAGR of 7.9% from 2023 to 2030. Several firms in this region are predicted to contribute substantially to the market's growth throughout the forecast period by implementing cloud-based solutions and boosting data security investments. Furthermore, rising spending due to organizations' adoption of cutting-edge technologies, such as cloud-based technology and advanced technology for company development, is expected to contribute to market growth. The Indian government's cybersecurity activities have resulted in a rapid restructuring of the governance structure, underscoring the necessity for strong governance.

Key Companies & Market Share Insights

Prominent firms have used product launches and developments, followed by expansions, M&As, contracts, agreements, partnerships, and collaborations, as their primary business strategy to increase their market share. Companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, in May 2023, Alfar Capital and Walter Capital Partners completed the acquisition of MSP Corp, a managed IT service provider in Canada. The MSP Corp would merge with Groupe Access, an MSP of IT and cybersecurity solutions. The acquisition would help the company to deliver cutting-edge solutions and strengthen its position in Canada.

IBM Corporation accounts for a major share of the global threat intelligence market. The company offers IBM X-Force Exchange, a cloud-based threat intelligence platform that allows an organization or agency to consume, share, and act on malicious activity. The company introduced the Threat Feed Manager, which enables simplifying the data integration without getting out of various sources by putting it into one view. IBM Security also offers an integrated and intelligent security immune system that eliminates the traditional approach of defense strategy or technology to an existing disjoint and fragmented IT infrastructure. Key players are primarily investing in new product development & product portfolio expansion to provide affordable and dependable security services solutions.

They also focus on improving cloud services to support the incumbents in various end-use sectors as they undergo digital transformation. For instance, in January 2023, Rackspace Technology, a multi-cloud technology solutions provider, launched Rackspace Technology Modern Operations, a managed service for public cloud for customers across Azure, AWS, and GCP. The service will provide benefits including 24x7x365 managed support, cloud expertise, cloud resiliency, and innovation with cloud services, which help the company’s customers manage complex cloud environments.

Key Security Services Companies:

- Symantec Corporation

- IBM

- Accenture

- Dell Inc.

- Cisco Systems, Inc.

- Check Point Software Technologies Ltd.

- Microsoft Corporation

- Raytheon

- Trellix

- Capgemini

- Fortinet, Inc.

- Fujitsu

Security Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 138.97 billion

Revenue forecast in 2030

USD 212.36 billion

Growth rate

CAGR of 6.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

Symantec Corp.; IBM; Accenture; Dell Inc.; Cisco Systems; Check Point Software Technologies Ltd.; Microsoft Corp.; Raytheon; Trellix; Capgemini; Fortinet, Inc.; Fujitsu

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Security Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global security services market report based on type, application, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Managed Security Services

-

Security Consulting Services

-

SaaS Security Services

-

Threat Intelligence Security Services

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Government & Defense

-

IT & Telecommunication

-

Healthcare

-

Energy & Utilities

-

Manufacturing

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

Kingdom of Saudi Arabia (KSA)

-

UAE (United Arab Emirates)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global security services market size was estimated at USD 132.11 billion in 2022 and is expected to reach USD 138.97 billion in 2023.

b. The global security services market is expected to grow at a compound annual growth rate of 6.2% from 2023 to 2030 to reach USD 212.36 billion by 2030.

b. North America accounted for the highest share, with over 32.6% of the global revenue in 2022. Significant initiatives by major players in the region are augmenting the market growth. Moreover, the significant growth of SaaS Security Services is augmenting market growth.

b. Some key players operating in the security services market include Symantec Corporation IBM, Accenture, Dell Inc., Cisco Systems, Inc., Check Point Software Technologies Ltd., Microsoft corporation, Raytheon, Trellix; among others.

b. The advancement of technology is partially driving the increasing demand in security services market worldwide. A further significant factor contributing to security concerns is globalization. For instance, growing international trade encourages more travel by passengers and freight. The expansion of air, rail, road, and maritime transportation raises the possibility of security lapses that lead to robberies and organized smuggling, which encourages governments to strengthen cross-border surveillance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.