- Home

- »

- Network Security

- »

-

Security Testing Market Size & Share, Industry Report, 2033GVR Report cover

![Security Testing Market Size, Share & Trends Report]()

Security Testing Market (2025 - 2033) Size, Share & Trends Analysis Report By Type, By Technology, By Deployment (On-premises, Cloud), By Organization Size, By End-use (Retail & E-commerce, Healthcare & Life Sciences, BFSI), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-699-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Security Testing Market Summary

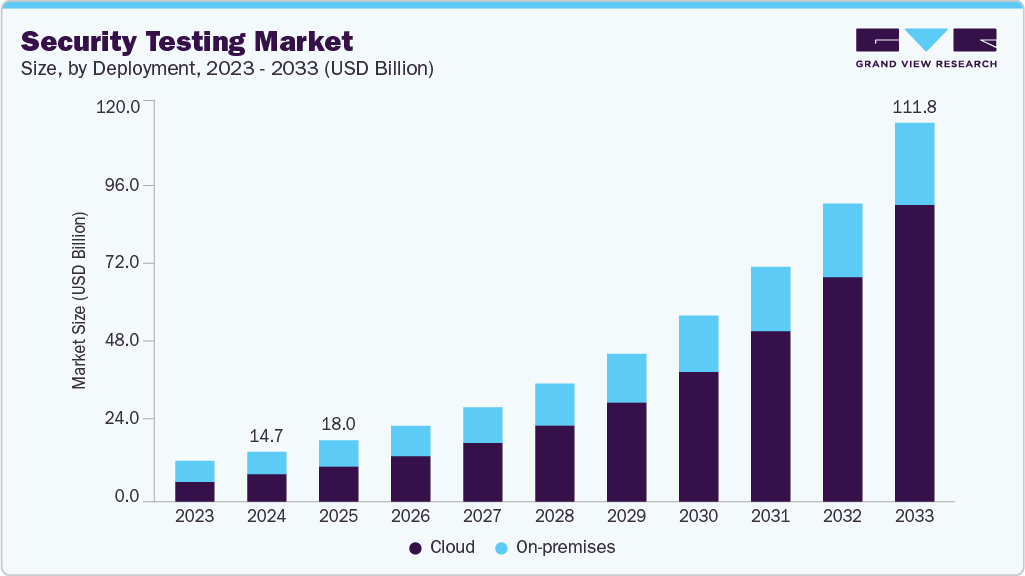

The global security testing market size was estimated at USD 14.67 billion in 2024 and is projected to reach USD 111.76 billion by 2033, growing at a CAGR of 25.6% from 2025 to 2033. This growth is driven by the surge in cyberattacks and data breaches, rapid cloud adoption and digital transformation, proliferation of IoT and mobile devices, growing adoption of BYOD and remote work models, and regulatory and compliance requirements.

Key Market Trends & Insights

- North America dominated the global security testing market with the largest revenue share of 36.3% in 2024.

- The security testing market in the U.S. led the North America market and held the largest revenue share in 2024.

- By type, network security testing segment led the market in 2024, accounting for over 38% of global revenue.

- By deployment, cloud segment held the dominant position in the market.

- By organization size, large enterprises segment held the dominant position in the market.

Market Size & Forecast

- 2024 Market Size: USD 14.67 Billion

- 2033 Projected Market Size: USD 111.76 Billion

- CAGR (2025-2033): 25.6%

- North America: Largest Market in 2024

- Asia Pacific: Fastest Growing Market

The increasing volume of cyberattacks has made security testing an essential component of enterprise risk management strategies. Organizations across industries are adopting numerous security testing tools to identify vulnerabilities before threat actors exploit them. Moreover, stringent regulatory frameworks such as General Data Protection Regulation (GDPR), and Health Insurance Portability and Accountability Act (HIPAA) require regular security assessments, pushing enterprises to invest in comprehensive testing solutions. Increasing digitalization, coupled with the integration of IoT, cloud, and mobile technologies, further expands the attack surface, necessitating robust security protocols. This growing need to maintain compliance and safeguard sensitive data is a significant driver accelerating the demand for security testing solutions globally.Businesses increasingly transition to cloud-native infrastructures and deploy dynamic web and mobile applications, and security testing has become vital to ensure secure digital operations. The growing adoption of DevOps and agile development practices fuels demand for continuous security testing integrated within CI/CD pipelines. Organizations are emphasizing application security testing (AST), including static and dynamic analysis, to mitigate risks during development stages. Cloud security testing is witnessing exponential growth with SaaS, PaaS, and IaaS platforms becoming core business enablers. This shift in enterprise IT architecture underlines the growing reliance on scalable, automated, and real-time security testing services.

Technological advancements are transforming the security testing market by enabling smarter, faster, and more accurate vulnerability detection. Integration of artificial intelligence (AI) and machine learning (ML) in testing tools allows predictive analytics, anomaly detection, and real-time threat response, enhancing overall testing efficiency. Automated security testing tools are gaining traction as they reduce human error and deliver consistent, scalable solutions. Furthermore, the rise of penetration testing-as-a-service (PTaaS) and managed security services provide flexible options for businesses of all sizes. These innovations improve test coverage and speed, and make security testing more accessible and cost-effective across diverse industries.

Type Insights

The network security testing segment led the market in 2024, accounting for over 38% of global revenue. The network security testing market is driven by the rising frequency of cyberattacks targeting enterprise networks, coupled with the need to safeguard sensitive data and maintain uninterrupted operations. Organizations are expanding their digital infrastructure, including cloud, IoT, and remote work environments, the complexity of network vulnerabilities increases. Compliance with regulatory mandates such as GDPR, HIPAA, and ISO 27001 further compels enterprises to implement regular network security assessments. In addition, the growing demand for real-time threat detection, automated testing tools, and managed security services is accelerating market growth. Enterprises are prioritizing proactive network security strategies to mitigate risks and enhance cyber resilience.

The application security testing segment is predicted to experience the fastest growth in the forecast years. The application security testing market is driven by the rapid growth of web, mobile, and cloud-based applications, which has significantly increased the attack surface for cyber threats. As businesses are undergoing digital transformation and agile development practices, identifying and fixing vulnerabilities early in the software development lifecycle is becoming critical. Regulatory mandates such as GDPR, HIPAA, and OWASP compliance require rigorous application-level security checks. Additionally, the adoption of DevSecOps, integration of automated testing tools, and demand for real-time security analytics are accelerating market growth. Organizations are prioritizing application security to protect data integrity, customer trust, and brand reputation.

Deployment Insights

The cloud segment accounted for the prominent market revenue share in 2024. The cloud-based security testing market is driven by the widespread adoption of cloud computing across industries, necessitating robust and scalable security solutions. As enterprises migrate critical workloads and data to public, private, and hybrid cloud environments, the demand for continuous and automated security testing is rising. Cloud-native applications and dynamic infrastructures require real-time vulnerability assessments to mitigate evolving threats. Additionally, regulatory compliance requirements and the increasing need for cost-efficient, on-demand testing capabilities are propelling market growth. Integration with DevOps pipelines and the emergence of AI-driven testing tools further enhance detection accuracy, making cloud-based security testing a strategic priority for digital-first enterprises.

The on-premises segment is anticipated to grow significantly during the forecast period. Organizations requiring full control over their data, infrastructure, and compliance processes drive the on-premises security testing market. Industries with stringent regulatory and data sovereignty requirements such as government, defense, and finance favor on-premises solutions to maintain confidentiality and reduce third-party risks. The rise in targeted cyberattacks and insider threats has heightened the need for robust in-house security assessment tools. In addition, businesses with legacy systems and complex IT environments often opt for on-premises testing to ensure compatibility and seamless integration. Customization, enhanced data privacy, and reduced dependency on external networks position on-premises security testing as a crucial component of enterprise cybersecurity strategies.

Organization Size Insights

The large enterprises segment accounted for the largest market revenue share in 2024. The large enterprises’ segment in the security testing market is propelled by their complex IT infrastructures and substantial digital assets, which demand comprehensive and continuous security assessments. These organizations face heightened risks from cyber threats, making vulnerability detection and mitigation essential to safeguard sensitive data and maintain business continuity. Strict regulatory compliance requirements across industries such as BFSI, healthcare, and government drive large enterprises to invest heavily in advanced security testing solutions. Moreover, large enterprises often lead digital transformation initiatives, adopting cloud, IoT, and DevOps, further increasing the need for integrated, scalable, and automated security testing frameworks.

The SMEs segment is expected to grow at the fastest CAGR during the forecast period due to the increasing awareness of cybersecurity risks and the rising frequency of cyberattacks targeting smaller businesses. Limited IT resources and budgets compel SMEs to adopt cost-effective, scalable security testing solutions, often leveraging cloud-based and automated tools. Regulatory pressures, such as data protection laws, are driving SMEs to comply with security standards to avoid penalties and reputational damage. The growing adoption of digital technologies and remote work models among SMEs further expands their attack surface, fueling demand for accessible and easy-to-deploy security testing services that safeguard critical business assets and customer information.

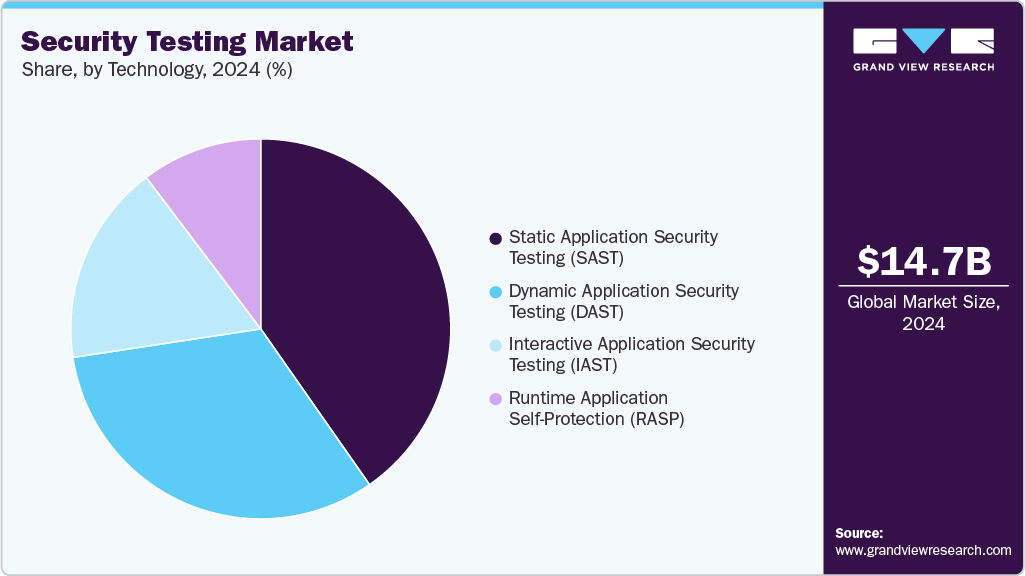

Technology Insights

The Static Application Security Testing (SAST) segment accounted for the largest market revenue share in 2024, driven by the increasing need for early detection of vulnerabilities within the software development lifecycle. As organizations adopt DevSecOps and agile methodologies, integrating SAST enables developers to identify and remediate security vulnerabilities during the coding phase, reducing costs and risks associated with post-deployment fixes. Compliance mandates such as OWASP, GDPR, and HIPAA emphasize secure coding practices, further accelerating SAST adoption. In addition, advancements in automation and AI-powered analysis improve SAST accuracy and efficiency. Growing awareness about securing source code and proprietary intellectual property fuels demand for robust static testing solutions across industries.

The Runtime Application Self-Protection (RASP) segment is expected to grow to the fastest CAGR over the forecast period due to the growing demand for real-time, in-application threat detection and prevention. As cyberattacks become more advanced, organizations seek solutions that offer continuous monitoring and automatic response within running applications, minimizing damage from zero-day vulnerabilities and insider threats. The rise of dynamic application environments, including cloud-native and microservices architectures, increases the need for adaptive security measures such as RASP. Additionally, compliance requirements and the shift towards DevSecOps practices emphasize embedding security directly into applications, fueling adoption. Progress in machine learning and behavioral analytics further boosts RASP’s effectiveness, driving faster market expansion across various industries.

End-use Insights

The BFSI segment accounted for the largest market revenue share in 2024 due to the increasing cyberattacks targeting financial data and digital banking infrastructure. Moreover, there is increasing digitalization across banking services, such as mobile banking, online payments, and blockchain-based transactions. In addition, there is a heightened demand for proactive security testing solutions to safeguard sensitive customer information and ensure regulatory compliance. Furthermore, stringent data protection regulations such as GDPR, PCI DSS, and region-specific frameworks are compelling BFSI institutions to adopt continuous vulnerability assessment, penetration testing, and application security practices. The rising focus on customer trust and operational resilience further accelerates investments in advanced security testing tools.

The healthcare & life sciences segment is anticipated to grow at the fastest CAGR during the forecasted period driven by the surge in digital health records, telemedicine platforms, and connected medical devices. The increasing volume of sensitive patient data, coupled with strict regulatory frameworks such as HIPAA (Health Insurance Portability and Accountability Act), and GDPR, necessitates rigorous security testing to ensure data privacy and system integrity. The sector’s vulnerability to ransomware attacks and data breaches has intensified the need for application and network security assessments. In addition, the adoption of AI-powered diagnostics, cloud-based healthcare solutions, and IoT-enabled medical infrastructure further reinforces the demand for comprehensive, real-time security testing to protect crucial health systems and patients’ data.

Regional Insights

North America security testing market dominated the global market with a revenue share of 36.3% in 2024. North American organizations face increasingly security threats such as, ransomware, phishing, malware, and high-profile breaches, fueling the demand for proactive security testing such as, penetration tests and vulnerability scanning. The growing financial and reputational fallout from attacks underscores testing as a core risk mitigation strategy. Furthermore, strict frameworks including HIPAA, CCPA (California Consumer Privacy Act), SOX (Sarbanes-Oxley Act), and FERC (Family Educational Rights and Privacy Act) require organizations to conduct testing to avoid penalties and protect sensitive data. The need for compliance continues to push investment in advanced testing solutions across sectors

U.S. Security Testing Market Trends

The U.S. security testing industry is expected to grow significantly in 2024 due to the rising frequency and complexity of cyber threats, widespread adoption of cloud services, and stringent regulatory frameworks such as HIPAA, SOX, and CCPA. Enterprises are increasingly integrating security testing into DevOps pipelines through DevSecOps practices, emphasizing automation and shift-left testing approaches. Demand for static (SAST), dynamic (DAST), and interactive (IAST) testing tools is rising, along with interest in AI-driven and Testing-as-a-Service (TaaS) solutions. However, the market faces various challenges such as, shortage of skilled professionals, high implementation costs, and managing false positives, which require strategic investments and vendor support.

Europe Security Testing Market Trends

The security testing market in Europe is expected to grow significantly over the forecast period. Organizations across various sectors such as, BFSI, healthcare, and manufacturing are prioritizing application and cloud-based security testing. The adoption of DevSecOps practices and automation tools is accelerating, enabling early vulnerability detection and faster remediation. Penetration testing remains a key area, while interactive application security testing (IAST) is emerging as a fast-growing segment. As cyber threats are rising, demand for comprehensive and scalable security testing solutions continues to rise across the region.

Asia Pacific Security Testing Market Trends

The security testing industry in the Asia Pacific region is anticipated to be at the fastest CAGR over the forecast period, driven by rising cyber threats, digital transformation across various sectors such as, BFSI, healthcare, and retail, and increasing adoption of cloud and IoT technologies. Regulatory frameworks such as GDPR and region-specific cybersecurity laws are compelling organizations to enhance their security measures. The integration of AI and machine learning into security testing tools, along with the rise of DevSecOps practices, is further propelling market growth.

Key Security Testing Company Insights

Some key companies in the security testing industry are IBM Corporation, Google LLC, X Corp., and Microsoft.

-

Synopsys, Inc. is a prominent player in the security testing market due to its comprehensive and scalable application security portfolio, encompassing Static Application Security Testing (SAST), Interactive Application Security Testing (IAST), and Software Composition Analysis (SCA). Its industry-leading tools such as, Coverity, Seeker, and Black Duck enable enterprises to identify and remediate vulnerabilities early in the development lifecycle, supporting secure DevOps adoption. Synopsys provides robust analytics, seamless CI/CD integration, and broad language support.

-

Veracode is a key player in the security testing market, offering a robust, cloud-native platform that integrates Static Application Security Testing (SAST), Dynamic Application Security Testing (DAST), and Software Composition Analysis (SCA). Veracode enables organizations to embed security into every phase of the software development lifecycle designed for scalability and rapid deployment. Its seamless CI/CD pipeline integration, low false positive rates, and actionable insights empower development teams to remediate vulnerabilities efficiently. Veracode’s SaaS model delivers flexibility and cost-efficiency.

Key Security Testing Companies:

The following are the leading companies in the security testing market. These companies collectively hold the largest market share and dictate industry trends.

- Synopsys, Inc.

- Veracode

- Checkmarx Ltd.

- IBM Corporation

- Contrast Security

- Rapid7

- Qualys, Inc.

- HCL Technologies Limited

- PortSwigger Ltd.

- ImmuniWeb SA

Recent Developments

-

In July 2025, Okta, Inc., a company specializing in security testing, broadened its collaboration with cybersecurity firm Palo Alto Networks to create a unified security structure. This partnership supports organizations in automating threat responses, securing application access across all devices, and reducing security-related disruptions. The integration of Okta Workforce Identity with Palo Alto Networks’ Prisma Access Browser introduces a conditional access feature, restricting SSO application access to a secure browser environment. Furthermore, Okta AI-powered Identity Threat Protection has been integrated with Palo Alto Networks’ Cortex SecOps platform, enhancing visibility into identity-related threats across digital systems. The extended compatibility with Cortex XSIAM and Cortex XDR further strengthens coordinated defenses against advanced cyber threats.

-

In June 2025, Cobalt, security services provider, introduced a series of advanced enhancements to its Offensive Security Platform, designed to assist organizations scale their security testing platform with increased transparency, automation, and control. These updates reinforce the company’s dedication to delivering expert-led, rapid-deployment penetration testing, featuring more comprehensive data insights and optimized workflows.

-

In October 2024, CyCognito, AI based security testing product provider, introduced various improvements to its CyCognito Automated Security Testing (AST) solution, part of the CyCognito platform designed for automated exposure validation and security assessments. These updates accelerate the setup of automated testing within Amazon Web Services (AWS) cloud environments, enhance detection of data exposures, and support penetration testers by automating reconnaissance and prioritizing identified vulnerabilities.

Security Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.05 billion

Revenue forecast in 2033

USD 111.76 billion

Growth rate

CAGR of 25.6% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, organization size, technology, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Synopsys, Inc.; Veracode; Checkmarx Ltd.; IBM Corporation; Contrast Security; Rapid7; Qualys, Inc.; HCL Technologies Limited; PortSwigger Ltd.; ImmuniWeb SA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Security Testing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented global security testing market report based on type, deployment, organization size, technology, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Application Security Testing

-

API Security Testing

-

Web Application Security Testing

-

Mobile Application Security Testing

-

-

Network Security Testing

-

Vulnerability Scanning

-

Penetration Testing

-

Firewall & Intrusion Detection System Testing

-

Wireless Network Security Testing

-

Network Configuration Auditing

-

-

Device Security Testing

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Static Application Security Testing (SAST)

-

Dynamic Application Security Testing (DAST)

-

Interactive Application Security Testing (IAST)

-

Runtime Application Self-Protection (RASP)

-

-

Organization Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Enterprises

-

SMEs

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-premises

-

Cloud

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail & E-commerce

-

Healthcare & Life Sciences

-

BFSI

-

Government and Defense

-

Automotive

-

Energy & Utilities

-

IT & Telecommunication

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global security testing market size was estimated at USD 14.67 billion in 2024 and is expected to reach USD 18.05 billion in 2025.

b. The global security testing market is expected to grow at a compound annual growth rate of 25.6% from 2025 to 2030 to reach USD 111.76 billion by 2033.

b. North America dominated the security testing market with a share of 36.3% in 2024. North American organizations face increasingly security threats such as, ransomware, phishing, malware, and high-profile breaches, fuel demand for proactive security testing such as, penetration tests and vulnerability scanning. The growing financial and reputational fallout from attacks underscores testing as a core risk mitigation strategy. Furthermore, strict frameworks including HIPAA, CCPA (California Consumer Privacy Act), SOX (Sarbanes-Oxley Act), and FERC (Family Educational Rights and Privacy Act) require organizations to conduct testing to avoid penalties and protect sensitive data.

b. Some key players operating in the security testing market include Synopsys, Inc.; Veracode; Checkmarx Ltd.; IBM Corporation; Contrast Security; Rapid7; Qualys, Inc.; HCL Technologies Limited; PortSwigger Ltd.; and ImmuniWeb SA.

b. Key factors that are driving the security testing market growth include the surge in cyberattacks and data breaches, rapid cloud adoption and digital transformation, proliferation of IoT and mobile devices, growing adoption of BYOD and remote work models, and regulatory and compliance requirements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.