- Home

- »

- Plastics, Polymers & Resins

- »

-

Self-Adhesive Labels Market Size And Share Report, 2030GVR Report cover

![Self-Adhesive Labels Market Size, Share & Trends Report]()

Self-Adhesive Labels Market (2024 - 2030) Size, Share & Trends Analysis Report By Composition (Facestock, Adhesives), By Type (Release Liner, Linerless) By Technology (Flexography, Digital Printing), By Nature, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-362-5

- Number of Report Pages: 220

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Self-Adhesive Labels Market Summary

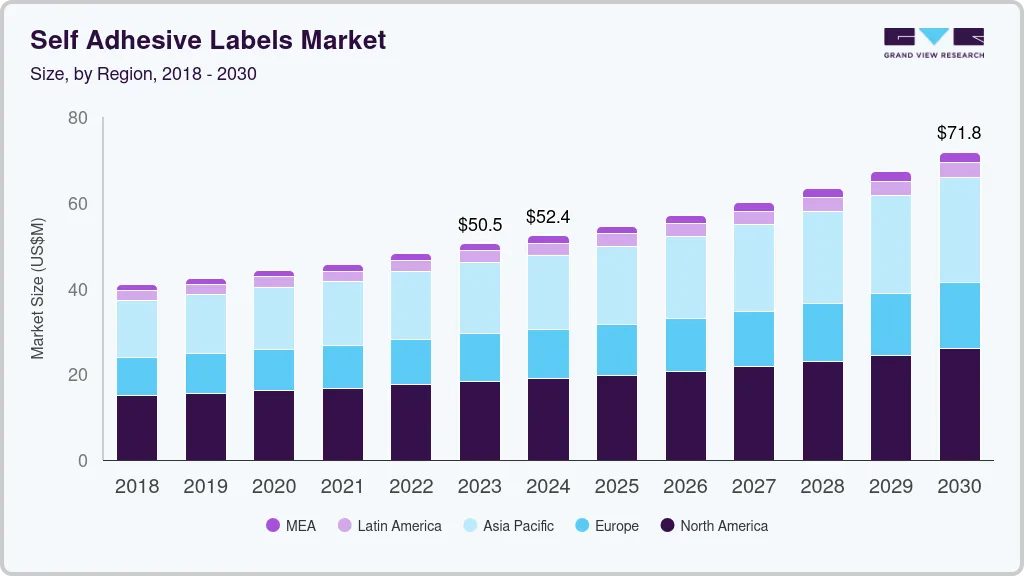

The global self adhesive labels market size was estimated at USD 50.47 billion in 2023 and is projected to reach USD 71.80 billion by 2030, growing at a CAGR of 5.4% from 2024 to 2030. The market is experiencing robust growth driven by the increasing demand for packaged goods, particularly in the food and beverage, personal care, and pharmaceuticals industries.

Key Market Trends & Insights

- North America holds the largest market share in the global market.

- By composition, adhesives segment held the largest market share of 85% in 2023.

- By type, release liners segment dominated the self-adhesive labels market and accounted for largest revenue share of over 74% in 2023.

- By nature, permanent labels segment held the largest market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 50.47 Billion

- 2030 Projected Market Size: USD 71.80 Billion

- CAGR (2024-2030): 5.4%

- North America: Largest market in 2023

As consumers seek convenience and product information, the need for high-quality, informative, and aesthetically pleasing labels is rising. Another critical driver is the advancement in labeling technologies. Innovations such as smart labels, which incorporate QR codes and RFID tags for better tracking and consumer engagement, are gaining traction. For example, Avery Dennison launched its new range of sustainable self-adhesive labels that reduce environmental impact, highlighting the trend towards eco-friendly products. Additionally, regulatory requirements for product information, safety, and traceability are pushing manufacturers to adopt advanced labeling solutions. In emerging markets, urbanization and increased consumer spending are leading to higher demand for labeled products.

Opportunities in the market are also emerging from the shift towards sustainable materials. With increasing environmental concerns, there is a growing preference for labels made from recyclable and biodegradable materials. Companies like UPM Raflatac are investing in developing sustainable facestock and adhesives, opening new avenues for growth. The rise of e-commerce also presents significant opportunities, as online retailers require efficient labeling solutions for logistics and branding purposes.

Composition Insights

Adhesives held the largest market share of 85% in 2023. Hot melt adhesives are preferred for their strong bonding capabilities and quick setting times, making them suitable for high-speed production lines. Acrylic adhesives are witnessing the fastest-growing CAGR due to their versatility and superior performance in various environmental conditions, including resistance to UV light and chemicals.

Among Facestock Paper-based is the fastest growing due to its cost-effectiveness and versatility. It is widely used in various industries, including food and beverages and retail. Plastic facestock is also driven by its durability and aesthetic appeal. It is particularly popular in personal care and household products.

Type Insights

Release liners segment dominated the self-adhesive labels market and accounted for largest revenue share of over 74% in 2023. Release liners hold the highest market share due to their wide usage across multiple industries for their reliability and ease of use. They also have the fastest-growing CAGR as innovations in liner materials and recycling processes boost their appeal.

Linerless labels are gaining traction due to their eco-friendly nature, as they eliminate the waste associated with release liners. Their market share is growing as companies seek sustainable labeling solutions.

Printing Technology Insights

Flexography holds the highest market share due to its cost-effectiveness and versatility in printing on various substrates. It also has the fastest-growing CAGR, driven by advancements in flexographic printing technology that improve print quality and efficiency.

Digital printing is gaining popularity for its ability to produce high-quality, customized labels with shorter turnaround times. The segment is growing rapidly due to increasing demand for personalized packaging and short-run label production.

Nature Insights

Permanent labels segment held the largest market share in 2023, due to their strong adhesive properties, making them ideal for products requiring long-term durability. They also exhibit the fastest-growing CAGR as industries such as pharmaceuticals and logistics demand reliable, tamper-proof labeling solutions.

Removable labels are used for temporary applications, while repositionable labels cater to needs where the label position may need adjusting. Both segments are growing steadily as they find applications in retail and logistics.

Application Insights

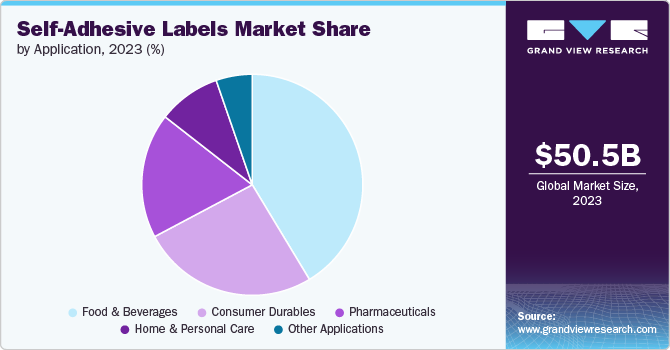

The food and beverages segment held the largest market share of over 54% in 2023, due to the extensive use of labels for product information, branding, and regulatory compliance. The demand for labels in this sector is driven by the need for product differentiation and the growing trend of packaged and convenience foods.

The pharmaceuticals segment is the fastest-growing due to stringent regulatory requirements for labeling, including information on dosage, expiration dates, and safety instructions. The increasing demand for over-the-counter drugs and the growth of the pharmaceutical industry contribute to this segment's rapid expansion.

Other applications include automotive, logistics, and industrial products, where labels are used for tracking, inventory management, and compliance with industry standards. This segment is also witnessing growth due to the increasing need for efficient and reliable labeling solutions across various industries.

Regional Insights

North America holds the largest market share in the global market. The region's dominance can be attributed to the robust growth of industries such as food and beverages, pharmaceuticals, and retail. The increasing demand for packaged goods and stringent labeling regulations are driving market growth. Moreover, the presence of leading market players and the adoption of advanced labeling technologies contribute to the region's significant market share.

Asia Pacific Self-Adhesive Labels Market Trends

The Asia Pacific region is the fastest-growing market for self-adhesive labels. Rapid industrialization, urbanization, and increasing consumer spending are key factors fueling the market's expansion.

Self-adhesive labels market in China is growing on account of rising e-commerce sector which also boosts the demand for efficient labeling solutions. Additionally, the increasing adoption of packaged and convenience foods, along with rising awareness about product information and safety, contributes to the region's rapid growth.

Europe Self-Adhesive Labels Market Trends

Europe is a significant market for self-adhesive labels, driven by stringent environmental regulations and a strong focus on sustainability. The European Union's regulations on packaging waste and recycling are pushing manufacturers to adopt eco-friendly labeling solutions. Companies in the region are increasingly investing in sustainable materials and technologies to meet regulatory requirements and consumer preferences for environmentally responsible products. The market growth in Europe is also supported by advancements in labeling technologies and the presence of a well-established packaging industry.

Central & South America Self-adhesive Labels Market Trends

The market in Central and South America is experiencing steady growth, driven by the expanding food and beverage, retail, and pharmaceutical sectors. The region's market growth is supported by increasing consumer awareness about product information and safety. Additionally, the growing middle-class population and rising disposable incomes are driving the demand for packaged goods, further boosting the need for labeling solutions. Countries like Brazil and Argentina are key contributors to the market's growth in this region, with increasing investments in the packaging industry and the adoption of advanced labeling technologies.

Key Self-Adhesive Labels Company Insights

The market is highly fragmented with the presence of a significant number of companies. Self-adhesive labels industry has been witnessing a significant number of new product launches and expansions over the past few years. This can be attributed to the circular economy initiatives, innovation in materials and technologies, and consumer demand for sustainability.

-

In May 2024, Beontag launched self-adhesive labels in the Latin America wine market. These new self-adhesive labels comprise of 40% of grass fiber which is combined with FSC certified cellulose.

-

In February 2024, Coveris acquired Czech Republic based self-adhesive label producer, S&K LABEL. Since Coveris is also engaged in manufacturing of self-adhesive labels, this strategic acquisition will provide Coveris to expand its geographical presence in Central & Eastern Europe.

-

In November 2023, UK based premium self-adhesive labels manufacturer, Royston Labels, was acquired by Autajon Group which is engaged in manufacturing of labels, set-up boxes, and folding cartons. This acquisition is a part of Autajon Group’s expansion plan to grow is presence in the UK market.

Key Self-Adhesive Labels Companies:

The following are the leading companies in the self-adhesive labels market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Avery Dennison Corporation

- LINTEC Corporation

- Mondi

- UPM

- Optimum Group

- HERMA

- AKO GROUP

- Advance Marks & Labels Pvt Ltd.

- Consolidated Label Co

- Nova Label

- Elite Labels

- StickyLine

- Rebsons Labels

- S&K LABEL spol. s r.o.

- Multipack Labels

- Swati Polypack

- Valley Forge Tape & Label

- Coast Label Company

- Jiangmen Hengyuan Label Co.Ltd.

Self-Adhesive Labels Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 52.37 billion

Revenue forecast in 2030

USD 71.80 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Million Square Meter, and CAGR from 2024 to 2030

Report coverage

Volume Forecast, Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Composition, type, technology, nature, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

3M; Avery Dennison Corporation; LINTEC Corporation; Mondi; UPM; Optimum Group; HERMA; AKO GROUP; Advance Marks & Labels Pvt Ltd.; Consolidated Label Co; Nova Label; Elite Labels; StickyLine; Rebsons Labels; S&K LABEL spol. s r.o.; Multipack Labels; Swati Polypack; Valley Forge Tape & Label; Coast Label Company; Jiangmen Hengyuan Label Co.Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Self-Adhesive Labels Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global self-adhesive labels market report based on composition, type, technology, nature, application, and region:

-

Composition Outlook (Revenue, USD Million; Volume, Million Square Meter, 2018 - 2030)

-

Facestock

-

Paper

-

Plastic

-

-

Adhesive

-

Hot melt

-

Acrylic

-

-

-

Type Outlook (Revenue, USD Million; Volume, Million Square Meter, 2018 - 2030)

-

Release Liner

-

Linerless

-

-

Technology Outlook (Revenue, USD Million; Volume, Million Square Meter, 2018 - 2030)

-

Flexography

-

Digital Printing

-

Letterpress

-

Screen Printing

-

Gravure

-

Offset

-

-

Nature Outlook (Revenue, USD Million; Volume, Million Square Meter, 2018 - 2030)

-

Permanent

-

Removable

-

Repositionable

-

-

Application Outlook (Revenue, USD Million; Volume, Million Square Meter, 2018 - 2030)

-

Food & Beverages

-

Pharmaceuticals

-

Consumer Durables

-

Home & Personal Care

-

Other Applications

-

-

Regional Outlook (Revenue, USD Million; Volume, Million Square Meter, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global self-adhesive labels market was estimated at USD 50.47 billion in 2023 and is expected to reach USD 52.37 billion in 2024.

b. The global self-adhesive labels market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030, reaching USD 71.80 billion by 2030.

b. The release liners segment dominated the market and accounted for over 74% of the largest revenue share in 2023. Release liners hold the highest market share due to their wide usage across multiple industries, reliability, and ease of use. They also have the fastest-growing CAGR, as innovations in liner materials and recycling processes boost their appeal.

b. Key players in the market include 3M, Avery Dennison Corporation, LINTEC Corporation, Mondi, UPM, Optimum Group, HERMA, AKO GROUP, Advance Marks & Labels Pvt Ltd., Consolidated Label Co, Nova Label, Elite Labels, StickyLine, Multipack Labels; Swati Polypack; Valley Forge Tape & Label; Coast Label Company; and Jiangmen Hengyuan Label Co.Ltd.

b. The global market for self-adhesive labels is growing significantly due to the rising demand for packaged goods, especially in the food and beverage, personal care, and pharmaceutical sectors. As consumers look for convenience and product details, the requirement for top-notch, informative, and visually appealing labels is increasing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.