- Home

- »

- Smart Textiles

- »

-

Self-contained Breathing Apparatus Market Size Report, 2030GVR Report cover

![Self-contained Breathing Apparatus Market Size, Share & Trends Report]()

Self-contained Breathing Apparatus Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Open-Circuit SCBA, Closed-Circuit SCBA), By End-use (Fire Services, Oil & Gas), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-038-3

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

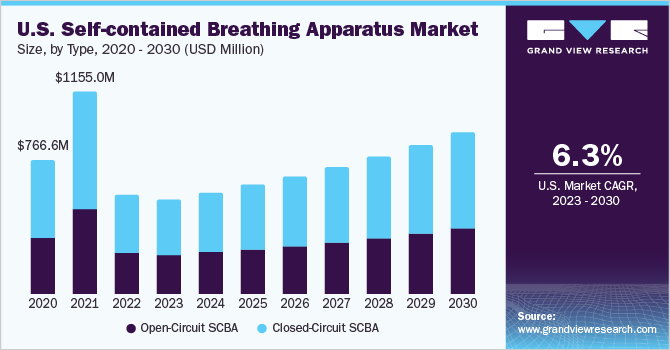

The global self-contained breathing apparatus market size was valued at USD 3,832.2 million in 2022 and is expected to expand at a compounded annual growth rate (CAGR) of 6.3% from 2023 to 2030. The market demand is anticipated to be driven by the rising need for safety equipment in rescue operations, fire stations, ironworks, nuclear facilities, and chemical industries. Furthermore, it is anticipated that increased workplace injuries, such as severe abrasions, and chemical & thermal burns, will increase demand for g Apparatus Market Report Scopein the coming years.

The COVID-19 pandemic has had a favorable impact on the global market for self-contained breathing apparatus. Major manufacturers deployed a range of strategies to expand their market share during the pandemic, including mergers & acquisitions, product launches, product upgrades, and R&D expenditure. For instance, in July 2021, MSA Safety acquired Bacharach, Inc. to support global product innovation, which will further drive market expansion over the projected period.

Construction is critical to manufacturing, mining, and other industries. Increasing construction activity in the U.S., as well as a focus on worker safety, are likely to drive market expansion. For instance, the Occupational Safety and Health Administration (OSHA) requires businesses to establish workplace fire safety and prevention procedures. Self-contained breathing equipment (SCBA) is used to protect people from oxygen deficit, dust, fumes, and vapors in plants, on ships, during fires, and in tunnels. These factors are anticipated to stimulate demand for self-contained breathing devices in the coming years.

According to the ILO (International Labor Organization), around 2.3 million women and men worldwide die every year due to work-related accidents. This is equal to over 6000 deaths every day. Moreover, every year, there are roughly 340 million occupational accidents and 160 million sufferers of work-related illnesses worldwide. The rising incidence of industrial accidents and injuries has compelled regulatory agencies to tighten their standards. Federal and municipal governments have been enforcing necessary restrictions and taking efforts to limit the occurrence of these accidents. For instance, changes to the National Fire Protection Association's (NFPA) regulations, such as new speech intelligibility criteria, are predicted to boost product demand over the forecast period.

The increasing usage of respiratory protection equipment during oil & gas drilling activities, electric power utilities, and combustible dust industries has aided product penetration in the United States in recent years. Additionally, worker safety and sustainability have acquired significance in a variety of end-use industries. Several organizations in the U.S., including OSHA, NIOSH, and the EPA, have modified the standards to make them stricter, requiring companies to furnish respiratory protective equipment, including self-contained breathing apparatus. Over the projection period, this is likely to result in higher demand for SCBA.

High product penetration in the U.S. is attributed to the stringent regulatory scenario and growing employee awareness regarding personal safety. An increasing number of large-scale infrastructure investment projects in the industrial sector in New York, Missouri, and Los Angeles is expected to boost industry growth, thereby driving the demand for self-contained breathing apparatus in the U.S.

Type Insights

The closed-circuit SCBA type segment led the market and accounted for 64.1% of the global revenue share in 2022. As closed-circuit SCBAs are suited for applications where breathing gas is required for long-duration applications, these are often employed in the mining industry. It provides a wide range of advantages, including long deployment times, improved breathing and working comfort, dependable CO2 absorption, comfortable wearing, and superior respiratory monitoring.

Due to changing health and safety laws, rising customer expectations, and a continuing need for innovation and development, SCBA manufacturers are pushed to increase expenditure on R&D to create effective solutions. For instance, Honeywell has radio frequency identification tags on SCBA that connect it to firefighters so that firefighters can transmit any issues with self-contained breathing apparatus and receive evacuation notices urgently from the command. In the coming years, the aforementioned factors will fuel the market for SCBAs.

The open-circuit SCBA type segment is likely to grow at a CAGR of 5.8% over the forecast period. Open-circuit products are composed of light metals or carbon fiber-wrapped composites and are filled with filtered compressed air. Firefighters favor composite material cylinders because they promise a lower weight load. Moreover, open circuit SCBA is helpful for longer rescue missions or oil rig shifts.

These aforementioned factors will drive the demand for open-circuit SCBA in the coming years. Many new product developments also promise a brighter prospect. For instance, MSA Safety Inc.'s G1 SCBA integrated thermal imaging camera was certified by a third party to meet the requirements of the NFPA Standard on Open-Circuit Self-Contained Breathing Apparatus for Emergency Services.

The self-contained breathing apparatus is used in the mining and chemical industries as well as firefighting. The presence of stringent regulations such as the NFPA, which specifies the performance and design standards for SCBAs designed for firefighters remains key to growth. These guidelines must be met for manufacturers to sell equipment to be utilized for firefighting.

Moreover, National Institute for Occupational Safety and Health approves industrial SCBAs that are employed for uses other than firefighting due to their low costs and improved production efficiency. In the coming years, the aforementioned regulations will fuel demand for the SCBA market.

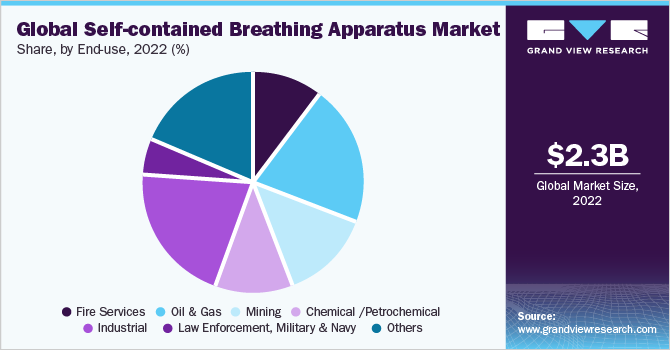

End-use Insights

The oil & gas end-use segment led the market and accounted for 23.4% of the global revenue share in 2022. In the oil & gas industry, SCBAs are used for offshore applications and need to be tough and dependable due to the presence of airborne contaminants and dangerous gases. Additionally, if employees are exposed to dangerous environments, companies are required by law and organizations such as the Occupational Safety and Health Administration to supply them with the proper personal protective equipment, which includes reliable respiratory devices. The aforementioned elements will increase demand for SCBA in the oil & gas sector.

Although considerable effort is made to maintain a safe environment, there is always the possibility of encountering hazardous gases or low oxygen levels in dangerous environments, leading the atmosphere to become flammable, which increases risks to employees in underground mines and tunnels. When a longer supply of breathing gas is required, such as during rescue operations in mines, in lengthy tunnels, or while navigating spaces too, the use SCBAs is essential.

Over the foreseeable period, the aforementioned factors will fuel demand for SCBA in the mining industry. Such solutions are already making their way into the global market. For example, Carroll Technologies offers a selection of SCBA for mines and tunnels, such as the MSA W65 Self-Rescuer Respirator. This device guards against carbon monoxide poisoning, thereby driving product demand.

The fire services end-use segment is likely to grow at a CAGR of 6.9% over the forecast period. The use of breathing equipment may be necessary for various firefighting circumstances. The use of such apparatus will ensure that the wearer has access to oxygen so that he or she may safely carry out their specific task. Also, the increasing expenditure on worker protection in the fire services sector will increase demand for SCBA in the coming years.

For instance, in 2021, the Administration and Legislature approved a USD 1.5 billion investment in a comprehensive wildfire and forest resilience strategy, including USD 536 billion as part of an early action package intended to start crucial projects before the upcoming fire season and introduce several new programs.

Additionally, in January 2021, MSA acquired Bristol Uniforms, a company based in the UK. This acquisition solidifies MSA's position as a world leader in fire service protective personal equipment products and gives the company a chance to grow its operations in the UK and other important European markets. Through this collaboration, MSA will support the distribution of repurposed SCBA to firefighters who are in critical need of and frequently have little access to protective gear. In the upcoming years, the aforementioned causes will increase demand for SCBA in the fire services sector.

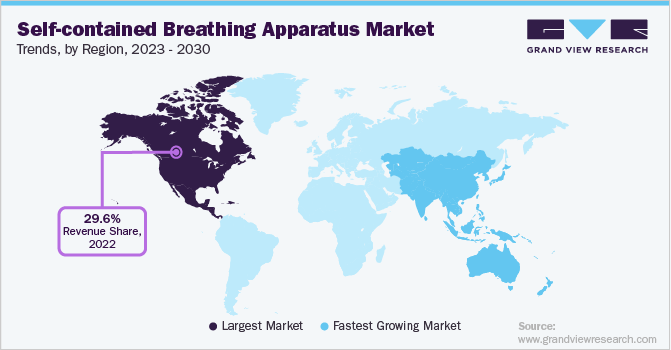

Regional Insights

North America dominated the market with a 29.6% share of global revenue in 2022. The SCBA market is largely driven by the rise in fire accidents in North America. For instance, in 2021, local fire departments dealt with 1,353,500 fires. 3,800 civilians were killed in these fires, 14,700 civilians were wounded, and USD 15.9 billion worth of property was damaged, according to the National Fire Protection Association (NFPA).

Additionally, according to the NFPA, a structure, and a dwelling caught fire, every 65 and 93 seconds respectively, in 2021. Furthermore, there are strict environmental rules in the U.S., as well as improved staff knowledge of safety. Companies competing in the SCBA industry also provide products with features like dependability, lightweight design, advancement, and ease of use to attract more clients. These aforementioned factors will drive the demand for SCBA in North America over the forecast period.

The Asia Pacific regional SCBA industry is anticipated to grow at a CAGR of 7.6% over the forecast period. The region's demand for industrial construction is being driven by a rapid increase in mergers & acquisitions, integration activities, and site relocations. Furthermore, due to cheap production costs, multinational corporations are likely to construct production facilities in emerging countries in the region. For instance, Honeywell offers the Cougar SCBA, which is designed for industrial customers who want protection against situations that are instantly life-threatening or hazardous to health. These factors are projected to drive the self-contained breathing apparatus industry’s growth further in the future years.

According to a longitudinal study published by the European Commission, between 2012-2019, the overall number of non-fatal workplace accidents in the EU increased by 6.9%, or 203,000. In Europe, an increasing frequency of industrial injuries, along with a growing need for high-utility protective equipment such as self-contained breathing gear, is predicted to boost SCBA penetration in the near future.

The rigorous legal scrutiny by agencies such as OSHA and CSA necessitates the use of a self-contained breathing apparatus (SCBA) with emergency escape. Furthermore, due to the growing threat posed by Dangerous To Life or Health (IDLH) airborne contaminants, market demand is likely to grow further in the future years.

As a result of continuous expenditures in exploration and refining capacity growth, the oil & gas industry in the Middle East and Africa will account for a sizable portion of the market in 2022. According to industry analysts, on average, a fire catastrophe on an offshore or onshore facility occurs every 2-3 years, resulting in large-scale destruction and subsequent, casualties. In the approaching years, the aforementioned factors will increase demand for the SCBA market in this region.

Key Companies & Market Share Insights

Key companies are keen to increase market penetration and cater to changing technological requirements from various end-users such as fire services, oil & gas, mining, chemical /petrochemical, industrial, law enforcement, military & navy. The key manufacturers continue to employ a variety of strategies such as acquisitions, mergers, joint ventures, new product developments, and geographical expansions.

For instance, Drägerwerk GmbH & Co. KGaA launched Dräger PSS AirBoss in June 2021, the next-generation in self-contained breathing apparatus that offers firefighters and emergency service teams a premium experience with robust usability, safety, serviceability, and connection.

Moreover, 3M acquired Johnson Controls' Scott Safety for a total value of USD 2.0 billion. The latter is a leading manufacturer of innovative products like self-contained breathing apparatus systems, gas & flame detection equipment, and other safety devices that supplement 3M's personal safety portfolio.

Key Self-Contained Breathing Apparatus Companies:

The following are the leading companies in the self-contained breathing apparatus market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- MSA

- Drägerwerk AG & Co. KGaA

- Avon Protection

- Honeywell International Inc.

- Interspiro

- Worthington Industries

- Axiom Manufacturing

- Afex Fire & Safety

- MATISEC

- SHIGEMATSU WORKS CO.LTD.

- KOKEN LTD.

- Cam Lock Ltd

- Sure Safety

- Shanghai Fangzhan Fire Technology Co., Ltd.

- Bullard Limited

Self-contained Breathing Apparatus Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 2,225.93 million

Revenue forecast in 2030

USD 3,832.25 million

Growth Rate

CAGR of 6.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, trends

Segments covered

Type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; France; Germany; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; UAE

Key companies profiled

3M; MSA; Drägerwerk AG & Co. KGaA; Avon Protection; Honeywell International Inc.; Interspiro; Worthington Industries; Axiom Manufacturing; Afex Fire & Safety; MATISEC; SHIGEMATSU WORKS CO.,LTD.; KOKEN LTD.; Cam Lock Ltd; Sure Safety; Shanghai Fangzhan Fire Technology Co., Ltd.; Bullard Limited

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Self-contained Breathing Apparatus Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global self-contained breathing apparatus market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Open-Circuit SCBA

-

Closed-Circuit SCBA

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Fire Services

-

Oil & Gas

-

Mining

-

Chemical /Petrochemical

-

Industrial

-

Law Enforcement, Military, and Navy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

France

-

Germany

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The self-contained breathing apparatus cylinders market size was estimated at USD 1,081.4 million in 2024 and is expected to reach USD 1,136.2 million in 2025.

b. The self-contained breathing apparatus cylinders market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2030 to reach USD 1,466.7 million by 2030.

b. The type III tank segment held 55.7% market share in 2024. Type III SCBA cylinders are typically constructed from a combination of aluminum and carbon fiber reinforcements, resulting in a lightweight yet durable solution suitable for various applications, including firefighting and industrial use.

b. Some of the key players operating in the self-contained breathing apparatus cylinders market include 3M, MSA, Drägerwerk AG & Co. KGaA, Avon Protection, Honeywell International Inc., Interspiro, Worthington Industries, Axiom Manufacturing, Afex Fire & Safety, MATISEC, SHIGEMATSU WORKS CO.,LTD., KOKEN LTD., Cam Lock Ltd, Sure Safety, Shanghai Fangzhan Fire Technology Co., Ltd., Bullard Limited.

b. The self-contained breathing apparatus (SCBA) cylinders market is experiencing significant growth primarily due to increasing safety regulations across various industries. As governments and regulatory bodies impose stricter occupational health and safety standards, companies are compelled to invest in reliable safety equipment, including SCBA systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.