- Home

- »

- Clinical Diagnostics

- »

-

Self-testing Market Size And Share, Industry Report, 2030GVR Report cover

![Self-testing Market Size, Share & Trends Report]()

Self-testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Kits, Devices, Strips), By Sample (Blood, Urine), By Application, By Distribution Channel, By Usage, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-113-2

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Self Testing Market Summary

The global self testing market size was estimated at USD 11,390.8 million in 2024 and is projected to reach USD 18,321.8 million by 2030, growing at a CAGR of 8.4% from 2025 to 2030. The self-testing industry growth is driven by increasing emphasis on personalized healthcare, technological advancements in rapid diagnostics, and rising demand for convenient and rapid diagnostics kits.

Key Market Trends & Insights

- The self-testing market in North America dominated globally and accounted for a 33.40% revenue share in 2024.

- The self-testing market in the U.S. held a significant revenue share in the North American region in 2024.

- By sample, the blood sample segment dominated the overall market, with the largest revenue share of 35.19% in 2024.

- By product, the kits segment dominated the market with a revenue share of 48.25% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period.

- By application, the allergy test application segment held the largest revenue share of 17.35% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 11,390.8 Million

- 2030 Projected Market Size: USD 18,321.8 Million

- CAGR (2025-2030): 8.4%

- North America: Largest market in 2024

Self-test/kits are used for rapid diagnosis of a wide variety of illnesses. Furthermore, rising awareness about the benefits of early diagnosis and regular monitoring has boosted the uptake of self-testing devices, and an increasing number of product launches are also expected to have a positive impact on the self-testing industry.

The COVID-19 pandemic has accelerated the need and emphasis on self-testing kits with an aim to increase the rate of diagnosis. To reduce the risk of serious disease, hospitalizations, or death, many organizations have implemented various efforts. For instance, the Administration for Strategic Preparedness and Response (ASPR) and NIH collaborated to launch the Home Test to Treat program in January 2024. This program is a virtual community health intervention that will provide free COVID-19 health services, such as telehealth consultations, home treatments, and at-home rapid tests, in a few selected communities. Such factors further boost the self-testing industry.

Growing regulatory approvals are driving market expansion by instilling confidence in self-testing products. As more diagnostic tools receive approval from reputable regulatory bodies, including the WHO and FDA, they gain broader acceptance and credibility. This encourages adoption by both consumers and healthcare providers, facilitating access to accurate, reliable testing options. Regulatory approvals not only ensure product safety but also create pathways for market growth, promoting the development and availability of new self-testing solutions across various healthcare sectors. For instance, in July 2022, Innova secured a CE mark for its rapid antigen self-test, allowing the company to distribute the product across European markets. This approval provides a significant boost to the availability of at-home COVID-19 testing solutions, enabling easier access for consumers and enhancing the capacity to manage the pandemic. The CE mark indicates that the test meets the European Union's safety, health, and environmental protection standards, reinforcing confidence in its reliability and effectiveness.

In addition, increasing funding and investments by various organizations, as well as market players for the development of robust and novel diagnostics, have created beneficial opportunities for the market. For instance, in January 2022, the Florida Atlantic University (FAU) approved funding of USD 1.3 million to NIH for the development of quick and automated HIV self-kits. Furthermore, in April 2022, India-based start-up Cervicheck received approval from the Central Drugs Standard Control Organization (CDSCO) for its commercialization in India. The kit is used for the diagnosis of Human Papillomavirus (HPV).

Furthermore, improved accuracy, ease of use, and portability of self-testing devices, such as blood glucose monitors and at-home rapid test kits, are driving adoption. The market is anticipated to show growth as several initiatives are being undertaken by major key players and with ongoing technological advancements. For instance, in November 2022, F. Hoffmann-La Roche introduced a pilot COVID-19 At-Home Test, a new name and brand for the COVID-19 Test, to expand retail channels for the COVID-19 At-Home Test.

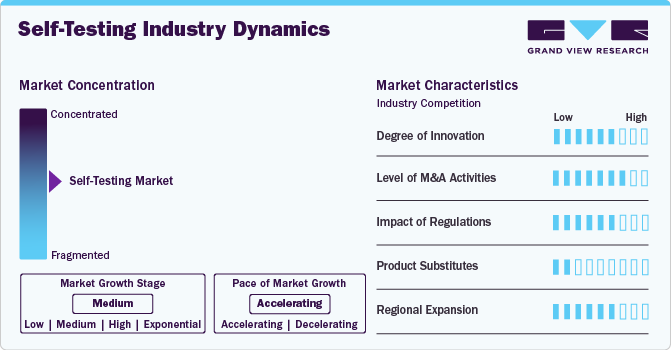

Market Concentration & Characteristics

The self-testing industry is driven by a high degree of innovation propelled by continuous advancements in diagnostic technologies. Companies in the industry are heavily investing in research and development to improve the accuracy, convenience, and usability of self-testing devices. Innovations such as smartphone-integrated diagnostic kits, wearable biosensors, and AI-powered analysis tools have enhanced consumer confidence and expanded the market. In addition, the adoption of minimally invasive and non-invasive testing methods reflects the sector's commitment to addressing user comfort and safety while maintaining diagnostic reliability.

The self-testing industry experiences a moderate level of mergers and acquisitions (M&A) activity, driven by the need for companies to diversify their product portfolios and enhance their technological capabilities. These acquisitions often target smaller, innovative firms specializing in niche diagnostic solutions, enabling larger players to stay competitive.

Regulations play a critical role in shaping the self-testing industry by establishing mandatory guidelines for product safety, accuracy, and efficacy. Regulatory frameworks like those from the U.S. FDA, European CE marking, and other regional authorities ensure that self-testing devices meet stringent quality standards. While these regulations build consumer trust, they also pose challenges for manufacturers, such as increased development costs and extended time-to-market. The swift approval of emergency-use diagnostic kits during the COVID-19 pandemic, however, showcased the industry's ability to adapt and innovate under regulatory guidelines.

Product substitution in the market is robust, driven by the need to address emerging diagnostic trends and unmet needs. As new health concerns arise, manufacturers are expanding their offerings to include a diverse range of self-testing kits for conditions such as infectious diseases, chronic illnesses, and genetic predispositions. This product expansion is further driven by advancements in materials science, enabling the development of more reliable, cost-effective, and user-friendly alternatives to traditional laboratory testing.

Regional expansion in the market is characterized by targeted efforts to penetrate emerging markets while strengthening footholds in developed regions. Companies are leveraging strategic partnerships, collaborations, and localized manufacturing to address region-specific healthcare challenges and regulatory requirements. For instance, the growing demand for self-testing kits in Asia-Pacific, Latin America, and Africa highlights untapped opportunities, particularly in rural and underserved areas.

Sample Insights

The blood sample segment dominated the overall market, with the largest revenue share of 35.19% in 2024. The dominance of the segment can be attributed to the increasing use of blood samples for diagnostics due to its non-invasiveness, ability to provide comprehensive insights into various health conditions and advancements in diagnostic technologies. Moreover, a growing number of product launches with advanced mechanisms is also projected to offer favorable opportunities for segment growth. For instance, in May 2022, Laboratory Corporation of America Holdings announced the launch of its very first at-home blood sample collection device for diabetes diagnostics.

The urine sample segment is expected to grow at the fastest CAGR over the forecast period owing to the increasing use of urinalysis for various disease diagnostics. These tests are commonly used for detecting a range of conditions, including urinary tract infections (UTIs), kidney function, and pregnancy. The segment is particularly appealing for at-home diagnostics, driven by rising health awareness and the growing preference for convenient, accessible healthcare solutions. Besides, the rising capabilities of kits & devices to offer a range of diagnostics insights are also projected to accelerate urine segment growth by 2030. In November 2021, Vivoo received funding of USD 6.0 million through rounds of series funding for the development of at-home urine test kits. The kit is integrated with an app and provides hassle-free real-time insights.

Product Insights

The kits segment dominated the market with a revenue share of 48.25% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The kits offer convenience, ease of use, and the ability to monitor various health conditions, such as pregnancy, diabetes, and infections, from the comfort of home. Innovations in test accuracy, user-friendly designs, and the expansion of distribution channels are fueling the segment's popularity. The segment growth is attributed to the growing focus of key players on investing in R&D and the development of new products. For instance, in May 2021, Zoe, a personalized nutrition startup, raised USD 20 million for home testing kits. Moreover, in February 2022, Abingdon Health plc entered into a supply agreement with Salignostics to expand sales of its saliva-based pregnancy test kits in Ireland.

The strips segment held a considerable market share in 2024, owing to the high usage of strips and affordability. Testing strips are commonly used for monitoring blood glucose levels, urinalysis, ketone detection, and other diagnostic purposes, making them indispensable in chronic disease management. Their affordability, portability, and ease of use make them a preferred choice among consumers, particularly for daily health monitoring. The increasing geriatric population, growing cases of chronic diseases, and technological advancement in the medical sector are projected to boost the segment's revenue share.

Application Insights

The allergy test application segment held the largest revenue share of 17.35% in 2024. The increasing incidence of allergic conditions is one of the key factors contributing to market growth over the forecast period. As per the data published by the Asthma and Allergy Foundation of America, in 2021, an estimated 81 million people were detected with hay fever in the U.S. Increasing number of product launches further boosted market growth. In June 2022, Everlywell launched affordable home tests for food allergy and celiac disease, along with virtual follow-up care.

Cancer tests are projected to showcase the fastest CAGR over the forecast period. Rising cases of cancer are one of the key reasons for the segment's growth. In 2023, cancer was responsible for approximately 9.6 to 10 million deaths worldwide, equating to nearly 26,300 deaths daily. In the U.S. itself, the American Cancer Society (ACS) projected 1,958,310 new cancer cases and 609,820 cancer-related deaths for the year. These estimates, derived from central cancer registries and the National Center for Health Statistics, highlight the critical need for accessible diagnostic tools like self-test kits. Such kits empower individuals to detect cancer at earlier stages, potentially reducing mortality rates and easing the pressure on healthcare systems. Increasing focus of companies to launch new products further boosts market growth. For instance, in August 2022, Viome Life Sciences launched a self-testing throat cancer test for consumers. The saliva-based tests have shown 95% specificity and 90% sensitivity.

Distribution Channel Insights

Based on distribution channel, the offline segment dominated the market with the largest revenue share of 62% in 2024. Significant investments by companies in building their distribution networks are projected to accelerate segment growth. In addition, the increasing number of distribution agreements within companies is also estimated to have a positive impact on segment growth by 2030. This channel continues to play a vital role in regions where access to online platforms is limited or where consumers prefer in-person consultations. The offline segment is particularly important for markets with regulatory requirements that necessitate direct interactions with healthcare professionals.

Online channels are projected to witness the fastest CAGR over the forecast period, as online retailers offer greater accessibility of self-testing products, allowing easier access to consumers regardless of their location. Online channels offer wider options for self-testing products than offline channels and also provide access to niche products. Furthermore, the convenience of e-commerce platforms and direct-to-consumer (DTC) websites enables individuals to purchase self-test kits directly and easily from the comfort of their homes.

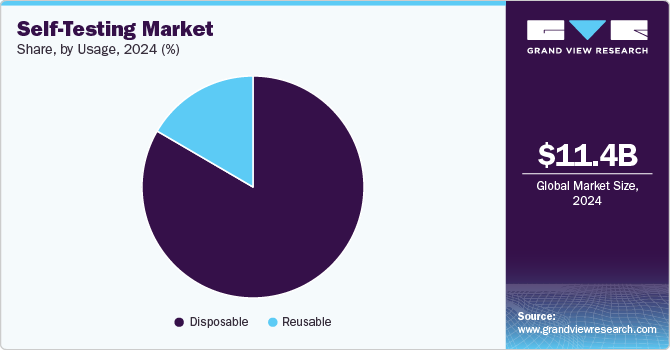

Usage Insights

The disposable segment held the largest revenue share of 83.43% in 2024. The segment is further projected to grow at the fastest CAGR over the forecast period. Self-testing provides new opportunities to detect, diagnose, and address patients and their treatment process. Disposable kits offer remarkable usability due to their convenient and user-friendly nature. They eliminate the need for complex preparation or cleaning, ensuring a hygienic and hassle-free experience. Such advantages of disposable kits and improved safety are likely to accelerate segment growth during the forecast period.

Reusable kits are expected to witness a reasonable CAGR over the forecast period. They are commonly used for health monitoring purposes, such as blood glucose testing or ovulation prediction. Reusable kits are appealing to consumers seeking long-term value and a more sustainable approach to healthcare while also providing the convenience of home testing. The segment's growth is supported by innovations in durability and ease of cleaning.

Regional Insights

The self-testing marketinNorth America dominated globally and accounted for a 33.40% revenue share in 2024. This large share is attributed to growing cases of chronic conditions that require quick diagnosis, technological advancement in the healthcare sector, and availability of key players. Increasing the number of FDA approvals for new products also boosts the market growth. For instance, in May 2022, empowerDX announced the launch of an at-home celiac disease genetic risk test. The kits perform molecular testing and provide accurate results.

U.S. Self-testing Market Trends

The self-testing market in the U.S. held a significant revenue share in the North American region in 2024. This large share is attributed to a combination of factors that include high health awareness, advanced healthcare infrastructure, and the increasing prevalence of chronic conditions such as diabetes and hypertension. The market has also benefited from the widespread adoption of telemedicine and digital health solutions, which have driven the demand for at-home diagnostic kits. In addition, the convenience of online distribution channels and the availability of FDA-approved self-testing kits have further cemented the U.S. as a leading market in this segment.

Europe Self-testing Market Trends

The Europe self-testing market is anticipated to experience significant growth over the forecast period. The growth is supported by rising consumer demand for accessible healthcare solutions and government initiatives promoting preventive care. The increasing burden of chronic diseases, such as cardiovascular disorders and cancer, has fueled the adoption of self-testing kits for early detection and monitoring. Technological advancements and the growing acceptance of at-home diagnostics across European countries have also played a pivotal role in driving market expansion.

The self-testing market in the UK is anticipated to experience significant growth over the forecast period, primarily due to heightened health awareness and the National Health Service (NHS) initiatives encouraging early diagnosis and self-monitoring. The COVID-19 pandemic significantly accelerated the adoption of self-testing solutions, particularly for infectious diseases.

The Germany self-testing market is anticipated to experience significant growth over the forecast period, driven by high adoption rates of innovative self-diagnostic tools supported by robust healthcare policies that have further strengthened the market. Germany's aging population and increasing prevalence of chronic illnesses have also amplified the demand for reliable and user-friendly self-testing solutions, contributing to the market's upward momentum.

Asia Pacific Self-testing Market Trends

The self-testing market in Asia Pacific is anticipated to experience the fastest CAGR over the forecast period. The rising number of activities related to research & development of novel therapeutics for infections, improving the healthcare sector, and government initiatives to reduce the disease burden are key factors driving regional market growth. Other factors, such as increasing healthcare reforms, expanding healthcare infrastructure, growing population, rising incidence of chronic diseases, and increasing number of local companies entering the market, are also estimated to drive the Asia Pacific Self-testing industry during the forecast period. The critical need for self-testing kits, particularly in countries like Thailand, due to high disease prevalence demands accessible and efficient diagnostic tools. Self-test kits can play a pivotal role in early detection, empowering individuals to seek timely treatment and support public health goals. In Thailand, recent data from the Ministry of Health indicates that over 2 million people are currently living with chronic hepatitis B, underscoring its status as a significant public health challenge. The World Health Organization (WHO) has launched a global campaign aiming to eradicate hepatitis B by 2030, reflecting the urgency to address this pressing issue.

The China self-testing market is anticipated to experience significant growth over the forecast period, driven by a large population with increasing health awareness and a growing burden of chronic diseases such as diabetes and cardiovascular disorders. Government initiatives to expand healthcare access and promote early diagnosis have further driven market demand. Furthermore, the availability of affordable self-testing kits and the rapid expansion of e-commerce platforms have also played a critical role in market development.

The self-testing market in Japan is anticipated to experience significant growth over the forecast period,driven by the country’s focus on preventive healthcare and high adoption rates of advanced technologies. Furthermore, Japan's strong healthcare infrastructure and consumer preference for user-friendly, accurate diagnostic tools are driving innovation in the market.

The India self-testing market is experiencing growth driven by critical health challenges, including the rising prevalence of diseases like dengue fever, with nearly 300,000 cases reported in 2023. Early diagnosis is essential to avoid severe complications, but many cases remain undetected until symptoms worsen. The growing need for self-testing solutions in India is evident, as they provide a timely and accessible way to detect health issues, helping individuals manage their conditions before they escalate into more serious concerns. Furthermore, UTIs affect around 30% of Indian women, and if untreated, they can lead to serious health problems, including kidney damage. In addition, the rise in early menopause, occurring as early as age 40, can lead to anxiety and depression if undiagnosed. To address such issues, manufacturers such as Mankind Pharma’s offer RAPID NEWS self-test kits, which are accessible, easy-to-use solutions for detecting dengue, UTIs, and early menopause, empowering individuals to test privately and reliably from home.

Latin America Self-testing Market Trends

The self-testing market in Latin America is anticipated to experience significant growth over the forecast period due to the region's improving healthcare infrastructure and growing middle-class population with access to disposable income, which has also spurred demand for self-testing solutions. In addition, collaborations between local manufacturers and global players are enhancing market penetration.

Brazil Self-testing Market Trends

The self-testing market in Brazil is shaped by an evolving regulatory landscape that emphasizes product safety and accuracy. The growing prevalence of conditions like diabetes and hypertension has increased the demand for self-monitoring solutions. Moreover, government-led health campaigns and partnerships between public and private sectors are driving market growth, particularly in urban areas where access to healthcare facilities is limited.

Middle East and Africa Self-testing Market Trends

The MEA self-testing market is expanding as awareness of chronic and infectious diseases is rising across the region. Initiatives to improve healthcare access, especially in underserved areas, have enhanced the adoption of self-testing kits. The growing affordability of these solutions and the region's increasing reliance on digital health technologies are additional contributors to market growth.

The self-testing market in Saudi Arabia is characterized by rapid innovation, growing competition, and a dynamic regulatory environment. The government’s Vision 2030 initiative, which aims to modernize the healthcare sector and promote preventive care, has accelerated the adoption of self-diagnostic tools. The market is also benefiting from a tech-savvy population, increasing investments in healthcare, and a strong focus on localized manufacturing to meet growing demand.

Key Self-testing Company Insights

The self-testing industry is projected to show lucrative growth as major players in the market are focusing on various strategic initiatives such as the launching of new products, mergers & acquisitions, and expansion in other regions. For instance, in March 2022, Brain Chemistry Labs announced its plan to develop an easy-to-use rapid self-testing kit in collaboration with Arlington Scientific. The kit will be used for the detection of β-methylamino-L-Alanine (BMAA) presence in the body.

Key Self-testing Companies:

The following are the leading companies in the self-testing market. These companies collectively hold the largest market share and dictate industry trends.

- Geratherm Medical AG

- Cardinal Health

- OraSure Technologies, Inc.

- bioLytical Laboratories Inc.

- PRIMA Lab SA.

- BD

- F. Hoffmann-La Roche Ltd.

- Bionime Corporation

- Abbott

- Everlywell, Inc.

Recent Developments

-

In September 2024, Mankind Pharma announced the launch of rapid self-test kits aimed at addressing critical health challenges in India. These kits are designed to provide quick and accurate results for various health conditions, thereby enhancing accessibility to healthcare services. The initiative is part of Mankind Pharma's commitment to improving public health and empowering individuals to take charge of their health management.

-

In July 2024, the World Health Organization (WHO) prequalified the OraQuick HCV self-test manufactured by OraSure Technologies, which is used in enhancing access to hepatitis C testing and diagnosis. , this self-test builds on the OraQuick HCV Rapid Antibody Test.

-

In October 2023, Phase Scientific Americas announced the launch of its Indicaid Health platform, which aims to enhance point-of-care testing capabilities. This innovative platform provides rapid diagnostic solutions for various health conditions, enabling healthcare providers to deliver timely and accurate results. The launch underscores Phase Scientific's commitment to improving healthcare accessibility and efficiency through advanced diagnostic technology.

Self-testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.24 billion

Revenue forecast in 2030

USD 18.32 billion

Growth rate

CAGR of 8.40% from 2025 to 2030

Actual Data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, sample, application, distribution channel, usage, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Norway, Denmark, Sweden, China, Japan, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Geratherm Medical AG, Cardinal Health, OraSure Technologies, Inc., bioLytical Laboratories Inc., PRIMA Lab SA, BD, F. Hoffmann-La Roche Ltd., Bionime Corporation, Abbott, Everlywell, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Self-testing Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels and provides an analysis of industry trends in each of the subsegments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the global self-testing market report based on product, sample, application, distribution channel, usage, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Kits

-

Devices

-

Strips

-

-

Sample Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood

-

Urine

-

Stool

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Pressure Test

-

Diabetes and Glucose Tests

-

Cholesterol and Triglycerides Tests

-

Pregnancy Test

-

STD /STI Test

-

Urinary Tract Infection Test

-

Cancer Test

-

Celiac disease Test

-

Thyroid Test

-

Transaminase Test

-

Anemia Test

-

Allergy Test

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Usage Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Disposable

-

Reusable

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global self-testing market size was estimated at USD 11.39 billion in 2024 and is expected to reach USD 12.24 billion in 2025.

b. The global self-testing market is expected to grow at a compound annual growth rate of 8.40% from 2025 to 2030 to reach USD 18.32 billion by 2030.

b. North America dominated the self-testing market with a share of 33.40% in 2024. This is attributable to growing cases of chronic conditions that requires quick diagnosis, technological advancement in the healthcare sector and availability of key players in the region.

b. Some key players operating in the self-testing market include Geratherm Medical AG, Cardinal Health, OraSure Technologies, Inc., bioLytical Laboratories Inc., PRIMA Lab SA, BD, F. Hoffmann-La Roche Ltd., Bionime Corporation, Abbott, Everlywell, Inc.

b. Key factors that are driving the market growth include increasing emphasis on personalized healthcare, technological advancements in rapid diagnostics, and rising demand for convenient and rapid diagnostics kits.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.