- Home

- »

- Automotive & Transportation

- »

-

Semi-trailer Market Size And Share, Industry Report, 2033GVR Report cover

![Semi-trailer Market Size, Share & Trends Report]()

Semi-trailer Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Flat Bed Trailer, Dry Vans, Refrigerated Trailers, Lowboy Trailers, Tankers), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-3-68038-900-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Semi-trailer Market Summary

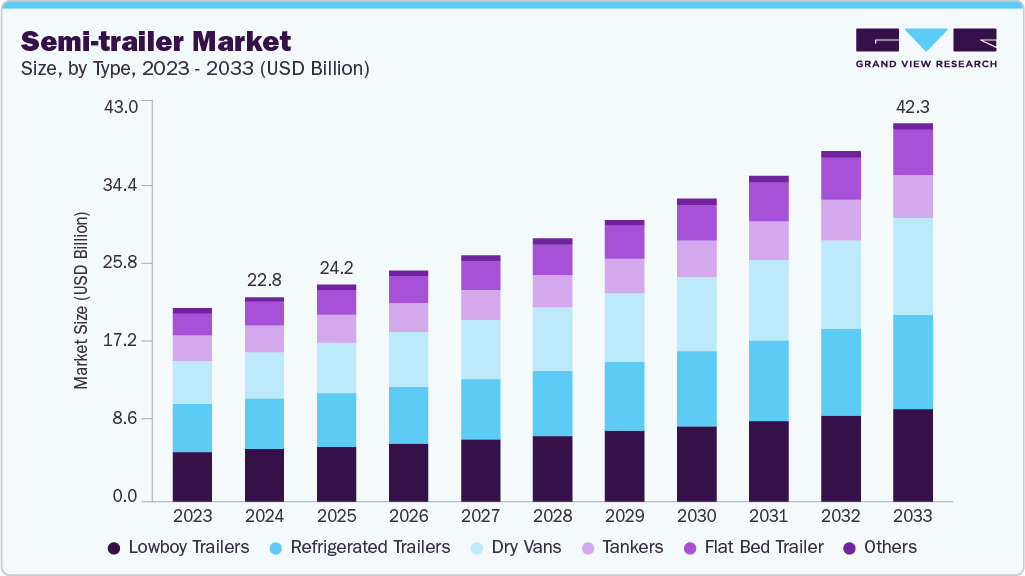

The global semi-trailer market size was estimated at USD 22.8 billion in 2024, and is projected to reach USD 42.3 billion by 2033, growing at a CAGR of 7.2% from 2025 to 2033. Rising urbanization, increasing manufacturing output, and the growing need for efficient freight transportation are expected to be key factors driving the demand for semi-trailers.

Key Market Trends & Insights

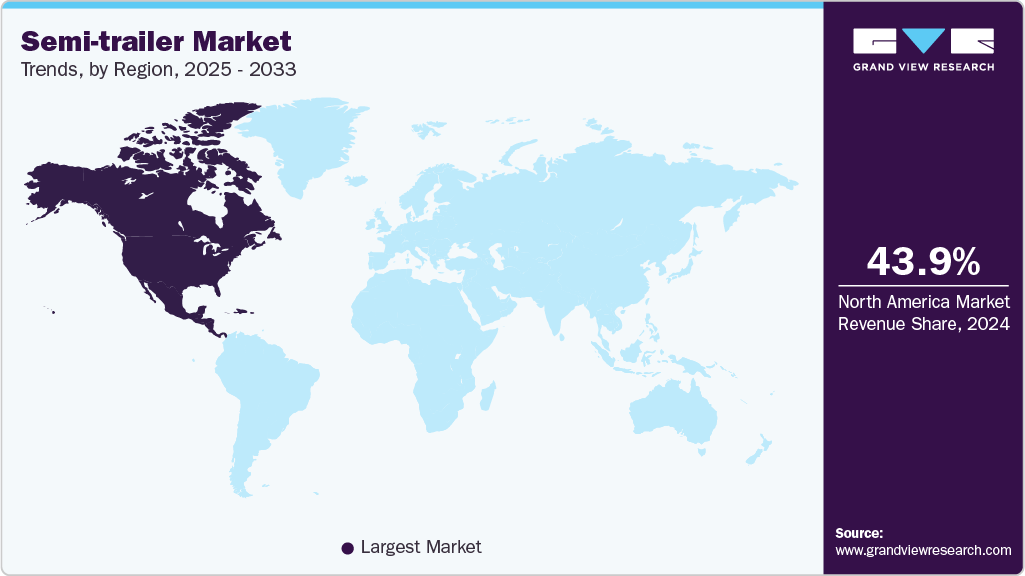

- Asia Pacific semi-trailer market accounted for a 43.9% share of the overall market in 2024.

- North America is expected to witness significant growth with a CAGR of 8.5% over the forecast period.

- By type, the lowboy trailers segment accounted for the largest share of 25.7% in 2024.

- By type, the dry vans segment is expected to expand at the fastest CAGR of 8.5% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 22.8 Billion

- 2033 Projected Market Size: USD 42.3 Billion

- CAGR (2025-2033): 7.2%

- Asia Pacific: Largest market in 2024

The expansion of end-use industries such as logistics, retail, and construction is further contributing to the market growth. In particular, the rapid development of the cold chain industry is fueling the demand for refrigerated trailers to ensure temperature-sensitive cargo remains intact throughout transit. Moreover, fleet operators are increasingly adopting custom-built and application-specific semi-trailers, creating new avenues for manufacturers to offer tailored solutions.This shift toward customization enhances operational efficiency and meets niche transportation requirements across different sectors. Also, the integration of telematics and smart tracking technologies into semi-trailers is emerging as a lucrative opportunity, enabling real-time fleet management, predictive maintenance, and improved asset utilization.

Logistics is one of the primary end use sectors for semi-trailers, with road transportation offering a cost-effective and flexible mode of freight movement. Improved road infrastructure, especially in emerging economies, is accelerating the use of trailers and trucks to meet the rising demand for goods delivery across the FMCG, e-commerce, and retail sectors. The shift toward fast and doorstep deliveries, driven by urbanization and changing lifestyles, is further boosting demand for road freight solutions. The growing demand for temperature-sensitive products such as pharmaceuticals, poultry, dairy, and fresh produce is fueling the need for refrigerated semi-trailers. Rising middle-class incomes, along with increasing awareness of health and nutrition, are encouraging consumers to opt for fresh, organic, and premium-quality products. This shift has supported the growth of QSR chains and fresh food delivery services, thereby expanding the global cold chain logistics network.

The FMCG industry, which depends on the rapid distribution of low-cost, high-demand perishable goods, continues to be a major driver of transportation needs. Factors such as increasing consumer spending, heightened brand awareness, growing digital retail adoption, and population growth are accelerating the demand for fast and reliable logistics. Since many FMCG items have limited shelf lives, efficient and timely transport using semi-trailers is essential for maintaining product quality and availability.

The shift from internal combustion engines to electric propulsion in commercial transportation is opening up a significant opportunity for manufacturers. Electrification addresses the dual goals of sustainability and cost efficiency, especially in regions enforcing strict emission norms. With ongoing R&D and investment in EV infrastructure, electric semi-trailers are poised to become a mainstream segment over the next decade. The explosion of e-commerce, along with omnichannel retail strategies, is driving the need for efficient regional and last-mile delivery networks. Semi-trailers that support intermodal logistics and quick loading/unloading cycles are gaining prominence. This trend is particularly visible in densely populated urban areas and fast-growing tier-2 and tier-3 cities.

Although semi-trailers are cost-effective over the long term, the high upfront investment can be a barrier for small and mid-sized fleet operators. The lack of widespread awareness about long-term TCO benefits and operational efficiency gains can slow down the market adoption in cost-sensitive regions.

Type Insights

The lowboy trailers segment accounted for the largest share of 25.7% in 2024. The demand for heavy equipment transportation, infrastructure development, and e-commerce drive the need for lowboy trailers. Additionally, new technologies are making lowboy trailers more efficient and cost-effective.

The dry vans segment is expected to expand at the fastest CAGR of 8.5% over the forecast period. Dry vans generally transport freight that requires nominal protection against road and climate conditions. Full truckload (FTL) and less-than-truckload (LTL) fleet operators rely on these trailers for their operations due to their cost-effectiveness and flexibility.

The flatbed trailer held a significant market share in 2024. The growth in the construction industry across developed and emerging economies is anticipated to fuel the segment growth. Flatbed trailers are generally used to transport heavy cargo, such as machinery, construction materials, and equipment. Besides, the adoption of refrigerated trailers is expected to increase significantly due to the flourishing cold chain industry. The increasing number of QSRs, the general push for healthier, fresh products, and higher disposable income positively impact every aspect of the cold chain industry.

Regional Insights

The Asia Pacific semi-trailer market accounted for 43.9% of the global share in 2024. The regional market is mainly driven 4, driven by rapid economic expansion in India and China, the rise of e-commerce logistics, growing demand for sustainable freight solutions, and increasing public-private investments in road freight infrastructure. The region’s growing emphasis on domestic manufacturing partnerships and technological integration is shaping a more self-reliant and efficient trailer supply chain. For instance, in April 2023, MaxiTRANS, a major Australian heavy-duty trailer supplier, partnered with Schmitz Cargobull to strengthen its market footprint and technological capability. This strategic alliance enabled the localization of premium trailer manufacturing, enhancing supply efficiency within Australia and nearby Asian markets.

Asia Pacific is also becoming a key launchpad for next-generation, clean-energy freight vehicles amid tightening emissions standards. In December 2024, Propel Industries introduced the 470 eTR electric tractor-trailer at bauma CONEXPO India, featuring a 55-ton GCW, up to 550 kWh battery options, and a 350 km range. Designed for long-haul logistics, it integrates advanced telematics and supports zero-emission operations, underscoring the region’s shift toward decarbonized freight transport. This reinforces the region’s strategic pivot toward sustainable freight mobility, where regulatory support, innovation, and commercial demand are converging to accelerate the deployment of electric and environmentally responsible semi-trailer solutions.

The China semi-trailer market held a substantial market share in 2024. The Semi-trailer market in China is experiencing rapid growth, driven by the rapid expansion of domestic logistics networks, the rising demand for cold chain infrastructure, increased government investment in freight corridor development, and the ongoing shift toward high-capacity and fuel-efficient transport vehicles. China's booming e-commerce and retail sectors have intensified the need for scalable, last-mile and intercity freight capabilities, while stricter emissions regulations are pushing the adoption of more advanced and compliant semi-trailer systems.As a result, China continues to emerge as one of the most dynamic and strategically important markets for semi-trailer manufacturers and fleet operators worldwide.

The semi-trailer market in Japan held a significant share in 2024. Japan's mature logistics ecosystem relies heavily on precision, timeliness, and advanced vehicle technologies to support its dense urban networks and export-heavy economy. With space constraints and a shrinking workforce, the country is gradually shifting toward higher-capacity and technologically integrated trailer solutions. In Japan, the semi-trailer market is influenced by the steady demand for efficient freight transportation, rising focus on low-emission logistics, aging driver demographics prompting automation, and robust aftermarket trailer maintenance services.

Europe Semi-trailer Market Trends

The European semi-trailer industry was identified as a lucrative region in 2024. The European semi-trailer market is witnessing significant transformation, driven by rising demand for smart trailer technologies, stringent CO₂ emission norms, the growth of cross-border e-commerce, and increased investments in digital freight platforms. The region’s strong regulatory framework and emphasis on sustainability have encouraged manufacturers to integrate telematics, automation, and energy-efficient designs into their trailer offerings. For instance, in April 2023, Schmitz Cargobull partnered with Trimble to enhance data-driven freight forwarding. This collaboration allows freight forwarders to leverage real-time trailer data for better operational planning, efficiency, and visibility. This reflects Europe’s strategic push toward intelligent transport systems, making the region a leading hub for connected and eco-conscious semi-trailer innovations.

Germany Semi-trailer market is witnessing growth due toGermany’s position as a logistics hub within Europe, coupled with its ambitious decarbonization goals, is pushing fleets to adopt technologically advanced and fuel-efficient trailer solutions. The German semi-trailer market is being shaped by increasing emphasis on green logistics, strong demand from the automotive and industrial sectors, integration of advanced telematics in fleet operations, and ongoing investment in cold chain transport infrastructure. Germany’s central location and highly developed autobahn network make it a natural distribution gateway for intra-European trade, boosting demand for high-performance trailers, particularly refrigerated and curtain-side variants. Furthermore, EU regulations promoting CO₂ reduction in freight transportation are accelerating the shift toward lightweight materials, electric axles, and digital trailer monitoring systems.

The semi-trailer market in UK is driven by post Brexit supply chain adjustments, growth in online retail logistics, rising focus on fleet automation, and investments in last-mile cold chain delivery. As logistics companies adapt to new customs and cross-border regulations, there is a growing preference for semi-trailers that offer flexibility, modularity, and data integration to ensure delivery continuity. The surge in e-commerce, particularly in food, pharmaceuticals, and same-day delivery segments, has prompted investment in temperature-controlled trailers and smaller-format urban delivery units. In addition, government incentives around decarbonizing transport are promoting the adoption of smart trailers equipped with fuel-saving features and load-tracking sensors.

North America Semi-trailer Market Trends

The semi-trailer industry in North America was identified as a lucrative region in 2024. The market is currently in the replacement phase with an aging fleet that needs to be replaced with technologically advanced semi-trailers. Moreover, the busy road infrastructure network and the growing transportation and logistics industry in the U.S. and Canada are expected to boost the regional market growth. Furthermore, relaxation in government regulations regarding weight carrying capacity and dimensions of the semi-trailer is anticipated to fuel the demand for lightweight transport vehicles, thereby driving the market demand. In addition, the California Air Resources Board (CARB) mandated the installation of “SmartWay,” a verified aerodynamic technology, to improve fuel efficiency in tractors and semi-trailers.

In Canada, the semi-trailer market is driven by the expansion of cross-border trade with the U.S., increasing infrastructure investments, rising demand for temperature-controlled logistics, and adoption of smart trailer technologies. Mexico’s growing role as a North American manufacturing base has intensified demand for flatbed, lowboy, and tank trailers to support sectors including automotive, electronics, and petrochemical. In Mexico, the semi-trailer market is experiencing strong growth, fueled by nearshoring trends, the expansion of industrial manufacturing hubs, rising exports to the U.S., and government-backed investments in logistics infrastructure.

U.S. Semi-trailer Market Trends

The U.S. semi-trailer industry held a dominant position in 2024. The semi-trailer market in the U.S. is witnessing significant transformation, driven by rising demand for sustainable freight solutions, rapid expansion of cold chain logistics, integration of advanced telematics and automation, and federal investments in transportation infrastructure. The country’s vast domestic freight movement, growing e-commerce volumes, and focus on emission reduction targets are prompting fleet operators to modernize their trailer fleets with energy-efficient, smart, and compliant technologies. Increased regulatory pressure and customer expectations for transparency and traceability in logistics are also accelerating the adoption of connected and low-emission trailer systems. For instance, in September 2024, Carrier Transicold launched the Vector HE 19 refrigeration unit for semi-trailers at IAA Transportation in Germany. Featuring a low-GWP refrigerant and B100 biofuel compatibility, the unit offers up to 84% annual CO₂ emission reduction, supporting the shift toward sustainable cold chain logistics solutions.

Key Semi-trailer Company Insights

Some of the key players operating in the market include Qingdao CIMC Special Vehicles Co., Ltd, Fontaine Trailer, Kögel, and Great Dane A Division of Great Dane LLC.

-

Founded in 2004 and headquartered in Qingdao, China, Qingdao CIMC Special Vehicles Co., Ltd. is a subsidiary of China International Marine Containers (CIMC). The company specializes in the manufacturing of a wide range of semi-trailers, including flatbeds, container chassis, low-bed trailers, dump trailers, cement tankers, fuel tankers, and other specialized transport equipment. It serves markets across Africa, Southeast Asia, the Americas, Australia, and South Korea. The company operates a large-scale manufacturing facility near Qingdao Port and Airport, integrating advanced production lines, automation technologies, and high-quality branded components.

-

Founded in 1940 and headquartered in Haleyville, Alabama, Fontaine Trailer Company is a division of Marmon Holdings, a Berkshire Hathaway company. It is the largest platform trailer manufacturer in North America, specializing in the production of flatbeds, drop decks, extendables, lowbeds, and hydraulic tail trailers. The company operates advanced manufacturing facilities in Haleyville and Springville, Alabama. Fontaine Trailer is known for its commitment to quality and innovation, offering durable trailer solutions under product lines such as Velocity and TraverseHT. Its trailers are widely used across the heavy-haul, construction, industrial, and intermodal sectors, supported by IATF 16949-certified processes and a focus on continuous improvement.

Key Semi-trailer Companies:

The following are the leading companies in the semi-trailer market. These companies collectively hold the largest market share and dictate industry trends.

- Qingdao CIMC Special Vehicles Co., Ltd

- Fontaine Trailer

- Great Dane A Division of Great Dane LLC.

- Kögel

- KRONE Trailer

- LAMBERET SAS

- Polar Tank Trailer.

- Schmitz Cargobull.

- Utility Trailer Manufacturing Company

- Wabash National Corporation.

- HYUNDAI TRANSLEAD

Recent Developments

-

In April 2025, Disfrimur launched Spain’s largest refrigerated semi-trailer combination, a 32-meter, 70-ton truck set using two SOR trailers and a dolly. Developed with MAN and SOR Ibérica, the project aims to optimize cold chain logistics by doubling cargo capacity while reducing emissions and operational costs.

-

In February 2025, Volvo Trucks launched India’s first Road Train solution in partnership with Delhivery Ltd. The configuration includes a 44-ft semi-trailer and offers 50% more cargo volume than standard setups, marking a major advancement in high-capacity road transport under India’s Gati Shakti infrastructure initiative.

-

In January 2025, EKA Mobility unveiled its 55-ton electric tractor-trailer at Auto Expo 2025. Featuring a 322 kW battery, dual charging options, and a 42-ton payload capacity, the vehicle represents a significant step toward electrifying heavy-duty semi-trailer transport in India’s evolving logistics landscape.

-

In November 2024, Mack Trucks announced plans to launch a new flagship Class 8 semi-tractor in 2025. Touted as a market disruptor, the vehicle is designed to significantly expand Mack’s competitive footprint across long-haul freight, with expectations to boost its share in the semi-trailer-driven logistics segment.

-

In February 2023, The Great Dane, a Division of Great Dane LLC., a trailer manufacturer, announced upgrades to its FleetPulse smart trailer system and an electrification option from SAF-Holland for its trailers. ABS fault code notifications and hub rotation miles added to the FleetPulse system, which assists fleets in enhancing safety and efficiency.

-

In February 2023, Kögel opened a workshop at its headquarters in Burtenbach, Germany. The workshop offers a wide range of services for semi-trailers and trailers of all brands. With this workshop, customers gained access to repairs, maintenance, upgrades, and customizations.

-

In January 2023, a container logistics company, KBC, expanded its fleet of Krone trailers with 51 new Box Liner FS10 skeletal trailers. The new trailers help KBC to support its rapid growth in the container logistics market.

-

In January 2023, J.B. Hunt and Wabash National Corporation signed a multi-year trailer supply agreement. The agreement between Wabash Trailers and J.B. Hunt included a supply of over 15,000 trailers.

Semi-trailer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.2 billion

Revenue Forecast in 2033

USD 42.3 billion

Growth rate

CAGR of 7.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Units and CAGR from 2025 to 2033

Report Coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments Covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Qingdao CIMC Special Vehicles Co., Ltd; Fontaine Trailer; Great Dane A Division of Great Dane LLC.; Kögel; KRONE Trailer; LAMBERET SAS; Polar Tank Trailer.; Schmitz Cargobull.; Utility Trailer Manufacturing Company; Wabash National Corporation.; HYUNDAI TRANSLEAD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Semi-trailer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global semi-trailer market report based on type and region.

-

Type Outlook (Revenue, USD Million; Volume Units, 2021 - 2033)

-

Flat Bed Trailer

-

Dry Vans

-

Refrigerated Trailers

-

Lowboy Trailers

-

Tankers

-

Others

-

-

Regional Outlook (Revenue, USD Million; Volume, Units, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global semi-trailer market size was estimated at USD 22.8 billion in 2024 and is expected to reach USD 42.3 billion in 2033.

b. The global semi-trailer market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2033 to reach 42.3 billion by 2033.

b. The Asia Pacific semi-trailer market accounted for 43.9% of the global share in 2024. The regional market is mainly driven by rapid economic expansion in India and China, the rise of e-commerce logistics, growing demand for sustainable freight solutions, and increasing public-private investments in road freight infrastructure. The region’s growing emphasis on domestic manufacturing partnerships and technological integration is shaping a more self-reliant and efficient trailer supply chain.

b. Some key players operating in the semi-trailer market include Qingdao CIMC Special Vehicles Co., Ltd; Fontaine Trailer; Great Dane A Division of Great Dane LLC.; Kögel; KRONE Trailer; LAMBERET SAS; Polar Tank Trailer.; Schmitz Cargobull.; Utility Trailer Manufacturing Company; Wabash National Corporation.; HYUNDAI TRANSLEAD.

b. Key factors that are driving the semi-trailer market growth include the rising urbanization, increasing manufacturing output, and the growing need for efficient freight transportation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.