- Home

- »

- Biotechnology

- »

-

Separation Systems For Commercial Biotechnology Market Report, 2030GVR Report cover

![Separation Systems For Commercial Biotechnology Market Size, Share & Trends Report]()

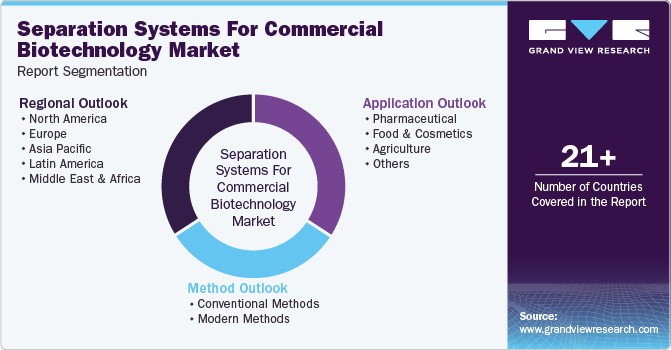

Separation Systems For Commercial Biotechnology Market (2024 - 2030) Size, Share & Trends Analysis Report By Method (Conventional Methods, Modern Methods), By Application (Pharmaceutical, Food & Cosmetics), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-841-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

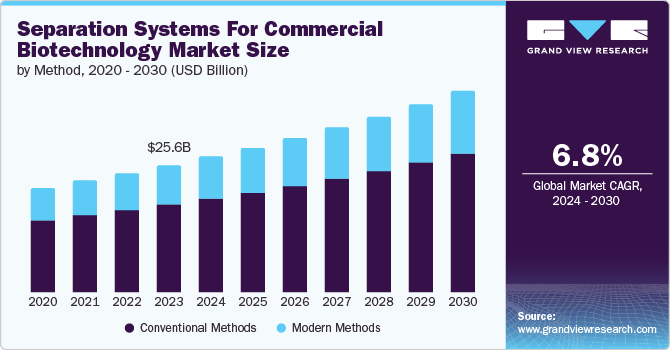

The global separation systems for commercial biotechnology market size was valued at USD 25.6 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2030. Separation systems are crucial for purifying valuable biomolecules from complex mixtures in biopharma production. The rise of biopharmaceuticals and personalized medicine fuels this growing demand for highly pure biologics.

In addition, advancements in automation and technology are making these systems more efficient and driving their use in various biotech applications. Increased R&D investments and a growing biotechnology industry in emerging regions are expected to further propel the market growth.

The increasing regulatory requirements for purity and safety in biotechnological products is a significant driver. Regulatory bodies such as the Food and Drug Administration and the European Medicines Agency impose stringent guidelines on the purity of biologics, necessitating advanced separation technologies to ensure compliance. These systems are very important in eliminating impurities and contaminants and improving the quality and safety of the products. Therefore, it is observed that due to increasing governmental standards, especially in drug safety and purity, biopharmaceutical companies are focusing on innovative separation technologies, thereby driving the market.

According to the U.S. FDA, biologics manufacturers must adhere to several regulatory sections including 21 CFR Part 600 (General Biological Products Standards), 21 CFR Part 601 (Licensing), 21 CFR Part 610 (General Biological Products Standards), 21 CFR Part 211 (Current Good Manufacturing Practice for Finished Pharmaceuticals), and 21 CFR Part 1271 (Human Cells, Tissues, and Cellular and Tissue-Based Products), covering manufacturing, quality control, labeling, and post-market surveillance to ensure the safety, purity, and potency of biologic products.

The increasing focus on sustainability and environmental concerns within the biotechnology sector is anticipated to drive market growth. As industries strive to reduce their environmental footprint, there is a growing demand for energy-efficient separation systems that produce minimal waste and utilize eco-friendly materials. Manufacturers are responding by developing technologies that enhance separation efficiency and align with sustainability goals, thereby attracting environmentally conscious biotech companies. For instance, in 2023, Merck & Co., Inc.'s life science portfolio expanded to include 2,500 Greener Alternative Products, a 34% increase from the previous year. In addition, they actively collaborated with industry peers through the Sustainable Markets Initiative Health Systems Taskforce to drive sustainable changes across industries.

Method Insights

Conventional methods dominated the market and accounted for a share of 69.2% in 2023 driven by their established reliability and cost-effectiveness. These methods, including centrifugation and filtration, have a long history of proven efficacy and regulatory acceptance, encouraging continued use. In addition, technological advancements have enhanced the efficiency and scalability of conventional systems, making them preferable for large-scale biotechnological applications.

Modern methods are expected to grow at the fastest CAGR of 7.0% over the forecast period because they provide higher precision and efficiency in separating complex biomolecules. Innovations in chromatography and membrane technologies enhance the purification process, increasing demand for high-purity biopharmaceuticals. Moreover, the rising investment in research and development for novel biotechnological applications supports the adoption of these advanced separation techniques. For instance, in February 2024, Thermo Fisher Scientific Inc. launched an ion chromatography system called Dionex Inuvion Ion Chromatography (IC). It's designed to be flexible and handle various analyses, making it a single solution for labs to study ions and small polar molecules. This simplifies ion analysis for researchers of all levels.

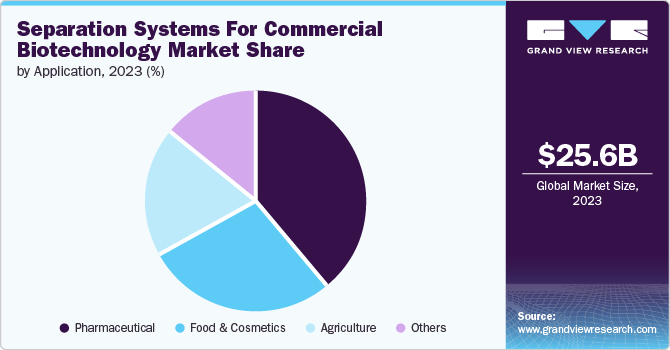

Application Insights

The pharmaceutical segment dominated and accounted for the share of 39.1% of the market in 2023 due to growing industry focus and spending on the manufacturing of timely drugs. The rise of biopharmaceuticals, personalized medicine, and stricter drug purity standards fuel the demand for advanced separation techniques in the biopharma market.

The food and cosmetics segment are projected to grow at a CAGR of 7.0% over the forecast period due to increased customer awareness about natural and clean-label products. Better extraction and purification tech means safer, higher-quality food and cosmetics. Consumers wanting healthy, organic products and stricter regulations are pushing manufacturers to adopt these advanced separation methods. For instance, in October 2023, Organic Harvest entered the color cosmetics category by launching a new makeup line with toxin-free and cruelty-free formulations. The company introduced products that prioritize both skin health and environmental well-being. This initiative aligns with the increasing demand for eco-friendly and safe beauty options.

Regional Insights

North America separation systems for commercial biotechnology dominated the market in 2023 due to its well-established pharmaceutical and biotechnology industries, which drive high demand for advanced separation technologies. Significant investments in research and development, coupled with a robust regulatory framework, also contributed to this dominance. The region's strong focus on innovation and technological advancements further propelled growth in separation systems. Furthermore, the existence of major biopharmaceutical companies and some leading research institutions in North America supported the expansion of the market.

U.S. Separation Systems for Commercial Biotechnology Market Trends

The U.S. separation systems for commercial biotechnology market dominated North America with a share of 78.0% in 2023 due to substantial federal funding, initiatives taken by authorities, and private investments in biotech research and development. The country’s advanced healthcare infrastructure and presence of leading biotechnology companies also fueled market growth. Furthermore, a high demand for innovative biopharmaceuticals and personalized medicine drove the adoption of cutting-edge separation technologies. For instance, established under the Agriculture, Food, Conservation, and Trade Act of 1990, the U.S. Department of Agriculture (USDA) Biotechnology Risk Assessment Grants (BRAG) program supports research on the environmental impact of genetically engineered organisms (GE). This program assesses risks associated with introducing GE organisms into the environment, aiming to generate new information to make science-based decisions with the help of regulatory agencies.

Europe Separation Systems for Commercial Biotechnology Market Trends

Europe separation systems for the commercial biotechnology market grew high in 2023. This is due to robust investments in regional biopharmaceutical research and development. In addition, stringent regulatory standards for drug purity and quality are enhancing the adoption of advanced separation technologies. Furthermore, the increasing focus on personalized medicine and biotechnological innovations further propelled market growth in Europe. According to the Wallonia Export and Investment Agency, Belgium leads Europe in biopharmaceutical R&D investment, spending nearly 70% more than Denmark and Slovenia. In 2021, 578 clinical trials, a 20% increase from the previous year, were approved in Belgium, which ranked second in clinical trials per capita. In addition, Belgium ranks second for biopharmaceutical patent applications per capita, filing over one application daily and third for the share of biopharmaceutical patents in total applications.

The UK separation systems for the commercial biotechnology market are expected to grow higher in the coming years due to increased government support and funding for biotechnology research and development initiatives. The presence of world-class research institutions and strong collaborations between educational institutions and industry are also driving advancements in separation technologies. Furthermore, the rising demand for biopharmaceuticals and the focus on sustainable production processes are anticipated to propel market growth further.

Asia Pacific Separation Systems for Commercial Biotechnology Market Trends

Asia Pacific separation systems for the commercial biotechnology market are anticipated to grow significantly due to expanding biopharmaceutical manufacturing capabilities in countries such as China and India. In addition, healthcare expenditures are increasing, along with significant rises in investments in biotechnology infrastructure, which is driving the growth in this region. Furthermore, a growing focus on developing innovative biotechnological solutions and the presence of a large patient population are driving the adoption of advanced separation technologies in the region.

China separation systems for the commercial biotechnology market held a substantial share in 2023 due to its rapid expansion in biopharmaceutical manufacturing capabilities and biotechnology infrastructure. Government initiatives promoting innovation and biotech investment, alongside favorable regulatory policies, have stimulated market growth. In addition, collaborations between domestic and international biotech firms have increased the adoption of advanced separation technologies in China. For instance, from 2010 to 2020, China's biopharma sector surged, with market capitalization leaping from USD 1 billion to over USD 200 billion and startup funding doubling to USD 26.12 billion. During this period, 141 new biopharma companies emerged, outpacing the 79 formed in the previous decade. This contrasts sharply with declines in biotech companies across the US, EU, and Japan, highlighting China's rapid growth and investment in the industry.

Key Separation Systems For Commercial Biotechnology Company Insights

Some key companies in the global separation systems for commercial biotechnology market include Thermo Fisher Scientific Inc., QIAGEN, Horizon Discovery Ltd., OriGene Technologies, Inc., Oxford Biomedica PLC, SignaGen Laboratories, Flash Therapeutics, Takara Bio Inc., Bio-Rad Laboratories, Inc., System Biosciences, LLC., Promega Corporation, F. Hoffmann-La Roche Ltd, Revvity, and Catalent, Inc. Organizations in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Thermo Fisher Scientific Inc. offers advanced chromatography and mass spectrometry solutions. Their technologies are designed to enhance biomolecular analysis and purification efficiency and precision. These systems support research and development across various biotech applications, from drug discovery to production.

-

Bio-Rad is a player in life sciences, offering various tools for research and clinical diagnostics. They have crucial technology for isolating and purifying biomolecules such as proteins and DNA used in drug development, gene editing, and other biotech applications. The company's focus on quality and innovation helps researchers and biotech companies make breakthroughs.

Key Separation Systems For Commercial Biotechnology Companies:

The following are the leading companies in the separation systems for commercial biotechnology market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- QIAGEN

- Horizon Discovery Ltd.

- OriGene Technologies, Inc.

- Oxford Biomedica PLC

- SignaGen Laboratories

- Flash Therapeutics

- Takara Bio Inc.

- Bio-Rad Laboratories, Inc.

- System Biosciences, LLC.

- Promega Corporation

- F. Hoffmann-La Roche Ltd

- Revvity

- Catalent, Inc

Recent Developments

-

In June 2024, Thermo Fisher Scientific Inc. launched biobased solutions to reduce the environmental footprint in manufacturing therapies. These innovations are designed to substitute traditional materials with sustainable alternatives, lowering carbon emissions and promoting eco-friendly practices within the pharmaceutical industry.

-

In February 2023, Bio-Rad launched StarBright Blue and StarBright Yellow dyes, which enhance multiplex flow cytometry by providing bright and distinct fluorescence signals. These dyes aim to improve researchers' ability to simultaneously analyze multiple biomarkers with high sensitivity and resolution in biological samples.

Separation Systems For Commercial Biotechnology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 27.27 billion

Revenue forecast in 2030

USD 40.55 billion

Growth Rate

CAGR of 6.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

September 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Method, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; QIAGEN; Horizon Discovery Ltd.; OriGene Technologies, Inc.; Oxford Biomedica PLC; SignaGen Laboratories; Flash Therapeutics; Takara Bio Inc.; Bio-Rad Laboratories, Inc.; System Biosciences, LLC.; Promega Corporation; F. Hoffmann-La Roche Ltd; Revvity; Catalent, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Separation Systems For Commercial Biotechnology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global separation systems for commercial biotechnology market report based on method, application, and region.

-

Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional Methods

-

Chromatography

-

Flow Cytometry

-

Membrane Filtration

-

Electrophoresis

-

Centrifugation

-

-

Modern Methods

-

Microarray

-

Lab-on-a-chip

-

Magnetic Separation

-

Biochip

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical

-

Vaccines

-

Proteins

-

Hormones/Insulin

-

Enzymes

-

Human Blood Plasma Fractionation

-

Mammalian Cell Cultures

-

-

Food & Cosmetics

-

Agriculture

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.