- Home

- »

- Biotechnology

- »

-

Sequencing Reagents Market Size, Industry Report, 2030GVR Report cover

![Sequencing Reagents Market Size, Share & Trends Report]()

Sequencing Reagents Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Sanger Sequencing, NGS, 3G), By Type (Library Kits, Template Kits), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-683-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Sequencing Reagents Market Size & Trends

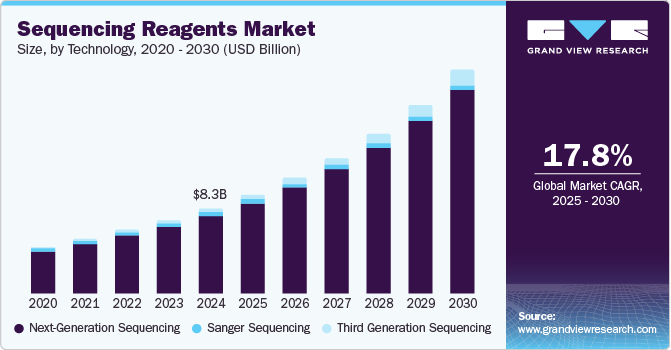

The global sequencing reagents market size was estimated at USD 8.27 billion in 2024 and is projected to grow at a CAGR of 17.8% from 2025 to 2030. Market growth worldwide is driven by a combination of technological advancements, increasing demands for advanced sequencing methods, and significant investments in genomic research. One of the most notable trends is the rising demand for third-generation sequencing (3G) techniques, such as Nanopore and single-molecule real-time sequencing. These technologies are recognized for their high accuracy, efficiency, and cost-effectiveness in genomic studies, making them increasingly attractive to researchers. As a result, the market is benefiting from a heightened focus on precision medicine, which relies heavily on high-quality sequencing reagents.

A significant factor contributing to market growth is the substantial decline in the cost of genetic sequencing. According to Frontline Genomics, the price of sequencing plummeted from approximately USD 10-15 million per genome in 2001 to around USD 1,200 by 2017, enhancing the accessibility of these technologies across various research fields. This reduction enables more institutions to adopt sequencing solutions, thus stimulating demand. Furthermore, increased funding from government initiatives and private entities has bolstered the development of new sequencing technologies and reagents, particularly in North America and Asia Pacific.

The expansion of Next-Generation Sequencing (NGS) applications is a critical driver of market growth, with notable gains in clinical diagnostics, molecular pathology, and research. According to the World Health Organization (WHO), as of December 2022, 84% of WHO Member States reported sequencing capabilities for SARS-CoV-2, a significant increase from earlier years. The WHO aims for universal genomic sequencing access for all 194 Member States by 2032, supported by guidelines for national strategies, capacity building efforts, and integration into public health systems. These developments underscore the growing demand for genomic studies, particularly in enhancing global health security post-COVID-19.

Moreover, the availability of economic genome sequencing techniques is creating new opportunities in the market. For instance, in February 2024, Quantum-Si launched enhancements to its Platinum platform, including V2 Sequencing Kits, increasing sequencing output, performance, and cost efficiency while enabling the identification of unknown proteins. As the market evolves, continuous advancements will likely enhance diagnostic capabilities and foster greater integration into precision medicine systems, significantly benefiting patient outcomes.

Technology Insights

Next-generation sequencing (NGS) dominated the market and accounted for a share of 91.7% in 2024. NGS is widely employed in molecular diagnostics, pathology, and clinical research due to its cost-effectiveness and high throughput capabilities. It facilitates the identification of rare genetic variations, advancing personalized medicine and companion diagnostics. For instance, in March 2024, the WHO issued recommendations for targeted NGS tests to detect drug-resistant tuberculosis and introduced a new sequencing portal.

Third generation sequencing (3G) is expected to register the fastest CAGR of 29.8% over the forecast period. 3G sequencing, particularly utilizing single-molecule real-time (SMRT) technology, significantly enhances the accuracy and efficiency of genome sequencing by enabling precise re-sequencing and detection of chromosomal dislocations. A Frontiers in Genetics study demonstrated that an Oxford Nanopore sequencer successfully identified translocation breakpoints in carriers, validating six of eight breakpoints, thus emphasizing its effectiveness in delivering comprehensive genetic insights.

Type Insights

Sequencing kits led the market with a revenue share of 35.7% in 2024, owing to the presence of major high-throughput platforms such as Illumina, Inc.’s MiniSeq, MiSeq, iSeq, NextSeq, HiSeq X, and NovaSeq series; Thermo Fisher Scientific’s PGM, Ion S5, and Ion Proton systems; and Oxford Nanopore Technologies’ MinION, GridION X5, and PromethION. Recent product launches by key industry players are anticipated to propel market growth further. For instance, in October 2024, Illumina, Inc. introduced the MiSeq i100 Series, featuring its most user-friendly and rapid benchtop sequencers.

Library kits are expected to grow at the fastest CAGR of 20.7% over the forecast period. Automating library construction with liquid handling platforms and essential accessories for heating, cooling, shaking, and magnetic bead manipulations enhances the quality of libraries for whole-genome sequencing. This segment is poised for significant growth, driven by the launch of innovative library kits. For instance, in May 2024, QIAGEN introduced the QIAseq Multimodal DNA/RNA Library Kit, which streamlines RNA and DNA library creation, enabling target enrichment from a single sample.

Application Insights

Applications in oncology held the largest market share of 31.7% in 2024, driven by the extensive use of sequencing reagents in clinical research and advancements in cancer diagnostics and therapeutics. Enhanced sequencing technologies provide oncologists with critical genetic insights, facilitating precision oncology and innovative clinical trials. Notably, a Springer Nature 2024 study demonstrated that whole-genome sequencing (WGS) of 281 pediatric tumors influenced clinical management in approximately 7% of cases, identifying 108 disease-related findings, far surpassing standard molecular testing capabilities.

Consumer genomics is expected to witness the fastest growth of 22.3% over the forecast period. The industry is transitioning from personal applications to clinical uses, encompassing direct-to-consumer and patient-requested testing via healthcare providers. This shift, bolstered by rising consumer interest and accessible genomic testing options, drives the demand for sequencing reagents, necessitating a broader range of high-quality solutions. Consequently, this growth elevates the need for advanced technologies and larger reagent volumes to support personal and clinical genomic testing.

End Use Insights

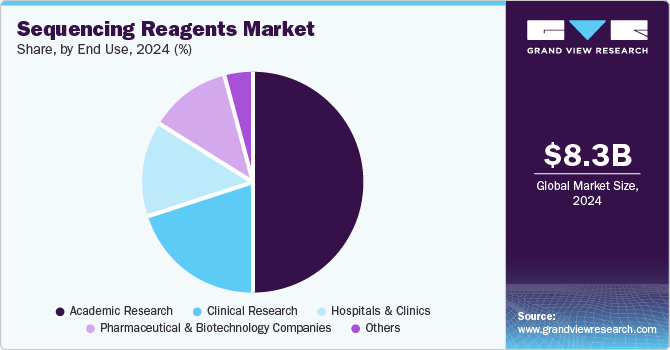

Academic research led the market and accounted for a share of 50.0% in 2024, with numerous universities and research centers offering molecular biology courses that extensively employ next-generation sequencing (NGS) techniques. Scholarships for Ph.D. studies in NGS will further drive the demand for NGS reagents. Noteworthy funding initiatives, such as the 10X Genomics/Illumina Sequencing Pilot Program, the PacBio STAR Grant, and the Mellowes Center Sequencing and Analysis Grant from 2024, among others, are available to support genomic research. These grants promote innovation in sequencing technologies, facilitating significant advancements in genomics across various research domains.

The clinical research segment is projected to grow at the fastest CAGR of 21.6 over the forecast period. NGS reagents are increasingly utilized in clinical diagnostics due to their capability to detect minute mutations at single-nucleotide resolution without requiring additional mutation data. The rising adoption of various genomic technologies is expected to propel market growth. For instance, in October 2024, MyOme and Broad Clinical Labs collaborated to support Southern Research’s Catalyst program, delivering free genetics-driven health assessments to enhance healthcare decision-making for Alabamians and address disparities.

Regional Insights

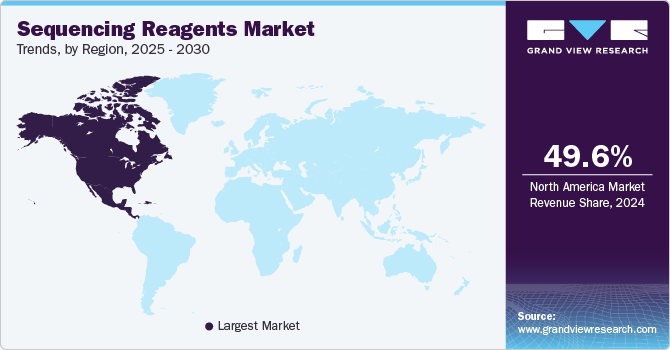

North America sequencing reagents market dominated the global market with a revenue share of 49.6% in 2024. The market is projected to experience rapid growth due to increased research funding in precision medicine, which leverages next-generation sequencing technology. For instance, in July 2024, Thermo Fisher Scientific Inc. partnered with the National Cancer Institute on the myeloMATCH precision medicine trial, focusing on AML and MDS treatments. The collaboration uses Thermo Fisher’s NGS technology to quickly match patients to trials by analyzing bone marrow and blood genetic biomarkers to target specific mutations.

U.S. Sequencing Reagents Market Trends

The sequencing reagents market in the U.S. dominated the North America sequencing reagents market with the largest revenue share in 2024. The market is expected to register rapid growth during the forecast period due to recent partnerships announced by key companies. For instance, in February 2024, Standard BioTools and Next Gen Diagnostics announced a long-term partnership to transform the process of automating sample preparation for sequencing the entire genome of pathogens.

Europe Sequencing Reagents Market Trends

Europe sequencing reagents market held substantial market share in 2024, fueled by an intensified emphasis on personalized medicine and robust investment in healthcare. The surge in genomic research and advancements in sequencing technologies are contributing to the rising demand for high-quality reagents. For instance, in September 2024, Takara Bio Europe launched the Shasta Single-Cell System, a high-throughput NGS solution for oncology research, enhancing biomarker discovery and significantly improving throughput and cost-efficiency.

The sequencing reagents market in Germany is thriving, primarily due to cost-effective sequencing technologies and a strong research infrastructure. In January 2024, the Federal Ministry of Health updated the genomDE National Strategy for Genomic Medicine to enhance disease prevention, diagnosis, and treatment while addressing ethical concerns and data security. This initiative underscores Germany’s strategic importance in advancing genomic research and its influence on clinical diagnostics, reinforcing its position in the European market.

Asia Pacific Sequencing Reagents Market Trends

Asia Pacific sequencing reagents market is expected to register the fastest CAGR of 18.6% in the forecast period. This growth owes to the significantly increasing investments in genomics-focused biomedical research across the region. For instance, in March 2024, The Advanced Genomic Collaboration (TAGC) announced it would fund USD 6.5 million to boost genomics research in oncology, inherited eye diseases, and gynecological diseases.

The sequencing reagents market in China is expected to grow at the fastest rate in the Asia Pacific market over the forecast period, driven by substantial government investment in genomic research and an increasing demand for personalized medicine. For instance, in September 2024, MGI Tech secured global rights to commercialize CycloneSEQ technology, enhancing its sequencing product portfolio with advanced capabilities for high accuracy, throughput, and diverse omics applications. Furthermore, in July 2024, the Ministry of Science and Technology (MOST) released new Ethical Guidelines for Human Genome Editing, underscoring the importance of responsible research practices and addressing ethical considerations associated with genome editing technologies.

Key Sequencing Reagents Company Insights

Some key companies operating in the market include Thermo Fisher Scientific Inc., Illumina, Inc., QIAGEN, BGI, PacBio, and F. Hoffmann-La Roche Ltd. Key market players are prioritizing strategic partnerships and innovative product launches, including cost-effective sequencing kits and automation solutions, to strengthen their market presence and streamline workflows.

-

Thermo Fisher Scientific Inc. provides various products and services, including analytical instruments and life sciences solutions. Key among these is the CE-IVD marked Ion Torrent Genexus Dx Integrated Sequencer, designed for clinical laboratories of varying expertise levels. This NGS tool offers an accessible, user-friendly experience while ensuring regulatory compliance.

-

Illumina, Inc. provides array-based and genomic sequencing solutions for genetic analysis in molecular diagnostics, genomics, and cancer research. Its portfolio includes sequencing reagents, tools, kits, and services for whole-genome consulting, microarrays, and sequencing. The company serves genomic research centers, academic institutions, pharmaceutical firms, clinical research organizations, and biotechnology companies.

Key Sequencing Reagents Companies:

The following are the leading companies in the sequencing reagents market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Illumina, Inc.

- QIAGEN

- BGI

- PacBio

- F. Hoffmann-La Roche Ltd

- Oxford Nanopore Technologies plc.

- Agilent Technologies, Inc.

- Standard BioTools Inc.

- Integrated DNA Technologies, Inc.

- Takara Bio Inc.

- Meridian Bioscience

Recent Developments

-

In December 2024, Quantum-Si launched its Platinum Library Prep Kit, V2, optimizing single-molecule protein sequencing. This kit improved accessibility, reduced preparation time, and enhanced workflow efficiency for researchers.

-

On November 22, 2024, Mahidol University and Oxford Nanopore Technologies launched Southeast Asia’s first Nanopore Center of Excellence to enhance genomics research and medical advancements regionally.

-

In November 2024, PacBio launched the Vega system, a benchtop long-read sequencing platform priced at USD 169,000, enhancing access to accurate HiFi sequencing for diverse research applications.

-

In June 2024, MGI Tech launched an efficient whole workflow solution for agricultural low-pass whole genome sequencing at PAG Asia 2024, streamlining processes for large-scale molecular breeding genotyping.

-

In May 2024, SOPHiA GENETICS, in partnership with Microsoft and NVIDIA, launched a scalable whole genome sequencing analytical solution for healthcare institutions.

-

In April 2024, the European Parliament adopted a new directive, impacting pricing and reimbursement timelines for pharmaceuticals, requiring compliance within specified deadlines and potentially imposing financial penalties for non-compliance.

Sequencing Reagents Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.64 billion

Revenue forecast in 2030

USD 21.91 billion

Growth rate

CAGR of 17.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Technology, type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Illumina, Inc.; QIAGEN; BGI; PacBio; F. Hoffmann-La Roche Ltd; Oxford Nanopore Technologies plc.; Agilent Technologies, Inc.; Standard BioTools Inc.; Integrated DNA Technologies, Inc.; Takara Bio Inc.; Meridian Bioscience

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Sequencing Reagents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global sequencing reagents market report based on technology, type, application, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Sanger Sequencing

-

Next-Generation Sequencing

-

Third Generation Sequencing

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Library Kits

-

Template Kits

-

Control Kits

-

Sequencing Kits

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Reproductive Health

-

Clinical Investigation

-

Agrigenomics & Forensics

-

Consumer Genomics

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic Research

-

Clinical Research

-

Hospitals & Clinics

-

Pharmaceutical & Biotechnology Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global sequencing reagents market size was estimated at USD 8.27 billion in 2024 and is expected to reach USD 9.64 billion in 2025.

b. The global sequencing reagents market is expected to grow at a compound annual growth rate of 17.85% from 2025 to 2030 to reach USD 21.91 billion by 2030.

b. Next-generation sequencing (NGS) segment dominated the sequencing reagents market with a share of 91.71% in 2024. This is because NGS has become a common practice in molecular diagnostics, molecular pathology, and other clinical research applications due to its lower costs and higher throughput capabilities.

b. Some key players operating in the sequencing reagents market include Thermo Fisher Scientific, Inc.; Illumina, Inc.; QIAGEN; BGI; Pacific Biosciences of California, Inc.; F. Hoffmann-La Roche AG; Oxford Nanopore Technologies; Agilent Technologies, Inc.; Fluidigm Corporation; ArcherDX, Inc.;Takara Bio Inc.; and Bioline.

b. Key factors that are driving the market growth include decreasing costs for genetic sequencing, increasing demand for third-generation sequencing, presence of a substantial number of funding programs, and a rise in competition amongst prominent market entities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.