- Home

- »

- Pharmaceuticals

- »

-

SGLT2 Inhibitors Market Size & Share, Industry Report 2033GVR Report cover

![SGLT2 Inhibitors Market Size, Share & Trends Report]()

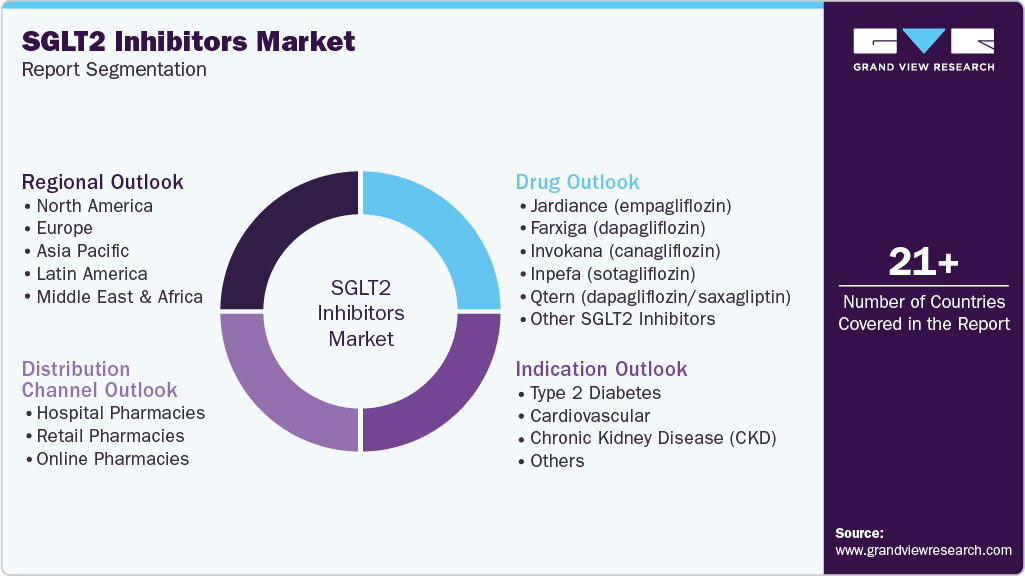

SGLT2 Inhibitors Market (2025 - 2033) Size, Share & Trends Analysis Report By Drug (Jardiance, Farxiga, Inpefa, Invokana), By Indication (Type 2 Diabetes, Cardiovascular), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-322-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

SGLT2 Inhibitors Market Summary

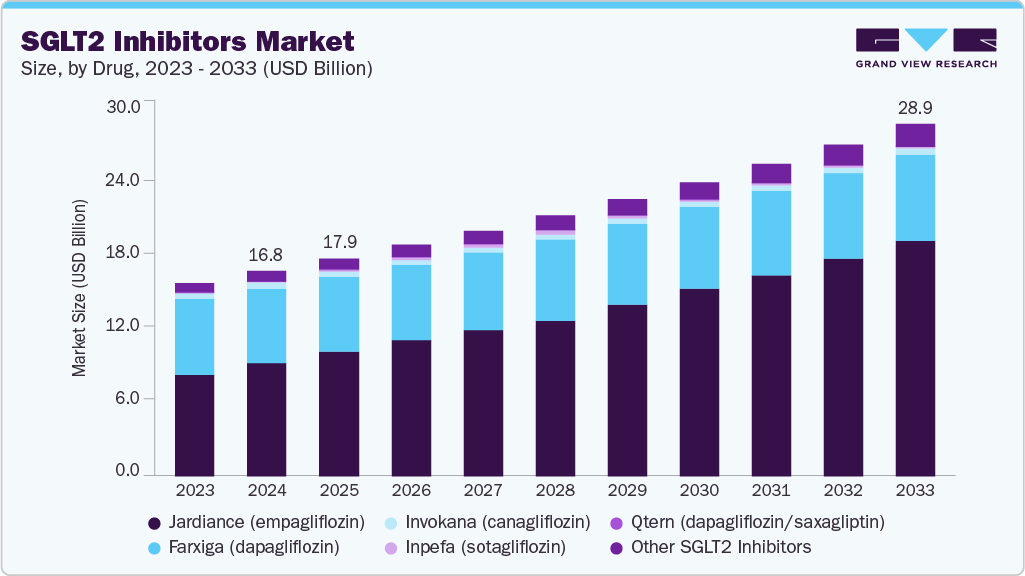

The global SGLT2 inhibitors market size was estimated at USD 16.8 billion in 2024 and is projected to reach USD 28.9 billion by 2033, growing at a CAGR of 6.19% from 2025 to 2033. These drugs, used for Type 2 diabetes and comorbidities, are in high demand due to their effectiveness in glycemic control and cardiovascular risk reduction.

Key Market Trends & Insights

- North America held the largest revenue share of 40.79% in 2024.

- The SGLT2 inhibitors market in the U.S. is expanding due to the increasing prevalence of type 2 diabetes, cardiovascular diseases, and chronic kidney disease.

- Based on the drug category, the Jardiance (empagliflozin) segment dominated the market with a share of 55.30% in 2024.

- Based on indication, type 2 diabetes dominated the market with a share of 71.83% in 2024.

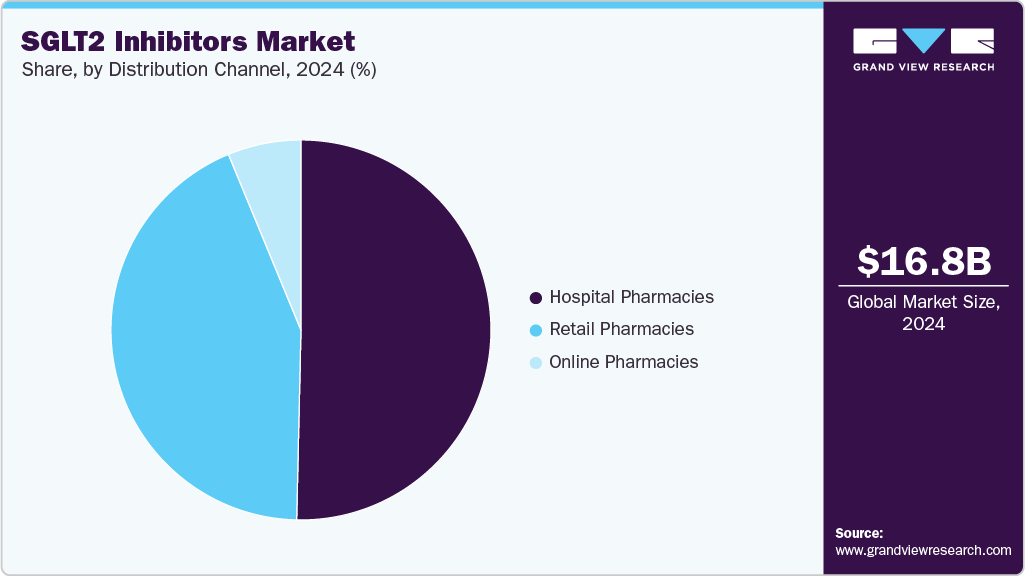

- By distribution channel, the hospital pharmacies segment held a considerable market share of 50.36% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16.8 Billion

- 2033 Projected Market Size: USD 28.9 Billion

- CAGR (2025-2033): 6.19%

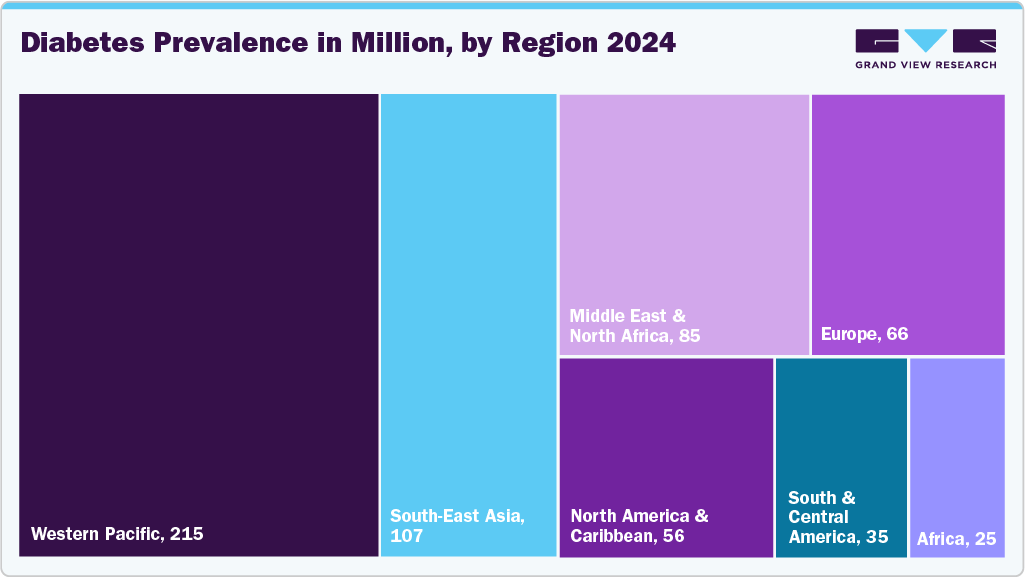

The market is experiencing significant growth due to the increasing global prevalence of Type 2 diabetes, along with related comorbidities such as cardiovascular diseases and chronic kidney disease. According to the International Diabetes Federation (IDF), nearly 589 million adults worldwide were living with diabetes in 2024, a figure that is expected to rise to 853 million by 2050. This growing burden of diabetes is prompting healthcare systems to seek more effective treatment options, with SGLT2 inhibitors gaining popularity due to their dual benefits of glycemic control and cardiovascular protection. These drugs, such as empagliflozin and dapagliflozin, have shown significant efficacy in reducing cardiovascular mortality and hospitalizations for heart failure in diabetic patients. Furthermore, the increasing recognition of the role of SGLT2 inhibitors in treating chronic kidney disease is driving further market demand, with the FDA’s approval of dapagliflozin for chronic kidney disease in non-diabetic patients marking a notable expansion of its indications in 2020.

Key market players, such as AstraZeneca, Boehringer Ingelheim, and Janssen Pharmaceuticals, continue to invest heavily in developing and commercializing SGLT2 inhibitors, expanding their therapeutic applications beyond diabetes. In May 2023, AstraZeneca received approval from the FDA for dapagliflozin (Farxiga) to treat heart failure with preserved ejection fraction (HFpEF), a major development in the cardiovascular space. Similarly, the approval of sotagliflozin by the FDA in May 2023, which targets both SGLT1 and SGLT2, represents a major advancement in heart failure and chronic kidney disease management, offering new hope for patients with Type 2 diabetes. Furthermore, ongoing clinical trials, such as those investigating the use of empagliflozin in non-diabetic chronic kidney disease patients, highlight the expanding pipeline in this therapeutic area.

Governments and regulatory bodies are also crucial in supporting market growth. For example, the U.S. FDA and the European Medicines Agency (EMA) have approved multiple SGLT2 inhibitors for a range of indications beyond diabetes, including heart failure and chronic kidney disease. In addition, many countries are implementing healthcare policies to improve access to these therapies for patients with Type 2 diabetes and related conditions. According to the U.S. Centers for Disease Control and Prevention (CDC), cardiovascular disease is one of the leading causes of death among people with diabetes, further emphasizing the need for innovative treatments like SGLT2 inhibitors. These efforts, coupled with increasing investments in research and development, are expected to accelerate the adoption of these drugs across various regions and further contribute to market growth.

Moreover, introducing new drugs such as Infepa is anticipated to contribute to market dynamics. Infepa, developed as a treatment for Type 2 diabetes and related comorbidities, has entered the market with significant attention from both healthcare providers and patients. As the market matures, factors such as the expiration of patents for several SGLT2 inhibitors will likely influence competitive dynamics, leading to the introduction of generics and potentially reducing costs. With the growing demand for alternatives, other treatment options, including GLP-1 receptor agonists and insulin-based therapies, are being explored to address gaps in current diabetes management. The ongoing evolution of the market suggests that stakeholders will need to adapt to regulatory changes and the increasing preference for more cost-effective solutions.

Table: Drug patent expiration data

Drug Name

Brand Name

Patent Expiration Date

Notes

Dapagliflozin

Forxiga

2023

Molecule patent expired; formulation patents extend exclusivity until 2028.

Empagliflozin

Jardiance

2025

Multiple patents; earliest generic entry possible after 2026.

Canagliflozin

Invokana

2031

Last patent expiration; generic entry possible after this date.

Source: FDA, EMA

Pipeline Analysis

Ongoing market research focuses on expanding therapeutic indications and improving patient outcomes. Drugs like sotagliflozin, a dual SGLT1/2 inhibitor, have shown potential in reducing cardiovascular events in patients with type 2 diabetes, chronic kidney disease, and cardiovascular risk factors. In addition, enavogliflozin has been approved for clinical use in South Korea and Ecuador, with further trials underway. Ongoing Phase 3 trials for drugs such as HRS9531, Cagrilintide, Orforglipron, and Dapagliflozin target Type 2 diabetes, heart failure, and chronic kidney disease, with expected launches in the near future. These developments aim to broaden the patient population eligible for SGLT2 therapies and enhance market prospects by addressing a wider range of health issues.

Table: Ongoing Clinical Trials and Expected Launch

NCT Number

Conditions

Interventions

Sponsor

Phases

Expected Launch

NCT06649344

Type 2 Diabetes

DRUG: HRS9531 Injection|DRUG: Semaglutide Injection

Fujian Shengdi Pharmaceutical Co., Ltd.

Phase 3

2028

NCT06534411

Diabetes Mellitus, Type 2

DRUG: Cagrilintide|DRUG: Semaglutide|DRUG: Tirzepatide

Novo Nordisk A/S

Phase 3

2028

NCT06109311

Type 2 Diabetes

DRUG: Orforglipron|DRUG: Placebo

Eli Lilly and Company

Phase 3

2027

NCT06221969

Type 2 Diabetes

DRUG: Cagrilintide|DRUG: Semaglutide|DRUG: Tirzepatide

Novo Nordisk A/S

Phase 3

2028

NCT06260722

Diabetes Mellitus, Type 2

DRUG: Retatrutide|DRUG: Semaglutide

Eli Lilly and Company

Phase 3

2029

NCT06065540

Type 2 Diabetes Mellitus

DRUG: Cagrilintide|DRUG: Semaglutide|DRUG: Placebo cagrilintide|DRUG: Placebo semaglutide

Novo Nordisk A/S

Phase 3

2028

NCT06683053

Congestive Heart Failure (CHF)

DRUG: empagliflozin

Conrado Roberto Hoffmann Filho

Phase 3

2027

NCT06415773

T2DM (Type 2 Diabetes Mellitus)

DRUG: HTD1801|DRUG: Dapagliflozin

HighTide Biopharma Pty Ltd

Phase 3

2027

NCT06192108

Type 2 Diabetes

DRUG: Orforglipron|DRUG: Dapagliflozin

Eli Lilly and Company

Phase 3

2027

NCT06087835

Chronic Kidney Disease With High Proteinuria

DRUG: Zibotentan/Dapagliflozin|DRUG: Dapagliflozin

AstraZeneca

Phase 3

2029

NCT03762850

Immunoglobulin A Nephropathy

DRUG: sparsentan|DRUG: irbesartan|DRUG: Dapagliflozin

Travere Therapeutics, Inc.

Phase 3

2028

Source: Clinicaltrial.gov

Opportunity Analysis

The growth opportunities are driven by ongoing clinical trials and expanding therapeutic indications. Established therapies like empagliflozin and sotagliflozin have demonstrated strong efficacy in managing type 2 diabetes, chronic kidney disease, and heart failure, with sotagliflozin showing a 23% reduction in cardiovascular events. The pipeline is rich with Phase 3 trials, including promising agents like HRS9531 and enavogliflozin, which are poised to broaden treatment options and patient populations. These advancements, alongside new launches expected between 2027 and 2029, address a wider range of health issues and reinforce the market’s growth, particularly in regions with increasing healthcare needs. The expansion of indications and the development of novel treatments strengthen the market's long-term prospects.

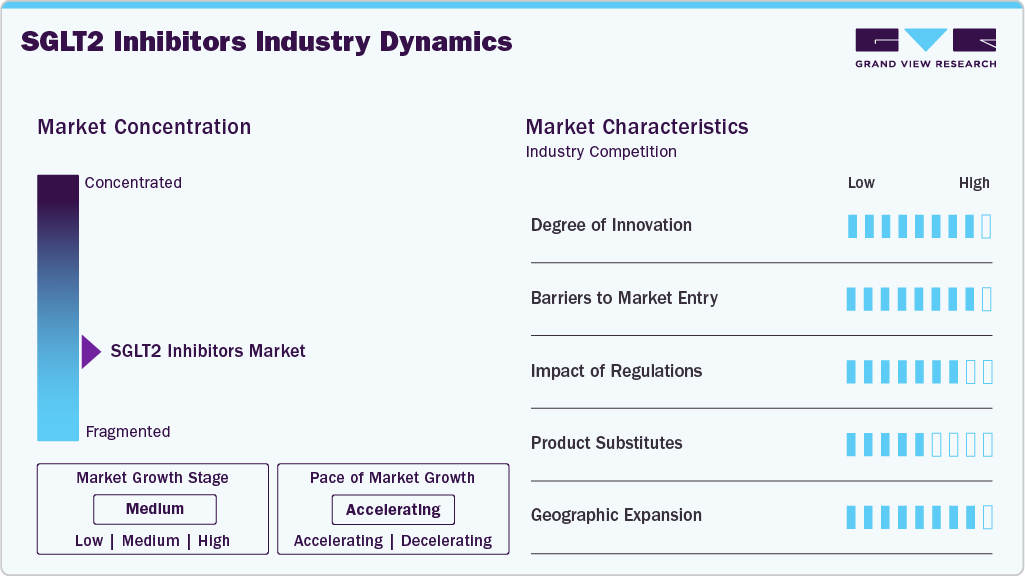

Market Concentration & Characteristics

The SGLT2 inhibitors industry is moderately concentrated, with key players like AstraZeneca, Boehringer Ingelheim, and Eli Lilly dominating through products such as Farxiga (dapagliflozin) and Jardiance (empagliflozin). These companies leverage strong brand recognition, clinical data, and distribution networks. However, emerging competitors and generic manufacturers are increasing competition, leading to price pressures and spurring innovation. The market is expanding rapidly in regions like Asia-Pacific, fueled by rising diabetes rates and better healthcare infrastructure. New players and therapeutic expansions into heart failure and chronic kidney disease are reshaping market dynamics, driving continued growth.

The SGLT2 inhibitors industry demonstrates a high degree of innovation, driven by ongoing research and the expansion of therapeutic indications. Initially developed for type 2 diabetes, these agents have shown efficacy in managing cardiovascular diseases and chronic kidney disease. FDA-approved sotagliflozin (Inpefa) inhibits both SGLT1 and SGLT2, offering enhanced efficacy in heart failure and chronic kidney disease management. This dual-target approach represents a significant advancement in the field. Furthermore, the development of fixed-dose combination therapies, such as those combining SGLT2 inhibitors with GLP-1 receptor agonists, has improved patient adherence and therapeutic outcomes. These innovations underscore the dynamic nature of the market, with continuous advancements enhancing the clinical utility of these medications.

Entering the SGLT2 inhibitors industry presents several challenges. The high cost of research and development, coupled with stringent regulatory requirements, can impede the introduction of new competitors. For example, the approval process for sotagliflozin involved multiple submissions and rejections before receiving FDA approval, highlighting the rigorous evaluation standards. Furthermore, the dominance of established players like AstraZeneca, Eli Lilly, and Janssen Pharmaceuticals creates a competitive landscape that may deter new entrants. These companies benefit from extensive clinical data, established market presence, and robust distribution networks, making it challenging for newcomers to gain market share.

Regulatory bodies such as the U.S. FDA and the European Medicines Agency play a pivotal role in shaping the market. Their stringent approval processes ensure that only medications meeting high safety and efficacy standards reach the market. For instance, the approval of sotagliflozin required overcoming initial rejections, emphasizing the importance of comprehensive clinical data. These regulatory frameworks, while ensuring patient safety, can also delay market entry and increase development costs for pharmaceutical companies. However, once approved, these medications often benefit from established reimbursement pathways, facilitating broader market access.

The SGLT2 inhibitors industry faces competition from alternative diabetes treatments, including GLP-1 receptor agonists, DPP-4 inhibitors, and insulin therapies. These alternatives offer different mechanisms of action and may be preferred in certain patient populations. For example, GLP-1 receptor agonists have shown efficacy in weight management and cardiovascular risk reduction, which may appeal to patients with specific comorbidities. Moreover, the emergence of generic versions of SGLT2 inhibitors, such as dapagliflozin, introduces cost-effective options that could influence prescribing patterns. Despite these alternatives, SGLT2 inhibitors maintain a strong position due to their multifaceted benefits, including glycemic control, weight loss, and cardiovascular protection.

The SGLT2 inhibitors industry is experiencing significant geographical expansion, particularly in emerging markets. In 2024, North America held a dominant market share of 40.79%, but regions like Asia-Pacific are witnessing faster growth rates, with a 7.15% CAGR projected from 2025 to 2033. This growth is attributed to increasing diabetes prevalence, improved healthcare infrastructure, and rising awareness of treatment options. However, challenges such as high drug costs and limited access to healthcare in low-income regions may hinder market penetration. To address these barriers, pharmaceutical companies are exploring strategies like tiered pricing and partnerships with local healthcare providers to enhance accessibility and affordability in these regions.

Drug Insights

Jardiance dominated the market and accounted for 55.30% of the global revenue in 2024, which is anticipated to grow significantly over the forecast period. Primarily used for treating type 2 diabetes and in patients at risk of heart failure, Jardiance has extended patient lives by over 461,000 patient-life years. The drug generated €9.2 billion in sales for Boehringer Ingelheim in 2024, reflecting a 14.6% increase from the previous year. Notably, in August 2024, Jardiance was selected by the Centers for Medicare & Medicaid Services (CMS) for the first round of drug price negotiations under the Inflation Reduction Act. This initiative aims to reduce out-of-pocket costs for Medicare beneficiaries, with the negotiated prices set to take effect on January 1, 2026.

Tirzepatide is the fastest-growing market segment in 2024, driven by its dual action on GLP-1 and GIP receptors, enhancing efficacy in managing Type 2 diabetes and obesity. In 2023, tirzepatide received approval from the Saudi Food and Drug Authority (SFDA) for treating Type 2 diabetes, boosting its uptake in the region. The combination of increased regulatory support and demonstrated clinical benefits continues to accelerate its global adoption. For example, a large cardiovascular outcomes trial revealed that Mounjaro (tirzepatide) reduced major adverse heart events by 8% more than Trulicity and decreased overall mortality by 16%. Following its March 2025 launch, Mounjaro achieved USD 5.9 million in sales in India within just 90 days, with USD 3.1 million generated in June alone.

Indication Insights

Type 2 Diabetes dominated the market with a market share of 71.83% in 2024. This is primarily driven by increasing diabetes awareness in developed and developing countries and a growing patient population. According to the Centers for Disease Control and Prevention (CDC), approximately 38.2 million people with type 2 diabetes are expected to visit physicians for primary diagnosis in 2024. The rising number of patient visits for diagnosis and treatment is anticipated to accelerate the demand for SGLT2 inhibitors in this segment, supporting continued market expansion in the coming years.

The cardiovascular segment is expected to grow fastest over the forecast period. SGLT2 inhibitors significantly reduce the risk of hospitalization for heart failure, offering substantial benefits for patients with reduced and preserved ejection fractions. With the growing prevalence of cardiovascular diseases, the demand for effective treatments such as SGLT2 inhibitors is set to increase. Heart failure continues to be a major public health issue, with more than 64 million people worldwide currently affected, according to the HF Stats 2024. This condition’s prevalence is expected to increase substantially, with predictions suggesting a 70% growth in cases by 2050 due to factors such as an aging population and increasing rates of conditions like diabetes and hypertension. Government efforts to mitigate heart failure's social and economic burden are anticipated to further drive the market demand for SGLT2 inhibitors, leading to robust growth in the cardiovascular segment.

Distribution Channel Insights

The hospital pharmacies segment held a considerable market share of 50.36% in 2024. This dominance is attributed to the significant advantages that hospital pharmacies offer over other types, such as retail and online pharmacies. Hospital pharmacies operate 24/7, ensuring continuous access to medications and pharmacy services for inpatient and emergency care. In contrast, retail pharmacies typically have limited operating hours, often unavailable during evenings, weekends, or holidays. This round-the-clock availability is especially critical in urgent medical situations, making hospital pharmacies a preferred choice for many patients and contributing to their market share.

The online pharmacies segment is projected to experience significant growth over the forecast period. Online pharmacies provide patients with convenient access to SGLT2 inhibitors, enabling them to order medications from the comfort of their homes and deliver them directly to their doorstep. This is particularly beneficial for patients with mobility limitations or those residing in remote areas. Furthermore, online pharmacies offer a discreet and confidential purchasing option, which helps reduce the stigma often associated with medical conditions like diabetes or erectile dysfunction. This added privacy is expected to contribute to the growing preference for online pharmacies, driving their expansion in the market.

Regional Insights

The North American market for SGLT2 inhibitors holds the largest market share of 40.79% in 2024, driven by several key trends. One prominent trend is the increasing shift toward using these medications for broader indications, including not just type 2 diabetes, but also heart failure and chronic kidney disease. This trend is supported by a growing body of clinical research demonstrating the benefits of SGLT2 inhibitors in these additional therapeutic areas, fueling demand. In particular, the approval of drugs like Farxiga (dapagliflozin) and Jardiance (empagliflozin) for multiple indications has made them essential components in the treatment regimens for patients with cardiovascular and renal conditions.

In addition, North America’s healthcare infrastructure and ongoing government efforts to improve patient access to medications are other contributing factors. For example, the inclusion of SGLT2 inhibitors in government programs, such as the U.S. Centers for Medicare and Medicaid Services' (CMS) negotiations, has helped make these therapies more affordable and accessible. As the region continues to focus on managing the growing burden of chronic diseases like diabetes and heart failure, the demand for SGLT2 inhibitors is expected to rise. Furthermore, the intensifying competition from established and emerging pharmaceutical companies, combined with the launch of generic versions, is shaping the market landscape, ensuring continued innovation and market growth.

U.S. SGLT2 inhibitors Market Trends

The SGLT2 inhibitors market in the U.S. is expanding due to the increasing prevalence of type 2 diabetes, cardiovascular diseases, and chronic kidney disease. As of the latest data by HFSA, approximately 6.7 million Americans aged 20 and older are living with heart failure. This figure is projected to rise to 8.7 million by 2030, 10.3 million by 2040, and 11.4 million by 2050, underscoring the significant need for treatments addressing diabetes and cardiovascular conditions. The growing recognition of the dual benefits of SGLT2 inhibitors, particularly in managing diabetes and heart failure, has bolstered their adoption in clinical settings.

Government initiatives also play a critical role in shaping the market dynamics. The U.S. Centers for Medicare & Medicaid Services (CMS) has included SGLT2 inhibitors in its reimbursement programs, improving patient access, especially in underserved populations. Furthermore, the U.S. Food and Drug Administration (FDA) has approved additional indications for these drugs, most recently with the approval of sotagliflozin (Inpefa) in June 2023, the first dual SGLT1/2 inhibitor for heart failure and chronic kidney disease. Such regulatory advancements highlight the evolving therapeutic role of SGLT2 inhibitors in addressing multiple comorbidities, further driving market growth in the U.S.

Europe SGLT2 Inhibitors Market Trends

The SGLT2 inhibitors market in Europe is experiencing significant growth, driven by the rising prevalence of type 2 diabetes and cardiovascular diseases. According to the International Diabetes Federation (IDF), over 66 million people in Europe have been diagnosed with diabetes, a number projected to reach 64 million by 2030. This increasing patient population contributes to the growing demand for effective treatments, including SGLT2 inhibitors.

Key regulatory developments have further bolstered the adoption of SGLT2 inhibitors in Europe. In July 2023, the European Commission approved empagliflozin for treating adults with CKD, expanding its indication beyond type 2 diabetes and heart failure. Furthermore, sotagliflozin, a dual SGLT1/2 inhibitor, is under review by the European Medicines Agency (EMA) for potential use in type 1 diabetes, highlighting the region's commitment to advancing treatment options. These developments underscore Europe's proactive approach in integrating SGLT2 inhibitors into comprehensive treatment strategies for chronic diseases, driving market growth and enhancing patient outcomes.

The UK SGLT2 inhibitors market is experiencing growth, driven by the rising prevalence of type 2 diabetes and chronic kidney disease (CKD). According to the UK government, approximately 7% of adults in England are diagnosed with type 2 diabetes, a key factor driving the demand for effective treatments like SGLT2 inhibitors. Moreover, increasing awareness of these medications' benefits in managing diabetes and cardiovascular risks further supports market growth. In particular, the National Institute for Health and Care Excellence (NICE) has recognized the importance of SGLT2 inhibitors, recommending them as a first-line treatment for individuals with type 2 diabetes who also have heart failure or are at high risk of cardiovascular disease.

The UK healthcare system’s proactive approach to incorporating SGLT2 inhibitors into treatment regimens is also a driving factor. In December 2023, NICE expanded its approval for empagliflozin to treat CKD, significantly increasing the number of patients eligible for these medications. Moreover, the introduction of prescribing tools and decision aids by the Improving Diabetes Steering Committee helps healthcare providers optimize the use of SGLT2 inhibitors, ensuring they are prescribed appropriately. This standardization in care, combined with strong clinical evidence supporting the efficacy of these drugs, is expected to continue fueling market growth in the UK.

The SGLT2 inhibitors market in Germany is driven by the increasing prevalence of type 2 diabetes and chronic kidney disease (CKD). With the rising incidence of these conditions, there is a growing demand for effective treatments such as SGLT2 inhibitors. Strong clinical evidence supports the adoption of these medications, which effectively control blood glucose, reduce cardiovascular risks, and improve kidney function. As the patient population grows, the need for these drugs is expected to rise accordingly, further fueling market expansion.

Regulatory developments and reimbursement policies have played a significant role in facilitating market growth in Germany. The European Medicines Agency (EMA) has expanded the indications for SGLT2 inhibitors, approving them for use in patients with heart failure and CKD, in addition to type 2 diabetes. This broadening of indications has made these drugs essential components of treatment strategies. Moreover, the German healthcare system’s robust reimbursement framework ensures that SGLT2 inhibitors are accessible to a wide range of patients, contributing to their increasing adoption by healthcare providers and further driving the market in Germany.

France SGLT2 inhibitors market is experiencing growth, driven by the rising prevalence of type 2 diabetes and chronic kidney disease (CKD). According to the International Diabetes Federation, the number of people with diabetes in France is projected to reach over 4 million by 2045, highlighting the increasing patient population requiring effective treatments. In addition, the adoption of SGLT2 inhibitors has been facilitated by their inclusion in national treatment guidelines, which recommend their use in patients with type 2 diabetes and established cardiovascular disease or CKD. This broadening of indications has expanded the therapeutic applications of SGLT2 inhibitors, contributing to their growing utilization in clinical practice.

Table: France Diabetes prevalence data

Number of adults (20-79 years) with diabetes in France (FR)

2000

1.7 million

2011

3.2 million

2024

4.1 million

2050

4.2 million

Table: France Diabetes prevalence data

The French healthcare system's reimbursement policies have also supported the adoption of SGLT2 inhibitors. These medications are included in the list of reimbursed drugs, ensuring that patients have access to these treatments. Furthermore, ongoing clinical research and the publication of real-world data continue to reinforce the efficacy and safety profiles of SGLT2 inhibitors, encouraging their use among healthcare providers. As a result, the market for SGLT2 inhibitors in France is expected to continue its upward trajectory, driven by the increasing demand for effective treatments for type 2 diabetes and related complications.

Asia Pacific SGLT2 Inhibitors Market Trends

The SGLT2 inhibitors market in Asia Pacific is experiencing rapid growth, driven by the increasing prevalence of type 2 diabetes and chronic kidney disease (CKD), particularly in countries like India, China, and Japan. This market growth is attributed to factors such as rising urbanization, sedentary lifestyles, and dietary habits contributing to the increasing burden of diabetes and cardiovascular diseases in the region.

Key developments in the Asia Pacific market include approving and adopting SGLT2 inhibitors for indications beyond type 2 diabetes, such as heart failure and CKD. The growing recognition of these medications' cardiovascular and renal benefits has increased clinical practice use. Furthermore, the hospital pharmacies segment is projected to grow fastest, reflecting the increasing demand for comprehensive diabetes and cardiovascular care in healthcare institutions.

Japan SGLT2 inhibitors market is driven by the increasing prevalence of type 2 diabetes, chronic kidney disease (CKD), and the aging population. Diabetes remains a significant public health issue in Japan. As the population ages, there is a growing demand for effective therapies. The Japanese healthcare system has recognized the dual benefits of these medications, leading to expanded indications for their use. For example, dapagliflozin (Forxiga) was approved in 2020 for treating chronic heart failure with reduced ejection fraction, marking a significant step in the broader use of SGLT2 inhibitors.

The SGLT2 inhibitors market in China is experiencing significant growth, driven by the increasing prevalence of type 2 diabetes, chronic kidney disease (CKD), and cardiovascular diseases. This growing patient population contributes to the rising demand for effective treatments, including SGLT2 inhibitors. Regulatory developments have further bolstered the adoption of SGLT2 inhibitors in China. In September 2022, AstraZeneca's Forxiga (dapagliflozin) was approved by the National Medical Products Administration (NMPA) for treating CKD in adults with and without type 2 diabetes. This approval marked a significant advancement in the treatment options available for CKD patients.

Latin America SGLT2 Inhibitors Market Trends

The SGLT2 inhibitors market in Latin America is experiencing robust growth, primarily driven by the rising prevalence of type 2 diabetes and chronic kidney disease (CKD) across the region. Countries such as Mexico, Brazil, and Argentina are facing alarmingly high rates of diabetes. This growing patient population is fueling the demand for effective treatments like SGLT2 inhibitors, which provide glycemic control and offer significant cardiovascular and renal benefits, positioning them as a crucial element in managing diabetes and associated complications in the region.

Brazil SGLT2 inhibitors market is experiencing notable growth, driven by the increasing prevalence of type 2 diabetes and chronic kidney disease (CKD). According to the International Diabetes Federation, approximately 35 million people in the South and Central America region were living with diabetes in 2024, with Brazil being a significant contributor to this figure. The rising incidence of these conditions has led to a heightened demand for effective treatments, including SGLT2 inhibitors, which are known for their dual benefits in managing blood glucose levels and providing cardiovascular and renal protection.

Regulatory advancements have further facilitated the adoption of SGLT2 inhibitors in Brazil. The Brazilian Health Regulatory Agency (ANVISA) has approved several SGLT2 inhibitors for treating type 2 diabetes and CKD, expanding the therapeutic options available to healthcare providers. Furthermore, the introduction of combination therapies, including SGLT2 inhibitors, has offered patients more convenient treatment regimens, contributing to improved adherence and better management of their conditions.

Middle East & Africa SGLT2 Inhibitors Market Trends

The SGLT2 inhibitors market in the Middle East & Africa (MEA) region is seeing increased demand for SGLT2 inhibitors due to the rising prevalence of type 2 diabetes, cardiovascular diseases, and chronic kidney disease (CKD). Countries like Saudi Arabia, the UAE, and South Africa are facing a rapid increase in diabetes cases, spurring the adoption of SGLT2 inhibitors. These medications control blood glucose and provide essential cardiovascular and renal protection, addressing the region's growing diabetes-related complications. Regulatory progress has accelerated the use of SGLT2 inhibitors. In Saudi Arabia, the UAE, and South Africa, multiple SGLT2 inhibitors have been approved for both type 2 diabetes and CKD, enhancing treatment options. Moreover, combination therapies featuring SGLT2 inhibitors are improving patient adherence. Challenges like high treatment costs and limited awareness in some regions persist, but efforts to expand healthcare access and raise awareness are expected to support the continued market growth in MEA.

Saudi Arabia SGLT2 inhibitors market is experiencing significant growth, driven by the rising prevalence of type 2 diabetes and chronic kidney disease (CKD). The increasing incidence of these conditions has led to a higher demand for effective treatments, including SGLT2 inhibitors, which offer benefits beyond glycemic control, such as cardiovascular and renal protection. This trend is supported by the Saudi Food and Drug Authority's (SFDA) approval of various SGLT2 inhibitors, expanding the therapeutic options available to healthcare providers.

The adoption of SGLT2 inhibitors in Saudi Arabia is further facilitated by their inclusion in national treatment guidelines and reimbursement schemes, ensuring broader patient access. In addition, ongoing clinical research and real-world studies continue to reinforce these medications' efficacy and safety profiles, encouraging their use among healthcare providers.

Key SGLT2 Inhibitors Companies:

The following are the leading companies in the SGLT2 inhibitors market. These companies collectively hold the largest market share and dictate industry trends.

- Boehringer Ingelheim International GmbH

- AstraZeneca

- Merck & Co., Inc.

- Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.)

- TheracosBio, LLC

- Lexicon Pharmaceuticals, Inc.

- Eli Lilly and Company

- Bristol-Myers Squibb Company

- Glenmark Pharmaceuticals Ltd.

Recent Developments

-

In June 2024, the U.S. FDA approved Farxiga (dapagliflozin) developed by AstraZeneca for treating type-2 diabetes in patients aged 10 years and older. This additional approval is expected to boost market growth.

-

In April 2024, Boehringer Ingelheim International GmbH announced that its EMPACT-MI phase 3 clinical trial showed a 10% risk reduction in hospitalized heart failure patients after using Jardiance (empagliflozin). The positive study result is anticipated to boost drug demand over the forecast period.

-

In September 2023, Eli Lilly and Company and Boehringer Ingelheim International GmbH jointly announced that the U.S. FDA approved its Jardiance (empagliflozin) owing to its ability to reduce the risk of cardiovascular mortality and CKD in hospitalization.

SGLT2 Inhibitors Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.9 billion

Revenue forecast in 2033

USD 28.9 billion

Growth rate

CAGR of 6.19% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Drug, indication, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait

Key companies profiled

Boehringer Ingelheim International GmbH; AstraZeneca; Merck & Co., Inc.; Johnson & Johnson Services, Inc. (Janssen Pharmaceuticals, Inc.); TheracosBio, LLC; Lexicon Pharmaceuticals, Inc.; Eli Lilly and Company; Bristol-Myers Squibb Company; Glenmark Pharmaceuticals Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global SGLT2 Inhibitors Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global SGLT2 Inhibitors market report based on drug, indication, distribution channel,and region:

-

Drug Outlook (Revenue, USD Million, 2021 - 2033)

-

Jardiance (empagliflozin)

-

Farxiga (dapagliflozin)

-

Invokana (canagliflozin)

-

Inpefa (sotagliflozin)

-

Qtern (dapagliflozin/saxagliptin)

-

Other SGLT2 Inhibitors

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Type 2 Diabetes

-

Cardiovascular

-

Chronic Kidney Disease (CKD)

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global SGLT2 inhibitors market size was estimated at USD 16.8 billion in 2024 and is expected to reach USD 17.9 billion in 2025.

b. The global SGLT2 inhibitors market is projected to grow at a CAGR of 6.19% from 2025 to 2033 to reach USD 28.9 billion by 2033.

b. Based on drug, jardiance segment dominated the market with the largest revenue share of 55.30% in 2024, primarily used for the treatment of type 2 diabetes and in patients at risk of heart failure.

b. The key players in the SGLT2 Inhibitors market are Boehringer Ingelheim International GmbH, AstraZeneca, Merck & Co., Inc., these companies dominate the market with their leading drugs, such as Jardiance and Farxiga, which are widely prescribed for managing type 2 diabetes and heart failure. Boehringer Ingelheim and AstraZeneca, in particular, have established strong global positions due to robust clinical evidence and strategic patent protection for their products.

b. The SGLT2 inhibitors market is driven by the rising prevalence of type 2 diabetes and heart failure, increasing awareness of the benefits of SGLT2 inhibitors, and strong clinical evidence supporting their efficacy. Favorable reimbursement policies, expanding indications for chronic kidney disease, and strategic partnerships between key pharmaceutical players further boost market growth. Additionally, the growing adoption of combination therapies and continuous innovation in drug formulations contribute to the market's expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.