- Home

- »

- Advanced Interior Materials

- »

-

Shape Memory Alloys Market Size, Industry Report, 2030GVR Report cover

![Shape Memory Alloys Market Size, Share & Trends Report]()

Shape Memory Alloys Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Nitinol, Copper-based), By End Use (Biomedical, Automotive, Aerospace & Defense), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-963-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Shape Memory Alloys Market Summary

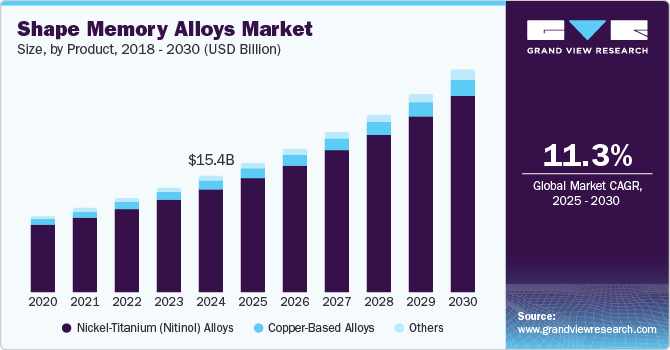

The global shape memory alloys market size was estimated at USD 15.44 billion in 2024 and is projected to reach USD 29.28 billion by 2030, growing at a CAGR of 11.3% from 2025 to 2030. The growth is owing to the expanding applications of shape memory alloys (SMAs) in consumer electronics and the growing emphasis on smart materials.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- The region held a market share of 35.1% in 2024.

- In terms of product, the nickel-titanium alloys (nitinol) segment dominated the market by capturing the largest share of 79.6% in 2024.

- Copper-based alloys are emerging as the fastest-growing segment in the market and are projected to grow at a CAGR of 10.7% during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 15.44 Billion

- 2030 Projected Market Size: USD 29.28 Billion

- CAGR (2025-2030): 11.3%

- North America: Largest market in 2024

SMAs are increasingly used in smartphones, wearables, and medical electronics, offering unique benefits such as miniaturization, flexibility, and energy efficiency. Their ability to return to a pre-defined shape upon activation is crucial in enhancing product functionality. Also, as industries seek smarter, more adaptive materials, SMAs are being integrated into robotics, actuators, and aerospace, boosting demand and market expansion.

Continuous innovation in materials and manufacturing techniques substantially enhances the performance and applicability of shape memory alloys (SMAs). Advances in processing methods are improving the alloys’ functionality, precision, and cost-effectiveness. Additionally, the escalating demand in the automotive industry for lightweight, durable, and energy-efficient components, such as actuators and sensors, is further fueling market growth. SMAs’ ability to respond to environmental stimuli, leading to enhanced vehicle performance and design flexibility, positions them as critical materials in automotive applications, driving the expansion of the market.

Product Insights

The nickel-titanium alloys (nitinol) segment dominated the market by capturing the largest share of 79.6% in 2024, propelled by their unique properties, including exceptional corrosion resistance, biocompatibility, and impressive mechanical performance. When subjected to heat, these alloys can return to a predefined shape, making them highly valuable in medical devices such as stents and orthodontic wires. Nitinol's adaptability to extreme conditions and ability to undergo significant deformation without permanent damage has further fueled its demand across diverse industries, such as aerospace, automotive, and robotics, solidifying its market dominance.

Moreover, copper-based alloys are rapidly emerging as the fastest-growing segment in the market and are projected to grow at a CAGR of 10.7% between 2025 and 2030, attributed to their unique combination of excellent thermal conductivity, corrosion resistance, and cost-effectiveness. These alloys, particularly copper-aluminum-nickel, and copper-zinc, exhibit significant shape memory and super elastic properties, making them ideal for automotive, aerospace, and medical applications. As industries increasingly demand efficient and reliable materials for actuation, sensing, and energy systems, the copper-based SMA segment is expected to grow rapidly.

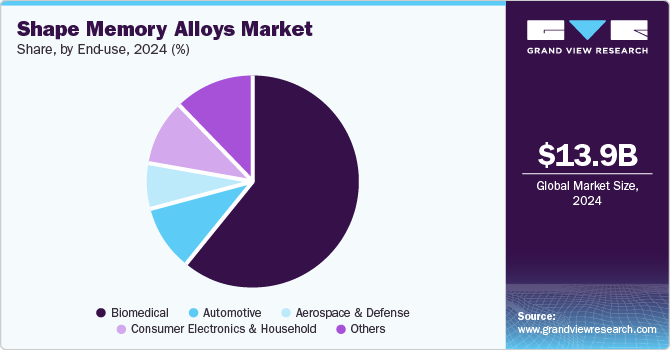

End Use Insights

The biomedical segment secured the largest share of 55% in 2024 due to the unique properties of SMAs, such as biocompatibility, flexibility, and the ability to return to their original shape when triggered. These alloys are increasingly used in medical devices such as stents, surgical instruments, and orthopedic implants, improving patient outcomes and reducing complications. The burgeoning demand for minimally invasive surgeries and advancements in medical technology has driven the adoption of SMAs in the healthcare industry, solidifying its dominant position in the market.

The automotive segment is poised to emerge as the fastest-growing segment and capture a CAGR of 11.2% over the forecast period, fueled by its unique ability to change shape in response to temperature changes. SMAs offer significant advantages for automotive applications, including lightweight construction, fuel efficiency, and enhanced safety features. These alloys are used in various components, such as actuators, sensors, and self-healing materials. With the growing demand for advanced, high-performance vehicles, the integration of SMAs in automotive design is expected to increase, thereby driving the market's growth in the coming years.

Regional Insights

North America shape memory alloys market secured the largest market share of 35.1% in 2024, owing to its strong industrial base, technological breakthroughs, and high demand across various sectors such as aerospace, automotive, and medical devices. The region's extensive research and development activities, coupled with the presence of key players and manufacturing capabilities, have driven the adoption of SMAs. Furthermore, the growing emphasis on innovation and smart materials to enhance product performance has further propelled North America's dominance in the global SMA market.

U.S. Shape Memory Alloys Market Trends

The U.S. shape memory alloys market held a considerable position in 2024 due to technological advancements, escalating demand from various industries, and ample investments in research and development. Market growth is anticipated, with key sectors such as aerospace, automotive, and healthcare adopting SMAs to return to a predefined shape. Moreover, the U.S. government's support for manufacturing innovations and sustainable materials further enhances the country's position. As SMAs find applications in robotics, electronics, and medical devices, the U.S. is expected to lead the market expansion.

Canada shape memory alloys market is anticipated to achieve noteworthy CAGR over the forecast period, owing to its strong manufacturing sector, advanced technological infrastructure, and focus on innovation. The growing demand for SMAs in the aerospace, automotive, healthcare, and robotics industries is expected to fuel Canada's market growth. Additionally, the country’s commitment to sustainable energy solutions and smart technologies will further boost the adoption of SMAs. With a skilled workforce and government support, Canada is set to emerge as a booming region for SMA production and development.

Europe Shape Memory Alloys Market Trends

Europe shape memory alloys market prominence in the is attributed to the region’s strong presence in advanced industries such as aerospace, automotive, and healthcare. The region’s emphasis on innovation, sustainability, and technological development fosters the integration of SMAs into high-performance applications. European countries invest heavily in research and development, particularly for lightweight and energy-efficient materials. Besides, the burgeoning demand for smart materials and the push toward electric and autonomous vehicles are expected to accelerate the growth of the SMA market in Europe.

Germany shape memory alloys market is poised to accumulate remarkable gains by 2030, driven by its strong industrial base and technological leadership in the automotive, aerospace, and healthcare sectors. The country's focus on innovation, particularly in developing advanced materials and high-performance components, positions it at the forefront of SMA adoption. With a robust manufacturing infrastructure and rising demand for smart technologies, Germany is well-equipped to capitalize on the growing need for SMAs. Strategic investments in R&D and sustainable solutions further strengthen its potential in the global market.

The UK is set to establish a considerable foothold by 2030, fueled by its strong focus on technological innovation and industrial applications. With growing demand in the aerospace, automotive, and healthcare sectors, the UK is increasingly adopting SMAs for their lightweight and high-performance properties. Ongoing investments in research and development, along with government initiatives promoting advanced manufacturing, are expected to drive market growth. As the demand for smart materials and energy-efficient solutions rises, the UK’s SMA market is set for substantial expansion.

Asia Pacific Shape Memory Alloys Market Trends

Asia Pacific captured ample market share in 2024, spurred by the region's fast-paced industrialization, technological progress, and surging demand across the automotive, aerospace, healthcare, and electronics industries. Countries such as China, Japan, and South Korea are key contributors due to their strong manufacturing capabilities and focus on innovation. The rising need for smart materials and sustainable solutions in these industries, along with sizeable investments in research and development, positions Asia Pacific as a rapidly growing hub for SMA production and application.

China is projected to grow at a noteworthy CAGR during the forecast period, spurred by rapid industrialization, technological advancements, and strong demand across aerospace, automotive, and medical devices. The country’s notable investments in research and development, particularly in advanced materials, foster innovation in SMA applications. Also, China’s expanding manufacturing capabilities and focus on producing lightweight, energy-efficient solutions are expected to fuel market growth. With escalating demand for high-performance materials, China’s role in the global SMA market is expected to grow considerably.

Japanis anticipated to grow at a significant CAGR over the forecast period,driven by its strong industrial base, technological innovation, and high demand for advanced materials. The country’s leadership in the automotive, robotics, and electronics sectors drives substantial adoption of SMAs, which offer unique properties such as self-healing and shape recovery. Japan’s focus on precision manufacturing and research in material science positions it well for growth. Besides, the increasing need for SMAs in medical devices and aerospace applications further bolsters Japan’s prospects in the global market.

Key Shape Memory Alloys Company Insights:

Some of the key companies in the shape memory alloys market include ATI, Baoji Seabird Metal Material Co., Ltd., Dynalloy, Inc., Fort Wayne Metals Research, Furukawa Electric Co., Ltd., Johnson Matthey, Mishra Dhatu Nigam Limited (MIDHANI), Nippon Seisen Co., Ltd., Nippon Steel Corporation, SAES Group, and others.

-

Johnson Matthey specializes in sustainable technologies, offering catalysts, clean energy solutions, and emission control systems to help industries reduce their environmental impact and promote a cleaner future.

-

SAES Group specializes in producing high-performance shape memory alloys, advanced materials, gas purification, and vacuum technology solutions, serving industries such as electronics, healthcare, and energy, focusing on enhancing performance and sustainability.

Key Shape Memory Alloys Companies:

The following are the leading companies in the shape memory alloys market. These companies collectively hold the largest market share and dictate industry trends.

- ATI

- Baoji Seabird Metal Material Co., Ltd.

- Dynalloy, Inc.

- Fort Wayne Metals Research Products Corp

- Furukawa Electric Co., Ltd.

- Johnson Matthey

- Mishra Dhatu Nigam Limited (MIDHANI)

- Nippon Seisen Co., Ltd.

- Nippon Steel Corporation

- SAES Group

Recent Developments

-

In March 2024, Montagu agreed to acquire Johnson Matthey's recently carved-out Medical Device Components (MDC) business.

-

In December 2023, Fluid-o-Tech expanded its focus from magnetic systems to include shape memory alloys and piezo technologies, enhancing its capabilities for product development in precision fluidics and targeting new market opportunities.

Shape Memory Alloys Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.12 billion

Revenue forecast in 2030

USD 29.28 billion

Growth Rate

CAGR of 11.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Report updated

February 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, and region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East and Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Australia, Brazil, and Saudi Arabia

Key companies profiled

ATI, Baoji Seabird Metal Material Co., Ltd., Dynalloy, Inc., Fort Wayne Metals Research, Furukawa Electric Co., Ltd., Johnson Matthey, Mishra Dhatu Nigam Limited (MIDHANI), Nippon Seisen Co., Ltd., Nippon Steel Corporation, SAES Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Shape Memory Alloys Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global shape memory alloys market report on the basis of product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Nickel-Titanium (Nitinol) Alloys

-

Copper-Based Alloys

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biomedical

-

Automotive

-

Aerospace & Defense

-

Consumer Electronics & Household

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central and South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.