- Home

- »

- Automotive & Transportation

- »

-

Shared Vehicles Market Size & Share Report, 2028GVR Report cover

![Shared Vehicles Market Size, Share & Trends Report]()

Shared Vehicles Market (2022 - 2028) Size, Share & Trends Analysis Report By Service (Car Rental, Bike Sharing, Car Sharing), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-931-2

- Number of Report Pages: 74

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2028

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

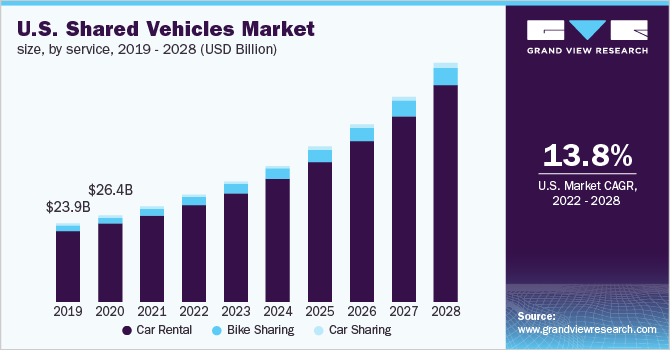

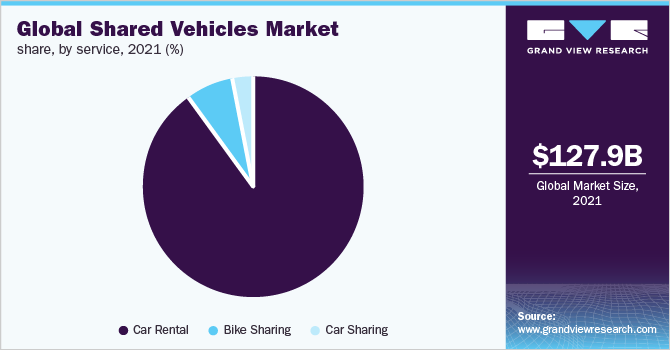

The global shared vehicles market size was valued at USD 127.9 billion in 2021 and is expected to expand at a CAGR of 14.4% from 2022 to 2028. Increasing inclination toward shared vehicles as they are flexible, convenient, and saves travel cost are the factors expected to propel the market growth. Additionally, the usage of shared vehicles is increasing since they provide better, high-quality, and personalized travel options to the targeted population base, who does not own a vehicle, thus driving the market expansion.

COVID-19 outbreak had an adverse impact on the shared vehicles market. A significant fall-off has been observed due to the drop in the demand and usage of shared vehicles, during the COVID-19 pandemic, to maintain the regulatory norms imposed by the government.

The various number of vehicles presented in a particular system that can be used by numerous individuals all day long is known as shared vehicles and the system is known as the shared vehicles system. Shared vehicles are highly flexible as they provide convenience equivalent to private automobiles. Shared vehicles can either be used by an individual or by a group of people by renting a particular vehicle as per their needs and choice.

Shared vehicles help the users to save money, enjoy several benefits associated with the cars, help in decreasing the emission of greenhouse gas, and reduce the maintenance cost of the vehicles along with space needed for parking infrastructure. Shared vehicles are proved to be a practical alternative for individuals with a limited budget and do not require a full-time vehicle. The above-mentioned factors increase the usage of shared vehicles in the market.

The COVID-19 pandemic had a severe negative impact on the shared vehicles market as the lockdown was imposed in all the countries, across the globe, to stop the further spread of SARS-CoV-2. Several restrictions were made, associated with the traveling. Break and hold on supply chains along with delay in the process of decision making by the corporate sector, local partners, and authorities regarding new agreements also furthermore harshly affected the shared vehicles market.

Service Insights

The car rental segment dominated the market and contributed a revenue share of more than 90.0% in 2021. It is forecast to expand at a CAGR of 14.4% from 2022 to 2028. In car rental service, vehicles are supplied by the professional providers of the rental car intended for personal use, and the rent for the same is fixed in advance based on the time. Moreover, car rental service is highly popular and rapidly getting adopted by millennial since they are cost-effective and also help in saving fuel, thus high demand for car rental will drive the market revenue.

The bike sharing segment is expected to witness the highest CAGR of 15.0% from 2022 to 2028. Bike sharing is a type of service in which bikes are owned by various companies and they form a partnership with various cities, to provide bikes for public use. The growing usage of vehicles, that are environment friendly and fuel-efficient along with the increase in the number of initiatives by the government to support bike sharing systems, is contributing to the bike sharing segment growth. Thus, the segment is expected to grow at the fastest CAGR, during the forecast period.

Regional Insights

Asia Pacific accounted for the major revenue share of the global market. It was more than 35.0% in 2021 and is estimated to expand at a CAGR of 15.3% from 2022 to 2028. China in Asia Pacific has the highest number of active shared vehicle systems, which is approximately more than half of the total, which makes it the dominating region. The growth of the regional market is owing to the increasing adoption of shared vehicles in developing countries including India and Japan.

The growth of the market can also be attributed to growing travel & tourism activities in the region along with the increasing and easy availability of the economical and high-end luxury shared vehicle services. Thus, due to the above-mentioned factors, the demand for shared vehicles in Asia Pacific is high and it contributes more to revenue generation.

Europe is expected to register the 2nd highest CAGR of 14.5% from 2022 to 2028. The growth of the market in this region is credited to the increasing tourism, related to education and business. The growth of the region is also attributable to increased investment and spending by the government on transportation services, which in consequence attracts numerous professionals, investors, and executives. Therefore, Europe is estimated to expand by a steady CAGR during the forecast period.

Key Companies & Market Share Insights

The shared vehicles market is characterized by the presence of established as well as new players. Most of the key players working in the shared vehicles market are adopting various strategies such as alliances, partnerships, mergers, development, and the launch of new systems to gain maximum share in the market. For instance, a partnership was formed between Hertz Global Holdings, Inc. and Tesla Inc. to supply 100,000 Model 3S, among which half of these vehicles are estimated to be rented out to Uber drivers. Some of the prominent players in the global shared vehicles market include:

-

Daimler AG

-

SIXT SE

-

Avis Budget Group Inc.

-

Lyft, Inc.

-

Hertz Global Holdings, Inc.

-

Europcar Mobility Group SA

-

Avis Budget Group Inc.

Shared Vehicles Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 143.5 billion

Revenue forecast in 2028

USD328.2 billion

Growth rate

CAGR of 14.4% from 2022 to 2028

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2028

Quantitative units

Revenue in USD million/ billion, CAGR from 2022 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Service, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France.; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Daimler AG, SIXT SE, Avis Budget Group Inc., Lyft, Inc., Hertz Global Holdings, Inc., Europcar Mobility Group SA, Avis Budget Group Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For this study, Grand View Research has segmented the global shared vehicles market report based on the type and region:

-

Service Outlook (Revenue, USD Million, 2017 - 2028)

-

Car Rental

-

Bike Sharing

-

Car Sharing

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global shared vehicles market size was estimated at USD 127.9 billion in 2021 and is expected to reach USD 143.5 billion in 2022.

b. The global shared vehicles market is expected to grow at a compound annual growth rate of 14.4% from 2022 to 2028 to reach USD 328.2 billion by 2028.

b. Asia Pacific dominated the shared vehicles market with a share of 36.45% in 2021. This is attributable to the increasing adoption of shared vehicles in developing countries including India and Japan, growing travel & tourism activities, and increasing and easy availability of economic and high-end luxury shared vehicle services.

b. Some key players operating in the shared vehicles market include Daimler AG; Sixt SE; Avis Budget Group Inc.; Lyft, Inc.; Hertz Global Holdings, Inc.; Europcar Mobility Group SA; and Avis Budget Group Inc.

b. Key factors that are driving the shared vehicles market growth include the increasing inclination towards shared vehicles as they are flexible, convenient, and saves travel cost and increasing usage of shared vehicles as they provide better, high-quality and personalized travel options to the targeted population base who does not own a vehicle.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.