- Home

- »

- Clinical Diagnostics

- »

-

Shingles Vaccine Market Size, Share, Industry Report, 2030GVR Report cover

![Shingles Vaccine Market Size, Share & Trends Report]()

Shingles Vaccine Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Shingrix, Zostavax, SkyZoster), By Vaccine Type (Recombinant Vaccine, Live Attenuated Vaccine), By End Use (Private Healthcare Settings), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-638-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Shingles Vaccine Market Summary

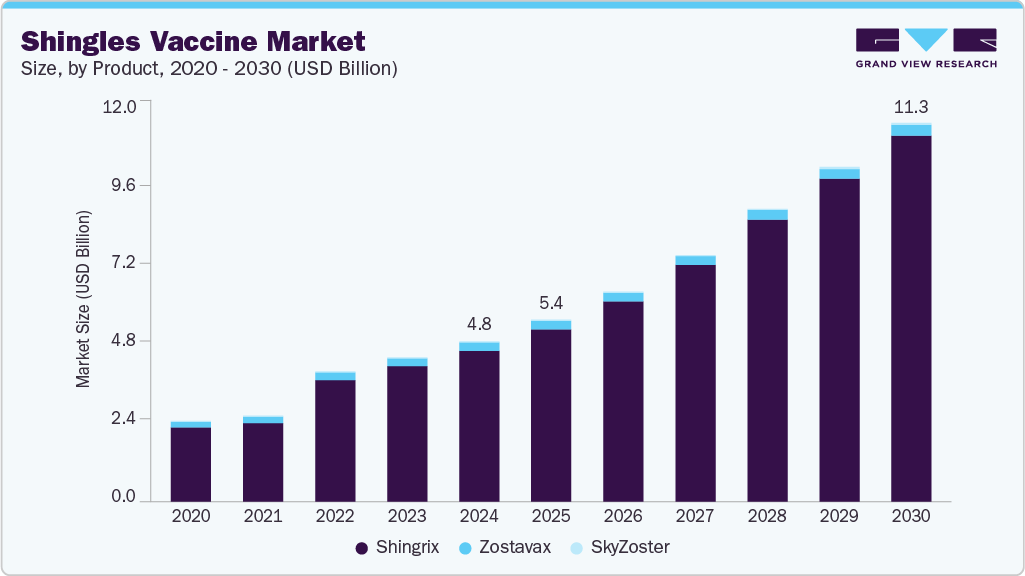

The global shingles vaccine market size was estimated at USD 4.78 billion in 2024 and is projected to reach USD 11.26 billion by 2030, growing at a CAGR of 15.7% from 2025 to 2030. The market Growth is driven by the rising incidence of shingles, especially among older adults and immunocompromised individuals, increased awareness of vaccination benefits, and expanded immunization programs.

Key Market Trends & Insights

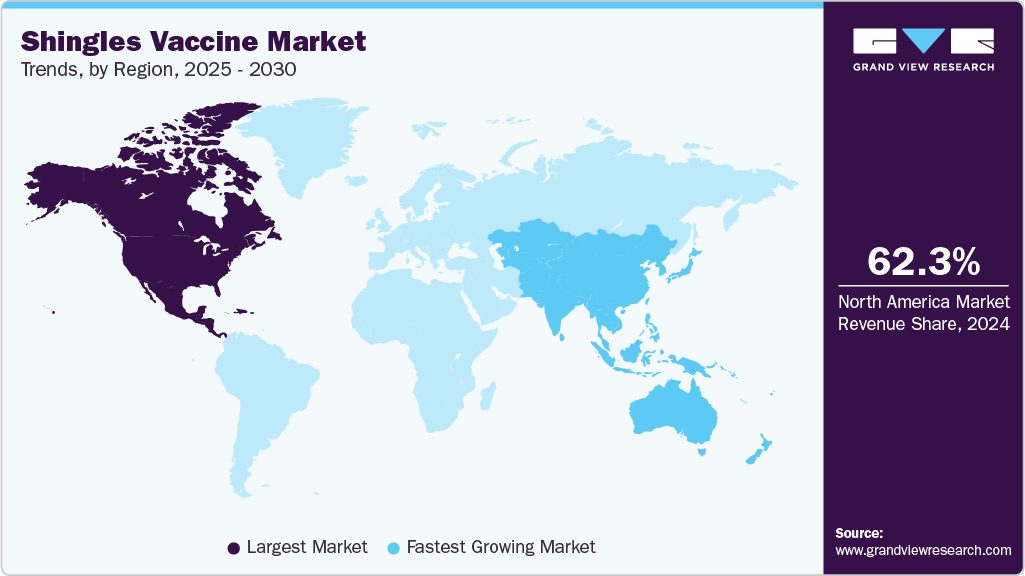

- North America led the global market in 2024, holding the largest revenue share of 62.26%.

- The U.S. shingles vaccine market dominated North America in 2024.

- By product, the shingrix segment dominated the shingles vaccine market in 2024, accounting for the largest revenue share of 94.14%.

- By end use, the private healthcare settings segment dominated the shingles vaccine market accounting for the largest revenue share of 68.33% in 2024.

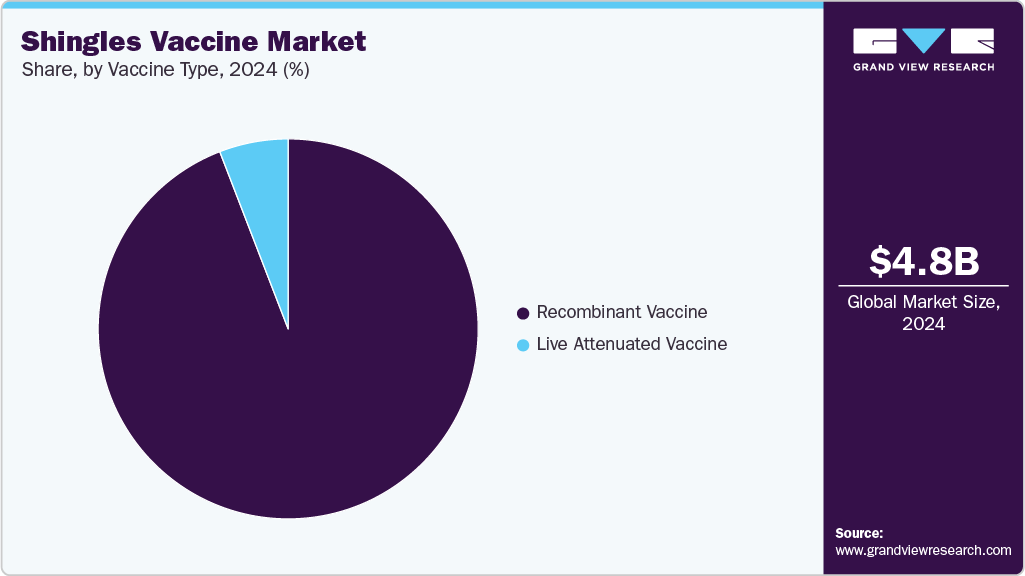

- By vaccine type, the recombinant vaccine segment accounted for the largest share of the shingles vaccine market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.78 Billion

- 2030 Projected Market Size: USD 11.26 Billion

- CAGR (2025-2030): 15.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Advances in vaccine technology, such as recombinant vaccines with improved efficacy and safety, also contribute to market expansion. In addition, improving healthcare infrastructure and government initiatives promoting adult vaccination in emerging markets support development, while high vaccine costs and limited access in low-resource regions may restrain growth during the forecast period.The rising aging population worldwide further accelerates demand for shingles vaccination, as older adults are at higher risk of developing the condition and its complications. According to the World Health Organization’s 2024 data, the global population aged 60 and above is expected to double by 2050, reaching nearly 2.1 billion. In addition, the increased prevalence of immunocompromising conditions such as HIV and cancer contributes to greater susceptibility to shingles. Growing emphasis on preventive healthcare and vaccination programs for seniors enhances the focus on shingles immunization, driving steady demand for innovative vaccines with improved safety and efficacy profiles.

Moreover, ongoing research and development efforts have improved vaccine formulations that offer enhanced immune responses and longer-lasting protection against shingles. Innovations in adjuvant technology and delivery methods have increased vaccine effectiveness, particularly among older adults who typically exhibit weaker immune responses. In addition, expanding public-private collaborations and government funding are accelerating clinical trials and vaccine availability, facilitating broader immunization coverage across different regions and healthcare settings. These advancements are critical for overcoming existing challenges related to vaccine acceptance and accessibility.

In addition, new product approvals further support market growth by increasing vaccine availability across regions. For example, in January 2023 , SK Bioscience obtained approval for its shingles vaccine, SKYZoster, from Malaysia’s National Pharmaceutical Regulatory Agency (NPRA), following earlier authorization in Thailand in 2020. Rising shingles risk, an aging population, national vaccination programs, improved recombinant vaccine effectiveness, and new product launches continue to drive steady market expansion.

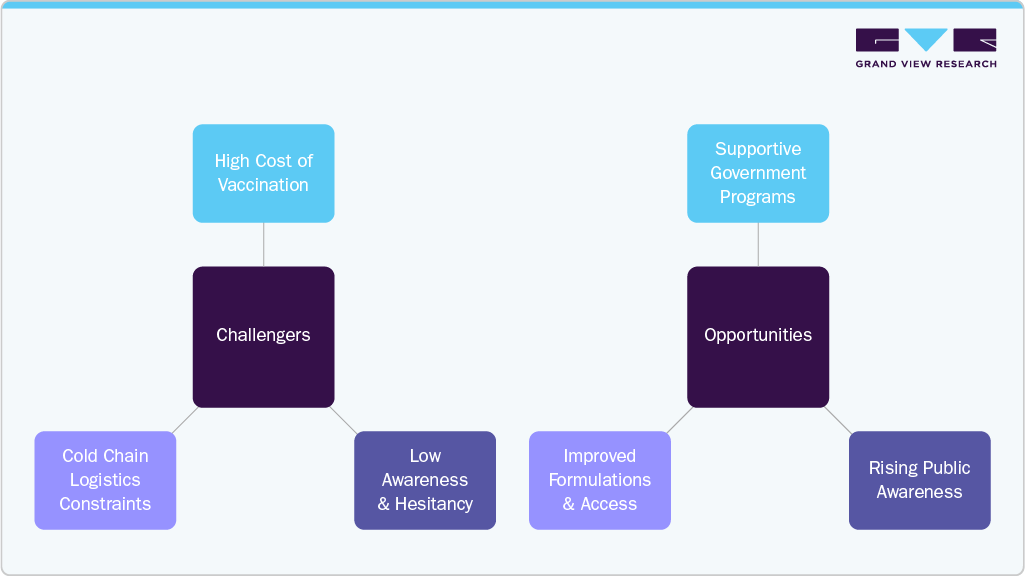

Challenges and Opportunities

Challenges

-

High vaccine costs limit accessibility, especially in low-and middle-income countries. The price of shingles vaccines can be prohibitive, restricting widespread vaccination efforts in regions with constrained healthcare budgets and slowing overall market growth.

-

Vaccine hesitancy due to misinformation and lack of awareness affects immunization rates. Many individuals remain unaware of shingles risks or hold misconceptions about vaccine safety, leading to lower acceptance and reduced vaccination coverage.

-

Cold chain storage requirements create logistical difficulties in remote and resource-limited areas. Maintaining proper refrigeration throughout the supply chain is complex and costly, particularly in rural or underdeveloped regions, impacting vaccine availability and effectiveness.

Opportunities

-

Government-led immunization programs targeting older adults and high-risk populations support vaccine adoption. Many countries have introduced or expanded shingles vaccination campaigns, significantly increasing vaccine uptake and creating a reliable demand base.

-

Increasing public awareness campaigns help reduce hesitancy and educate about the benefits of shingles vaccination. Educational initiatives improve knowledge about shingles complications and vaccine effectiveness, encouraging more individuals to get vaccinated.

-

Advances in vaccine formulation and healthcare infrastructure expansion improve vaccine accessibility and distribution. Innovations like more stable vaccine formulations and strengthened healthcare networks facilitate easier delivery and administration, especially in emerging markets.

Market Concentration & Characteristics

Shingles vaccine development is shifting from live attenuated platforms to recombinant and mRNA-based technologies, offering improved immunogenicity, safety profiles, and durability of protection. Innovations such as lyophilized mRNA formulations support stability and global distribution, while adjuvant optimization enhances immune response with lower reactogenicity. Co-administration studies, prefilled syringe formats, and digital tools for post-vaccination tracking are streamlining the patient experience. These advancements contribute to scalable, efficient, and equitable immunization, supporting broader global health initiatives targeting aging populations.

Mergers and acquisitions in the shingles vaccine market are moderate, with activity centered mainly around broader vaccine portfolios rather than shingles alone. Strategic partnerships and licensing agreements are more common, particularly involving emerging mRNA technologies and adjuvant innovations. While major players continue to invest in pipeline diversification and global reach, the niche nature of shingles vaccines limits frequent M&A transactions focused solely on this segment.

Regulatory oversight plays a central role in shaping the shingles vaccine market, with agencies like the FDA, EMA, and WHO establishing rigorous standards for safety, efficacy, and manufacturing. Approval pathways for recombinant and adjuvanted vaccines are well-defined, though post-market surveillance and periodic safety updates remain critical for continued compliance. Expedited review programs and updated immunization guidelines for aging populations support faster access in some regions. However, regional requirements and cold chain documentation variations can complicate global rollout, underscoring the need for harmonized regulatory strategies to enable broader market penetration.

The shingles vaccine market is witnessing active product expansion with next-generation vaccines designed to improve efficacy, safety, and patient convenience. New formulations, such as mRNA-based and lyophilized vaccines, aim to overcome storage and stability challenges, enabling wider distribution. In addition, companies are developing combination vaccines and co-administration protocols to simplify immunization schedules. Prefilled syringes and alternative delivery methods enhance ease of use, while pipeline candidates focus on extending protection duration and targeting broader age groups, creating opportunities for increased market penetration.

The shingles vaccine market is expanding rapidly across key regions, driven by growing awareness and aging populations. North America remains a dominant market with widespread vaccination programs and strong healthcare infrastructure. Europe follows closely, supported by government initiatives and reimbursement policies. Emerging markets in Asia-Pacific and Latin America are attracting increased attention due to improving healthcare access and rising demand for preventive care. To ensure broader vaccine availability in these regions, expansion efforts focus on overcoming logistical challenges, including cold chain management.

Product Insights

The Shingrix segment dominated the shingles vaccine market in 2024, accounting for the largest revenue share of 94.14%. This leadership is driven by Shingrix’s recombinant, adjuvanted formulation, which delivers higher efficacy and longer-lasting protection than traditional live attenuated vaccines. Its widespread recommendation by healthcare authorities and inclusion in adult vaccination programs have significantly boosted adoption rates. The vaccine’s proven ability to reduce shingles incidence and postherpetic neuralgia cases has made it the preferred choice among healthcare providers and patients. Recently, in September 2024, GlaxoSmithKline (GSK) introduced its shingles vaccine, Shingrix, in Malaysia. Shingrix is a non-live, recombinant subunit vaccine administered in two doses. It is designed to prevent shingles (herpes zoster) and post-herpetic neuralgia (PHN) in adults aged 50 and above, as well as individuals aged 18 and over who are at increased risk due to immunosuppression or immunodeficiency. Henceforth, shingrix is now accessible at major hospitals, clinics, and pharmacies across Malaysia. It is recommended for eligible individuals to help reduce the burden of shingles and its complications.

The SkyZoster segment is projected to grow at a lucrative rate during the forecast period. This growth is supported by increasing approvals and expanded availability in key markets, which are driving greater vaccine adoption. SkyZoster’s recombinant vaccine formulation offers improved safety and efficacy, making it an attractive option for immunization programs targeting aging populations. Additionally, ongoing efforts to increase awareness and government support in emerging markets contribute to the segment’s promising growth outlook. On January 9, 2023, SK bioscience announced that its shingles vaccine, SKYZoster, received biologics license application approval from Malaysia's National Pharmaceutical Regulatory Agency (NPRA).This marks the vaccine's second international approval following Thailand in May 2020. SKYZoster is a live attenuated vaccine developed to prevent shingles (herpes zoster) in adults aged 50 and above.Clinical trials demonstrated that the vaccine increased antibody titers against the varicella zoster virus by 2.75 times post-vaccination compared to pre-vaccination levels.The vaccine's safety profile was comparable to that of the control vaccine, with no serious adverse reactions reported during a 26-week follow-up period. In South Korea, SKYZoster has achieved significant market penetration, capturing a 56% market share based on the number of doses administered in the third quarter of 2022.SK Bioscience plans to seek World Health Organization pre-qualification to facilitate the vaccine's availability in additional emerging markets.

End Use Insights

The private healthcare settings segment dominated the shingles vaccine market, accounting for the largest revenue share of 68.33% in 2024. Private healthcare settings represent a significant and growing share of the shingles vaccines market, particularly in high-income and urban regions where access to premium medical services and awareness about adult immunization are high. These settings include private hospitals, specialty clinics, corporate wellness programs, and retail pharmacies. The demand in this segment is primarily driven by individuals willing to pay out-of-pocket for faster service delivery, personalized care, and vaccine availability without government restrictions.

The government healthcare settings segment is projected to grow at a lucrative rate during the forecast period. Government healthcare settings are critical to public immunization programs, particularly in countries where universal healthcare policies support access to adult vaccines. Public hospitals, primary health centers, and national vaccination programs typically offer shingles vaccines to older adults and high-risk populations, either free of cost or at subsidized rates. This segment is driven by government-led efforts to reduce healthcare costs associated with shingles complications and to improve the quality of life among senior citizens.

Vaccine Type Insights

The recombinant vaccine segment accounted for the largest share of the shingles vaccine market in 2024, comprising a revenue share of 94.14%. This dominance is attributed to the improved efficacy and safety profiles offered by recombinant vaccines compared to traditional live attenuated formulations. Recombinant vaccines, such as Shingrix and SkyZoster, use advanced technology to stimulate a stronger immune response, making them particularly effective for older adults and immunocompromised individuals. The segment’s growth is supported by widespread recommendations from health authorities and inclusion in immunization programs worldwide. In addition, ongoing research to refine recombinant vaccine formulations and adjuvants is expected to sustain their market leadership in the forecast period.

The live attenuated vaccine segment is projected to expand steadily over the forecast period, driven by growing concern about transmissible diseases and increasing acceptance of vaccination programs, particularly in developing countries. These vaccines use weakened forms of the varicella-zoster virus to stimulate long-lasting immunity against shingles, making them a crucial part of global preventive healthcare strategies. Their established safety profile and fewer required doses support their continued use. With developing nations investing in expanding vaccination coverage and healthcare infrastructure, demand for live attenuated vaccines is expected to rise steadily. However, limitations related to use in immunocompromised individuals and older adults may restrict broader adoption in some regions.

Regional Insights

North America shingles vaccine marketled the global market in 2024, holding the largest revenue share of 62.26%. This leadership is attributed to the well-established healthcare infrastructure, awareness of shingles vaccination benefits, and widespread adoption of advanced vaccine technologies. Government immunization programs targeting older adults and immunocompromised populations support strong market demand. In addition, extensive investments in vaccine research and development and regulatory approvals contribute to the region’s dominant position.

For example, the U.S. continues to promote adult vaccination initiatives, supported by recommendations from public health agencies such as the CDC. These efforts enhance vaccine uptake and drive market growth. The presence of key manufacturers actively expanding their product portfolios and distribution networks in North America also reinforces the region’s prominence in the global shingles vaccine market.

U.S. Shingles Vaccine Market Trends

The U.S. shingles vaccine market dominated North America in 2024, accounting for a significant share. According to the CDC, this leadership stems from the high prevalence of shingles, with approximately 1 million cases reported annually. The CDC’s vaccination recommendations and coverage through Medicare, Medicaid, and private insurance plans support broader vaccine access, particularly among older adults and high-risk groups. In addition, the country’s advanced healthcare infrastructure supports efficient vaccine distribution and administration.

Strong government initiatives to promote adult immunization, alongside growing awareness about the benefits of shingles vaccination, are further driving market growth. The presence of key vaccine manufacturers and ongoing research efforts to improve vaccine efficacy and safety also contribute to the U.S. market’s dominant position within the region.

Europe Shingles Vaccine Market Trends

Europe shingles vaccine market is witnessing significant growth, powered by robust EU funding programs (Horizon Europe), collaborative translational research networks, and strong regulatory guidance from the European Medicines Agency. Higher healthcare spending on precision medicine, coupled with increasing incidence of genetic and infectious diseases, drives demand for rapid, accurate assays. Innovations from leading biotech hubs in Germany, France, and Switzerland, alongside scalable manufacturing capabilities, further accelerate adoption across clinical laboratories and point-of-care settings.

UK shingles vaccine market is contributing to the growth of the shingles vaccine market through strong public health programs and awareness campaigns. The National Health Service (NHS) offers shingles vaccines to eligible age groups, helping to improve access and coverage. The rising number of older adults, who are more vulnerable to shingles, also supports market demand. The availability of effective vaccines such as Shingrix and government-backed immunization efforts continue to drive growth in the UK market.

Shingles vaccine market in Germany is a key player in the European market, supported by a well-established healthcare system, strong public health infrastructure, and widespread awareness about adult immunization. Including shingles vaccines such as Shingrix in the national immunization program has expanded vaccine coverage, particularly among older people. Germany's aging demographic and the rising incidence of shingles contribute to steady vaccine demand. In addition, ongoing education campaigns and physician-led awareness programs have improved public understanding of vaccine benefits, further encouraging uptake. These factors collectively support Germany's strong position in the regional market.

Asia Pacific Shingles Vaccine Market Trends

The Asia Pacific shingles vaccine market is projected to experience the fastest growth from 2025 to 2030, with a CAGR of 16.94% supported by rising disposable income, expanding healthcare access, and a large at-risk population. Many countries in the region, particularly low- and middle-income nations, are working to address unmet medical needs through improved vaccination policies and national immunization efforts. Government initiatives and increased public awareness are contributing to higher vaccine uptake. In addition, the expected approval and broader availability of recombinant vaccines across several Asian countries are anticipated to boost regional market growth during the forecast period significantly.

China shingles vaccine market is experiencing significant growth in the shingles vaccine market, supported by increased government backing and strategic investments in healthcare infrastructure. The National Medical Products Administration (NMPA) plays a key role in regulating and approving vaccines, ensuring timely access to innovative immunization options. Rising awareness about shingles, combined with expanding vaccination programs and ongoing research in the biotechnology sector, is driving market growth. These efforts strengthen China’s position as a growing contributor in the global shingles vaccine market.

Shingles vaccine market in Japan is a notable market for shingles vaccines, supported by a strong healthcare system and proactive government vaccination programs. The Pharmaceuticals and Medical Devices Agency (PMDA) oversees the regulation and approval of vaccines, ensuring safety and efficacy standards. Japan’s aging population and growing awareness of shingles risks are increasing the demand for effective vaccination. Continued innovation and public health initiatives are expected to maintain steady market growth, positioning Japan as an important player in the regional shingles vaccine market.

Latin America Shingles Vaccine Market Trends

Latin America is showing promising growth in the shingles vaccine market, driven by rising awareness of shingles and expanding healthcare access in countries like Brazil and Argentina. Government efforts to improve immunization coverage and introduce recombinant vaccines such as Shingrix contribute to market development. The region's growing elderly population and increasing healthcare investments further support demand. Regulatory bodies like Brazil's Agência Nacional de Vigilância Sanitária (ANVISA) play a key role in vaccine approval and distribution, helping to strengthen the market's growth prospects in Latin America.

Middle East and Africa Shingles Vaccine Market Trends

The Middle East and Africa (MEA) region is gradually expanding its presence in the shingles vaccine market, supported by improving healthcare infrastructure and growing public health initiatives. Countries in the Gulf Cooperation Council (GCC), such as the UAE and Saudi Arabia, are increasing investments in preventive healthcare and expanding adult immunization programs. The rising incidence of shingles among the aging population and the availability of recombinant vaccines are contributing to regional uptake. Health authorities such as the Saudi Food and Drug Authority (SFDA) and the South African Health Products Regulatory Authority (SAHPRA) facilitate regulatory pathways for vaccine approvals, aiding market growth across MEA.

Key Shingles Vaccine Company Insights

The shingles vaccine market is dominated by major pharmaceutical companies such as GlaxoSmithKline (GSK), Merck & Co., and Sanofi. GSK’s Shingrix holds a significant market share due to its high efficacy and growing adoption worldwide. Merck’s Zostavax, though less prevalent, still maintains a presence in some regions. Emerging players and generic manufacturers are gradually entering, contributing to market diversification.

Key Shingles Vaccine Companies:

The following are the leading companies in the shingles vaccine market. These companies collectively hold the largest market share and dictate industry trends.

- GlaxoSmithKline plc.

- Pfizer Inc.

- Merck & Co., Inc.

- CanSinoBIO

- Vaccitech

- Green Cross Corp

- Geneone Life Science

- SK Bioscience

Recent Developments

-

In March, 2025, AIM Vaccine Co., Ltd. announced its independently developed mRNA shingles vaccine received clinical trial approval from the U.S. Food and Drug Administration (FDA). AIM holds FDA approval to commence clinical trials for two key mRNA vaccine candidates: the mRNA shingles vaccine and the mRNA RSV vaccine.

-

In March, 2025, GlaxoSmithKline (GSK) announced a research collaboration with the UK Dementia Research Institute (UK DRI) and Health Data Research UK (HDR UK) to study neurodegeneration through a novel dementia study. The project will leverage the UK's health data ecosystem to investigate a potential link between GSK's shingles vaccine, Recombinant Zoster Vaccine (RZV), and a lower risk of dementia. If the findings support this association, the study could serve as a model for large-scale health data research.

-

In June 2024, Dynavax Technologies Corporation announced enrollment and dosing of first participant in Phase 1/2 clinical trial for assessing the safety, tolerability, and immune response of Z-1018. This investigational vaccine candidate is being developed to prevent shingles (herpes zoster), a painful condition caused by the varicella-zoster virus.

-

In January 2023, SK bioscience announced that its shingles vaccine, SKYZoster™, received biologics license application (BLA) approval from Malaysia's National Pharmaceutical Regulatory Agency (NPRA). This marks the vaccine's second international approval following Thailand in May 2020.

Shingles Vaccine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.42 billion

Revenue forecast in 2030

USD 11.26 billion

Growth rate

CAGR of 15.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, vaccine type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GlaxoSmithKline plc.; Pfizer Inc.; Merck & Co. Inc.; CanSinoBIO; Vaccitech; Green Cross Corp; Geneone Life Science; SK Bioscience.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Shingles Vaccine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global shingles vaccine market report based on product, vaccine type, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Shingrix

-

Zostavax

-

SKYZoster

-

-

Vaccine Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Recombinant Vaccine

-

Live Attenuated Vaccine

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Private Healthcare Settings

-

Government Healthcare Settings

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global shingles vaccine market size was estimated at USD 4.78 billion in 2024 and is expected to reach USD 5.42 billion in 2025

b. The global shingles vaccine market is expected to grow at a compound annual growth rate of 15.7% from 2025 to 2030 to reach USD 11.26 billion by 2030.

b. Shingrix vaccine dominated the shingles vaccine market with a share of 94.14% in 2024. This is attributable to high efficacy and inclusion of the vaccine in national immunization programs of various countries.

b. Some key players operating in the shingles vaccine market include GlaxoSmithKline plc.; Merck & Co., Inc.; and SK chemicals, Green Cross Corp, Geneone Life Science, and Vaccitech.

b. Key factors that are driving the shingles vaccine market growth include increased risk of developing shingles especially in adults aged 60 & above and high adoption of vaccines in developed and developing countries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.