- Home

- »

- Semiconductors

- »

-

Silicon Photonics Market Size, Share & Trends Report, 2030GVR Report cover

![Silicon Photonics Market Size, Share & Trends Report]()

Silicon Photonics Market (2023 - 2030) Size, Share & Trends Analysis Report By Component, By Product (Transceivers, Active Optical Cables, Optical Multiplexers, Optical Attenuators, Others), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-323-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Silicon Photonics Market Summary

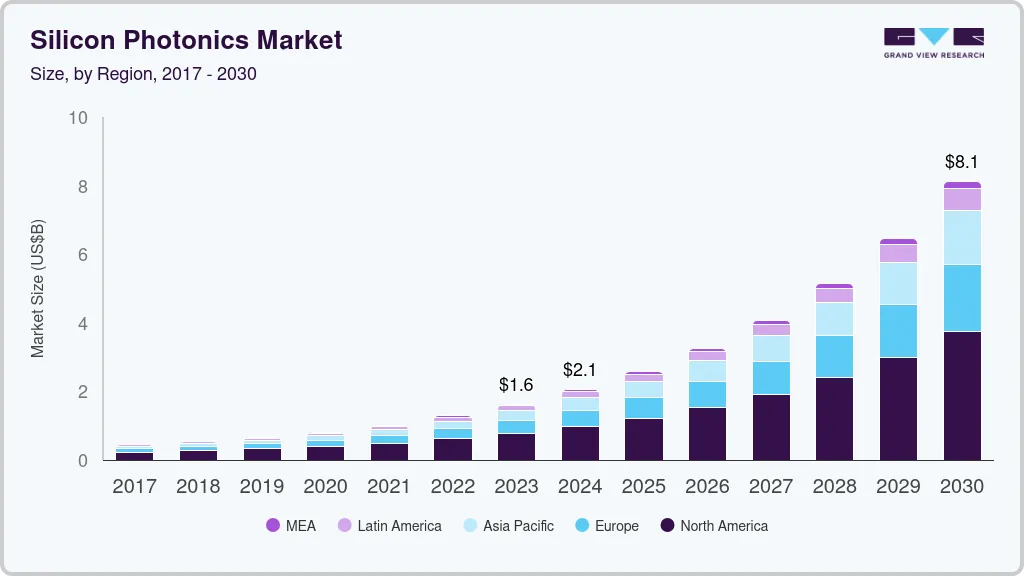

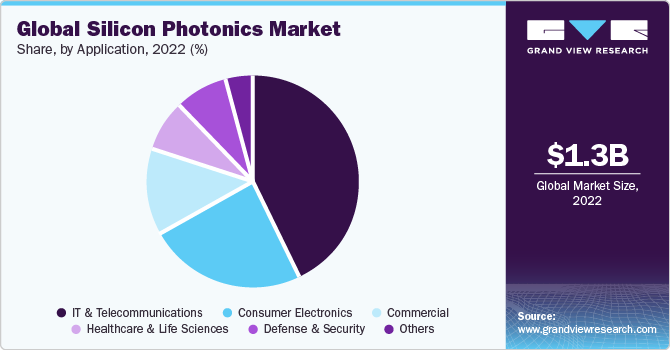

The global silicon photonics market size was estimated at USD 1.29 billion in 2022 and is projected to reach USD 8.13 billion by 2030, growing at a CAGR of 25.8% from 2023 to 2030. Silicon Photonics is an emerging technology experiencing growing demand due to the need for higher data transfer rates and bandwidth-intensive applications.

Key Market Trends & Insights

- North America dominated the market and accounted for the largest revenue share of 47.8% in 2022.

- Asia Pacific is expected to register the fastest CAGR of 27.8% over the forecast period.

- By component, the Wavelength-Division Multiplexing (WDM) filters segment accounted for the largest revenue share of 32.2% in 2022.

- By product, the active optical cables segment captured the largest revenue share of over 35.9% in 2022.

- By application, the IT & telecommunications segment accounted for the largest revenue share of around 43.1% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 1.29 Billion

- 2030 Projected Market Size: USD 8.13 Billion

- CAGR (2023-2030): 25.8%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

It has found significant traction in data centers and telecommunications, where it offers high-speed data transmission, reduced power consumption, and integration with existing silicon-based electronic systems. Silicon photonics has also been explored as a solution for optical interconnects, replacing traditional copper-based interconnects in data centers and high-performance computing systems.A key advantage of silicon photonics is its compatibility with existing silicon-based electronic technologies, enabling the integration of photonic components with electronic circuits on a single silicon chip. This compatibility results in more efficient and cost-effective systems. Extensive research and development have focused on improving performance, enhancing manufacturing processes, and reducing costs to drive silicon photonics advancement further. Researchers are exploring new materials, fabrication techniques, and design methodologies to push the boundaries of the technology.

Collaborations and partnerships have played a crucial role in the commercialization of silicon photonics. Semiconductor companies, telecommunications providers, data center operators, and research institutions have come together to develop standardized solutions, overcome technical challenges, and bring silicon photonics products to the market. These partnerships aim to accelerate the adoption of silicon photonics and drive its widespread use in various applications.

Component Insights

Based on the component, the market is segmented, including optical waveguides, optical modulators, photodetectors, Wavelength-Division Multiplexing (WDM) filters, and lasers. The Wavelength-Division Multiplexing (WDM) filters segment accounted for the largest revenue share of 32.2% in 2022. WDM filters play a crucial role in enabling the integration of multiple wavelength channels on a single silicon chip. Silicon photonics leverages the compatibility of silicon with both electronic and photonic components, allowing for the integration of WDM filters alongside other photonic and electronic functionalities.

The trends in Wavelength-Division Multiplexing (WDM) filters for silicon photonics include a focus on increased integration density to accommodate many wavelength channels on a single chip. Efforts are being made to minimize insertion loss and crosstalk, optimizing filter performance for improved efficiency and reliability.

Other trends observed are the expansion of the wavelength range, integration of additional functionalities, and the exploration of low-cost manufacturing processes. Moreover, researchers are investigating advanced material systems, such as silicon nitride, to enhance WDM filter performance. These trends collectively aim to advance silicon photonics technology and enable high-capacity data transmission in compact, cost-effective systems.

The optical waveguides segment is expected to grow at the fastest CAGR of 27.3% during the forecast period. The growing focus on energy-efficient solutions drives the adoption of optical waveguides in the market. Optical waveguides exhibit low power consumption compared to traditional copper-based interconnects. As energy efficiency becomes critical in data centers and other high-performance computing environments, using optical waveguides can help reduce power consumption and dissipate heat more effectively.

Product Insights

Based on the product, the global silicon photonics market is segmented into transceivers, active optical cables, optical multiplexers, and attenuators. The active optical cables segment captured the largest revenue share of over 35.9% in 2022 and is expected to maintain its dominance throughout the forecast period. Through silicon photonic products, active optical cables transfer high data rates over a long distance. Active optical cables have significant cost advantages compared to traditional optical modules and provide streamlined installation for high-performance computing and storage applications.

The optical multiplexers segment is expected to grow at the fastest CAGR of 27.3% during the forecast period. Optical and demultiplexers are essential in Wavelength-Division Multiplexing systems, allowing multiple wavelengths to be transmitted over a single optical fiber. The trends in this product type include higher channel counts, compact designs, lower insertion losses, and compatibility with different wavelength bands. Advancements in multiplexer/demultiplexer technology aim to increase the capacity and efficiency of optical communication systems.

Application Insights

Based on application, the market is segmented into IT & telecommunications, consumer electronics, healthcare & life sciences, commercial, defense and security, and others. The IT & telecommunications segment accounted for the largest revenue share of around 43.1% in 2022. Silicon photonics is experiencing significant growth in the data center industry. The trends in data center applications focus on higher data transfer rates, increased bandwidth capacity, improved power efficiency, and scalability. Silicon photonics enables the development of high-speed optical interconnects, optical switches, and other components that address the growing demand for data-intensive applications, such as cloud computing, artificial intelligence, and big data analytics.

Telecommunications is another key application area for silicon photonics. The trends in telecommunications applications involve the deployment of silicon photonics-based devices for high-speed optical communications, including long-haul and metro networks. The industry is witnessing advancements in WDM technology, optical amplifiers, and coherent transmission systems, enabling higher data rates, longer transmission distances, and improved network performance.

The commercial segment is estimated to register the fastest CAGR of 27.5% over the forecast period. The advancements in manufacturing processes and packaging techniques play a crucial role in the growth of the commercial segment. Continuous improvements in fabrication technologies, such as wafer-scale manufacturing and 3D integration, enable higher production volumes, improved performance, and cost efficiencies. These advancements contribute to the scalability and affordability of silicon photonics components, making them more attractive for commercial applications.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 47.8% in 2022, attributable to the region's major development and adoption of silicon photonics technology. The trends in this region include significant investments in research and development, collaborations between academia and industry, and the presence of leading silicon photonics companies. North America has witnessed the deployment of silicon photonics in data centers, telecommunications networks, and high-performance computing systems. The region continues to drive innovations in silicon photonics, focusing on higher data rates, improved energy efficiency, and advanced applications such as quantum computing and sensing.

Asia Pacific is expected to register the fastest CAGR of 27.8% over the forecast period. Countries like China, Japan, and South Korea invest heavily in developing silicon photonics technology and its applications. The trends in this region include the establishment of research institutes, government initiatives, and collaborations to foster innovation in silicon photonics. The region also has a strong presence in the manufacturing and fabricating of silicon photonics components, contributing to cost optimization and scalability.

Key Companies & Market Share Insights

The market is highly competitive, and the players are undertaking strategies such as forecast launches, acquisitions, and collaborations to increase their global reach. For instance, in August 2021, I-PEX Inc collaborated with Teramount LTD to develop an optical detachable silicon photonics connection for data centers and other high speeds datacom and telecommunications applications. The collaboration will offer an innovative solution for detachable fiber-to-chip connection based on Teramount's self-aligning optical technologies and I-PEX's ultra-precision plug and holder solutions.

Key Silicon Photonics Companies:

- Intel Corporation

- Cisco Systems, Inc.

- DAS Photonics

- Hamamatsu Photonics K.K.

- IBM Corporation

- STMicroelectronics N.V.

- Adtran Networks

- Finisar Corporation

- Molex, LLC

- Mellanox Technologies (NVIDIA Corporation)

- Infinera Corporation

Recent Developments

-

In May 2023, SkyWater Technology collaborated with PsiQuantum to develop silicon photonic chips deployed in future quantum computing devices. The firms collaborated to produce the chips in SkyWater's semiconductor production facility in Minnesota, U.S. This collaboration advances PsiQuantum's objective of developing a financially feasible, error-corrected multipurpose quantum computing system that extends beyond 1,000,000 qubits using silicon photonics. The collaboration between the two firms is a crucial step towards achieving this aim, bringing together the skills of leading companies to develop a quantum computer capable of driving modifications across various sectors.

-

In December 2022, Altair Engineering Inc. announced an investment of USD 10 million in Xscape, a company that has developed an innovative platform. Xscape developed a platform that sustainably connects numerous computer aspects while providing the best efficiency accessible. Xscape's unique approach utilizes photonics to minimize power consumption and heat generation while simultaneously enhancing the speed and efficiency of communications. With Altair's investment, Xscape further advanced its platform and integrated it with leading simulation, high-performance computing, and artificial intelligence software that benefits clients across various industries.

-

In August 2022, DustPhotonics Ltd and MaxLinear collaborated to showcase a silicon photonics chipset incorporating lasers directly driven from a digital signal processor (DSP), eliminating the need for external driver chips. The partnership between MaxLinear's Keystone DSP and DustPhotonics' Carmel Silicon Photonics chip enables the development of cost-effective and low-power optical transceivers for data communication. This advancement allows for the design of 400Gb/s transceivers with power consumption below 7W.

-

In March 2022, GlobalFoundries Inc partnered with Broadcom, Cisco Systems, Inc., NVIDIA Corporation, and Marvell to introduce GF Fotonix, an advanced silicon photonics platform that promises to revolutionize the industry. GlobalFoundries Inc holds a significant market share and has secured design contracts with major customers. The company foresees its growth in this field surpassing the overall market growth. GlobalFoundries Inc and Cisco Systems, Inc., a leading industry player, are collaborating on a customized silicon photonics solution for data center interconnect, data communication, and computer network applications.

-

In October 2021, The New York State Government announced that the American Institute of Manufacturing Photonics awarded a new seven-year collaborative contract with the Air Force Research Laboratory and the State University of New York Research Foundation, totaling more than USD 321 million in investment. The investment is utilized to develop advanced photonics readiness. This technology is vital to developing high-performance microelectronics and is essential for the nation's safety.

Silicon Photonics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.63 billion

Revenue forecast in 2030

USD 8.13 billion

Growth rate

CAGR of 25.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, product, application, region

Regional scope

North America, Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; United Arab Emirates; Saudi Arabia; South Africa

Key companies profiled

Intel Corporation; Cisco Systems, Inc.; DAS Photonics; Hamamatsu Photonics K.K.; IBM Corporation; STMicroelectronics N.V.; Adtran Networks; Finisar Corporation; Molex; LLC; Mellanox Technologies (NVIDIA Corporation); Infinera Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Silicon Photonics Market Report Segmentation

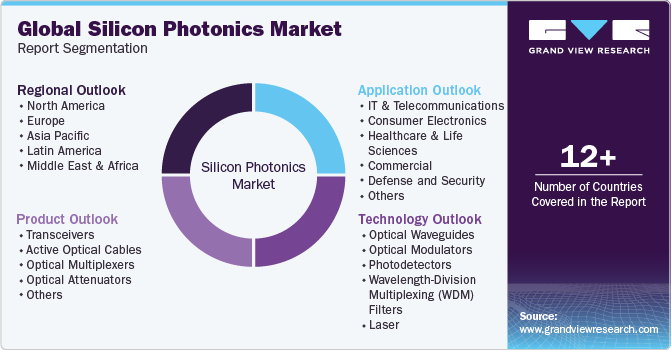

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest application trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global silicon photonics market on the basis of component, product, application, and region:

-

Component Outlook (Revenue in USD Million, 2017 - 2030)

-

Optical Waveguides

-

Optical Modulators

-

Photodetectors

-

Wavelength-Division Multiplexing (WDM) Filters

-

Laser

-

-

Product Outlook (Revenue in USD Million, 2017 - 2030)

-

Transceivers

-

Active Optical Cables

-

Optical Multiplexers

-

Optical Attenuators

-

Others

-

-

Application Outlook (Revenue in USD Million, 2017 - 2030)

-

IT & Telecommunications

-

Consumer Electronics

-

Healthcare & Life Sciences

-

Commercial

-

Defense and Security

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global silicon photonics market size was estimated at USD 1.29 billion in 2022 and is expected to reach USD 1.63 billion in 2023.

b. The global silicon photonics market is expected to grow at a compound annual growth rate of 25.8% from 2023 to 2030 to reach USD 8.13 billion by 2030.

b. North America dominated the silicon photonics market with a share of 47.82% in 2022. This is attributable to the presence of a large number of radio frequency circuit manufacturers in the U.S. coupled with cost-effectiveness.

b. Some key players operating in the silicon photonics market include Intel Corporation; Cisco Systems, Inc.; DAS Photonics; Hamamatsu Photonics K.K.; International Business Machines Corporation; STMicroelectronics N.V.; ADVA Optical Networking; Finisar Corporation; Molex Incorporated; Mellanox Technologies, Ltd.; and Infinera Corporation.

b. Key factors that are driving the silicon photonics market growth include high-speed data transfer, power efficiency & high level of integration, and the growing stakeholder investments in the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.