- Home

- »

- Biotechnology

- »

-

Skin Care Supplements Market Size, Industry Report, 2033GVR Report cover

![Skin Care Supplements Market Size, Share & Trends Report]()

Skin Care Supplements Market (2025 - 2033) Size, Share & Trends Analysis Report By Ingredients (Collagen, Vitamins), By Content Type (Chemical, Organic), By Formulation, By Application, By Gender, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-124-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Skin Care Supplements Market Summary

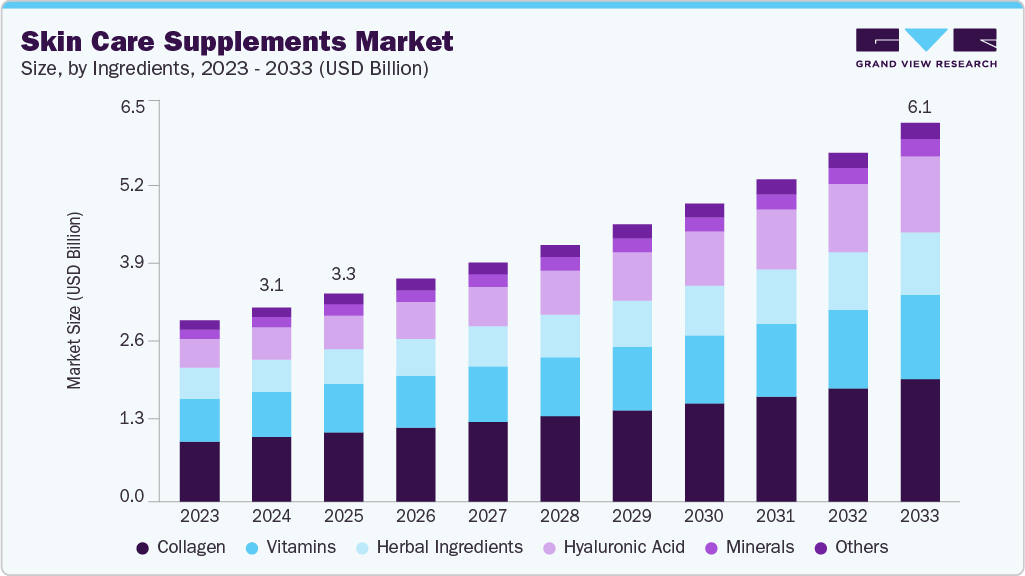

The global skin care supplements market size was estimated at USD 3.10 billion in 2024 and is projected to reach USD 6.05 billion by 2033, growing at a CAGR of 7.81% from 2025 to 2033. Market growth can be attributed to the increasing attention to physical appearance and the rising accessibility of skin care supplements.

Key Market Trends & Insights

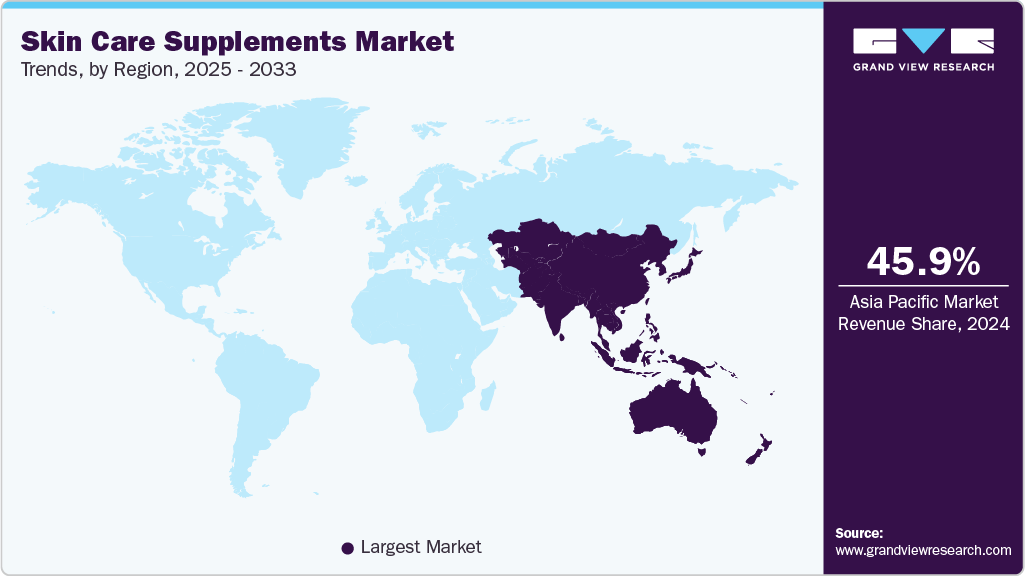

- Asia Pacific skin care supplements market held the largest share of 45.97% of the global market in 2024.

- The skin care supplements industry in the U.S. is expected to grow significantly over the forecast period.

- By ingredients, the collagen segment held the highest market share of 33.32% in 2024.

- By gender, the female segment held the highest market share in 2024.

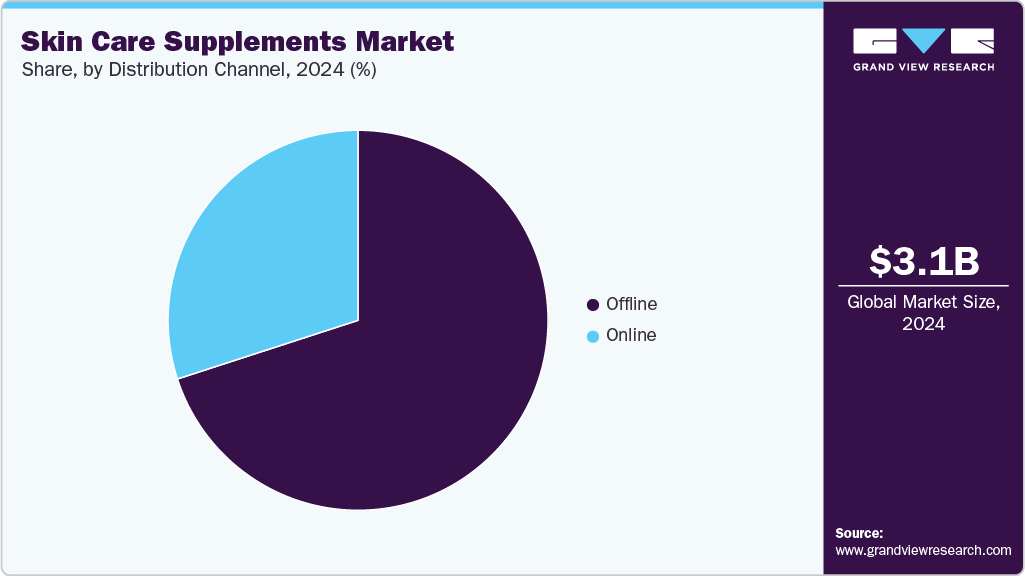

- By distribution channel, the offline segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.10 Billion

- 2033 Projected Market Size: USD 6.05 Billion

- CAGR (2025-2033): 7.81%

- Asia Pacific: Largest market in 2024

In addition, the increasing adoption of social media marketing by various supplement manufacturers is expected to drive the market over the forecast period. The skin care supplements market is expected to witness significant growth in the coming years due to the increasing social media marketing initiatives that manufacturers and providers undertake to promote these products globally. Due to the increasing number of social media users, it has become a popular platform to market offerings. Consumers can interact with brands via advertisements, quizzes, surveys, and forms provided by manufacturers on social media platforms, such as Instagram, Facebook, and YouTube.

These advertisements, quizzes, and forms provide insights into the consumer's preferences and choices, which can help manufacturers innovate supplements as per the market demand. These benefits associated with social media advertisements are expected to increase the adoption of social media marketing, which is expected to drive the skin care supplements industry growth in the coming years.

Some of the brands and retailers promoting their products on social media platforms like Instagram include Swisse Wellness Pty Ltd., Supplements Made Simple, hkvitals.com, Pure Encapsulations, LLC., Truebasics.com, Neutrogena, Cymbiotika, and Ritual. These brands provide information about their products via photos and videos, which helps them attract their target consumers easily. Furthermore, a large population is using social media.

According to the article published in July 2020 by Hootsuite, Inc., a leader in social media management, over 3.96 billion individuals use social media-about 51% of the worldwide population. Furthermore, brands can reach about 1.08 billion individuals using ads on Instagram. Thus, the rising social media marketing for skin care supplements and the growing number of social media users are expected to boost the skin care supplements industry.

The pandemic increased people's focus on health and wellness, which increased interest in supplements. Consumers searched for products that could boost their immune system and support their physical look, or overall well-being, boosting the demand for supplements. The global lockdowns, travel restrictions, and disruptions in international trade impacted the supply chains of many industries, including the supplements sector. Manufacturers faced challenges in sourcing raw materials, ingredients, and packaging materials, leading to delays & shortages. With social distancing measures and restrictions on in-person shopping, there was a significant shift toward online purchasing.

Furthermore, some articles have suggested that these supplements can interfere with COVID-19 test results, which has hindered the demand for these supplements. For instance, as per the article published by NatMed, a healthcare brand, in July 2020, some experts warned that biotin supplements might interfere with COVID-19 antibody testing. Thus, such opinions of industry experts about biotin supplements have hindered the adoption of skin supplements to a certain extent during the COVID-19 pandemic.

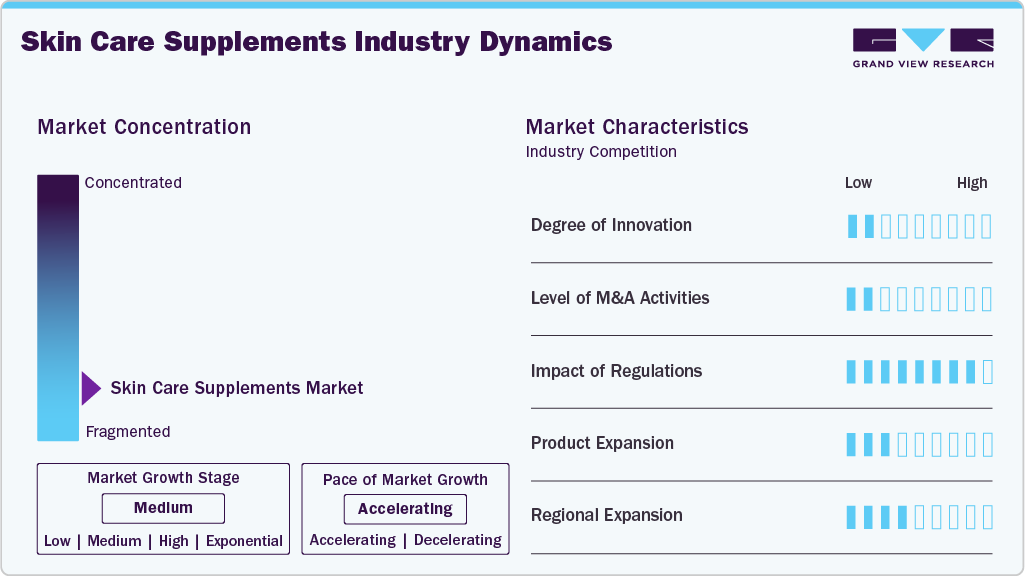

Market Concentration & Characteristics

The skin care supplements industry is witnessing a remarkable degree of innovation, with companies creating products that align with evolving consumer preferences and scientific advancements. From advanced formulations and delivery systems to personalized solutions and sustainable practices, these innovations are reshaping the industry and providing consumers with a diverse range of effective and customized supplement options.

Skin care supplement manufacturers are leveraging M&A to diversify and expand their product offerings. Acquiring brands with complementary products or unique formulations allows companies to address a broader spectrum of consumer needs and preferences. This strategic expansion broadens revenue streams and positions companies as comprehensive solution providers in the skin care and wellness space.

Regulations in the skin care supplements industry provide a framework for safety, quality, and consumer protection; they also present challenges for industry players. The impact varies depending on the nature and stringency of regulations, and successful companies are those that can navigate the regulatory landscape effectively while ensuring their products meet consumer needs.

The skin care supplements industry is witnessing new product launches for various cosmetic categories with key focus on addressing specific concerns. Products such as skin hydration supplements and anti-aging supplements are being launched by key players in the industry to solidify their market position and strengthen product portfolio.

The skin care supplements market currently demonstrates a moderate level of regional expansion, with expectations for growth driven by an expanding consumer base over time. As awareness of skin-related issues grows globally and access to healthcare improves in emerging markets, there is a rising demand for supplements across different regions.

Ingredients Insights

The collagen segment accounted for the largest revenue share of 33.32% in 2024. The dominance of the segment is due to the growing consumer demand for effective anti-aging solutions that improve skin elasticity, hydration, and firmness. Collagen supplementation is widely recognized for its ability to reduce wrinkles and promote youthful skin, which is especially appealing to aging populations in North America, Europe, and Asia-Pacific. Additionally, the rise of beauty-from-within trends, fueled by social media, influencer marketing, and the popularity of functional foods and beverages, has further propelled collagen-based products into the mainstream. Technological advancements in hydrolyzed and marine collagen have also enhanced bioavailability and product innovation, supporting continued market growth.

The hyaluronic acid segment is anticipated to witness a highest CAGR of 10.73% from 2025 to 2033. The market is driven by its strong association with skin hydration, plumpness, and visible reduction in fine lines-attributes highly valued in both anti-aging and general skin wellness segments. As consumers increasingly seek non-invasive, science-backed alternatives to topical treatments, hyaluronic acid supplements have gained popularity for their ability to retain moisture from within. The rise of beauty-from-within trends, clean-label formulations, and increased adoption of nutricosmetics in regions like Asia-Pacific and North America further fuel demand. Additionally, innovation in delivery formats-such as gummies, functional drinks, and capsules-has expanded accessibility and consumer appeal.

Content Type Insights

The chemical segment dominated the market and captured the largest revenue share in 2024. Chemical ingredients are known for delivering relatively quick and noticeable results, which can appeal to those seeking rapid improvements in their skin's appearance and texture. In addition, chemical preservatives can extend the shelf life of skin care products, reducing the risk of spoilage and ensuring that the product remains effective over an extended period. Such advantages support the segment's large share in the market and are expected to drive the segment during the forecast period.

Organic segment is expected to register a highest CAGR during the forecast period. Organic skin care supplements provide essential nutrients from natural sources, including ingredients such as vitamins C & E, collagen, biotin, and antioxidants. Stringent regulations and a growing demand for transparency in the beauty industry have led to a greater focus on clean & organic formulations. Brands are adapting to changing consumer expectations. In addition, the influence of social media, beauty influencers, and celebrities contribute to creating trends. The endorsement of organic supplements by popular figures and growing concerns about chemicals are expected to boost this segment over the coming years.

Formulation Insights

The tablets & capsules segment dominated the market and accounted for the largest revenue share of 52.15% in 2024. Tablets are preferred owing to their extended shelf life and easy packaging. These formulations are gaining traction owing to their cost-effectiveness and easy packaging techniques. In addition, the availability of tablets in various forms, such as enteric coated, chewable, sublingual & buccal, effervescent, and sustained release, is further driving the segment.

Furthermore, tablet formulation allows the development of multi-nutrient components in a single dosage form, enabling market players to develop customized formulations by combining minerals, herbs, vitamins, & other bioactive ingredients in a single formulation. Moreover, multinutrient tablets minimize the need to consume several supplements separately. Furthermore, newer capsules are being introduced to improve bioavailability, release, and extend the benefits of supplements. Hence, various benefits offered by capsule formulations, such as higher rate of absorption & lower irritation to the Gastrointestinal (GI) tract and their availability in various sizes, based on dosage, are factors contributing to segment growth.

The liquid formulation segment is expected to showcase the highest CAGR of 8.94% during the forecast period. Liquid formulations are widely accepted by consumers owing to their simple formulations, as they are easy to absorb and digest. Liquids are mostly taken by individuals who want to reduce the consumption of pills and people who prefer liquids to supplement their regular skin care routine. The high demand for liquid skin supplements is expected to facilitate market players to introduce more supplements. For instance, in April 2023, Perricone MD introduced Essential Fx Acyl-Glutathione Chia Body Oil. It is useful to reduce wrinkles and moisturize.

Application Insights

The skin aging application segment dominated the market and accounted for the largest revenue share of 30.17% in 2024owing to the increasing geriatric population using various products to treat skin aging issues and the availability of various products for treating problems related to skin aging. According to an article published in June 2023 in the National Library Of Medicine (NLM), the geriatric population has significantly increased globally in recent years amid rapid socioeconomic development. In 2019, around 1 billion individuals were aged 60 years or older.

This number is estimated to increase to about 1.4 billion by 2030 and 2.1 billion by 2050. The proportion of older people is estimated to increase to 22% of the global population by 2050. Thus, the rising geriatric population, facing problems such as wrinkles, skin tags, warts, brown rough patches, loose facial, dry, & transparent or thinned skin, is expected to boost the segment significantly. Therefore, the growing demand for skin care supplements targeting aging issues is expected to boost the segment's growth.

The skin hydration segment is expected to showcase the highest CAGR of 9.48% during the forecast period. The availability of multiple products for skin hydration and growing product launches in this segment is expected to support segment growth. For instance, in May 2023, Ritual introduced HyaCera, a dermis hydration product that can reduce fine lines and hydrate the skin. The product is gluten-free, non-GMO, and vegan, boosting access to all target groups.

Gender Insights

The female skin care supplements segment held the largest revenue share in 2024. The segment is expected to grow due to the increasing focus of female consumers on skin care and enhancing their appearance. Moreover, the number of product launches catering specifically to female skin care needs is the major reason for segment dominance. For instance, in June 2022, Hims & Hers Health, Inc., a wellness platform, introduced six supplements designed for women. The newly launched supplements include products for skin health. Such initiatives are helping the segment grow.

The male skin care supplements segment is expected to grow at a highest CAGR over the forecast period. The growing focus of the male population on wellness and grooming is anticipated to drive segment growth. In addition, industry participants target male consumers and offer products catering to their complexion needs. For instance, Vitabiotics Ltd., a key player operating in the market, offers Wellman Skin to boost collagen formation in men and provide a youthful appearance.

Distribution Channel Insights

The offline segment dominated the market and accounted for the largest revenue share in 2024. Several options are available to purchase skin care supplements offline. It includes pharmacies, supermarkets, and other offline channels like retail stores. These channels sell skin care supplements from different companies and offer the flexibility to choose from various brands. Furthermore, purchasing supplements from offline channels also provides certain benefits. Consumers can touch products and interact with knowledgeable store staff for product guidance. Such benefits associated with offline shopping of skin care supplements are expected to boost the demand for the offline segment over the forecast period.

The online segment is expected to register a highest CAGR during the forecast period. The demand for supplements through online distribution channels increased significantly during the COVID-19 pandemic. To boost the reach of their products, companies are collaborating with e-commerce platforms and focusing on digital distribution channels.

Furthermore, numerous companies have websites to help them distribute & sell skin care supplements in the industry. Industry participants are leveraging their digital presence to increase their brand visibility in the market. Several players, such as Amway, offer discounts, coupons, vouchers, and bundles of skin care supplements on their websites. Such sales promotional activities undertaken by companies via digital platforms, such as websites and e-commerce platforms, are expected to boost the sale of skin care supplements through online platforms.

Regional Insights

Asia Pacific skin care supplements market captured the largest revenue share of 45.97% in 2024. There is a growing awareness and interest in skin care & wellness among consumers across the region. Moreover, people are becoming more conscious of their skin care routines and seeking products promoting healthy skin. As disposable income rises across Asia Pacific, consumers are willing to spend more on skin-enhancing products. This has led to an increased demand for skin care supplements in the region.

The skin care supplements market in China is anticipated to grow over the forecast period as China is a dominating country in this region. The market in China is competitive, with numerous international brands and local players competing for the market share. Consumers are increasingly focused on beauty and skin care, driving the demand for these products. Some key players operating in the market include brands such as Amway, Perfect (China) Co., Ltd., and Nu Skin, among others.

The skin care supplements market in Japan is expected to witness robust demand due to the increasing emphasis on beauty and skin care. The companies are focusing on skin care supplements through partnerships and acquisitions.

The skin care supplements market in India is competitive due to the presence of domestic & international brands and the rising demand for skin care products. High population of the country presents a lucrative target for emerging companies in the region. Some of the major companies operating in the market include Amway, Himalayan Organics, and Herbalife.

North America Skin Care Supplements Market Trends

North America skin care supplements market held a significant share in the market, and its growth can be attributed to the rising desire for a youthful appearance, the increasing burden of skin-related issues, and the easy accessibility of supplements-based products. In addition, the growing awareness about health and changing lifestyles increased the number of consumers opting for noninvasive, long-lasting solutions to improve their overall skin health, creating a high demand for skin care supplements.

U.S. Skin Care Supplements Market Trends

The skin care supplements market in the U.S. is expected to grow over the forecast period due to the presence of various players in the industry. Some of the key companies operating in the market are Amway, Hum Nutrition, Nestle, Murad LLC, and Johnson & Johnson Services, Inc. (Neutrogena).

Europe Skin Care Supplements Market Trends

The skin care supplements market in Europe is anticipated to grow at a lucrative pace during the forecast period. This can be attributed to the increasing awareness about supplementation products and the growing desire for a beautiful & youthful appearance. In addition, new product launches and increased partnerships among key players & retailers are some of the factors expected to propel market growth over the forecast period. For instance, in January 2023, Neutrogena collaborated with Nourished for 3D-printed skin supplements. Such advancements in the industry are anticipated to propel the skin care supplementation market growth in Europe.

The skin care supplements market in UK is expected to witness strong competition and diverse offerings. Numerous local and international brands are undertaking various strategies to gain a competitive edge and expand their reach.

The skin care supplements market in France is expected to grow over the forecast period. Various companies are tapping into the country’s market. For instance, in April 2022, Shiseido launched a new skin care brand, “Ulé,” in France. Ule offers skin care products and supplements for inside & outside care.

The skin care supplements market in Germany is expected to grow over the forecast period. Some companies are introducing new products to expand their portfolio and market presence in the skin care supplements market. For instance, in March 2023, Symrise, a Germany-based company, introduced a line of bioactive for skin brightening and antiaging.

MEA Skin Care Supplements Market Trends

The MEA skin care supplements market is being driven by a growing emphasis on beauty and personal wellness. Consumers in the region are becoming increasingly conscious of their appearance, with a rising preference for holistic and preventive solutions to maintain youthful, radiant skin. This shift toward internal beauty care has boosted demand for supplements that support skin health from within.

Rapid urbanization and changing lifestyles are also key contributors. Increased exposure to environmental stressors such as pollution, UV radiation, and high-stress urban living is leading to a rise in skin-related concerns. As a result, many consumers are turning to nutritional supplements as a proactive way to combat skin aging, dryness, and pigmentation issues.

The skin care supplements market in Saudi Arabia is expected to grow over the forecast period. The number of retailers online & offline across the country providing skin care supplement products is expected to boost the market rivalry. Similarly, rising awareness about skin care is expected to boost market growth.

The skin care supplements market in Kuwait is driven by rising consumer awareness of beauty-from-within solutions, fueled by a growing interest in holistic wellness and anti-aging products. The high disposable income and a strong inclination toward premium personal care products among Kuwaiti consumers contribute to increased demand for supplements containing collagen, hyaluronic acid, vitamins C and E, and other skin-enhancing ingredients.

Key Skin Care Supplements Company Insights

Key players in the market are undertaking several strategic initiatives such as product launches, partnerships, and expansion activities to strengthen their foothold in the market and tap into the increasing demand for skin care products.

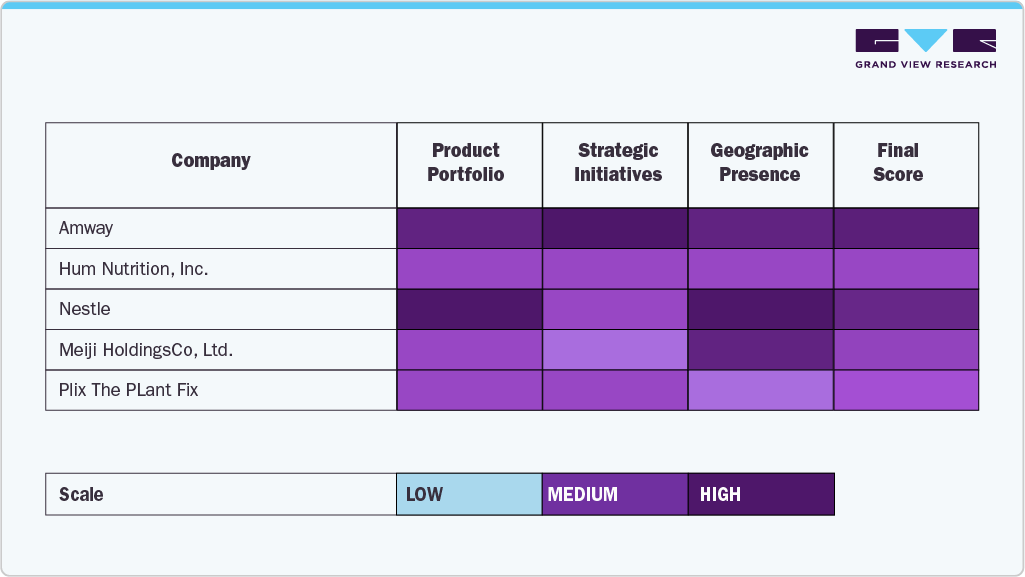

Heat Map Analysis

A heat map analysis of key players in the skin care supplements market reveals varied geographic and strategic strengths. Amway maintains a strong global presence, particularly in Asia and North America, leveraging its direct-selling model and Nutrilite brand to offer a broad range of beauty-from-within products. Hum Nutrition, Inc. is highly active in the U.S. and select European markets, focusing on premium, clean-label supplements targeting specific skin concerns like acne, hydration, and glow.

Nestlé, through its Nestlé Health Science division, holds a dominant position globally with clinically backed offerings such as the Vital Proteins brand, especially in North America and Europe. Meiji Holdings Co., Ltd. leads in Japan and parts of Asia with collagen-rich supplements in drink and powder form, benefiting from early adoption of nutricosmetics in the region. In contrast, Plix The Plant Fix, an emerging player from India, is rapidly gaining traction in South Asia with its plant-based, vegan-friendly beauty supplements, appealing to younger, urban consumers focused on clean, sustainable wellness solutions.

Key Skin Care Supplements Companies:

The following are the leading companies in the skin care supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Amway

- Hum Nutrition, Inc.

- Nestle

- Meiji Holdings Co., Ltd.

- Plix The Plant Fix

- Unilever (Murad LLC)

- Johnson & Johnson Services, Inc (Neutrogena)

- Perricone MD

- TCH, Inc (Researveage)

- Vitabiotics Ltd.

Recent Developments

-

In February 2025, The Estée Lauder Companies Inc. has announced a collaboration with biotechnology firm Serpin Pharma to explore the application of Serpin’s anti-inflammatory research in cosmetics, with the goal of delivering meaningful skin longevity benefits to consumers globally.

-

In January 2023, Johnson & Johnson brand Neutrogena partnered with Nourished, a personalized supplements specialist, and revealed the launch of 3D-printed personalized beauty gummies. These are tailored to fulfill the conditions based on the individual's skin.

-

In May 2023, Amway's Artistry Skincare products have received a seal of recommendation from the Skin Cancer Foundation. This recognition helps in promoting brands.

-

In May 2023, the Perricone MD has expanded its Vitamin C Ester Collection by launching two new products, Intensive Dark Spot Solution and Brightening & Exfoliating Polish, to remove stubborn pigmentation and brighten the skin.

Skin Care Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.32 billion

Revenue forecast in 2033

USD 6.05 billion

Growth rate

CAGR of 7.81% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, content type, formulation, application, gender, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; Kuwait; UAE; and South Africa

Key companies profiled

Amway; HUM Nutrition Inc.; Nestle; Meiji Holdings Co., Ltd.; Plix: The Plant Fix; Unilever (Murad LLC); Johnson & Johnson Services, Inc. (Neutrogena); Perricone MD; TCH, Inc. (Researveage); Vitabiotics Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Skin Care Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global skin care supplements market report based on ingredient, content type, formulation, application, gender, distribution channel, and region.

-

Ingredients Outlook (Revenue, USD Million, 2021 - 2033)

-

Collagen

-

Vitamins

-

Herbal Ingredients

-

Hyaluronic Acid

-

Minerals

-

Others

-

-

Content Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Organic

-

Chemical

-

-

Formulation Outlook (Revenue, USD Million, 2021 - 2033)

-

Tablets & Capsules

-

Powder

-

Liquid

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Skin Aging

-

Skin Hydration

-

Acne & Blemishes

-

Skin Brightening

-

Others

-

-

Gender Outlook (Revenue, USD Million, 2021 - 2033)

-

Female

-

Male

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Online

-

E-commerce

-

Company Website

-

-

Offline

-

Pharmacies

-

Supermarkets

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global skin care supplements market size was estimated at USD 3.10 billion in 2024 and is expected to reach USD 3.32 billion in 2025.

b. The global skin care supplements market is expected to grow at a compound annual growth rate of 7.81% from 2025 to 2033 to reach USD 6.05 billion by 2033.

b. Asia Pacific dominated the skin care supplements market with a share of 45.97% in 2024. This is attributable to increasing awareness regarding skin care routines among teenagers and adults

b. Some key players operating in the skin care supplements market include Amway, Hum Nutrition, Inc., Nestle, Meiji Holdings Co., Ltd., Plix The Plant Fix, Unilever (Murad LLC), Johnson & Johnson Services, Inc (Neutrogena), Perricone MD, TCH, Inc (Researveage)

b. Key factors that are driving the market growth include increasing awareness regarding skin care products, rising social media marketing done by manufacturers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.