- Home

- »

- Petrochemicals

- »

-

Slideway Oil Market Size And Share, Industry Report, 2033GVR Report cover

![Slideway Oil Market Size, Share & Trends Report]()

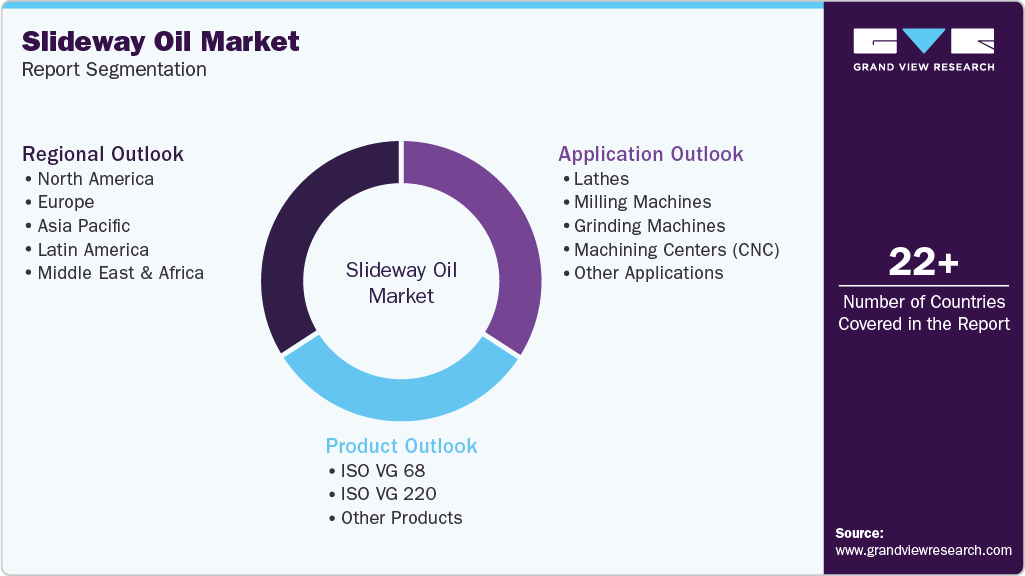

Slideway Oil Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (ISO VG 68, ISO VG 220, Other Products), By Application (Lathes, Milling Machines, Grinding Machines, Machining Centers, Others), By Region, And Segment Forecasts

- Report ID: 978-1-68038-741-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Slideway Oil Market Summary

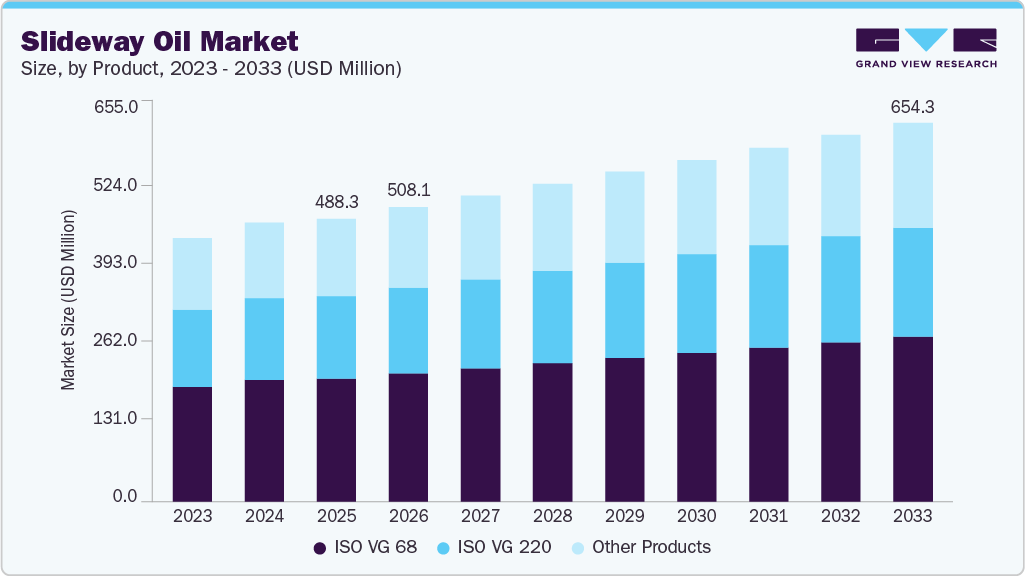

The global slideway oil market size was estimated at USD 488.3 million in 2025 and is projected to reach USD 654.3 million by 2033, growing at a CAGR of 3.7% from 2026 to 2033. The market is primarily driven by the sustained growth of the metalworking and machine tool industries, supported by rising investments in the automotive, aerospace, general manufacturing, and precision engineering sectors.

Key Market Trends & Insights

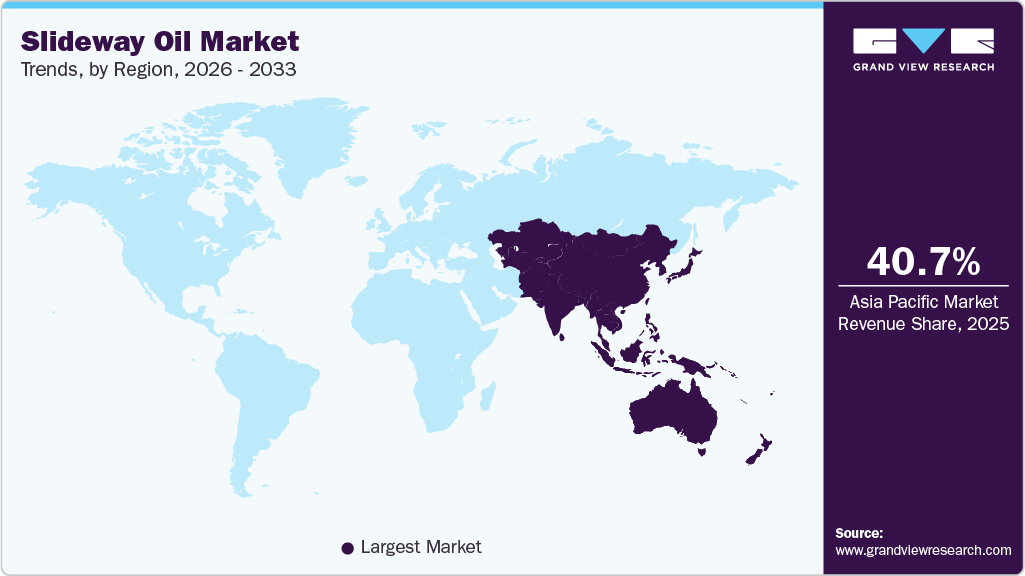

- Asia Pacific dominated the global slideway oil market with the largest revenue share of 40.7% in 2025.

- The slideway oil industry in China accounted for the largest market revenue share in Asia Pacific in 2025.

- By product, the ISO VG 68 segment led the market with the largest revenue share of 43.6% in 2025.

- By application, the machining centers (CNC) led the market with the largest revenue share of 33.2% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 488.3 Million

- 2033 Projected Market Size: USD 654.3 Million

- CAGR (2026-2033): 3.7%

- Asia Pacific: Largest market in 2025

The increasing adoption of CNC machining centers, high-speed lathes, and automated milling systems has heightened the demand for specialized slideway lubricants that ensure positioning accuracy, minimize stick-slip behavior, and prolong machine life. In addition, ongoing replacement and maintenance demand from the large installed base of machine tools across mature and emerging economies continues to underpin steady consumption of slideway oils.

The slideway oil industry presents significant opportunities driven by rapid industrialization and manufacturing expansion across Asia Pacific, particularly in China, India, and Southeast Asia, where machine tool installations are accelerating. Growing emphasis on higher productivity, tighter machining tolerances, and reduced equipment downtime is encouraging end users to shift toward premium, high-performance slideway oils with enhanced frictional characteristics and compatibility with modern metalworking fluids. Furthermore, increasing adoption of environmentally acceptable lubricants and low-mist formulations offers lubricant manufacturers opportunities to differentiate through innovation and value-added product development.

The slideway oil industry faces challenges from pricing pressure and commoditization, as slideway oils are often viewed as mature, low-differentiation products within broader industrial lubricant portfolios. Volatility in base oil prices and additive supply chains can impact margins, particularly for regional and mid-tier manufacturers. In addition, growing regulatory scrutiny on lubricant disposal, workplace safety, and environmental compliance, coupled with the gradual adoption of multifunctional or extended-drain lubricants, may constrain volume growth in certain mature markets.

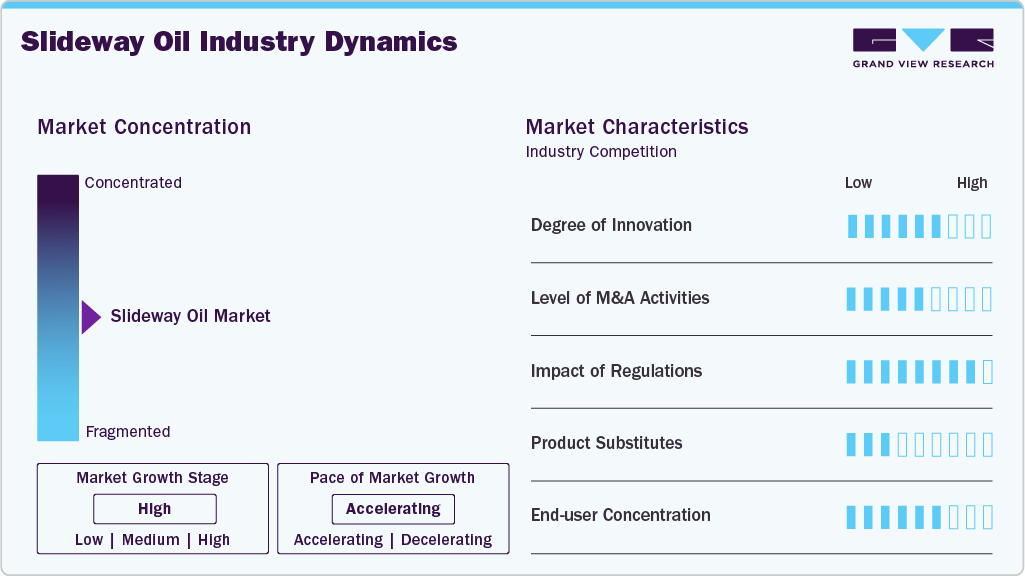

Market Concentration & Characteristics

The global slideway oil industry is dominated by major multinational lubricant producers such as Exxon Mobil, Shell, Chevron, TotalEnergies, BP, and Phillips 66, which leverage extensive R&D, global distribution networks, and strong OEM relationships to deliver high-performance products. These integrated majors focus on premium quality, technical reliability, and compliance with sustainability standards, maintaining leadership across both mature and emerging markets.

Specialist players like FUCHS, Quaker Houghton, Idemitsu Kosan, and SINOPEC compete through application-specific formulations, tailored technical support, and regional expertise. FUCHS and Quaker Houghton offer integrated metalworking lubricant solutions, Idemitsu provides high-performance precision machining oils, and SINOPEC dominates in Asia with cost-effective local supply. The slideway oil industry balances scale and brand strength of global majors with the technical differentiation and agility of specialists, driving innovation and competitive intensity.

Product Insights

The ISO VG 68 segment led the market with the largest revenue share of 43.6% in 2025, primarily due to its versatility and suitability for a wide range of machine tools, including lathes, milling machines, and conventional CNC equipment. Its moderate viscosity ensures optimal friction control, smooth slideway movement, and excellent anti-stick-slip performance, making it the preferred choice for both horizontal and vertical applications. The widespread adoption of standard machinery and ongoing replacement demand from existing industrial equipment further reinforced ISO VG 68’s leading position in the market.

In contrast, ISO VG 220 and other product grades (including ISO VG 32, 100, and specialty formulations) account for a smaller but growing share, collectively representing more than half of the market. ISO VG 220 is expected to witness the fastest growth from 2026 to 2033, driven by increasing use in heavy-duty CNC machining centers and high-load industrial applications that demand higher viscosity for enhanced film strength and durability. Meanwhile, other products offer niche and specialized performance characteristics, catering to advanced manufacturing, environmentally acceptable formulations, and emerging high-precision applications, presenting opportunities for innovation and premium product development.

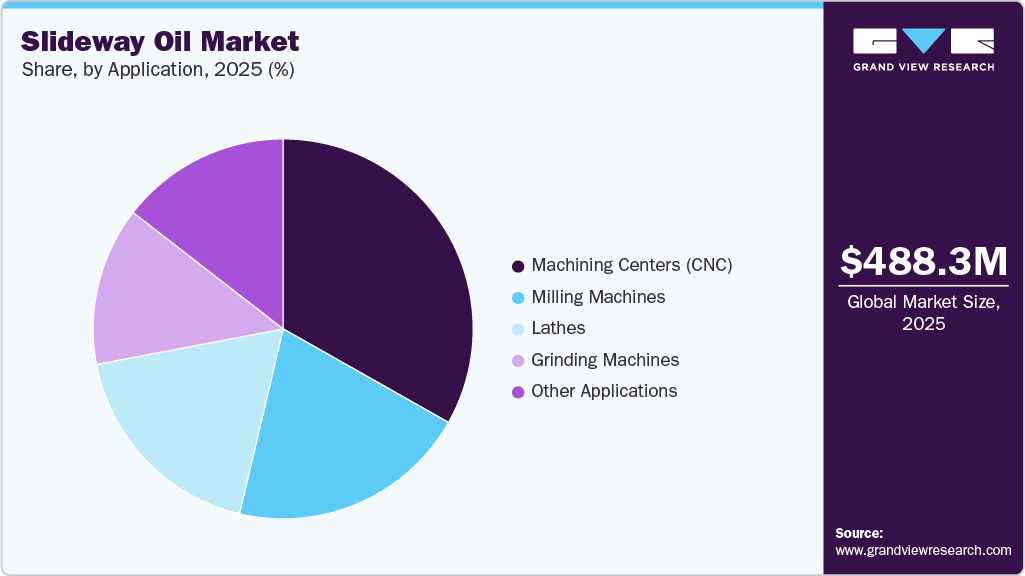

Application Insights

The machining centers (CNC) segment led the market with the largest revenue share of 33.2% in 2025, reflecting the rapid adoption of automated, high-precision machining systems across automotive, aerospace, electronics, and general manufacturing industries. CNC machines require highly reliable slideway lubrication to maintain dimensional accuracy, reduce stick-slip effects, and ensure consistent surface finishes. Their widespread deployment in modern factories, combined with rising maintenance and replacement demand, has driven significant consumption of slideway oils, positioning CNC machining centers as the dominant application segment in the global market.

Other segments, such as lathes, milling machines, grinding machines, and other applications, collectively contribute the remaining share but are growing at a comparatively moderate pace. Lathes and milling machines continue to serve traditional machining needs, while grinding machines cater to specialized precision operations. The fastest-growing application from 2026 to 2033 is expected to remain CNC machining centers, fueled by ongoing automation, adoption of multi-axis machines, and industrial expansion in the Asia Pacific. Simultaneously, emerging applications and niche equipment present opportunities for slideway oil suppliers to introduce tailored formulations and value-added solutions, enhancing market penetration across diverse industrial segments.

Regional Insights

The slideway oil market in North America held a significant share in 2025, primarily fueled by mature manufacturing sectors in the U.S. and Canada, high-precision machining demand, and established maintenance practices. Strong adoption of automation and advanced CNC technologies in aerospace, automotive, and industrial equipment manufacturing supports steady consumption, while regulatory focus on environmental compliance and sustainable lubricants influences product offerings.

U.S. Slideway Oil Market Trends

The slideway oil market in the U.S. held the largest revenue share in North America in 2025. Its leadership stems from a highly developed industrial base, extensive use of CNC and high-precision machine tools, and OEM partnerships with lubricant manufacturers. Continuous investments in automation, modernization of manufacturing plants, and emphasis on productivity and precision maintenance drive sustained demand for premium slideway oils.

Asia Pacific Slideway Oil Market Trends

Asia Pacific dominated the global slideway oil market with the largest revenue share of 40.7% in 2025 and is anticipated to grow at the fastest CAGR during the forecast period, driven by rapid industrialization, expansion of the manufacturing sector, and high machine tool installations across China, India, Japan, and Southeast Asia. The region’s focus on automation, CNC adoption, and high-volume production has sustained strong demand for slideway oils, both for new equipment and maintenance, making the APAC a critical growth hub for lubricant suppliers.

The slideway oil market in China accounted for the largest market revenue share in North America in 2025, owing to its vast industrial base, dense machine tool population, and leadership in automotive, aerospace, and electronics manufacturing. The government’s ongoing support for smart factories and advanced manufacturing technologies has further accelerated the adoption of CNC and heavy-duty machining centers, driving increased consumption of premium slideway oil.

Europe Slideway Oil Market Trends

The slideway oil market in Europe is expected to grow at a significant CAGR during the forecast period, with demand concentrated in Germany, Italy, France, and the UK, where high-end manufacturing, automotive, and precision engineering industries dominate. Stringent environmental regulations and growing adoption of energy-efficient lubricants are shaping product preferences, while automation and CNC expansion in central and Western Europe drive consistent consumption.

The Germany slideway oil market is growing rapidly in the European region, supported by its strong machine tool industry, automotive manufacturing, and industrial automation. High investment in CNC machinery, precision engineering, and industrial maintenance ensures robust slideway oil consumption, reinforcing Germany’s position as a strategic hub for lubricant suppliers in Europe.

Middle East & Africa Slideway Oil Market Trends

The slideway oil market in the Middle East & Africa accounted for a modest but growing share of the global market, driven by industrial infrastructure expansion, automotive assembly, and metalworking sectors in countries like Saudi Arabia, the UAE, and South Africa. Increasing adoption of automated manufacturing systems and ongoing industrial modernization programs present opportunities for slideway oil suppliers, particularly in high-performance and specialty formulations.

Latin America Slideway Oil Market Trends

The slideway oil market in Latin America contributed a smaller portion of the global market, with Brazil, Mexico, and Argentina leading demand. Growth is fueled by manufacturing sector expansion, mining equipment maintenance, and the adoption of CNC and conventional machine tools. Challenges such as economic volatility and lower industrial automation penetration limit market size, but rising investments in industrial modernization are expected to sustain incremental growth.

Key Slideway Oil Company Insights

Key players, including ExxonMobil Corporation, FUCHS, Shell plc, Chevron Corporation, TotalEnergies, and BP p.l.c., dominate the market.

-

Exxon Mobil Corporation is one of the significant global integrated energy and petrochemical companies headquartered in Irving, Texas, U.S., with a diversified portfolio spanning upstream, downstream, and chemical operations. The company is a prominent player in the industrial lubricants market, offering high-performance slideway oils under its Mobil Vactra and Mobil SHC brands, designed for precision machining, CNC equipment, and heavy-duty metalworking applications. Leveraging its advanced R&D capabilities, extensive global distribution network, and strong OEM partnerships, ExxonMobil maintains a competitive edge by delivering technologically advanced lubricants that enhance machine performance, reduce maintenance costs, and comply with stringent environmental standards. Its strategic focus on innovation, operational efficiency, and sustainability continues to drive market leadership across mature and emerging economies.

Key Slideway Oil Companies:

The following are the leading companies in the global slideway oil market. These companies collectively hold the largest market share and dictate industry trends.

- Exxon Mobil Corporation

- FUCHS

- Shell plc

- Chevron Corporation

- TotalEnergies

- BP p.l.c.

- Phillips 66 Company

- Quaker Houghton

- Idemitsu Kosan Co., Ltd.

- SINOPEC

Recent Developments

-

In November 2024, TotalEnergies acquired Tecoil, a Finnish producer specializing in regenerated base oils (RRBOs). While not limited to slideway oils, this acquisition strengthens TotalEnergies’ capacity to integrate sustainable base oils into premium industrial lubricant lines, including slideway oil formulations. Such moves are significant for the market as sustainability becomes a competitive focus.

-

In March 2024, FUCHS Group introduced an updated generation of slideway oils under its RENOLIN MR Series, designed with improved friction control and enhanced compatibility with a variety of coolants and machining conditions. This product launch reflects supplier efforts to meet demand for premium slideway oils that improve machine efficiency and reduce downtime.

Slideway Oil Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 508.1 million

Revenue forecast in 2033

USD 654.3 million

Growth rate

CAGR of 3.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Exxon Mobil Corporation; FUCHS; Shell plc; Chevron Corporation; TotalEnergies; BP p.l.c.; Phillips 66 Company; Quaker Houghton; Idemitsu Kosan Co., Ltd.; SINOPEC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Slideway Oil Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global slideway oil market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

ISO VG 68

-

ISO VG 220

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Lathes

-

Milling Machines

-

Grinding Machines

-

Machining Centers (CNC)

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.