- Home

- »

- Electronic & Electrical

- »

-

Small Kitchen Appliances Market Size, Industry Report, 2030GVR Report cover

![Small Kitchen Appliances Market Size, Share & Trends Report]()

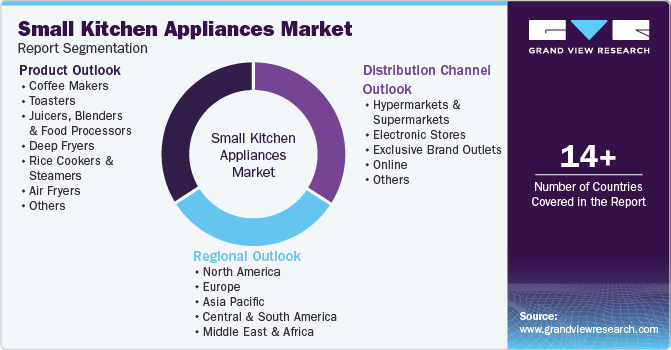

Small Kitchen Appliances Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Coffee Makers, Toasters, Juicers, Blenders & Food Processors, Deep Fryers, Rice Cookers & Steamers), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-936-9

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Small Kitchen Appliances Market Summary

The global small kitchen appliances market size was estimated at USD 29.09 billion in 2024 and is projected to reach USD 40.90 billion by 2030, growing at a CAGR of 5.9% from 2025 to 2030. The industry is a rapidly expanding sector that encompasses a diverse range of products designed to enhance cooking and food preparation tasks in households worldwide.

Key Market Trends & Insights

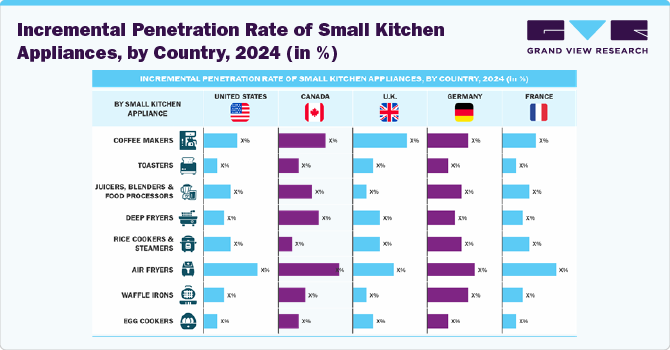

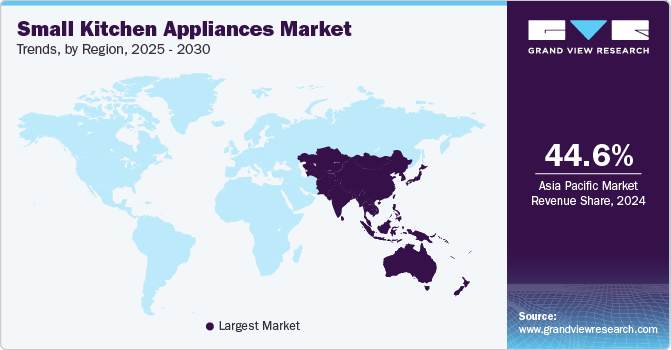

- The small kitchen appliances market in Asia Pacific accounted for a revenue share of 44.64% in 2024.

- The U.S. is expected to grow at a CAGR of 4.3% from 2025 to 2030.

- Based on product, the coffee makers segment accounted for a revenue share of 22.53% in 2024.

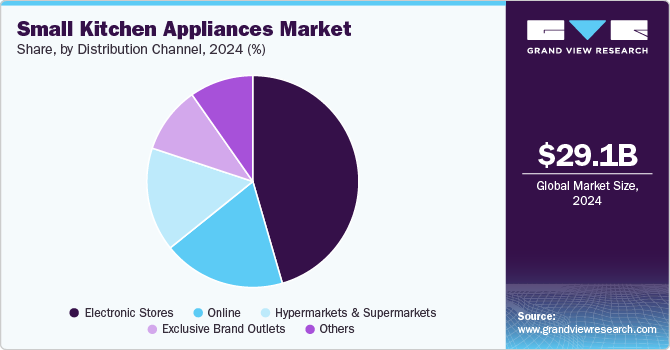

- Based on distribution channel, the Sales through electronic stores segment accounted for a revenue share of 45.51% in 2024

Market Size & Forecast

- 2024 Market Size: USD 29.09 Billion

- 2030 Projected Market Size: USD 40.90 Billion

- CAGR (2025-2030): 5.9%

- Asia Pacific: Largest market in 2024

These appliances, including coffee makers, blenders, toasters, electric kettles, juicers, rice cookers and steamers, food processors, and many more, play an integral role in modern kitchens, offering convenience, efficiency, and versatility to users. As consumer lifestyles evolve and technological advancements continue to shape the market, the demand for small kitchen appliances is expected to rise steadily in the coming years.

Several trends have emerged in the small kitchen appliances market in recent years, reflecting changing consumer preferences and technological innovations. One significant trend is the integration of smart technology into kitchen appliances, enabling features such as remote control, automation, and connectivity with other smart devices. For instance, DelishUp integrates a stainless-steel jar, variable speed blade, heating coil, built-in weighing scale, and an eight-inch Wi-Fi-enabled touchscreen in its smart cooking appliance.

Similarly, in January 2024, Xiaomi unveiled the Xiaomi Smart Multifunctional Rice Cooker, boasting an impressive 8-in-1 functionality alongside app control. This cutting-edge appliance seamlessly integrates into the Mi Home/Xiaomi Home app, enabling users to remotely control and customize their cooking experience. With this app, users can effortlessly select their preferred cooking time and rice texture, ensuring perfect results every time. For added convenience, the rice cooker features a button on the top for manual adjustments, accompanied by an integrated display that showcases the remaining cooking time. With its blend of smart technology and intuitive design, the Xiaomi Smart Multifunctional Rice Cooker promises to elevate the cooking experience for users seeking convenience and precision in their kitchen routines.

A significant trend in the industry is the rising popularity of cordless appliances. These devices operate without the need for direct power connections, relying instead on rechargeable batteries for power. This trend is driven by consumers' desire for convenience, mobility, and safety in the kitchen. Manufacturers are launching new products aligning with this trend. For instance, in September 2023, KitchenAid introduced its KitchenAid Go Cordless System. This innovative system comprises six cordless small appliances, including the KitchenAid Go Cordless Hand Mixer, Food Chopper, Hand Blender, Coffee Grinder, Personal Blender, and Kitchen Vacuum. In a bid to declutter kitchen spaces from cords, each tool in the KitchenAid Go Cordless System operates using a single removable, rechargeable battery.

Innovation is a key driver of demand in the small kitchen appliances industry, with manufacturers continually introducing new features and functionalities to meet consumer needs. Multi-functional appliances that combine multiple kitchen tasks into a single device, such as multi-cookers and combination blender-food processors, are becoming increasingly popular due to their space-saving and versatile nature. Customization and personalization options, including adjustable settings and recipe libraries, are also attracting consumers looking for tailored cooking experiences. In addition, there is a growing focus on health and wellness, with consumers seeking appliances that support healthier cooking options, such as air fryers and juicers. Sustainability and eco-friendly designs are also gaining traction, driven by increasing environmental awareness among consumers.

The future outlook for the industry is optimistic, with continued growth expected as consumers increasingly prioritize convenience, efficiency, and healthier living. Technological advancements, such as artificial intelligence and machine learning, are anticipated to further enhance the functionality and usability of kitchen appliances, driving demand for innovative products. In addition, as global lifestyles become busier and urbanization increases, the demand for time-saving and convenient kitchen solutions is expected to remain strong, fueling the growth of the small kitchen appliances market worldwide.

Consumer Insights

Consumers across the world are seeking convenience, efficiency, and versatility in the kitchen, driving the popularity of the small domestic appliances market. As consumers lead busier lifestyles, they prioritize appliances that save time and effort. In today's fast-paced lifestyles, people constantly seek ways to simplify their daily routines and save time. Having a coffee machine at home offers consumers the convenience of being able to prepare their favorite coffee beverages quickly and easily without the need to visit a coffee shop. This saves individuals the hassle of waiting in long lines or making detours during their daily commute.

In addition to the continued relevance of hybrid schedules and work-from-home arrangements, there is a growing trend among the developed countries customers to "skip the line" and prepare their coffee at home.

Furthermore, compact and multifunctional appliances, such as air fryers, slow cookers, and instant pots, have become household staples. These appliances enable consumers to prepare meals quickly and easily, catering to their fast-paced schedules. Health-conscious consumers are also influencing the small kitchen appliances market, presenting a high demand for appliances that promote healthy cooking, such as air fryers, blenders, juicers, and yogurt makers. Consumers are seeking appliances that allow them to incorporate fresh, nutritious ingredients into their diets. The surge in home cooking activities has fueled the demand for small cooking appliances in households during the forecast period.

Association of Home Appliance Manufacturers (AHAM's) consumer research, involving over 4,000 households across the U.S. in October 2021, revealed that cooking at home emerged as the most commonly cited activity expected to persist post-pandemic. Additionally, more than 30% of respondents reported buying small appliances in 2021.

Product Insights

Coffee makers accounted for a revenue share of 22.53% in 2024. Coffee, a ubiquitous beverage worldwide, has become an integral part of the daily routines of millions. To meet the soaring demand for this beloved brew, coffee makers have emerged as indispensable appliances in homes and offices globally. The rise in coffee production and consumption has driven the need for diverse coffee brewing equipment. Single-serve devices and high-end brewing techniques, such as pour-over and espresso machines, have become increasingly popular.

Moreover, leading kitchen appliance manufacturers are at the forefront of product innovation, introducing a wide array of coffee makers to cater to consumers' evolving preferences. Leveraging their extensive sales and distribution networks, these manufacturers ensure their coffee-making solutions reach consumers at multiple touchpoints.

In March 2024, Keurig Dr Pepper unveiled a multi-year innovation agenda for its Keurig single-serve brewing system, including a reimagined coffee system and a portfolio of new products and technologies. The company launched a revolutionary new form of single-serve coffee called K-Rounds. These pods are made from expertly roasted coffee beans that are ground, pressed, and wrapped in a proprietary, protective plant-based coating. This innovative design eliminates the need for plastic or aluminum, preserving the coffee's flavor and aroma while reducing environmental impact.

The air fryers market is expected to grow at a CAGR of 8.5% from 2025 to 2030. Air fryers are gaining widespread popularity, particularly in single-person households, due to their convenience and ability to prepare a variety of foods with minimal effort. They eliminate the mess and hassle associated with traditional deep frying, making them a practical option for health-conscious individuals and busy families.

In May 2023, COSORI, the leading air fryer brand known for its commitment to healthy living, introduced its latest innovation: the COSORI Lite 2.1-Quart Mini Air Fryer. Designed for single households, this compact and affordable appliance empowers individuals to prepare nutritious meals effortlessly. The COSORI Lite Mini Air Fryer features a sleek, space-saving design, making it ideal for small kitchens or limited counter space.

With growing concerns about health and nutrition, many people are seeking ways to enjoy their favorite fried foods without the guilt of consuming excessive oil. Air fryers offer a healthier alternative by using little to no oil in the cooking process. According to the Morbidity and Mortality Weekly Report (May–July 2022) by the U.S. Department of Health and Human Services/Centers for Disease Control and Prevention, more than half (54.0%) of respondents reported utilizing alternative appliances alongside, or instead of, conventional ovens for cooking frozen stuffed chicken products. These alternative appliances included air fryers (29.7%), microwaves (29.0%), toaster ovens (13.7%), and other small kitchen appliances (3.8%). This trend is expected to drive the growth of the air fryer market during the forecast period.

Distribution Channel Insights

Sales through electronic stores accounted for a revenue share of 45.51% in 2024 in the small kitchen appliances market. Electronic stores often stock a diverse range of small kitchen appliances, from coffee makers and blenders to air fryers and toaster ovens. This extensive selection enables customers to compare brands, features, and prices conveniently in one location. Additionally, many electronic stores carry premium and high-end products that are not always available through other retail channels, appealing to consumers seeking advanced or luxury appliances.

Technological advancements in small kitchen appliances have also played a significant role in boosting sales through electronic stores. The integration of smart features such as Wi-Fi connectivity, voice control, and app integration has made appliances like smart coffee makers and multi-cookers highly appealing to tech-savvy buyers. Electronic stores often capitalize on these innovations by offering live demonstrations and in-store experiences, which allow customers to witness these technologies in action, boosting confidence in their purchases. Moreover, these stores frequently provide exclusive promotions, discounts, and bundle deals, making it easier for consumers to access these appliances, driving sales through electronic stores and augmenting their growth during the forecast period.

Sales of major appliances through online channels are expected to grow with a CAGR of 6.4% from 2025 to 2030. The small kitchen appliances market is witnessing significant growth in the online channel, driven by a shift in consumer behavior toward digital shopping.

According to Adtaxi's 2024 E-commerce Consumer Survey, 78% of Americans are now comfortable purchasing major appliances online, an increase from 73% reported the previous year. This growing acceptance reflects broader trends in online shopping, where convenience and the ability to compare products and prices easily have become paramount. With 93% of American adults engaging in online shopping and a notable increase in daily online shoppers, the online channel has become a critical platform for household appliances, including small appliances, offering an efficient way to reach a vast audience.

Regional Insights

North America small kitchen appliances market is expected to grow at a CAGR of 4.3% from 2025 to 2030. The North American market is characterized by high consumer spending on innovative and smart kitchen appliances. Technological advancements and increasing integration of smart home devices have led to the adoption of connected kitchen appliances, such as voice-controlled coffee makers and Wi-Fi-enabled ovens. These appliances appeal to tech-savvy consumers, particularly in urban and suburban areas.

U.S. Small Kitchen Appliances Market Trends

The small kitchen appliances market in the U.S. is expected to grow at a CAGR of 4.3% from 2025 to 2030. The growing trend of home cooking, fueled by the pandemic, has further driven the sales of small kitchen appliances such as slow cookers, stand mixers, and air fryers. In addition, the popularity of health and wellness trends has prompted consumers to invest in appliances that enable the preparation of healthier meals, such as juicers, food steamers, and dehydrators, thus driving the market for the U.S. small domestic appliances market during the forecast period.

Asia Pacific Small Kitchen Appliances Market Trends

The small kitchen appliances market in Asia Pacific accounted for a revenue share of 44.64% in 2024. The market in Asia Pacific is driven by rapid urbanization, rising disposable incomes, and the growing middle-class population. With urban centers expanding in countries like China, India, and Southeast Asia, more nuclear families are turning to compact, efficient appliances to meet their daily cooking needs. Additionally, the region's younger population is increasingly adopting technologically advanced appliances such as smart rice cookers and multi-functional cookers, reflecting a preference for convenience and innovation.

Europe Small Kitchen Appliances Market Trends

The small kitchen appliances market in Europe is driven by the rising interest in premium and luxury kitchen appliances, as consumers are increasingly willing to invest in high-quality products that enhance their kitchen experience. Advanced appliances, such as smart coffee machines and built-in multi-cookers, are particularly popular in Western Europe.

Convenience is another key driver, with busy lifestyles leading to increased sales of products like food processors, hand blenders, and compact coffee machines. Additionally, the growing emphasis on healthy eating has boosted the demand for appliances such as juicers, smoothie makers, and air fryers, which cater to health-conscious consumers. These factors collectively highlight the strong growth potential and sustained demand for small kitchen appliances in Europe during the forecast period.

Key Small Kitchen Appliances Company Insights

Major companies in the small household appliances market are relying on strategic partnerships and localized production to cater to regional preferences and optimize supply chains.Furthermore, prominent players are investing in innovation and technology to offer advanced features and energy-efficient products. They are also focusing on expanding their distribution networks and enhancing customer service to improve accessibility and support.

Key Small Kitchen Appliances Companies:

The following are the leading companies in the small kitchen appliances market. These companies collectively hold the largest market share and dictate industry trends.

- Whirlpool Corporation

- LG Electronics Inc.

- Samsung Electronics Co., Ltd.

- Panasonic Corporation

- Koninklijke Philips N.V.

- Breville Group Limited

- De'Longhi S.p.A.

- Electrolux AB

- Hamilton Beach Brands Holding Company

- SharkNinja Operating LLC

- Toshiba Corporation

- Midea Group Co., Ltd.

Recent Developments

-

In October 2024, Daewoo, a prominent Korean brand operating in 110 countries, unveiled its plan to launch over 100 consumer appliance products in India, responding to the rising demand among nuclear families and dual-income households.

-

In June 2024, TTK Prestige Ltd. launched the Prestige 4.5-liter Nutrifry air fryer. This product uses smart airflow 360-diploma warm air circulation for frying, resulting in a crisp texture.

-

In April 2024, Koninklijke Philips N.V. introduced the newest air fryer in the signature series in addition to its lineup of air fryers. The appliance is built with seven-layer fast air technology and has a cooking ability of as much as 7.3 liters.

-

In March 2024, KitchenAid, known for kitchen appliances, unveiled its latest culinary marvel: the Grain and Rice Cooker. The appliance features an ingenious innovation that sets it apart from the competition. Through advanced sensors, it automatically detects the amount of grain or rice added to the cooking bowl. Based on this measurement, it dispenses the precise amount of water required for optimal cooking.

-

In March 2024, Midea introduced its latest innovations at the Inspired Home Show (IHS) 2024 in Chicago, Illinois. Midea showcased its diverse range of small appliances, featuring air fryers, multi-cookers, blenders, kettles, heaters, and more. Among the highlights are the introduction of cutting-edge products such as the Double Decker Dual-Zone Air Fryer, the Barista Brew Smart Coffee Maker, and the Easy Sauté Multicooker.

Small Kitchen Appliances Market Report Scope

Report Attribute

Details

Market size in 2025

USD 30.70 billion

Revenue forecast in 2030

USD 40.90 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in million/thousand units; revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, U.K., France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, U.A.E.

Key companies profiled

Whirlpool Corporation; LG Electronics Inc.; Samsung Electronics Co., Ltd.; Panasonic Corporation; Koninklijke Philips N.V.; Breville Group Limited; De'Longhi S.p.A.; Electrolux AB; Hamilton Beach Brands Holding Company; SharkNinja Operating LLC; Toshiba Corporation; Midea Group Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Small Kitchen Appliances Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global small kitchen appliances market report on the basis of product, distribution channel, and region.

-

Product Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Coffee Makers

-

Toasters

-

Juicers, Blenders & Food Processors

-

Deep Fryers

-

Rice Cookers & Steamers

-

Air Fryers

-

Waffle Irons

-

Egg Cookers

-

-

Distribution Channel Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Electronic Stores

-

Exclusive Brand Outlets

-

Online

-

Others

-

-

Regional Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

U.A.E.

-

-

Frequently Asked Questions About This Report

b. The Asia Pacific dominated the small kitchen appliances market with a share of 44.64% in 2024. The small kitchen appliances market in Asia Pacific is driven by rapid urbanization, rising disposable incomes, and the growing middle-class population.

b. Some key players operating in the small kitchen appliances market include Whirlpool Corporation; LG Electronics Inc.; Samsung Electronics Co., Ltd.; Panasonic Corporation; Koninklijke Philips N.V.; Breville Group Limited; De'Longhi S.p.A.; Electrolux AB; Hamilton Beach Brands Holding Company; SharkNinja Operating LLC; Toshiba Corporation; and Midea Group Co., Ltd.

b. Key factors that are driving the small kitchen appliances market growth include the growing demand for appliances that simplify and speed up cooking, such as air fryers, coffee makers, and blenders, which help save time in busy lifestyles. Furthermore, as disposable incomes rise, consumers are more willing to invest in small kitchen appliances that enhance their cooking experience.

b. The global small kitchen appliances market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2030 to reach USD 40.90 billion by 2030.

b. The global small kitchen appliances market size was estimated at USD 29.09 billion in 2024 and is expected to reach USD 30.70 billion in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.