- Home

- »

- Digital Media

- »

-

Smart Advertising Services Market Size & Share Report, 2030GVR Report cover

![Smart Advertising Services Market Size, Share & Trends Report]()

Smart Advertising Services Market Size, Share & Trends Analysis Report By Service Type (Email Advertising, Video Advertising, Mobile Advertising), By Platform Type, By Pricing Model, By Enterprise Size, By End-user, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-033-1

- Number of Report Pages: 162

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

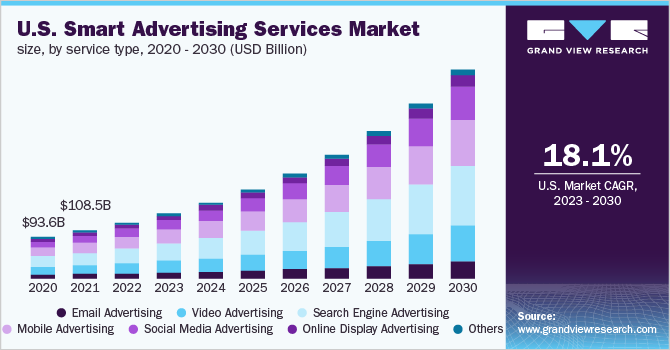

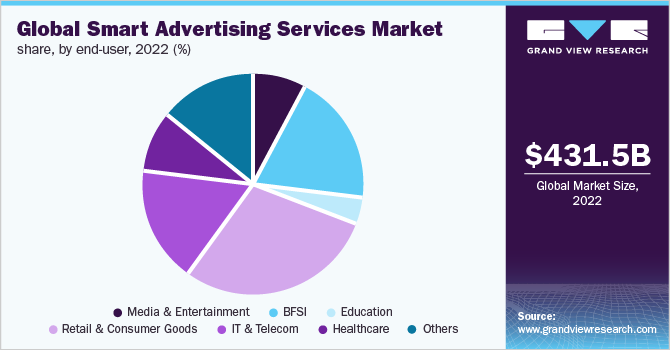

The global smart advertising services market size was valued at USD 431.53 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 20.4% from 2023 to 2030. The growing preference for digital media, the increasing adoption of digital displays, and the continued rollout of high-speed mobile data networks are the key factors expected to drive the growth. The proliferation of smartphones and the growing internet penetration are driving the spending on targeted advertisement. Advertisers have realized that presenting high-quality digital media on digital displays is particularly helping in capturing consumer attention, encouraging consumer interaction, and increasing brand recognition, which is particularly driving the demand for smart advertising services.

Changing data consumption, availability of multiple advertisement channels, and rising internet penetration have encouraged advertising agencies to develop innovative ad campaigns and attract more audiences. Digital media and digital displays are the preferred choices of consumers in the advertising market as they help advertisers reach their potential consumers and offer the ability to customize campaigns depending on the demography and size of the audience.

There is a substantial shift observed from traditional static displays to digital displays. The adoption of digital media and displays recorded a noteworthy outcome in capturing consumers’ attention, encouraging consumer interaction, and increasing brand recognition. Social media interaction, fast-moving marketing trends, and technological advancements are responsible for the adoption of digital media and displays for smart advertising.

Media and public relations (PR) companies are using technologies including Artificial Intelligence (AI) and Augmented Reality/Virtual Reality (AR/VR) to improve the delivery of advertisements based on businesses’ attributes. Ad tech, a broader term for software and tools that help agencies and brands target, deliver, and measure their online campaigns, allows online businesses and content creators to maximize ad revenues by connecting advertisers to their audiences.

Increasing internet penetration and digitization of businesses have increased the adoption and popularity of smart advertisement services. Businesses are focusing on advertising their offerings with the help of innovative marketing campaigns and reaching their target audience. Businesses opt for several advertising services, including email advertising, video advertising, SEO content creation services/search engine advertising/marketing, mobile advertising, social media advertising, and online display advertising, among others.

Since smart advertising services may involve access to customer personal information such as name, age, and geo-location, among others, marketers operating in the European Union are required to comply with the General Data Protection Regulation (GDPR) to ensure users’ data privacy and security. Similarly, the Federal Trade Commission (FTC), Advertising Regulatory Board (ARB), and Advertising Standards Authority (ASA) are responsible for regulating advertisement content and businesses must comply with the regulations while commencing any advertising campaign.

COVID-19 Impact

The outbreak of the COVID-19 pandemic severely impacted enterprises across several industries, including smart advertising services. The industry witnessed considerable obstacles in operations as lawmakers and companies put in place preventive measures to keep employees safe. Advertising media suffered a substantial decrease in investments during the pandemic. Revenue losses resulted in temporary layoffs at numerous advertising agencies. Furthermore, the lack of economic activities had an impact on the demand for smart advertisements.

Advertisement companies have started shifting their focus to alternative delivery channels, particularly Over-The-Top (OTT) providers. As a result, many major media companies across the globe have increased their investments in over-the-top services in recent years. This trend is likely to continue with the increasing audience base on OTT platforms, thus contributing to market growth.

Marketing spending is expected to increase as clients focus on low-cost advertisement methods to increase their sales, such as in-home media. The high demand for in-home media can be attributed to the frequent lockdowns during the pandemic, which resulted in higher digital consumption among individuals compared to television viewing. Moreover, the growing demand for social media platforms, streaming services, and gaming is also encouraging smart advertisers to adapt to the changing trends. The online environment has become ideal for direct response campaigns, which encourage customers to make quick purchases, making it an appealing prospect for companies seeking to boost sales while spending cautiously.

Service Type Insights

The search engine advertising segment dominated the overall market with a revenue share of 26.33% in 2022 and is expected to witness a CAGR of over 21.0% during the forecast period. In search engine marketing, advertisements are displayed on search engine result pages. Advertisers pay for keywords that users enter on search engines such as Bing and Google when looking for specific items or services. This allows their advertisements to appear along with the search results for those queries.

Website upgrades aimed at enhancing the website’s appearance and improving the exposure of services or products are known as search engine optimization. Websites that rank high on popular search engines have an increased chance of capturing more users and generating more business. The placement or rating of a website on Search Engine Results Pages (SERPs) is commonly used to evaluate its visibility. Companies are constantly competing for the front page, where they are most likely to get the most attention.

The social media advertising segment is anticipated to witness the fastest CAGR of 22.1% throughout the forecast period. Social networks like Facebook, Twitter, and Instagram, among others, are used to distribute sponsored advertisements to the target demographic as part of social media advertising. Social media advertisements are a quick and efficient approach to engaging customers and supporting marketing initiatives. Advertisers can provide personalized information to their consumers and hyper-target them depending on demographics and user activity by using a number of data sources. When a brand is exposed to an audience on social media, advertisers might notice an increase in interactions and conversions. In addition to being affordable, social media advertisements provide excellent returns on investment as well.

Platform Type Insights

The mobile segment dominated the overall market, gaining a market share of 59.01% in 2022 and witnessing the highest CAGR of 21.2% during the forecast period. Any form of marketing that utilizes cell phones and other portable electronics are referred to as mobile marketing. Mobile marketing makes use of the fact that many users of mobile devices take them with them wherever they go. Location-based marketing is mobile marketing integrated with location-based services.

Using data related to the location of an individual, mobile marketers can send advertisements related to a specific area on mobile devices. Through strategies including mobile-optimized advertisements, push notifications, and mobile applications, mobile marketing tries to connect with a mobile user audience. Examples include app-based marketing, social media marketing, location-based marketing, and mobile search ads. Mobile apps may feature a variety of advertisements, including videos, banners, and increasingly sophisticated app demos. Both organic and paid social media advertising that appears in mobile social feeds can be effective traffic generators.

The other segment is anticipated to grow at a CAGR of 19.5% throughout the forecast period. Advertisement in video games is becoming popular, whether it's a troublesome pop-up or planned product placement. For instance, EA Sports has a partnership with NHL. With this partnership, EA Sports considers not just the NHL but also its clubs, promoting some of the league's top players and featuring prominent equipment companies. The collaborations are a win-win situation as hockey fans prefer playing EA's games with their favorite clubs and known hockey personalities. The game may also capture the interest of younger players, who may later become fans of the NHL or another sport.

Pricing Model Insights

The performance-based advertising segment dominated the overall market with a revenue share of 45.52% in 2022 and is anticipated to expand at a CAGR of 20.3% during the forecast period. Performance marketing refers to the payment model in which the marketers pay the advertisement partners when a specific activity, such as a lead, sale, or click, is completed. Performance marketing agencies implement marketing campaigns and analytics using this model across a variety of digital mediums.

The hybrid segment is anticipated to witness the fastest CAGR of 22.5% throughout the forecast period. The hybrid pricing model includes a mix of pricing models, such as Cost Per Click (CPC), Cost Per View (CPV), Cost Per Install (CPI), Cost Per Acquisition (CPA), and Cost Per Lead (CPL). In the CPC model, companies pay for each advertisement click. The price is calculated by dividing the cost of the advertisement by the number of clicks. CPV is calculated by dividing the advertising cost by the number of video views. As the pricing model focuses solely on impressions, CPV is utilized in video advertising campaigns to promote brand exposure.

Enterprise Size Insights

The large enterprise's segment dominated with a market share of 66.71% in 2022 and is expected to witness a CAGR of over 19.0% during the forecast period. Large enterprises have more finances at their disposal, which helps them spend significantly on smart advertising. The worldwide presence of a few large-scale companies like Meta, Microsoft, Amaxon.Com Inc., etc., is expected to influence revenue generation. This factor suggests that these companies are expected to dominate the smart advertising industry.

The SMEs segment is anticipated to witness a rapid CAGR of 21.6% throughout the forecast period. Multiple marketing tools are available to small businesses. Smaller businesses have access to marketing automation and social media platforms because of their low entry barriers; however, this factor brings additional complexities and more channels to monitor. Increasing investments in their websites and social media are the marketing platforms to which SMEs devote the most of their budgets.

End-user Insights

The retail & consumer goods segment dominated the overall market with a revenue share of 28.48% in 2022 and is projected to witness a CAGR of over 19.0% during the forecast period. With retail and consumer goods smart advertising, retailers can employ online shop advertising to produce sales from their target audience by raising interest and awareness in their products. Retailers use smart advertising to persuade their audience to do a certain action. A retail marketing strategy is an approach used by retailers to acquire new customers and persuade them to buy in-store or order online. At present, most retailers are focused on attracting new customers. The retail marketing plan must be evaluated regularly to achieve optimal performance.

The media & entertainment segment is anticipated to witness the fastest CAGR of 22.8% throughout the forecast period. The digital wave and the growing consumption of entertainment content are offering firms more creative options to market their services to various consumer segments. Media and entertainment companies can create intriguing invites and post them on different social media websites to market their new projects.

Such digital invitations draw more attendees and facilitate quicker decision-making for the potential viewer when it comes to making instant reservations and visiting locations. Online surveys and quizzes can also be used to raise customer involvement. Newsletters are also useful tools for informing customers about the brand's latest services and goods.

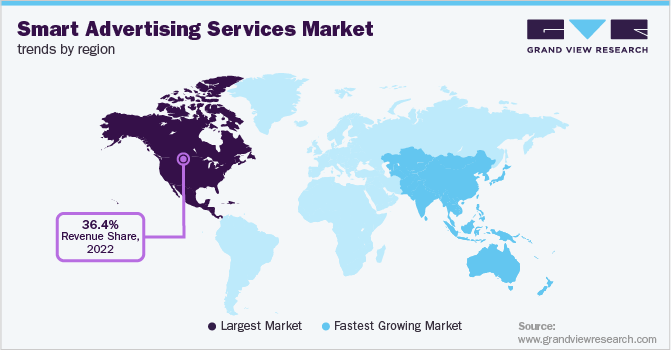

Regional Insights

North America led the overall market in 2022, with a revenue share of 36.44%. The region is experiencing high penetration of smart advertising services owing to the region’s tendency to adopt new technologies. The increasing number of manufacturers of electronic display products and hardware components, software developers, and research and development activities across the U.S. and Canada is expected to fuel regional growth.

In June 2022, Comscore, Inc., a trusted partner for media transacting, planning, and evaluating, reported that ad-supported streaming services gained more traction compared to subscription-based services. In 2022, there was a 29% increase in U.S. households that used ad-supported services compared to 2020 and a 21% increase in Subscription Video On Demand (SVOD) during the same period.

The Asia Pacific is expected to witness the fastest CAGR of 22.3% during the forecast period. The region is experiencing the fastest growth due to the massive penetration of advertising through the hospitality, and retail industry. Densely populated countries such as India and China focus on developing screens that deliver relevant and real-time advertising content. Furthermore, the growing prevalence of digital billboards is propelling the industry’s growth.

The advertisers in this region utilize virtual screens, motion graphics, and video content to target consumers to provide granular insights. Post the pandemic, smart advertisement is gaining popularity in the Asia Pacific region owing to the growing penetration of advanced technologies, emerging digital advertising platforms, and rapid urbanization.

Key Companies & Market Share Insights

The market is consolidated and is anticipated to witness increased competition due to several players' presence. All these market players are pursuing strategic partnerships and collaborations, and mergers & acquisitions as part of their efforts to defend their market share. Evolving business models and competitive pressures are prompting market players to reduce development cycles, innovate continuously, and provide highly efficient smart advertising services.

In December 2022, the National Football League (NFL) announced that its subscription package for Sunday Ticket would be available on YouTube TV starting the following season. This marked the NFL’s second media rights agreement with a streaming service. YouTube was looking forward to leveraging the partnership to increase its presence in the competitive streaming market. Some prominent players in the global smart advertising services market include:

-

YouTube

-

Meta

-

Google LLC

-

VaynerMedia

-

Omnicom Group Inc.

-

ibex Limited

-

Interpublic Group of Companies, Inc.

-

Twitter, Inc.

-

TikTok

-

Hulu LLC

-

Amazon.Com, Inc.

-

Alibaba Group Holding Limited

-

Microsoft

-

Deloitte

-

IBM

-

BlueFocus

Smart Advertising Services Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 512.61 billion

Revenue forecast in 2030

USD 1.87 trillion

Growth Rate

CAGR of 20.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, platform type, pricing model, enterprise size, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; China; Japan; India; Brazil; Mexico

Key companies profiled

YouTube; Meta; Google LLC; VaynerMedia; Omnicom Group Inc.; ibex Limited; Interpublic Group of Companies, Inc.; Twitter, Inc.; TikTok; Hulu LLC; Amazon.Com, Inc.; Alibaba Group Holding Limited; Microsoft; Deloitte; IBM; BlueFocus

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Advertising Services Market Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global smart advertising services market report based on service type, platform type, pricing model, enterprise size, end-user, and region:

-

Service Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Email Advertising

-

Video Advertising

-

Search Engine Advertising

-

Mobile Advertising

-

Social Media Advertising

-

Online Display Advertising

-

Others

-

-

Platform Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Mobile

-

Laptops, Desktops & Tablets

-

Others

-

-

Pricing Model Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cost Per Mille (CPM)

-

Performance Based Advertising

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

End-user Outlook (Revenue, USD Billion, 2017 - 2030)

-

Media & Entertainment

-

BFSI

-

Education

-

Retail & Consumer Goods

-

IT & Telecom

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global smart advertising services market size was estimated at USD 431.53 billion in 2022 and is expected to reach USD 512.61 billion in 2023.

b. The global smart advertising services market is expected to grow at a compound annual growth rate of 20.2% from 2023 to 2030 to reach USD 1,878.26 billion by 2030.

b. North America dominated the smart advertising services market with a share of over 36% in 2022. The North American market is experiencing high penetration of smart advertising services owing to the region’s tendency to adopt new technologies.

b. Some key players operating in the smart advertising services market include YouTube; Meta; Google LLC; Omnicom Group Inc.; ibex Limited; Twitter, Inc.; Hulu LLC; Amazon.Com, Inc.; Alibaba Group Holding Limited; Microsoft; and BlueFocus, among others.

b. Key factors that are driving the smart advertising services market growth include the growing preference for digital media, the increasing adoption of digital displays, and the continued rollout of high-speed mobile data networks. The proliferation of smartphones and the growing internet penetration rate are driving the spending on targeted advertising.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."