Smart Clock Market Size & Trends

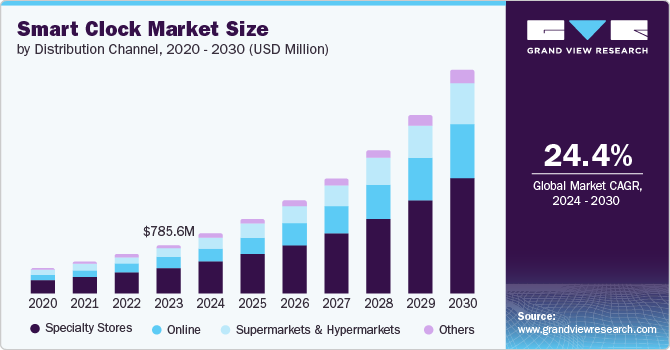

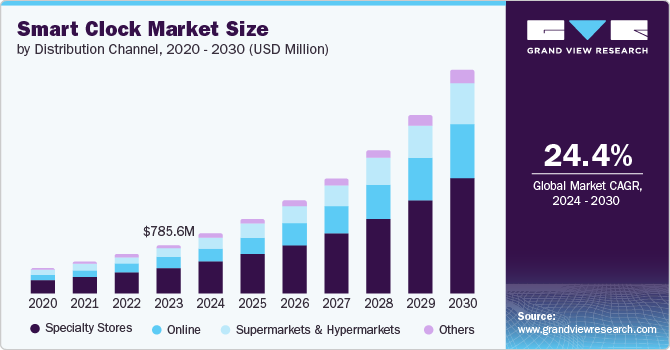

The global smart clock market size was valued at USD 785.6 million in 2023 and is projected to grow at a CAGR of 24.4% from 2024 to 2030. The rising awareness regarding the Internet of Things (IoT), coupled with improved standards of living, is expected to boost the demand for luxury household products, such as smart clocks. In addition, smart clocks can perform tasks such as providing weather forecasts and traffic reports, wireless charging, and making calls, which are expected to drive market growth.

Smart clocks allow users to control and monitor linked devices, such as lights, thermostats, and security cameras. This centralized control simplifies the user's experience and enhances comfort. Virtual assistants such as Google Assistant, Alexa, and Siri also enhance voice command capabilities. For instance, in July 2024, Amazon.com, Inc. launched Echo Spot, which is an Alexa-powered smart alarm clock.

The rising disposable income in developing economies such as India and China is further expected to add to the market growth over the forecast period. For instance, according to the information published by the Press Information Bureau, India, in February 2024, the Gross National Disposable Income in the country increased by 14.5% for the year 2022-23 and 18.8% for the year 2021-22. This rise in disposable income is likely to improve the standard of living and drive demand for luxurious products such as smart clocks.

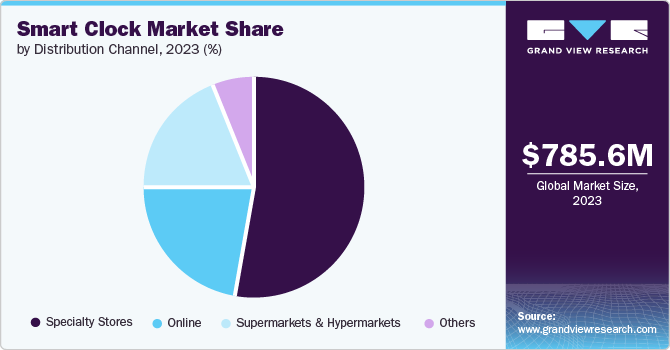

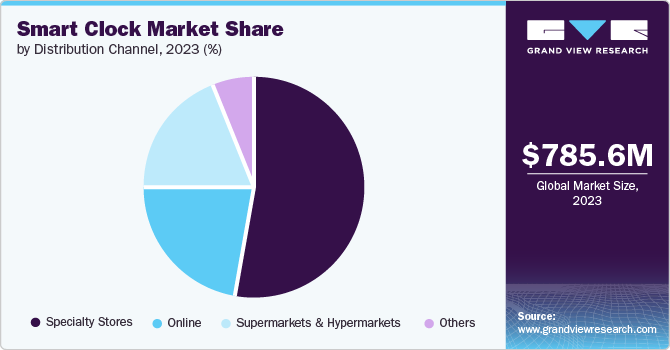

Distribution Channel Insights

The specialty stores segment dominated the smart clock market with a revenue share of 52.9% in 2023. Specialty stores offer unique products for a specific which helps them attract customers looking for specific features or product designs. In addition, these stores typically offer a more personalized shopping experience compared to larger retailers. The presence of knowledgeable staff can provide consumers with important product information, expert advice, and demonstrations and help them understand the benefits and functionalities of smart clocks. These benefits of the specialty stores drive the growth of specialty stores in the market.

The online segment is expected to register the fastest CAGR over the forecast period. The increasing emphasis on digitization and the rising use of e-commerce is expected to drive the growth of online distribution channels. According to the information published by the India Brand Equity Foundation, the number of internet connections in India had increased to 895 million by 2023, driven by the Digital India program. In addition, according to Eurostat, 70% of the internet users in Europe ordered goods or services online in 2023. This rising use of the internet and e-commerce is further expected to drive segmental growth over the forecast period.

Regional Insights

North America smart clock market dominated the global smart clock market with a revenue share of 37.8% in 2023. A rise in disposable income, high standards of living, and higher purchasing power enable consumers to invest in smart devices such as smart clocks. The well-developed digital and retail infrastructure in North America and the presence of key market players are further expected to increase product availability in the region and drive market growth.

U.S. Smart Clock Market Trends

The U.S. smart clock market accounted for a significant share of the global market owing to the rising standard of living and increasing demand for smart home automation. In addition, the increased convenience offered by the smart devices and increasing efforts to improve their security is further expected to drive market growth. For instance, in 2024, the Federal Communications Commission (FCC) proposed the Cybersecurity Labeling Program for IoT or smart devices, which would label the devices with a U.S. Cyber Trust Mark for meeting certain safety and security requirements.

Europe Smart Clock Market Trends

Europe smart clock market has a significant market share in the global smart clock market. The increasing use of the internet, growth of e-commerce, and demand for luxurious products such as smart clocks are driving market growth in the region. For instance, according to the statistics presented by Eurostat, approximately 91% of people in the European Union were using the internet in 2023. In January 2021, Xiaomi introduced the Mi Smart Clock with Google Assistant in Europe. This rising internet use and launch of new products is expected to drive market growth in the region.

The UK smart clock market held a substantial market share in 2023 owing to the increasing awareness and adoption of IoT devices including smart clocks. In addition, the key companies in the market often engage in strategic partnerships and collaborations with technology firms to develop advanced products. These collaborations lead to the introduction of innovative products such as smart clocks which is expected to drive market growth.

Asia Pacific Smart Clock Market Trends

The Asia Pacific smart clock market is expected to register the fastest CAGR over the forecast period. The increasing development activities in countries such as India and China and the growing technological advancements and launch of new products are majorly driving market growth in the region. For instance, in January 2022, Lenovo introduced the Lenovo Smart Clock 2 in India; the launch is expected to create product awareness and drive further growth in the market.

The India smart clock market is expected to grow owing to the increasing technological advancements in the country, increasing internet uses, and adoption of IoT devices. In addition, the increasing developmental initiatives of the government, such as the Smart Cities Mission, are expected to add to the increasing demand for advanced devices, including smart clocks.

Key Smart Clock Company Insights

Some key companies in the smart clock market include Amazon.com Inc.; Lenovo, JALL; Emerson Radio; getVobot.com; LaMetric; Xiaomi. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Lenovo is a global technology company that offers solutions that cater to diverse industries together with healthcare, education, retail, manufacturing, logistics, and expert services. The company also has a comprehensive portfolio of IoT devices, including smart clocks, smart cameras, smart home solutions, and others.

-

LaMetric Radio is a technology company engaged in developing smart devices for the home and office. The company’s smart devices portfolio includes LaMetric TIME for smart clocks and LaMetric SKY for mood lighting and visual effects.

Key Smart Clock Companies:

The following are the leading companies in the smart clock market. These companies collectively hold the largest market share and dictate industry trends.

View a comprehensive list of companies in the Smart Clock Market

Recent Developments

-

In June 2022, Lenovo launched a smart clock essential built-in with Alexa. The smart clock was equipped with digital smart clock features and has hands-free voice control with Alexa.

-

In January 2022, Lenovo introduced Smart Clock Essential, with Alexa built in.

Smart Clock Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 971.7 million

|

|

Revenue forecast in 2030

|

USD 3.59 billion

|

|

Growth rate

|

CAGR of 24.4% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Revenue in USD million and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Distribution channel, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, South Africa

|

|

Key companies profiled

|

Amazon.com Inc.; Lenovo, JALL; Emerson Radio; getVobot.com; LaMetric; Xiaomi.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Smart Clock Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart clock market report based on distribution channel, and region:

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Latin America

-

Middle East & Africa