- Home

- »

- Next Generation Technologies

- »

-

Smart Clothing Market Size & Share, Industry Report, 2033GVR Report cover

![Smart Clothing Market Size, Share & Trends Report]()

Smart Clothing Market (2026 - 2033) Size, Share & Trends Analysis Report By Textile Type (Active, Passive, Ultra Smart), By Product Type (Apparel, Footwear, Wearable Patches), By Distribution Channel (Offline, Online), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-166-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Clothing Market Summary

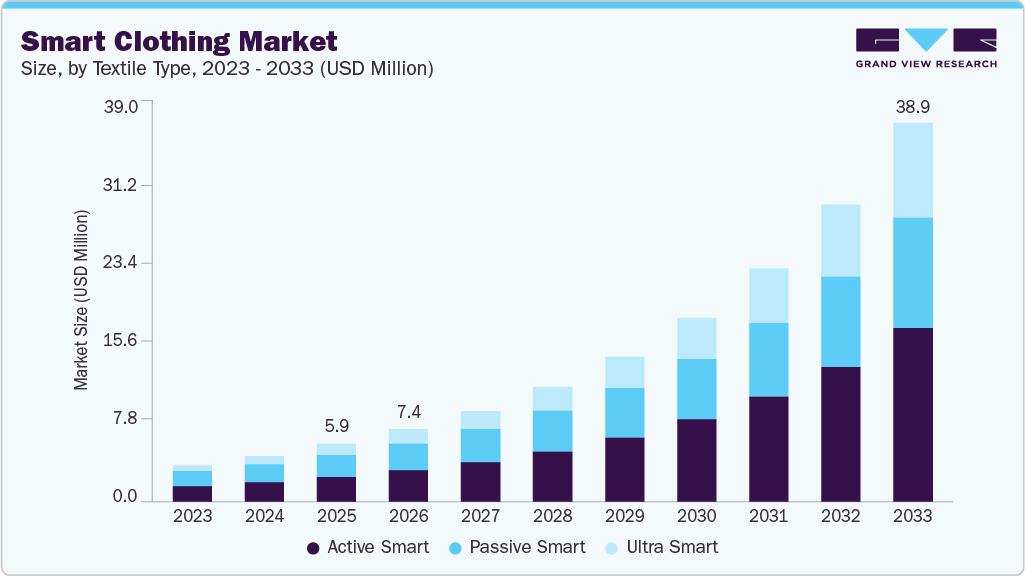

The global smart clothing market size was estimated at USD 5.88 billion in 2025 and is projected to reach USD 38.94 billion by 2033, growing at a CAGR of 26.8% from 2026 to 2033. The market is driven by rising adoption of wearable health and fitness monitoring, increasing integration of IoT and sensor technologies in textiles, growing demand for connected apparel in sports and defense applications, advancements in conductive fabrics and smart materials, and expanding consumer interest in personalized and data-driven lifestyle products.

Key Market Trends & Insights

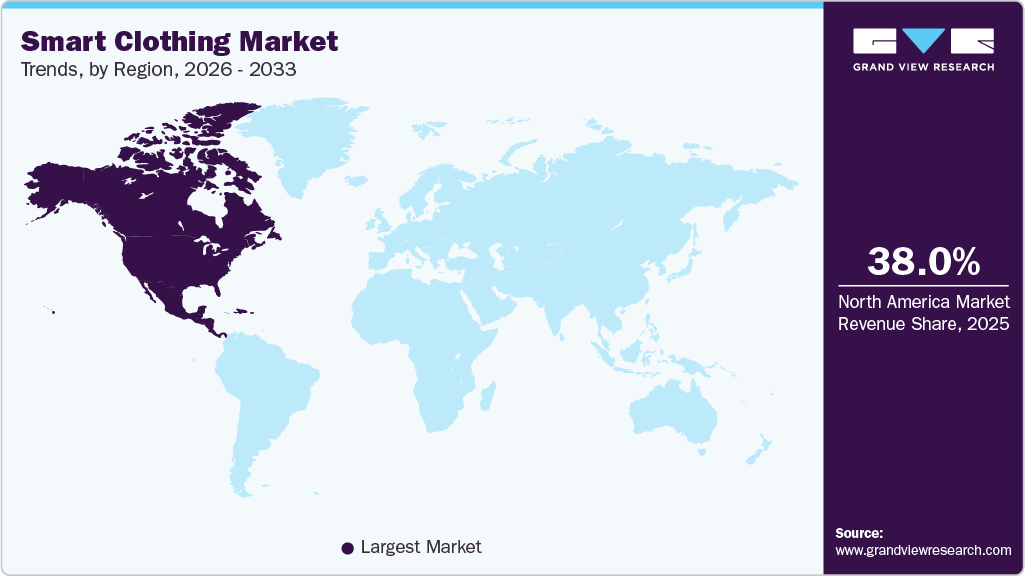

- North America is expected to hold the largest share of the global smart clothing market, with a revenue share of over 38% by 2025.

- The smart clothing market in U.S. led the North America market and held the largest revenue share in 2025.

- By Textile Type, Passive Smart segment led the market and held the largest revenue share of 43% in 2025.

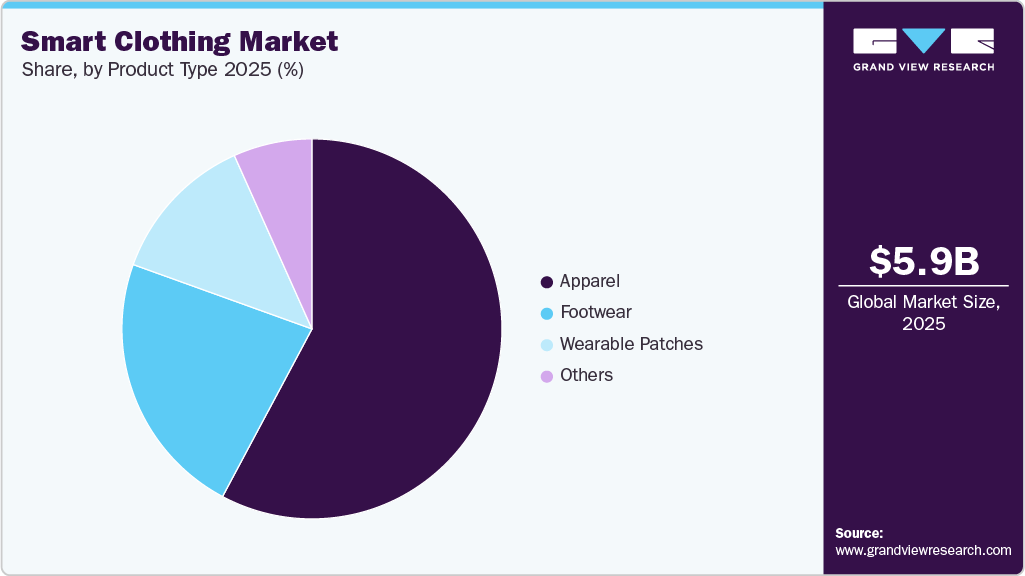

- By Product Type, Apparel segment led the market and held the largest revenue share of over 57% in 2025.

- By End Use, Fashion & Entertainment segment is expected to grow at the fastest CAGR of over 31% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 5.88 Billion

- 2033 Projected Market Size: USD 38.94 Billion

- CAGR (2026-2033): 26.8%

- North America: Largest Market in 2025

The smart clothing industry is witnessing strong growth, driven by rising adoption in the sports and healthcare sectors and increasing awareness of health and fitness in everyday life. Smart clothing integrates advanced electronic textiles and sensors to deliver real-time biometric data, including heart rate, body temperature, muscle activity, and pulse rate, supporting proactive health management. These capabilities enable users to track performance, optimize physical activity, and enhance overall well-being through data-driven insights. Additionally, the growing societal emphasis on healthy lifestyles and demand for continuous, real-time health monitoring are accelerating market adoption across consumer and professional segments.The rapid adoption of advanced wearable sensors, smart textiles, and data analytics is acting as a key growth driver for the smart clothing industry. Continuous innovation in microcontrollers, embedded sensors, and wireless connectivity is enabling seamless integration of intelligence directly into garments. This technological progress is improving the accuracy and reliability of real-time biometric and movement data. Enhanced comfort, durability, and user-friendly designs are lowering adoption barriers and expanding use cases beyond niche applications. As a result, smart clothing is increasingly being positioned as a practical, everyday solution for continuous health and performance monitoring.

The growing demand for data-driven fitness and performance optimization is strongly driving the adoption of smart clothing in the sports and fitness segment. Athletes and fitness enthusiasts are leveraging real-time biometric insights, such as heart rate, oxygen saturation, muscle activity, and movement patterns, to refine training programs. This capability is supporting injury prevention, performance enhancement, and more efficient recovery management. Smart clothing’s ability to provide posture, technique, and form feedback is further strengthening its value proposition. In addition, integration with mobile applications and wearable ecosystems is enabling personalized coaching and holistic fitness management, reinforcing long-term market growth.

Textile Type Insights

The passive smart segment led the market in 2025, accounting for 43% share of global revenue, driven by its strong cost efficiency and ease of adoption across multiple end-use applications. The segment benefits from simpler designs that integrate functional materials and basic sensing capabilities without complex electronics, reducing production and maintenance costs. Rising demand from sports, fitness, and everyday wellness monitoring is supporting large-scale deployment of passive smart garments. Superior comfort, lightweight construction, and high washability are further accelerating consumer acceptance. These factors collectively position passive smart clothing as a practical and scalable solution, sustaining its leadership in the global market.

The ultra smart segment is expected to experience a significant CAGR over the forecast period, driven by rising demand for advanced, real-time health and performance monitoring solutions. Increasing adoption across healthcare, sports, defense, and industrial applications is accelerating the integration of fully embedded sensors, processors, and wireless connectivity into garments. Continuous advancements in sensor miniaturization, battery efficiency, and AI-enabled analytics are enhancing accuracy, comfort, and usability. Growing emphasis on preventive healthcare and remote monitoring is further supporting segment growth. As smart ecosystems mature, ultra smart clothing is increasingly positioned as a high-value, next-generation wearable solution.

Product Type Insights

The apparel segment accounted for the largest market revenue share in 2025, owing to the widespread adoption of smart garments in everyday wear, sports, and fitness applications. Increasing consumer preference for clothing that seamlessly integrates health monitoring and activity tracking is driving strong demand. Apparel-based smart clothing offers superior comfort, flexibility, and ease of use compared to accessories or external devices. Advancements in smart fabrics and washable sensor integration are further enhancing product durability and user acceptance. These factors collectively reinforce the apparel segment’s leading position in the global smart clothing market.

The footwear segment is predicted to foresee significant growth in the coming years, driven by rising adoption of smart footwear across industrial and mining applications. Mining operators are increasingly deploying sensor-enabled shoes to monitor worker movement, posture, fatigue, and pressure distribution in hazardous environments. These capabilities support improved safety management, early risk detection, and compliance with strict occupational regulations. Advancements in ruggedized sensors and durable materials are making smart footwear suitable for extreme underground and outdoor conditions. As mining companies prioritize workforce safety and operational efficiency, demand for smart footwear is expected to accelerate steadily.

Distribution Channel Insights

The offline segment led the market in 2025, supported by the continued importance of brick-and-mortar stores and specialty retail channels in smart clothing distribution. Physical retail enables consumers to evaluate fit, comfort, quality, and embedded technology, which is critical for building trust in technology-enabled apparel. Interactive in-store demonstrations and guidance from knowledgeable sales staff help educate buyers and reduce adoption barriers. Offline channels also strengthen brand visibility through collaborations with established fashion retailers, pop-up stores, and experiential events. In addition, access to post-purchase support and services through physical outlets reinforces customer confidence and long-term brand loyalty.

The online segment is expected to witness significant growth in the coming years, driven by the expanding adoption of e-commerce platforms, brand-owned websites, and specialized digital marketplaces for smart clothing. This channel offers superior convenience, enabling consumers to access a wide range of products globally, compare features and pricing transparently, and purchase with minimal friction. Online platforms are increasingly leveraging rich digital content, including video demonstrations, customer reviews, and AI-driven chatbots, to educate buyers and enhance decision-making. The growing adoption of direct-to-consumer business models is streamlining the supply chain, improving margins, and allowing brands to engage directly with end users. These factors are enabling faster product iterations, improved personalization, and stronger responsiveness to evolving consumer preferences..

End Use Insights

The military & defense segment dominated the smart clothing market in 2025, owing to the rising adoption of advanced, technology-enabled uniforms to enhance soldier safety, performance, and situational awareness. Defense organizations are increasingly deploying smart garments embedded with sensors to monitor vital signs, physical exertion, fatigue levels, and injury indicators in real time. These capabilities support improved decision-making, mission readiness, and rapid medical response in high-risk environments. Growing investments in soldier modernization programs and battlefield digitization are further accelerating adoption. As a result, smart clothing is becoming a critical component of next-generation military equipment and operational strategy.

The fashion & entertainment segment is anticipated to exhibit a significant CAGR over the forecast period, driven by the increasing integration of sensors and digital technologies into lifestyle and performance-oriented apparel. Designers and entertainment brands are leveraging smart fabrics and embedded sensors to create interactive, responsive garments for stage performances, events, and immersive experiences. These technologies enable features such as motion tracking, light modulation, and biometric-driven visual effects, enhancing audience engagement. Growing collaboration between technology providers and fashion houses is accelerating innovation and product differentiation. As consumer interest in experiential fashion and tech-enabled self-expression rises, adoption across this segment is expected to accelerate.

Regional Insights

North America dominated the global smart clothing industry with a revenue share of over 38% in 2025, owing to early adoption of advanced wearable technologies and strong innovation in smart textiles. The region benefits from the presence of leading smart apparel and technology companies, supported by strong R&D investments. High demand from defense, sports, fitness, and healthcare applications continues to accelerate market growth. In addition, strong consumer awareness and well-established retail and digital ecosystems are reinforcing North America’s market leadership.

U.S. Smart Clothing Market Trends

The U.S. smart clothing industry maintained a dominant position in 2025, supported by strong adoption across fitness, defense, and fashion & entertainment applications. The fashion and entertainment industries are increasingly integrating smart textiles and embedded sensors into apparel for interactive performances, immersive experiences, and technology-driven self-expression. Growing collaboration between designers, entertainment brands, and technology providers is accelerating innovation and product commercialization. In addition, high consumer awareness and a well-developed digital retail ecosystem continue to reinforce the market’s leadership position.

Europe Smart Clothing Market Trends

The Europe smart clothing industry is expected to witness steady growth over the forecast period, primarily driven by rising adoption across industrial and mining applications. In the mining sector, smart clothing is increasingly used to monitor worker movement, fatigue, temperature, and exposure to hazardous environments, enhancing operational safety and productivity. Stringent workplace safety regulations and growing emphasis on risk mitigation are accelerating deployment in underground and high-risk mining operations. In addition, advancements in rugged, durable smart textiles designed for harsh working conditions are supporting broader adoption across Europe’s mining industry.

Asia Pacific Smart Clothing Market Trends

The Asia Pacific smart clothing industry is anticipated to register a significant CAGR, driven by rapid technological adoption, strong textile manufacturing capabilities, and increasing integration of sensors and electronics into garments. The region’s large, tech-savvy population and rising health and fitness awareness are accelerating consumer demand for smart apparel. Expanding collaborations between technology firms and textile manufacturers are improving scalability and cost efficiency. Furthermore, supportive government initiatives and growing investments in digital health and smart manufacturing are creating a favorable environment for long-term market growth.

Key Smart Clothing Company Insights

Some key players in the smart clothing market, such as AiQ Smart Clothing, DuPont, TORAY INDUSTRIES, INC., Sensoria, and Wearable X.

-

DuPont is a key player in developing high-performance textiles and conductive fabrics, which are essential for smart clothing applications. DuPont has pioneered materials like Intexar, a smart clothing technology platform. Intexar is a stretchable, washable, and durable electronic ink-based technology that can be integrated into garments to monitor biometrics such as heart rate, breathing, and activity levels. This material is used by apparel manufacturers to develop smart textiles.

-

AiQ Smart Clothing integrates electronics into fabrics by embedding conductive fibers directly into the material. This approach enables the production of washable, flexible, and durable smart clothing that retains the appearance and comfort of traditional garments while incorporating advanced technological functionalities. AiQ Smart Clothing targets various industries with tailored smart clothing solutions, including healthcare, sports and fitness, military, and industrial safety. For instance, the BioMan product line is designed to monitor biometrics such as heart rate, breathing rate, and muscle activity, making it valuable for medical and athletic purposes.

Key Smart Clothing Companies:

The following key companies have been profiled for this study on the smart clothing market.

- AiQ Smart Clothing

- DuPont

- Myontec

- Myzone

- Owlet UK

- Sensoria

- Siren

- TORAY INDUSTRIES, INC.

- Vulpes Electronics GmbH

- Wearable X

Recent Developments

-

In September 2025, Toray Industries partnered with MAS Holdings to establish a new apparel manufacturing operation in India, aimed at expanding production capacity and reinforcing global supply capabilities. The partnership is designed to address rising international demand for high-quality textile and apparel solutions while improving responsiveness to regional and global customers. A new manufacturing facility is being developed in Odisha, with commercial operations expected to begin in early 2026, contributing to local employment generation and industrial development. This initiative aligns with Toray Industries’ broader strategy of regional expansion, supply chain localization, and the adoption of sustainable and efficient manufacturing practices.

-

In May 2025, DuPont partnered with Epicore Biosystems to highlight the broader industry shift toward technology-enabled apparel and worker safety solutions. In a parallel development within advanced textile manufacturing, Active Clothing Co. Ltd. and Ningbo Cixing Co. Ltd. announced plans to launch India’s first “Knit to Shape” smart knitting factory, leveraging 3D seamless knitting, automation, and zero-waste production processes. The facility is designed to enhance manufacturing precision, reduce material waste, and enable faster, more flexible production of high-quality knitwear. This initiative reflects the growing adoption of smart manufacturing technologies in the textile sector and strengthens India’s position in next-generation, sustainable apparel production.

-

In April 2025, Toyota announced the launch of smart clothing embedded with perovskite solar cells, enabling garments to generate electricity directly from light exposure. The initiative integrates ultra-thin, flexible photovoltaic films into textiles, allowing wearable products to serve as self-powering platforms for future smart functions without compromising comfort or mobility. The smart apparel was developed in collaboration with perovskite technology partners and is being tested in real-world environments to assess durability, efficiency, and practical usability. This development highlights Toyota’s strategic focus on sustainable innovation and positions energy-harvesting smart textiles as a key enabler within the evolving smart clothing market.

Smart Clothing Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 7.40 billion

Revenue forecast in 2033

USD 38.94 billion

Growth rate

CAGR of 26.8% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Textile type, product type, distribution channel, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

AiQ Smart Clothing; DuPont; Myontec; Myzone; Owlet UK; Sensoria; Siren; TORAY INDUSTRIES, INC.; Vulpes Electronics GmbH; Wearable X

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Clothing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global smart clothing market report based on textile type, product type, distribution channel, end use, and region.

-

Textile Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Active Smart

-

Passive Smart

-

Ultra Smart

-

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Apparel

-

Footwear

-

Wearable Patches

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Fashion & Entertainment

-

Sports & Fitness

-

Healthcare

-

Mining

-

Military & Defence

-

Industrial Workwear

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the smart clothing market include AiQ Smart Clothing; DuPont; Myontec; Myzone; Owlet UK; Sensoria; Siren; TORAY INDUSTRIES, INC.; Vulpes Electronics GmbH; and Wearable X.

b. Key factors that are driving the smart clothing market growth include growing awareness of health and fitness among individuals, and advances in textile technology, wearable sensors, and data analytics.

b. The global smart clothing market size was estimated at USD 5.88 billion in 2025 and is expected to reach USD 7.40 billion in 2026.

b. The global smart clothing market is expected to grow at a compound annual growth rate of 26.8% from 2026 to 2033, reaching USD 38.94 billion by 2033.

b. North America dominated the smart clothing market, accounting for over 38.0% in 2025. This growth is attributed to the region's advancements in smart clothing technologies and the presence of key market players like Sensoria Inc., Ralph Lauren Media LLC, and Under Armour, Inc. The remarkable growth is further fueled by the increasing demand for smart clothing, especially from the military sector.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.