- Home

- »

- Homecare & Decor

- »

-

Smart Diapers Market Size And Share, Industry Report 2030GVR Report cover

![Smart Diapers Market Size, Share & Trends Report]()

Smart Diapers Market (2024 - 2030) Size, Share & Trends Analysis Report By End Use (Babies, Adults), By Distribution Channel (Offline, Online), By Region (North America, Europe, Asia Pacific, Latin America, MEA) And Segment Forecasts

- Report ID: GVR-2-68038-891-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Diapers Market Summary

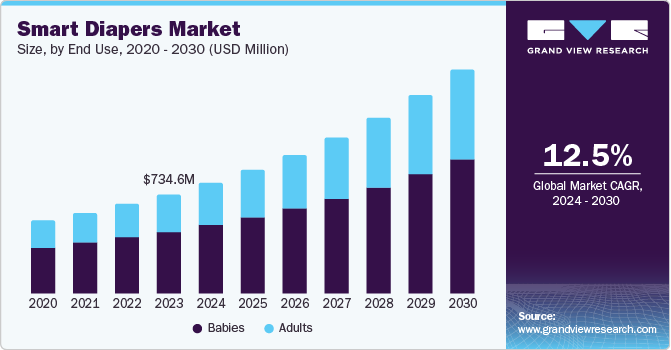

The global smart diapers market size was valued at USD 734.6 million in 2023 and is projected to reach USD 1,658.4 million by 2030, growing at a CAGR of 12.5% from 2024 to 2030. The key factors include increasing disposable incomes, geriatric populations, and growing populations in developing nations.

Key Market Trends & Insights

- North America smart diapers market held the largest market revenue share of 34.4% in 2023.

- The U.S. smart diapers market dominated the regional market in 2023.

- Based on end use, the babies segment dominated the market and accounted for a revenue share of 62.7% in 2023.

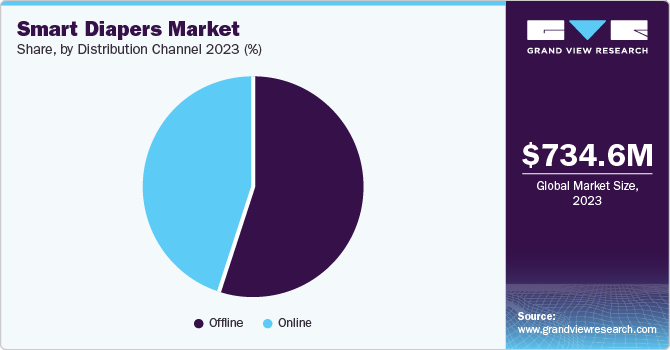

- Based on distribution channel, the offline segment accounted for the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 734.6 Million

- 2030 Projected Market Size: USD 1,658.4 Million

- CAGR (2024-2030): 12.5%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The growth of the smart diaper market is boosted by the rising use of smart diapers in medical facilities such as clinics, hospitals, and nursing homes. Increasing technology adoption to support nuclear and working families concerning baby care is also accountable for the market expansion. Adult diapers are made to help older people who face daily difficulties such as dementia, urinary or fecal incontinence, restricted movement, or diarrhea. Smart diapers can help with detecting health issues such as skin irritations, constipation, allergies, and incontinence, in addition to improving care. Moreover, the rising geriatric population worldwide is driving the growth of the market. According to the World Health Organization (WHO), by year 2030, one out of every six individuals worldwide is anticipated to be 60 years old or older. in 2050, the number of individuals aged 60 years old and above is anticipated to double, reaching 2.1 billion. Also, it is projected that the number of individuals aged 80 years or above will triple by 2050, reaching 426 million.

Smart diapers also allow the caregivers to track the baby’s health, which is expected to drive consumer demand. High birth rates in the Asia Pacific and the Middle East countries are expected to open up new avenues for the market. Moreover, a growing number of internet users support the growth of the e-commerce industry, making it an effective distribution channel for all consumer goods, driving the market's growth.

End Use Insights

The babies segment dominated the market and accounted for a revenue share of 62.7% in 2023. The baby’s health is the most essential aspect that needs to be taken care of. Therefore, various companies use smart diapers with upcoming technologies such as Alert Plus. The increasing popularity of smart diapers for babies is due to the rising need for baby care products and the growing number of newborns worldwide. According to WorldMapper, India recorded the largest number of births in 2022, totaling 23 million. China recorded 10 million births, while Nigeria, Pakistan, and Indonesia had 8 million, 6.4 million, and 4.5 million births respectively. Various opportunities and trends are emerging in the market that can benefit manufacturers and retailers of baby diapers.

The adult segment is expected to register the fastest CAGR during the forecast period. The growing geriatric population is expected to impact on the projected market expansion in the upcoming years. Moreover, the prevalence of health conditions such as incontinence and other health issues that can be detected with the sensors in smart diapers is driving the market growth. Alert with applications in smartphones is one of the emerging trends in the market. P&G (U.S.) is focusing on technological advancements in diapers manufactured to improve zero leakage and ultimate comfort.

Distribution Channel Insights

The offline segment accounted for the largest revenue share in 2023. Traditional distribution channels such as supermarkets, departmental stores, pharmacies, and baby specialty stores are anticipated to remain the primary market players during the forecast period. Offline distribution channels provide an opportunity for consumers to physically examine the product and purchase smart diapers in stores. Consumer preference for customer support and personalized assistance also encourages consumers to purchase offline smart diapers. Discounts on bulk purchases by healthcare settings such as nursing homes, hospitals, and others drive market growth.

The online distribution channel is expected to register the fastest CAGR during the forecast period. The rise of smartphones and internet access has made the e-commerce channel an essential way to distribute baby diaper products. Consumers are increasingly choosing to buy baby diapers online due to the convenience and simplicity of online shopping, providing manufacturers with a chance to improve their visibility on the internet. Moreover, online distribution channels are experiencing rapid growth due to the doorstep delivery services offered by these platforms to consumers.

Regional Insights

North America smart diapers market held the largest market revenue share of 34.4% in 2023. Factors such as rising consumer awareness of the benefits of smart diapers, advancements in technology, and a stronger focus on caring for infants and older people are contributing to the market expansion in the region. Moreover, a robust healthcare system and the presence of prominent market leaders resulted in the widespread use of smart diaper technology. Another development involves improving the hydration sensor technology currently utilized in the market. The sensors assist in monitoring general health and continuously monitor the skin for signs of dehydration. Technological advancements improve consumer experience and benefit the healthcare sector by making smart diapers essential for adults and infants.

U.S. Smart Diapers Market Trends

The U.S. smart diapers market dominated the regional market in 2023. The market is driven by rising nuclear families, growing number of working parents and increasing disposable income contributing to the rising demand for smart diaper to ensure maximum comfort level for their babies in the fast-paced lifestyle. For instance, in the U.S., about 71% of children under 18 reside in a household with both parents. Therefore, smart diapers can assist parents, and caregivers to carry out their responsibility efficiently. According to a survey carried out by the U.S. Bureau of Labor Statistics in 2023, about 32.6 million families included children below 18 years, and among those families about 91.9 percent of families with children, at least one parent had a job, from a rate of 91.2 percent in 2022. In 2023, in the category of married couples about 67.0 percent of families had both parents employed. Therefore, the rising number of working parents is contributing to the demand for products integrated with technology to ease their tasks and take care of their babies efficiently.

Europe Smart Diapers Market Trends

Europe smart diapers market was identified as a lucrative region in 2023. Rising awareness of personal hygiene, particularly among babies, is driving the demand for products such as smart diapers. Moreover, the increasing prevalence of urinary incontinence (UI) in the region is contributing to the expansion of the smart diaper market. According to the European Association of Urology, urinary incontinence is a prevalent problem that impacts 10 to 20% of individuals throughout Europe. The penetration of prominent players in the region to expand their brand identity is encouraging these companies to bring new features to their products to cater to wide consumer groups.

The UK smart diapers market is expected to grow rapidly during the forecast period. Rising technological advancements and awareness of personal hygiene are encouraging manufacturers to innovate new products, such as smart diapers consisting of sensors such as Alert Plus. The growing e-commerce sector is accelerating the sales of smart diapers due to the numerous benefits of these online platforms.

Asia Pacific Smart Diapers Market Trends

Asia Pacific smart diapers market is expected to grow at the fastest CAGR over the forecast period. The rising popularity of smart diapers in nations such as China, India, Japan, and South Korea. Innovation, deflating prices, a growing population, and higher household incomes in emerging Asian markets have led to a significant increase in their popularity, consequently boosting the smart diapers market in the region. Manufacturers constantly innovate to enhance diaper performance and comfort by incorporating wetness indicators, flexible waistbands, and hypoallergenic materials.

China smart diapers market held a substantial market share in 2023. Factors such as the strong presence of key companies such as opro9 constantly focus on incorporating technological advancements into their products, resulting in smart diapers. Increasing disposable income, rising penetration of the Internet, and urbanization are driving the market by accelerating the purchase of smart diapers. Moreover, health conditions such as mobility limitations, urinary incontinence, and other health conditions in the adult population drive the demand for smart diapers.

Key Smart Diapers Company Insights

Some of the key companies in the smart diapers market include Procter & Gamble (Lumi by Pampers), Opro9, Ontex BV, SINOPULSAR., Essity Aktiebolag (publ)., Pixie Scientific, and others. These companies are finding solutions with innovative technologies to avoid problems. Sensors attached to diapers are of low cost and apply technologies such as Alert Plus Technology, with the help of which information on excretion could be accessed through phones, tablets, and computers.

-

Procter & Gamble (P&G), a global consumer goods company, offers a variety of reliable brands such as Tide, Pampers, and Olay. Lumi by Pampers is a novel P&G product that combines traditional diapering with contemporary technology. It is a comprehensive connected care system developed to assist parents in keeping track of their baby's health.

-

Abena, a prominent Danish company, specializes in developing high-quality incontinence products and other disposable products for different industries. Abena Nova, an intelligent incontinence product for daily use is developed in collaboration with MediSens Wireless and combines cutting-edge sensor technology to provide immediate information and notifications to caregivers.

Key Smart Diapers Companies:

The following are the leading companies in the smart diapers market. These companies collectively hold the largest market share and dictate industry trends.

- Procter & Gamble (Lumi by Pampers)

- Opro9

- Ontex BV

- SINOPULSAR

- Essity Aktiebolag (publ).

- Pixie Scientific

- Simavita (Smartz AG)

- ElderSens

- Abena Holding A/S

Recent Developments

-

In May 2024, Woosh introduced a new recyclable diaper developed in collaboration with Ontex. With this initiative, the company continues to support sustainability and reduce harmful impacts on the environment.

-

In February 2023, A Penn State-led research team developed a new sensor, which is placed in between the absorbent layers of smart diapers and can detect wetness and signal for a change. This technology is developed to assist workers in hospitals, daycares, and other environments to offer quicker care to those they are responsible for.

Smart Diapers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 818.3 million

Revenue forecast in 2030

USD 1,658.4 million

Growth Rate

CAGR of 12.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End use, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, South Korea, Brazil, and South Africa

Key companies profiled

Procter & Gamble (Lumi by Pampers); Opro9; Ontex BV; SINOPULSAR; Essity Aktiebolag (publ).; Pixie Scientific; Simavita (Smartz AG); ElderSens; Abena Holding A/S

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Diapers Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the smart diapers market report based on end use, distribution channel, and region.

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Babies

-

Adults

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.