- Home

- »

- Next Generation Technologies

- »

-

Smart Government Market Size, Share & Trends Report 2030GVR Report cover

![Smart Government Market Size, Share & Trends Report]()

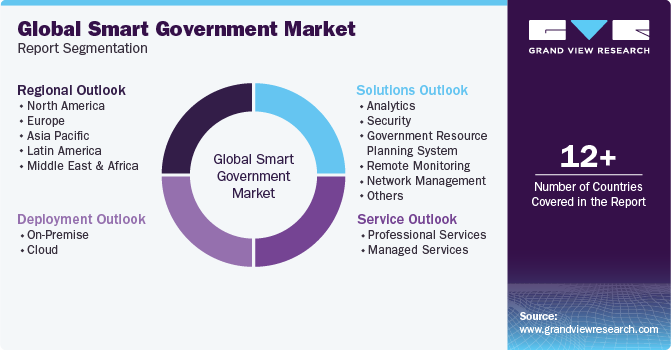

Smart Government Market (2024 - 2030) Size, Share & Trends Analysis Report By Services, By Solutions, By Deployment Model, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-190-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Government Market Summary

The global smart government market size was estimated at USD 34.44 billion in 2023 and is projected to reach USD 117.36 billion by 2030, growing at a CAGR of 20.2% from 2024 to 2030. The growth of the smart government market is driven by the increasing realization that technological innovation is important in tackling sustainability challenges.

Key Market Trends & Insights

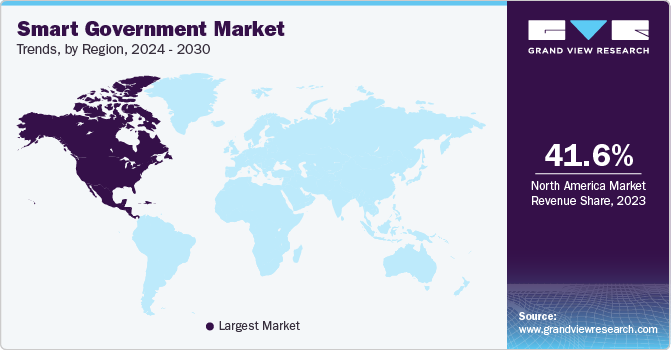

- North America accounted for a revenue share of over 41.6% in 2023.

- Asia Pacific is anticipated to witness significant CAGR growth over the forecast period.

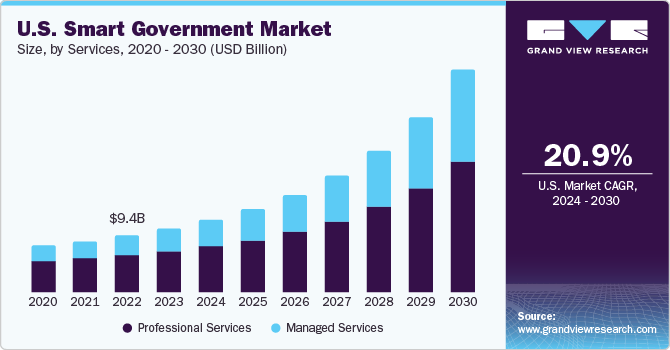

- In terms of services, The professional services segment dominated the market with a 61.4% share in 2023.

- In terms of solution, Government resource planning system accounted for the largest market revenue share in 2023.

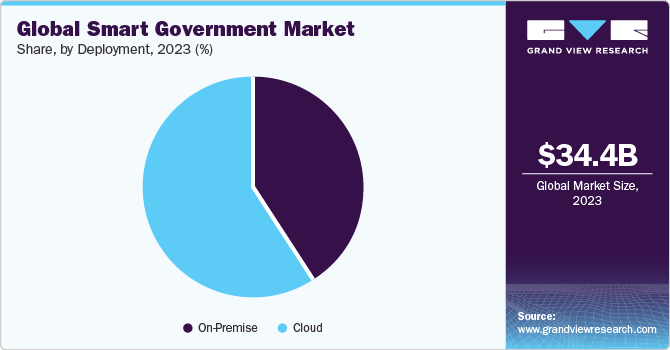

- In terms of deployment, The cloud segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 34.44 Billion

- 2030 Projected Market Size: USD 117.36 Billion

- CAGR (2024-2030): 20.2%

- North America: Largest market in 2023

Implementing smart infrastructure solutions such as smart grids, intelligent transportation systems, and connected buildings can significantly reduce energy consumption and emissions while improving overall urban sustainability. Smart technologies enable governments to optimize resource usage, whether it's energy, water, or waste.

Through IoT sensors and data analytics, governments can monitor and manage resources more efficiently, reducing waste and improving sustainability. For instance, in October 2023, the government of Tamil Nadu is collaborating with the U.K. on the 'Smart district administration using IoT technologies for a better quality of life' project. The initiative is part of the Frontier Technology Livestreaming (FTL) program supported by the U.K. This partnership aims to address sustainability challenges by employing smart technology for water, waste, and resource management within a district in Tamil Nadu.

The rapid advancements in technology, particularly in areas such as IoT, AI, and data analytics, have fueled the growth of the smart government market. Governments worldwide are utilizing these innovations to enhance efficiency, improve service delivery, and address sustainability challenges. The integration of these technologies enables better resource management, optimized public services, and streamlined operations, leading to increased adoption of smart solutions. Moreover, the scalability and flexibility of these technologies empower governments to adapt and evolve their systems, ensuring resilience in the face of changing needs and emerging challenges. As these innovations become more affordable and accessible, they encourage broader adoption across diverse government sectors, further propelling the expansion of smart government initiatives worldwide.

Smart government initiatives utilize extensive data collected via IoT sensors, AI algorithms, and analytics tools. This data-centered approach empowers governments to make informed decisions, forecast trends, and allocate resources more efficiently. Through transparent access to data and insights, these initiatives cultivate trust among citizens and stakeholders, promoting continued growth and endorsement of smart government solutions. Moreover, the utilization of this wealth of data aids in proactive policymaking and facilitates targeted interventions, ensuring resources are directed where they're most needed, thus maximizing their impact on society. As governments prioritize accountability and citizen engagement, the accessibility of this data promotes a collaborative environment where public input and scrutiny contribute to the refinement and success of smart government strategies.

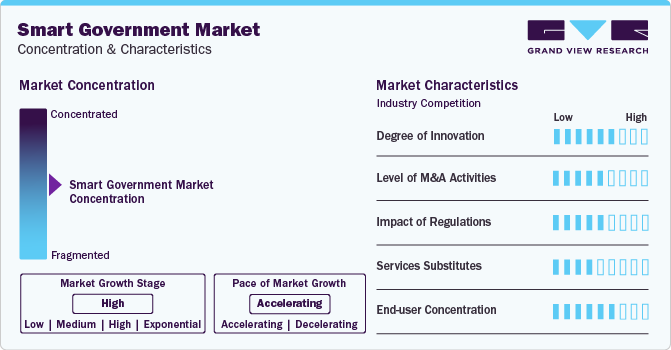

Market Concentration & Characteristics

In the domain of smart government, innovation flourishes due to the rapid advancement of technology, propelled by evolving AI algorithms, the wealth of big data, and amplified computing prowess. This continuous innovation leads to the emergence of pioneering AI Deployment Models, transforming traditional government practices and nurturing the development of groundbreaking public services and solutions.

For instance, in 2023, Power Grid Corporation of India Limited, a central public sector, collaborated with the Deomali Administration from Arunachal Pradesh to introduce Digi-kaksh at the NTC Upper Primary School. Their joint aim is to establish a sustainable and technologically advanced government school, transforming educational methods and preparing students for the future.

In the domain of smart government, although direct substitutes for AI are limited, several alternative technologies, such as automation, rule-based systems, and expert systems, can achieve analogous outcomes. These technologies serve as potential stand-ins for AI in specific applications, yet they often need more comprehensive performance and adaptability than AI offers. Despite their usefulness, these alternatives may deliver a different degree of versatility and effectiveness required for addressing multifaceted challenges in smart government initiatives.

End-user concentration is crucial in the smart government market, with demand stemming from diverse industries driving the need for AI solutions. The concentration of this demand within select government sectors presents opportunities for companies specializing in AI solutions customized to these areas. However, it also poses challenges for companies seeking to compete amid a competitive environment, vying for attention and market share within this specialized domain.

Services Insights

The professional services segment dominated the market with a 61.4% share in 2023. Professional services are experiencing growth within the smart government market due to the increasing complexity of implementing advanced technologies such as AI and IoT in governmental systems. These services offer expertise in strategy, implementation, and customization, aiding governments in navigating intricate technological integrations. The changing regulatory environment calls for specialized guidance, creating a demand for consultancy services to guarantee adherence to regulations and effective integration of smart technologies. Moreover, as governments prioritize efficiency and citizen-centric services, professional service providers offer customized solutions, strengthening this sector's growth.

The managed services segment accounted to register a significant CAGR over a forecast period. These services often operate on subscription-based models, enabling governments to predict and manage expenses more effectively. By outsourcing tasks such as system maintenance, updates, and cybersecurity to specialized providers, governments can minimize operational costs while ensuring top-notch performance and security of their technological infrastructure. This cost-effective approach encourages the adoption of managed services as a strategic solution within the smart government domain.

Solution Insights

Government resource planning system accounted for the largest market revenue share in 2023. Government Resource Planning Systems (GRP) are witnessing growth due to their capacity to centralize and optimize diverse administrative functions. These systems offer a consolidated platform that integrates financial, human resources, procurement, and operational data, aligning with the trend toward cohesive and efficient governance. The demand for streamlined operations, data-centered decision-making, and enhanced transparency in government operations is propelling the adoption of GRP systems. By providing real-time insights and facilitating smooth coordination across departments, GRP systems contribute significantly to the modernization and efficiency of smart government initiatives.

The remote monitoring segment accounted to register a significant CAGR over a forecast period. Remote monitoring is experiencing growth due to its capability to enable real-time tracking and management of critical infrastructure and services. With the increasing complexity of urban and rural areas, remote monitoring technologies offer a means to oversee diverse systems such as utilities, transportation, environmental factors, and public safety from a centralized location. This enables governments to proactively respond to issues, optimize resource allocation, and ensure the continuous functioning of essential services. Furthermore, the demand for remote monitoring has surged as governments seek to enhance efficiency, reduce operational costs, and improve overall responsiveness to citizen needs, driving its significant growth in the smart government sector.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2023. The growth of cloud technology in the smart government market arises from its capacity to offer scalable, cost-effective solutions for storing and processing vast amounts of data. Cloud services enable governments to efficiently manage and access data, applications, and resources remotely, encouraging collaboration and information sharing across departments. Furthermore, the adaptable nature of cloud-based solutions enables governments to quickly adopt new technologies, innovate services, and dynamically respond to evolving needs without extensive infrastructure investments. The increased emphasis on data security, disaster recovery, and accessibility further drives the adoption of cloud technologies in the smart government sector, facilitating efficient, secure, and agile operations.

On-premise segment accounted to register a significant CAGR over a forecast period. The growth of on-premise solutions is driven by specific security, compliance, and data sovereignty requirements. Some governmental bodies have regulations or security protocols that necessitate direct control over their data and infrastructure, leading to the preference for on-premise solutions. Moreover, certain sensitive operations or critical systems may require the high level of customization and control that on-premise solutions offer, enabling governments to customize technology to their unique needs without reliance on external providers.

Regional Insights

North America accounted for the highest share of the global revenue in 2023. The strong technological infrastructure and high digital maturity in the region create an environment favorable for embracing advanced technologies in government operations. Furthermore, robust government initiatives and investments in smart city projects, alongside the presence of prominent technology firms and research institutions, bolster the region's expansion in this field. Moreover, the growing emphasis on utilizing technology to elevate public services, boost effectiveness, and tackle urban issues expedites the uptake of smart government solutions in North America.

Asia Pacific is anticipated to witness significant CAGR growth over the forecast period. The region's rapid urbanization and population growth drive the demand for innovative solutions to address urban challenges efficiently. Governments in the Asia Pacific are increasingly prioritizing digital transformation and investing in smart city initiatives to improve public services and infrastructure. Furthermore, the presence of tech-savvy populations and a thriving tech industry promote an environment conducive to the adoption of advanced technologies in government operations. As a result, the region's focus on utilizing technology for inclusive development and enhancing governance accelerates the adoption of smart government solutions in the Asia Pacific.

Key Smart Government Company Insights

Some of the key players operating in the market include Amazon Web Service, Inc., Microsoft Corporation, Google Cloud Platform, International Business Machines Corporation, Oracle Corporation, and Salesforce, Inc.

-

Amazon Web Services, Inc. is a prominent provider of cloud computing services, offering a broad range of solutions for storage, computing power, and database management. It operates as a subsidiary of Amazon and is known for its scalability, reliability, and global reach in delivering cloud-based infrastructure and services to businesses and organizations across various industries.

-

Microsoft Corporation is a global technology company renowned for its software, hardware, and cloud services. The company is known for Windows operating systems, Office software, Azure cloud platform, Surface devices, and Xbox gaming consoles. Active in AI, cybersecurity, and enterprise solutions, Microsoft is a major player in the tech industry worldwide.

Palantir Technologies, CivicPlus, and Accela are some of the emerging market participants in the Smart Government market.

-

Palantir Technologies is a data analytics and software company known for its expertise in handling and analyzing large, complex datasets. It provides software solutions for data integration, analysis, and decision-making, particularly in sectors such as government, defense, intelligence, and finance. Palantir's platforms enable organizations to make data-driven decisions by integrating and visualizing diverse data sources, aiding in tasks such as fraud detection, cybersecurity, and strategic planning.

-

CivicPlus is a software company that provides digital solutions customized for local governments. CivicPlus offers a range of technology platforms focused on enhancing citizen engagement, communication, and service delivery for municipalities and local government agencies. Their solutions include software for website design, community engagement, and integrated technology systems aimed at facilitating efficient and transparent interactions between government entities and citizens.

Key Smart Government Companies:

The following are the leading companies in the smart government market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these smart government companies are analyzed to map the supply network.

- Accela

- Amazon Web Service, Inc.

- CivicPlus

- Google LLC

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Palantir Technologies

- Salesforce, Inc.

- Snowflake Inc.

Recent Developments

-

In July 2023, the U.S. government introduced the U.S. Cyber Trust Mark program to help Americans pick safer internet-connected devices. This initiative strives to enhance consumer awareness and confidence by ensuring that the devices they purchase possess strong built-in protections against cyber threats and potential cyberattacks.

-

In August 2023, the Singapore government and Google Cloud, a Cloud Computing Platform, teamed up to launch AI Trailblazers, aiming to speed up impactful generative AI solutions. This initiative assists Singaporean organizations in identifying issues suitable for generative AI, creating prototypes, and putting them into action. Services, and Krungsri Auto—by utilizing data analytics, machine learning (ML), and artificial intelligence (AI).

-

In September 2023, Singapore government is merging its Smart Nation and Digital Government Group with digital agencies under the Ministry of Communications and Information to strengthen its ability to lead and navigate digital advancements effectively. This strategic move is aimed at empowering the Government to lead a comprehensive digital agenda and adeptly address emerging opportunities and challenges in the evolving digital sector.

Smart Government Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 39.00 billion

Revenue forecast in 2030

USD 117.36 billion

Growth rate

CAGR of 20.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Market revenue in USD million/billion & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, solution, deployment, region

Regional

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil and Mexico; KSA; UAE South Africa

Key companies profiled

Accela, Amazon Web Service, Inc.; CivicPlus, Google LLC; International Business Machines Corporation; Microsoft Corporation; Oracle Corporation; Palantir Technologies; Salesforce, Inc.; Snowflake Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Global Smart Government Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global smart government market report based on services, solutions, deployment,and region.

-

Services Outlook (Revenue, USD Million, 2017 - 2030)

-

Professional Services

-

Managed Services

-

-

Solutions Outlook (Revenue, USD Million, 2017 - 2030)

-

Analytics

-

Security

-

Government Resource Planning System

-

Remote Monitoring

-

Network Management

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-Premise

-

Cloud

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Mexico

-

Brazil

-

-

Middle East and Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart government market size was estimated at USD 34.44 billion in 2023 and is expected to reach USD 39.00 billion in 2024.

b. The global smart government market is expected to grow at a compound annual growth rate of 20.2% from 2024 to 2030 to reach USD 117.36 billion by 2030.

b. North America dominated the smart government market with a share of 41.57% in 2023. This is attributable to the robust government initiatives and investments in smart city projects, alongside the presence of prominent technology firms and research institutions in the region.

b. Some key players operating in the smart government market include Accela, Amazon Web Service, Inc., CivicPlus, Google LLC, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, Palantir Technologies, Salesforce, Inc., Snowflake Inc.

b. Key factors that are driving the market growth include digital transformation initiatives, data-driven decision making, increasing connectivity and advancements in communication technologies and focus on sustainability and environmental considerations

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.