- Home

- »

- Medical Devices

- »

-

Smart Insulin Pens & Pumps Market Size Report, 2030GVR Report cover

![Smart Insulin Pens & Pumps Market Size, Share & Trends Report]()

Smart Insulin Pens & Pumps Market Size, Share & Trends Analysis Report By Type (Smart Insulin Pens, Smart Insulin Pumps), By End Use (Hospitals And Clinics, Homecare), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-151-1

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Report Overview

The global smart insulin pens & pumps market size was valued at USD 6.93 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.4% from 2024 to 2030. A rising prevalence of diabetes among the young population globally due to increasing adherence to a sedentary lifestyle, growing focus of patients on management and prevention of diabetes, and advancements in healthcare technology are primary factors driving market growth. Patients with type-1 diabetes and some rare cases with type-2 diabetes require insulin to keep their blood sugar at an optimum level. Continuous innovations in insulin delivery devices such as improved connectivity, data management capabilities, and enhanced dosing accuracy, have helped in driving demand for this market.

The increasing incidence of both type-1 and type-2 diabetes is a primary catalyst for market expansion. According to the IDF Diabetes Atlas 2021 report published by the International Diabetes Federation, around 537 million people globally between the ages of 20 and 79 years were suffering from diabetes and approximately 6.7 million people died due to this condition in 2021. Increasing global life expectancy has led to a steady rise in the geriatric population, which is contributing to a growth in the number of diabetic patients. As the diabetic population expands constantly in the coming years, the demand for effective and convenient insulin delivery systems is poised to rise accordingly.

The growing adoption of digital health technologies among patients has led to increased demand for smart insulin devices that offer convenience, improved adherence, and enhanced self-management capabilities. Smart insulin pens and pumps have proved to be the most sought-after and advanced solutions for diabetic people. The real-time blood sugar monitoring feature allows patients to keep a continuous check on hyperglycemia. Additionally, these devices administer precise dosages of insulin in comparison to traditional injections, which generally face dosage issues.

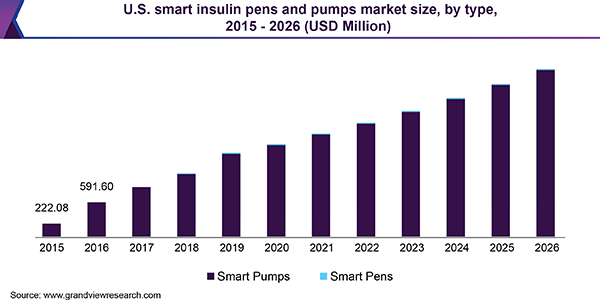

Type Insights

Smart insulin pumps accounted for the largest market revenue share of 58.6% in 2023. Insulin pumps offer a highly precise mode of insulin delivery by administering a constant flow of the hormone, enabling better glucose control compared to traditional insulin pens. This is particularly beneficial for patients with Type 1 diabetes and those requiring complex insulin regimens. Moreover, these pumps provide greater flexibility in insulin dosing, allowing for adjustments based on real-time glucose levels and meal intake. This improved convenience contributes to enhanced patient adherence. The ease of dosage administration and better hyperglycemic control achieved in comparison to smart insulin pens propels higher demand for smart insulin pumps, leading to their market dominance.

Smart insulin pens held a substantial revenue share of the market in 2023. Insulin pens are more cost-effective than insulin pumps, making them a more accessible option for a broader patient population. Furthermore, insulin pens are more user-friendly and convenient as compared to insulin pumps, particularly for patients with less complex diabetes management needs. Their compact size and portability facilitate their easy integration into daily routines. For instance, diabetic patients can carry an insulin pen anywhere during their travels by keeping it in their bags; on the other hand, pumps are attached to the body, making them inconvenient for patients with allergic reactions to pump adhesives and catheters. These factors of affordability and convenience are anticipated to drive steady segment growth.

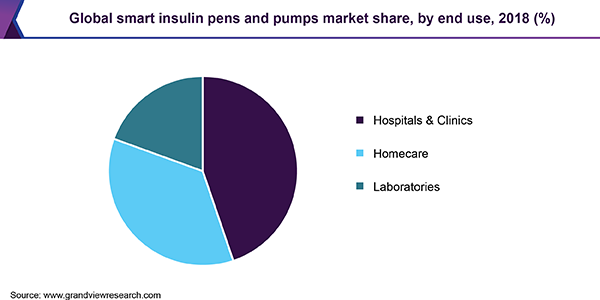

End Use Insights

Hospitals and clinics accounted for the largest market revenue share of 48.3% in 2023. These healthcare facilities serve as primary healthcare delivery centers, thus managing a significant population of diabetic patients requiring insulin therapy. This concentrated patient base requires a continuous supply of insulin-delivery devices. Moreover, hospitals possess the requisite clinical expertise and infrastructure to utilize and manage smart insulin devices effectively. This includes trained medical personnel, advanced monitoring equipment, and established protocols for insulin administration. These factors lead to a high demand for insulin delivery solutions from this segment, accounting for its market dominance.

The homecare segment is expected to register the fastest CAGR of 8.9% from 2024 to 2030. A growing preference for independent disease management has led to a surge in demand for devices that enable patients to monitor and administer their treatments at home. The integration of advanced technologies into smart insulin pens and pumps, such as Bluetooth connectivity for continuous blood sugar monitoring and a dedicated mobile application for accessing health data, have facilitated their increased use in home settings, enhancing patient convenience and compliance. Additionally, homecare solutions present a more cost-effective alternative to institutional care, making them increasingly attractive to patients, which has driven substantial product demand from this segment.

Regional Insights

Europe led the market with a revenue share of 31.9% in 2023. Europe possesses a well-developed healthcare infrastructure with significant investments in research and development activities. This has fostered a conducive environment for the adoption of innovative medical technologies, such as smart insulin pens and pumps. Thus, a substantial patient base and high disposable income to afford innovative solutions create a robust demand for smart insulin delivery devices in the region.

UK Smart Insulin Pens & Pumps Market Trends

The UK held a significant share of the regional market in 2023. The British Diabetic Association (Diabetes UK) estimated that in 2022-23, about 4.4 million people were living with diabetes in the country. The National Health Service (NHS) spends more than USD 12 billion every year on diabetes care in the UK. Smart insulin pens and pumps have proved their effectiveness in controlling high blood sugar levels in patients. The demand for these devices is expected to grow over the forecast period, as a larger patient base starts adopting these solutions.

North America Smart Insulin Pens & Pumps Market Trends

North America accounted for a notable market share in 2023. Increasing number of people suffering from obesity, a growing lack of physical activity among citizens, and an ageing population in the region have resulted in a high prevalence of diabetes. The IDF Diabetes Atlas estimated that the North America and Caribbean region had the second highest mortality rate due to diabetes, standing at 14%. Such figures are expected to provide a significant market opportunity for modern diabetes control devices such as smart insulin pens and pumps.

U.S. Smart Insulin Pens & Pumps Market Trends

The U.S. accounted for the largest share of the regional market in 2023. According to the American Diabetes Association, more than 38 million people in the U.S. suffer from diabetes and national cost of diabetes exceeded USD 412 billion in 2022. The U.S. is home to several prominent pharmaceutical and medical device companies specializing in diabetes care such as Abbott, Insulet Corporation, and Eli Lilly and Company. These industry giants have significantly contributed to the country’s market dominance through product innovation, research, and market penetration.

Asia Pacific Smart Insulin Pens & Pumps Market Trends

Asia Pacific is expected to register the fastest CAGR of 9.2% during the forecast period. The region is experiencing a rapid increase in the prevalence of diabetes. For instance, the IDF Diabetes Atlas has predicted a substantial growth rate of diabetes prevalence in this region between 2021 and 2045. Furthermore, rapid economic growth in China, South Korea, India, and Thailand, growing disposable income levels, and increased government investments in healthcare infrastructure are driving the adoption of advanced medical technologies. This growth is expected to create a substantial demand for innovative insulin-delivery solutions from 2024 to 2030.

India Smart Insulin Pens & Pumps Market Trends

According to Indian Council of Medical Research - India Diabetes (ICMR-INDIAB) study published in The Lancet, the country had an estimated 101 million patients living with diabetes in 2021. This number is expected to increase at a rapid rate owing to the combined effect of changing dietary preferences, sedentary lifestyle among urban populace, and increasing incidences of prediabetic conditions in children. The Indian government is providing financial and technical support to states for addressing this issue under its National Programme for Prevention and Control of Non-Communicable Diseases (NP-NCD). These factors, along with an increasing spending capacity of the country’s population, have ensured a high market potential for smart insulin pens and pumps.

Key Companies & Market Share Insights

Some key companies involved in the smart insulin pens & pumps market include Novo Nordisk A/S, Sanofi, and Insulet Corporation, among others.

-

Novo Nordisk A/S specializes in developing solutions for diabetes and insulin delivery. The company’s advanced NovoPen 6 and NovoPen Echo Plus record insulin dosing information automatically about each injection, such as time, date, and number of units dosed. These pens provide glucose information on mobile apps for better monitoring. Apart from smart diabetes management devices, the company offers other diabetes treatment options as per the budgets and needs of patients.

-

Insulet Corporation is a U.S.-based medical device company that offers its waterproof smart insulin pumps to over 25 countries worldwide under the brand Omnipod. Omnipod provides a continuous delivery of insulin for up to 72 hours. The latest Omnipod 5 comes with SmartAdjust technology for customized delivery of insulin in patients. Additionally, the Omnipod DASH personal diabetes monitor (PDM) is a tubeless, wireless insulin management system that provides convenience and ease of mobility for patients.

Key Smart Insulin Pens & Pumps Companies:

The following are the leading companies in the smart insulin pens & pumps market. These companies collectively hold the largest market share and dictate industry trends.

- Novo Nordisk A/S

- Sanofi

- Insulet Corporation

- Medtronic

- Abbott

- Lilly

- F. Hoffmann-La Roche Ltd

- Emperra GmbH E-Health Technologies

- YPSOMED

- Tandem Diabetes Care, Inc.

- Cambridge Consultants

- pendiq

- SOOIL Developments Co., Ltd

- DUKADA

- delfu-medical.com

Recent Developments

- In June 2024, Novo Nordisk announced its plan to invest around USD 4.1 billion to build a manufacturing facility in North Carolina, and to grow its capacity to produce injectable treatments for patients suffering with obesity and other chronic disorders.

- In September 2023, Abbott announced the acquisition of Bigfoot Biomedical, a manufacturer of smart insulin management systems for diabetic people. With this strategic acquisition, Abbott aims to expand its current diabetes management portfolio and simultaneously develop connected solutions for more precise and customized diabetes management in patients.

Smart Insulin Pens & Pumps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.54 billion

Revenue Forecast in 2030

USD 12.21 billion

Growth Rate

CAGR of 8.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Type, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, Australia, South Korea, India, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Novo Nordisk A/S; Sanofi; Insulet Corporation; Medtronic; Abbott; Lilly; F. Hoffmann-La Roche Ltd; Emperra GmbH E-Health Technologies; YPSOMED; Tandem Diabetes Care, Inc.; Cambridge Consultants; pendiq; SOOIL Developments Co., Ltd; DUKADA; delfu-medical.com

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Smart Insulin Pens & Pumps Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart insulin pens & pumps market report based on type, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart Insulin Pens

-

Companion Medical (InPen)

-

Novo Nordisk (NovoPen 6 & NovoPen Echo)

-

Emperra Gmbh (ESYSTA Pen)

-

pendiq intelligent diabetes care (pendiq 2.0)

-

Others

-

-

Smart Insulin Pumps

-

MiniMed (630G and 670G)

-

Accu-Chek (Combo and Insight)

-

Tandem (t:slim X2, t:slim G4)

-

Insulet (Omnipod)

-

myLife Omnipod

-

Others

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Homecare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

India

-

China

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."