- Home

- »

- Next Generation Technologies

- »

-

Smart Stadium Market Size & Share, Industry Report, 2030GVR Report cover

![Smart Stadium Market Size, Share & Trends Report]()

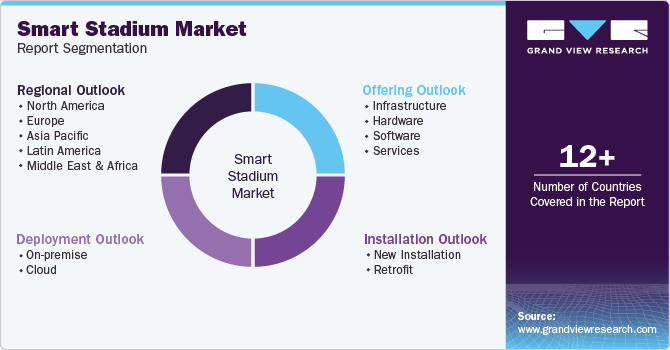

Smart Stadium Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Infrastructure, Hardware, Software, Services), By Installation (Retrofit, New Installation), By Deployment (On Premise, Cloud), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-005-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Stadium Market Summary

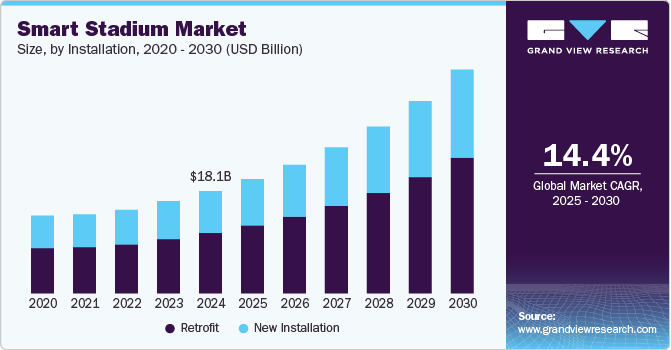

The global smart stadium market size was estimated at USD 18.09 billion in 2024 and is projected to reach USD 39.55 billion by 2030, growing at a CAGR of 14.4% from 2025 to 2030. The market is driven by the rising demand for immersive fan experiences enabled by 5G connectivity, IoT-enabled infrastructure, and AR/VR technologies.

Key Market Trends & Insights

- North America smart stadium market dominated the global market with a share of over 33% in 2024.

- The smart stadium market in the U.S. is expected to grow at the highest CAGR of over 14% from 2025 to 2030.

- By offering, the infrastructure segment dominated the market with a revenue share of over 40% in 2024.

- By installation, the new installation segment is expected to witness a significant CAGR from 2025 to 2030.

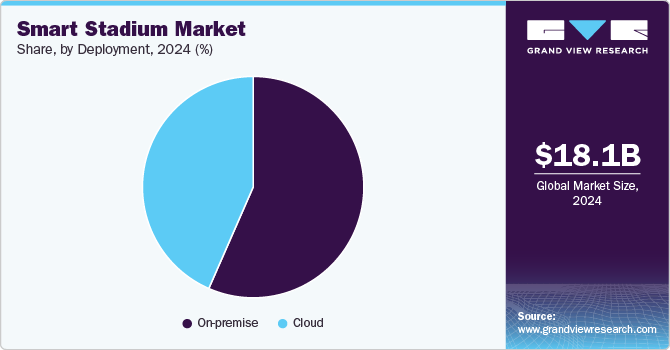

- By deployment, the on-premise segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 18.09 Billion

- 2030 Projected Market Size: USD 39.55 Billion

- CAGR (2025-2030): 14.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Advancements in AI-driven analytics and automation optimize operations, from crowd management to energy efficiency, while sustainability mandates and safety innovations like biometric systems further accelerate market adoption. In addition, revenue opportunities from dynamic pricing, targeted advertising, and partnerships with tech giants is expected to drive investments in next-generation smart stadium industry solutions worldwide.Smart stadiums are increasingly leveraging technologies such as IoT-enabled devices, AI-based systems, and cloud computing to automate operations, crowd management, and fan experience personalization. The convergence of smart ticketing systems, digital signage, real-time analytics, and interactive apps is enhancing the fan experience with personalized services such as customized recommendations, instant seat upgrades, and on-demand services. These factors are expected to drive the smart stadium industry expansion.

Additionally, energy-efficient systems such as smart lighting and heating are becoming more common for stadium operators, while data analytics are being utilized to maximize energy usage. The 5G network is also having a transformative impact by allowing uninterrupted, high-speed communication within and between stadiums, improving both operational effectiveness and fan experience. These trends are driving the smart stadium industry's growth.

Furthermore, augmented reality (AR) and virtual reality (VR) are two of the most promising technological trends changing the fan experience. AR is enhancing the in-stadium experience by offering supplementary layers of information on mobile phones, including interactive maps, real-time statistics, and player data. VR, however, provides fans with the chance to watch games from unusual angles or even at home, placing fans in closer proximity to the action. These technologies are changing the way fans engage with their favorite teams and players, providing a richer, more dynamic experience, thereby driving the smart stadium industry expansion.

Moreover, regulatory pressures, technological innovation, and increasing consumer demand are all driving the fast development of smart stadiums. With the increasing emphasis on sustainability, cost savings, and operational efficiency, smart stadiums are poised to transform the sports and entertainment sector, which is expected to further boost the smart stadium market expansion in the coming years.

Offering Insights

The infrastructure segment dominated the market with a revenue share of over 40% in 2024, driven by the increasing demand for advanced technologies to enhance fan experiences and operational efficiency. Stadiums are integrating IoT sensors, AI analytics, and 5G connectivity to optimize crowd management, security, and energy usage. Additionally, the need for sustainable practices and improved facility management is propelling investments in smart infrastructure solutions. These advancements enable stadiums to provide personalized services, real-time data analytics, and efficient resource utilization, thereby driving segmental growth.

The software segment is expected to witness the highest CAGR of over 15% from 2025 to 2030, fueled by the growing reliance on digital solutions for managing various stadium functions. Software platforms enable seamless integration of services such as ticketing, crowd management, video surveillance, and data analytics, enhancing the overall fan experience. Additionally, the increasing adoption of cloud-based solutions offers scalability, flexibility, and cost-effectiveness, further driving the demand for software in smart stadiums.

Installation Insights

The retrofit segment accounted for the largest revenue share in 2024, driven by the growing need to modernize existing stadiums in a cost-effective manner without complete reconstruction. Many older venues are being upgraded with smart technologies-such as advanced security systems, improved connectivity, and energy-efficient solutions-to enhance fan experience and operational performance. This approach allows operators to extend the life of their infrastructure while meeting the rising expectations for digital engagement and sustainability, all while minimizing disruption and investment compared to building new facilities.

The new installation segment is expected to witness a significant CAGR from 2025 to 2030, largely driven by the growing demand to host mega-events such as the FIFA World Cup 2034 and the Asian Games, where high-tech incorporation is a competitive advantage for new stadiums. New stadiums, such as SoFi Stadium in the US and Lusail Stadium in Qatar, are at the forefront of providing cutting-edge amenities, such as embedded 5G Distributed Antenna Systems for frictionless connectivity, sustainability elements such as energy-efficient architecture, and advanced seating and fan engagement systems. Such advancements are accelerating growth in the new installation segment, as the demand for technologically advanced, eco-conscious, and immersive stadium experiences continues to rise globally.

Deployment Insights

The on-premise segment accounted for the largest market share in 2024, driven by the demand for richer fan experiences, including high-speed internet connectivity, real-time analytics, and effortless connectivity within stadiums. On-premise technologies like high-definition video screens, intelligent seating, and built-in Wi-Fi systems are becoming a part of state-of-the-art stadiums. These technologies not only enhance fan engagement but also optimize operations, increase revenue through targeted advertising, and improve security measures. The growing use of Internet of Things (IoT) devices, smart ticketing, and data-based solutions also fuels the growth of the segment further

The cloud segment is expected to witness a significant CAGR from 2025 to 2030, owing to its scalability, flexibility, and cost-effectiveness. Cloud-based solutions enable stadiums to handle large amounts of data, especially during major events, without the need for costly physical infrastructure. These platforms allow real-time data processing, which is essential for enhancing fan engagement, improving operations, and offering personalized experiences. Cloud services also enable seamless integration with emerging technologies such as AI, 5G, and AR/VR, further enhancing the stadium experience and boosting segmental growth.

Regional Insights

North America smart stadium market dominated the global market with a share of over 33% in 2024, primarily driven by increasing demand for enhanced fan engagement and digital experiences. Stadiums are integrating advanced technologies like IoT, 5G, and AI to improve operational efficiency and safety. There is a rising adoption of mobile ticketing, contactless payments, and smart seating solutions, offering convenience and reducing physical touchpoints. Real-time data analytics is being widely used to manage crowd control, security, and resource optimization.

U.S. Smart Stadium Market Trends

The smart stadium market in the U.S. is expected to grow at the highest CAGR of over 14% from 2025 to 2030, driven by the integration of IoT, AI, and 5G networks. Stadiums are increasingly using facial recognition for security and contactless entry systems to enhance fan experience. Data analytics is being leveraged to optimize crowd management and personalize fan engagement. The rise of mobile apps for ticketing, concessions, and in-seat delivery is transforming the spectator experience.

Europe Smart Stadium Market Trends

Europe smart stadium market is expected to grow at a CAGR of over 13% from 2025 to 2030. This growth is driven by the region’s strong sports culture and technological innovation. Stadiums are increasingly adopting integrated systems for crowd management, digital signage, and interactive fan experiences. Advanced connectivity solutions, including 5G and Wi-Fi 6, are ensuring seamless digital interactions. AI-driven analytics help optimize event operations and improve security protocols.

The UK smart stadium market is expected to grow at a significant rate in the coming years. The UK is at the forefront of smart stadium innovation, with Premier League clubs investing heavily in technology. AI-powered crowd analytics are being used to enhance safety and optimize stadium operations. Mobile apps with wayfinding features and real-time updates are improving fan experience. The adoption of renewable energy sources, such as solar panels, is making stadiums more sustainable.

Germany smart stadium market is fueled by the region’s strong focus on integrating smart technologies to improve operational efficiency and fan satisfaction. Bundesliga stadiums are adopting IoT sensors to monitor crowd density and ensure safety. High-speed internet connectivity is being prioritized to support live streaming and interactive fan experiences. Smart parking systems are reducing congestion and improving access to stadiums.

Asia Pacific Smart Stadium Market Trends

Asia Pacific smart stadium market is expected to grow at the highest CAGR of over 15% from 2025 to 2030, driven by the increasing investments in digital infrastructure. Countries are adopting advanced technologies like facial recognition, cashless payments, and interactive displays. High-speed 5G networks and IoT devices are enhancing operational efficiency and fan engagement, and real-time analytics are optimizing crowd flow and event management.

Japan smart stadium market is gaining traction, fueled by its technological expertise to develop state-of-the-art smart stadiums. Robotics and automation are being used for cleaning, maintenance, and customer service. Stadiums are adopting cashless payment systems and digital ticketing to streamline operations. Japan is also prioritizing sustainability, with smart energy systems and eco-friendly materials. The upcoming Olympics and other international events are accelerating the adoption of smart technologies.

China smart stadium market is rapidly expanding, driven by government initiatives and tech advancements. AI-powered facial recognition systems are widely used for security and access control. Stadiums are integrating 5G networks to enable ultra-fast data transmission and enhance live streaming. Mobile apps with AR features provide interactive experiences for fans.

Key Smart Stadium Company Insights

Some key players operating in the market include Cisco Systems, Inc. and IBM Corporation, among others

-

Cisco Systems, Inc. is a prominent player in designing, manufacturing, and selling Internet Protocol-based networking products and services, with a presence across the globe. The company operates through diverse segments, including networking, security, collaboration, and observability, catering to businesses of all sizes, public institutions, governments, and service providers. Cisco’s product portfolio features advanced switching solutions for campus and data center environments, enterprise routing for secure network connectivity, wireless products for seamless mobility, and robust security solutions like network security and threat intelligence.

-

International Business Machines Corporation (IBM) is a prominent player in hybrid cloud, artificial intelligence (AI), and consulting services. The company operates through key business segments, including Software, Consulting, Infrastructure, and Financing. In the smart stadium market, IBM harnesses its advanced capabilities in cloud computing, AI, and the Internet of Things (IoT). The company’s products, such as IBM Watsonx, IBM Storage, and IBM Maximo, the company provide real-time data analytics, effective crowd management, and seamless connectivity, transforming traditional venues into sophisticated digital ecosystems.

GP Smart Stadium and Barco NV are some emerging market participants in the smart stadium market.

-

GP Smart Stadium is an independent company specializing in consultancy services and advanced embedded solutions for stadiums, arenas, and entertainment venues. The company offers a multidisciplinary approach that integrates strategic, marketing, and organizational elements, facilitating turnkey solutions that are durable and valuable for all parties involved. Their extensive network includes collaborations with high-tech companies, construction firms, security providers, and energy and climate control producers, ensuring comprehensive solutions for sports and cultural venues worldwide..

-

Barco NV is a Belgian technology company specializing in digital projection and imaging technology, focusing on entertainment, enterprise, and healthcare markets. Their product portfolio includes DLP projectors, LED displays, and connectivity platforms. In the smart stadium market, Barco leverages its expertise in visualization solutions to enhance fan engagement and operational efficiency. Their high-resolution projectors and LED displays are designed for large venues, providing immersive visual experiences for spectators.

Key Smart Stadium Companies:

The following are the leading companies in the smart stadium market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- Fujitsu

- GP Smart Stadium

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Intel Corporation

- Mapsted Corp.

- NEC Corporation

- Johnson Controls

- NXP Semiconductors

- Schneider Electric

- Telefonaktiebolaget LM Ericsson

- CommScope Holding Company, Inc.

- Corning Incorporated

- Hewlett Packard Enterprise Company

- Belden Inc.

- Extreme Networks, Inc.

- Barco NV

- Daktronics, Inc.

- KORE Wireless Group

Recent Developments

-

In February 2025, Barco's ClickShare partnered with Neat to enhance meeting room collaboration. Neat Bar 2 and Neat Bar Pro received ClickShare certification, enabling effortless wireless conferencing. This collaboration ensures seamless end-to-end experiences for ClickShare and Neat customers, reinforcing Barco's focus on improving professional environments.

-

In January 2025, Hewlett Packard Enterprise (HPE) faced an antitrust lawsuit from the U.S. Department of Justice over its proposed USD14 billion acquisition of Juniper Networks. The Justice Department argued that the merger would reduce competition and innovation by creating a combined entity controlling 70% of the wireless networking market. HPE and Juniper planned to defend the deal in court, claiming it would benefit customers and strengthen competition against global rivals.

-

In December 2024, Daktronics announced a new LED display installation at Grayson Stadium, home of the Savannah Bananas, set to debut in 2025. The display, over 26 feet high and 47 feet wide, offers variable content zoning for live video, replays, game info, and sponsorship messages. This upgrade aims to enhance the fan experience with dynamic and engaging visual content.

Smart Stadium Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20.22 billion

Revenue forecast in 2030

USD 39.55 billion

Growth rate

CAGR of 14.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, installation, deployment

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; Australia; Japan; India; South Korea; Brazil; Mexico; South Africa; Saudi Arabia; UAE

Key companies profiled

Cisco Systems, Inc.; Fujitsu; GP Smart Stadium; Huawei Technologies Co., Ltd.; IBM Corporation; Intel Corporation; Mapsted Corp.; NEC Corporation; Johnson Controls; NXP Semiconductors; Schneider Electric; Telefonaktiebolaget LM Ericsson; CommScope Holding Company, Inc.; Corning Incorporated; Hewlett Packard Enterprise Company; Belden Inc.; Extreme Networks, Inc.; Barco NV; Daktronics, Inc.; KORE Wireless Group

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Smart Stadium Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global smart stadium market report based on offering, installation, and deployment:

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Infrastructure

-

Distributed Antenna Systems (DAS)

-

Fiber Optics and Network Infrastructure

-

High-Density Wi-Fi and Connectivity

-

Surveillance & Security Systems

-

Access Control Systems

-

Emergency Response Systems

-

Power Management Systems

-

Others

-

-

Hardware

-

Digital Signage

-

Audio Systems

-

Smart Lighting

-

IoT Sensors

-

Others

-

-

Software

-

Stadium & Public Security

-

Building Automation

-

Event Management

-

Fan Engagement Platforms

-

Real-Time Analytics & Data Management Platforms

-

Others

-

-

Services

-

Professional Services

-

Design & Consulting

-

Integration & Installation

-

Others

-

-

Managed Services

-

-

-

Installation Outlook (Revenue, USD Million, 2018 - 2030)

-

New Installation

-

Retrofit

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global smart stadium market size was estimated at USD 18.1 billion in 2024 and is expected to reach USD 20.22 billion in 2025.

b. The global smart stadium market is expected to grow at a compound annual growth rate of 14.4% from 2025 to 2030 to reach USD 39.55 billion by 2030.

b. Europe dominated the smart stadium market with a share of more than 27% in 2024. Increasing demand for enhanced viewing experience and growing social media integration with stadium technologies are some of the factors driving the market in Europe.

b. Some key players operating in the smart stadium market include Cisco Systems, Inc.; Fujitsu Ltd.; IBM Corporation; Intel Corporation; Huawei Technologies Co.; Johnson Controls; NXP Semiconductors; and Telefonaktiebolaget LM Ericsson.

b. Key factors that are driving the market growth include the growing sports league culture, stringent security norms, and rising significance of improving fan engagement during the sports events.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.