- Home

- »

- Next Generation Technologies

- »

-

Smart Water Management Market Size, Industry Report 2033GVR Report cover

![Smart Water Management Market Size, Share & Trends Report]()

Smart Water Management Market (2025 - 2033) Size, Share & Trends Analysis Report By Offering (Solutions, Services, Water Meters), By End Use (Residential, Commercial, Industrial), By Region (North America, Asia Pacific, Europe), And Segment Forecasts

- Report ID: 978-1-68038-269-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Smart Water Management Market Summary

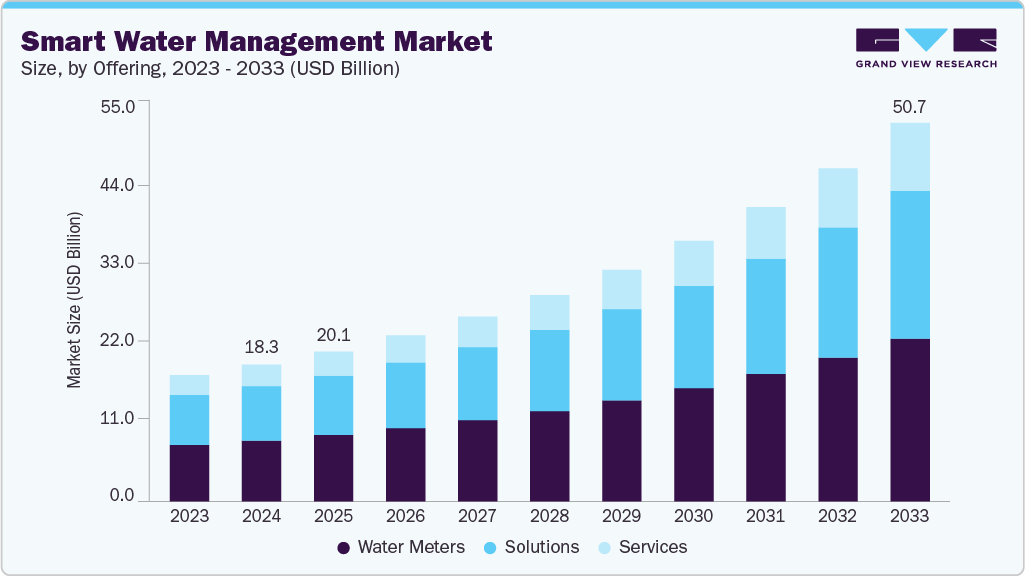

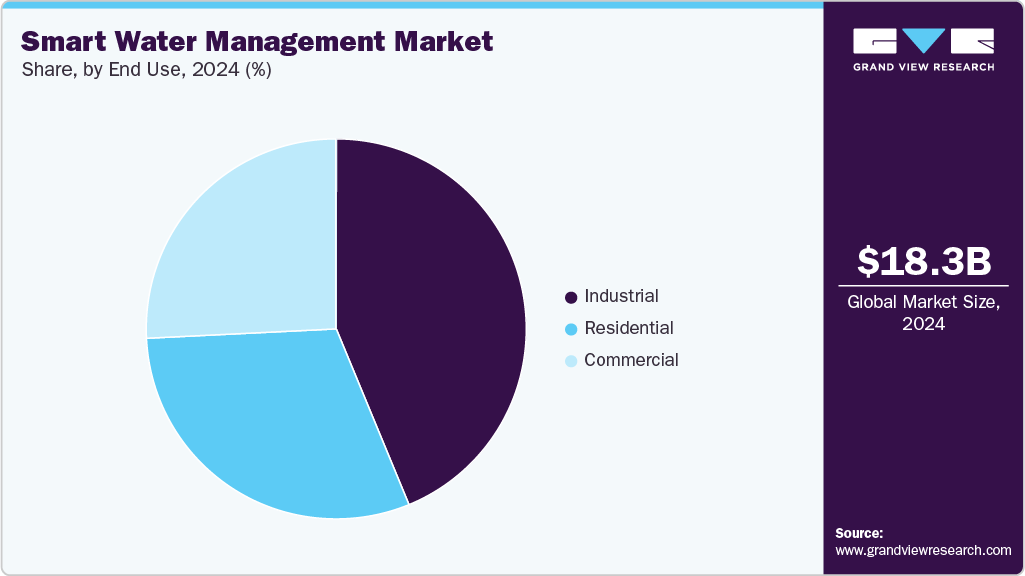

The global smart water management market size was estimated at USD 18,340.5 million in 2024 and is projected to reach USD 50,740.8 million by 2033, growing at a CAGR of 12.7% from 2025 to 2033. The market growth is primarily driven by rising concerns over water scarcity, increasing government regulations for water conservation, and growing investments in digital water infrastructure.

Key Market Trends & Insights

- North America dominated the global smart water management market with the largest revenue share of 34.0% in 2024.

- The smart water management market in the U.S. led the North America market and held the largest revenue share in 2024.

- By offering, the water meter segment led the market and held the largest revenue share of 44.5% in 2024.

- By end use, the industrial segment held the dominant position in the market and accounted for the leading revenue share of 43.8% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 18,340.5 million

- 2033 Projected Market Size: USD 50,740.8million

- CAGR (2025-2033): 12.7%

- North America: Largest market in 2024

The increasing pressure from population growth, rapid urbanization, and escalating water scarcity is accelerating the demand for smart water management solutions. Traditional water infrastructure systems often struggle to cope with rising consumption and deteriorating resource availability, prompting municipalities and utilities to adopt intelligent alternatives. Smart water management industry leverages advanced technologies such as IoT sensors, real-time data analytics, and automated control systems to reduce water loss, optimize distribution, and improve water quality. Governments and utilities are investing in smart solutions to enhance resource efficiency, ensure regulatory compliance, and promote sustainable water use, driving market expansion.Innovations in IoT, AI, and data analytics are significantly enhancing the capabilities of smart water management systems, revolutionizing how water resources are monitored and managed. IoT sensors and devices facilitate real-time monitoring of water quality, pressure, and flow, providing immediate insights into system performance and potential issues. AI algorithms analyze this vast amount of data to predict maintenance needs, detect leaks, and optimize water distribution. Data analytics enables utilities to gain actionable insights into consumption patterns, allowing for more efficient resource allocation and demand management. The growing adoption of these technologies is reshaping the smart water management industry landscape.

Additionally, the rising global emphasis on sustainability and environmental conservation is driving demand for smart water management. Increasing water scarcity and climate-related challenges, governments and industries are prioritizing efficient resource utilization and sustainable practices. Technologies enable proactive water conservation through automated monitoring and adaptive control systems, helping meet regulatory requirements and environmental goals. This alignment with sustainability objectives is significantly contributing to market growth.

Furthermore, urbanization and population growth are putting immense pressure on existing water infrastructure, prompting the adoption of smart water management. Cities expand and demand for water increases, and traditional water management systems struggle to maintain efficiency and service quality. Smart technologies provide the scalability and adaptability required to meet the evolving needs of urban centers. These systems ensure reliable water delivery, improve service continuity, and support urban planning by providing data-driven insights into water usage trends and infrastructure stress points, thereby boosting the smart water management industry growth.

Moreover, government initiatives and investments in smart infrastructure projects are creating a favorable environment for smart water management. Countries are launching smart city programs that prioritize the digital transformation of essential services, including water utilities. Public-private partnerships and funding for infrastructure modernization are accelerating the deployment of advanced water monitoring and control systems. These strategic initiatives are helping to overcome adoption barriers and are significantly propelling the smart water management industry.

Offering Insights

The water meters segment dominated the market with a revenue share of over 44% in 2024, owing to the rising demand for precise measurements of water consumption, which ensures accurate billing for consumers and significantly reduces revenue losses for utilities. Traditional meters that require manual readings and are prone to errors, smart meters automatically collect and transmit consumption data in real-time. This automated process eliminates discrepancies and ensures that consumers are billed accurately based on their actual water usage, thereby driving segmental growth.

The services segment is expected to witness a significant CAGR of over 14% from 2025 to 2033. The increased demand for consulting and advisory services in the smart water management sector reflects the utilities and municipalities' growing need for expert guidance in implementing efficient and effective solutions. The complexity of water management systems increases, particularly with the integration of IoT, AI, and data analytics, stakeholders seek specialized expertise to navigate technological advancements and regulatory requirements. Consulting services provide tailored strategies and roadmaps for deploying smart water solutions, conducting feasibility studies, and assessing the economic and environmental benefits of adopting new technologies.

End Use Insights

The industrial segment accounted for the largest revenue share in 2024, owing to the industrial facilities with substantial operational cost savings through several key mechanisms. Minimizing water losses through early leak detection and automated shut-off systems helps prevent wasted water, reduce utility costs, and conserve valuable resources. Optimizing water usage involves real-time monitoring of water flows and pressure, enabling precise control over water distribution and consumption, thereby contributing to the dominance of the industrial segment in the market.

The commercial segment is expected to witness the highest CAGR from 2025 to 2033. Stringent regulations and mandates governing water usage and conservation pressure commercial establishments to adopt smart water technologies. These regulations, often enforced by governmental bodies and environmental agencies, set stringent limits on water consumption, discharge standards, and conservation practices to mitigate environmental impact and ensure sustainable resource management. By implementing smart water management industry, businesses can accurately monitor water usage in real time, detect leaks promptly, and optimize consumption patterns to meet regulatory requirements, further propelling this segment's rapid expansion.

Regional Insights

North America smart water management market accounted for the largest revenue share of over 34% in 2024, primarily driven by rapid urbanization and population growth in North American cities, which are significantly increasing the demand for smart water solutions. As urban areas expand and populations increase, the pressure on existing water infrastructure intensifies, necessitating the adoption of advanced technologies to manage water resources efficiently. Smart water management industry enables cities to optimize their water distribution networks, ensuring that water is delivered efficiently and equitably. This technological integration is crucial for cities aiming to balance the demands of urban growth with the need for sustainability, driving the development of the smart water management industry.

U.S. Smart Water Management Market Trends

The U.S. smart water management market is expected to grow at a CAGR of over 11% from 2025 to 2033, driven by the rising public awareness about environmental issues and the growing demand for sustainable practices. Communities become more conscious of water usage's environmental impact and the importance of resource conservation. This awareness is driven by education and advocacy by environmental organizations, leading consumers to prioritize sustainability. Utilities and municipalities, in response, are turning to the smart water management industry that offers real-time monitoring and efficient water distribution to minimize waste and optimize usage.

Europe Smart Water Management Market Trends

Europe smart water management market is expected to grow at a CAGR of over 11% from 2025 to 2033. In Europe, the market emphasis on digital transformation includes numerous sectors, including water management, with a concerted effort towards digitalization. This strategic shift is driving the widespread adoption of smart water technologies aimed at revolutionizing traditional data collection, analysis, and decision-making approaches. Integrating IoT sensors, advanced data analytics, and AI-driven algorithms, smart water systems enable utilities and municipalities to gather real-time insights into water usage patterns, monitor infrastructure performance, and detect anomalies promptly. These technologies facilitate predictive maintenance, improving the reliability and sustainability of water supply networks, driving the growth of the market in the European region.

The UK smart water management market is expected to grow significantly in the coming years. The country benefits from a well-established water utility sector and a strong push toward digital transformation in public infrastructure. Major water companies invest heavily in the smart water management industry to modernize water distribution networks and reduce operational inefficiencies. This digital shift enables more intelligent water usage monitoring and predictive analytics, supporting long-term infrastructure resilience.

Germany smart water management market is driven by the country’s commitment to digital transformation and infrastructure modernization. Germany’s strong industrial base and highly organized water sector provide fertile ground for integrating smart technologies. Utilities and municipalities are increasingly adopting the IoT-enabled smart water management industry to improve efficiency and reduce operational costs. Government support for Industry 4.0 initiatives further encourages the digitalization of water utilities and drives smart water management industry adoption across the country.

Asia Pacific Smart Water Management Market Trends

The Asia Pacific smart water management market is expected to grow at the highest CAGR of over 14% from 2025 to 2033, driven by rapid investments in smart city initiatives to improve urban living standards. These systems utilize IoT sensors, data analytics, and AI to monitor water quality, detect leaks, and optimize distribution networks in real-time, ensuring that water resources are managed efficiently and sustainably. Integrating smart water management into broader smart city frameworks supports energy conservation, reduces operational costs, and enhances the overall resilience of urban infrastructure.

The Japan smart water management market is gaining traction, fueled by the country’s advanced technological capabilities and strong emphasis on automation and efficiency. Global leader in sectors such as robotics, electronics, and precision manufacturing, Japan is uniquely positioned to integrate cutting-edge technologies into water infrastructure, reflecting Japan’s broader commitment to developing smart water management infrastructure.

China smart water management market is rapidly expanding. China’s rapid urbanization and industrial growth have increased water consumption and stress on existing water infrastructure. To address these challenges, the Chinese government is actively promoting the adoption of smart water technologies that enable more efficient water monitoring, distribution, and conservation. These systems support the country’s urban planning goals and help ensure a sustainable water supply across growing metropolitan regions, thereby driving the smart water management industry growth.

Key Smart Water Management Company Insights

Some key players operating in the market include Siemens and International Business Machines Corporation (IBM), among others.

-

Siemens is a global company providing smart water management solutions, offering a comprehensive range of products and services tailored to optimize water infrastructure efficiency and sustainability. The company’s portfolio includes advanced technologies such as IoT-enabled sensors, data analytics platforms, and integrated automation systems designed to monitor and manage water networks in real-time. Siemens' smart water solutions empower utilities and municipalities to improve operational performance, reduce water losses through leak detection and predictive maintenance, and enhance overall system resilience.

-

IBM provides comprehensive smart water management solutions that leverage advanced technologies to address the complex challenges of water resource management. The company’s offerings include IoT-enabled sensors and devices for real-time monitoring of water quality, consumption patterns, and infrastructure health. IBM's analytics platforms integrate AI and machine learning algorithms to analyze vast amounts of data, enabling predictive insights into water system performance and proactive decision-making.

Trimble Inc. and Landis+Gyr are some emerging market participants in the smart water management market.

-

Trimble Inc. delivers advanced location-based technologies and software solutions for infrastructure, utilities, and environmental management. Trimble offers integrated hardware and software platforms in the smart water management industry that combine GPS, GIS, and IoT technologies to enhance asset management, field operations, and data visualization. The company’s solutions support real-time monitoring of water networks and improved decision-making. Connecting physical infrastructure with cloud-based analytics, Trimble enables smarter, more sustainable management of water resources and helps utilities optimize performance across their entire operational lifecycle.

-

Landis+Gyr specializes in smart metering and grid intelligence technologies. In the smart water management space, the company provides advanced metering infrastructure (AMI) and data analytics solutions that enable utilities to monitor, control, and optimize water distribution in real time. Landis+Gyr’s technologies facilitate leak detection, pressure management, and demand forecasting, allowing utilities to reduce non-revenue water and improve operational efficiency. Their end-to-end smart water solutions support sustainability goals by empowering municipalities to make data-driven water conservation and infrastructure resilience decisions.

Key Smart Water Management Companies:

The following are the leading companies in the smart water management market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens

- International Business Machines Corporation

- Xylem.

- Honeywell International Inc

- Schneider Electric

- Itron Inc.

- SUEZ

- Oracle

- Landis+Gyr

- Trimble Inc.

Recent Developments

-

In April 2025, SUEZ announced a five-year strategic partnership with the French National Centre for Scientific Research (CNRS) aimed at advancing sustainable water and waste management. The collaboration focuses on driving innovation in smart water management by developing new technologies and research-backed solutions to tackle environmental challenges. Through this partnership, SUEZ plans to enhance its capabilities in resource efficiency, pollution control, and real-time monitoring, reinforcing its leadership in intelligent water systems and supporting the global shift toward more resilient and sustainable water infrastructure.

-

In March 2025, Honeywell International Inc. announced the integration of Verizon 5G connectivity into its smart utility meters to enhance smart water and energy management capabilities. The collaboration aims to provide remote and autonomous management features that improve energy efficiency, operational effectiveness, and grid resiliency for utility companies, thereby supporting more responsive and efficient smart water infrastructure.

-

In January 2025, Siemens announced a collaboration with KETOS to enhance global water management. This partnership aims to equip water operators with integrated solutions that improve water quality monitoring and promote sustainability. Combining Siemens' expertise in automation with KETOS' real-time water analytics, the initiative seeks to provide actionable insights for efficient water resource management.

Smart Water Management Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 20,082.8 million

Revenue forecast in 2033

USD 50,740.8 million

Growth rate

CAGR of 12.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, end use, and region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Argentina; UAE.; Saudi Arabia; South Africa

Key companies profiled

Siemens; International Business Machines Corporation; Xylem.; Honeywell International Inc; Schneider Electric; Itron Inc.; SUEZ; Oracle; Landis+Gyr; Trimble Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

Global Smart Water Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global smart water management market report based on offering, end use, and region:

-

Offerings Outlook (Revenue, USD Million, 2021 - 2033)

-

Water Meters

-

Solutions

-

Asset Management

-

Distribution Network Monitoring

-

Supervisory Control and Data Acquisition (SCADA)

-

Meter Data Management (MDM)

-

Analytics

-

Others

-

-

Services

-

Integration & Deployment

-

Support & Maintenance

-

Consulting

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global smart water management market size was estimated at USD 18.34 billion in 2024 and is expected to reach USD 20.08 billion in 2025.

b. The global smart water management market is expected to grow at a compound annual growth rate of 12.7% from 2025 to 2033 to reach USD 50.74 billion by 2033.

b. North America dominated the smart water management market with a share of over 34% in 2024. This is attributable to early adoption of smart infrastructure, strong regulatory frameworks promoting water conservation, and significant investments in IoT-based water monitoring solutions across the region.

b. Some key players operating in the smart water management market include Siemens, International Business Machines Corporation, Xylem., Honeywell International Inc, Schneider Electric, Itron Inc., SUEZ, Oracle, Landis+Gyr, Trimble Inc.

b. Key factors that are driving the market growth include rising water scarcity, aging infrastructure, regulatory pressure, and advancements in IoT, alongside growing demand for efficiency and smart city development.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.